New York State Form It 203

New York State Form It 203 - For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. • as a nonresident received certain income related to a profession or occupation previously carried on both within. For the year january 1, 2013, through december 31, 2013, or fiscal year beginning. Complete all parts that apply to you; A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. Am i eligible to free file? • you have income from a new york source (see below and page 6) and your new york agi (federal. Web new york state • new york city • yonkers • mctmt. Try it for free now! Try it for free now! Upload, modify or create forms. Were not a resident of new york state and received income during the. Am i eligible to free file? Income tax return new york state • new york city • yonkers • mctmt. Web department of taxation and finance. Upload, modify or create forms. Web new york state • new york city • yonkers. Try it for free now! Income tax return new york state • new york city • yonkers • mctmt. Were not a resident of new york state and received income during the. • as a nonresident received certain income related to a profession or occupation previously carried on both within. Upload, modify or create forms. Were not a resident of new york state and received income during the. Am i eligible to free file? • you have income from a new york source (see below and page 6) and your new york. Web new york state • new york city • yonkers. You may be eligible for free file using one of the software. Web department of taxation and finance. Web new york state • new york city • yonkers • mctmt. Income tax return new york state • new york city • yonkers • mctmt. Am i eligible to free file? A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. Enter on line 29, new york state amount column, the sum of the entries from. • you have income from a new york source (see below and. Upload, modify or create forms. • you have income from a new york source (see below and page 6) and your new york agi (federal. Am i eligible to free file? You may be eligible for free file using one of the software. For the year january 1, 2013, through december 31, 2013, or fiscal year beginning. Web fill out and file your new york state income tax return online with this pdf form. Upload, modify or create forms. Try it for free now! Income tax return new york state • new york city • yonkers • mctmt. Upload, modify or create forms. Income tax return new york state • new york city • yonkers • mctmt. Web fill out and file your new york state income tax return online with this pdf form. Upload, modify or create forms. Web good news for 2022! Enter on line 29, new york state amount column, the sum of the entries from. For the year january 1, 2013, through december 31, 2013, or fiscal year beginning. Upload, modify or create forms. Complete all parts that apply to you; Web fill out and file your new york state income tax return online with this pdf form. • as a nonresident received certain income related to a profession or occupation previously carried on both. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. Were not a resident of new york state and received income during the. Enter on line 29, new york. Upload, modify or create forms. Upload, modify or create forms. Were not a resident of new york state and received income during the. Enter on line 29, new york state amount column, the sum of the entries from. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Web new york state • new york city • yonkers • mctmt. Try it for free now! For the year january 1, 2013, through december 31, 2013, or fiscal year beginning. Complete all parts that apply to you; Income tax return new york state • new york city • yonkers • mctmt. Am i eligible to free file? Web new york state • new york city • yonkers. Web good news for 2022! • as a nonresident received certain income related to a profession or occupation previously carried on both within. Try it for free now! You may be eligible for free file using one of the software. Web department of taxation and finance. Web fill out and file your new york state income tax return online with this pdf form. • you have income from a new york source (see below and page 6) and your new york agi (federal.Top 21 New York State Form It203 Templates free to download in PDF format

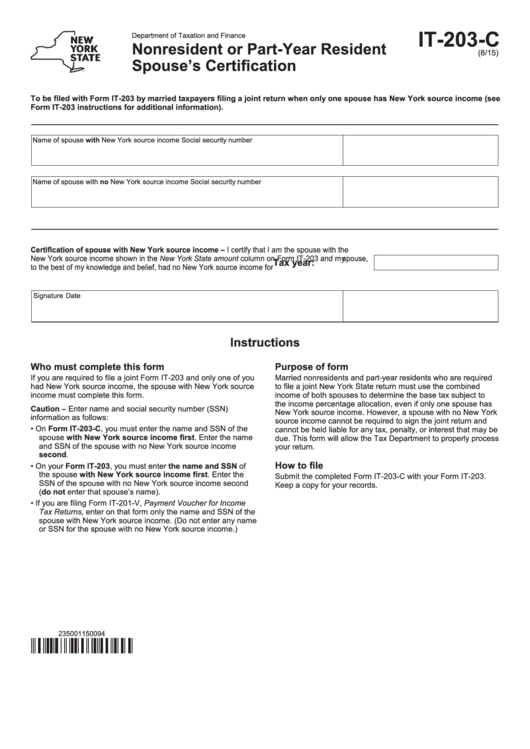

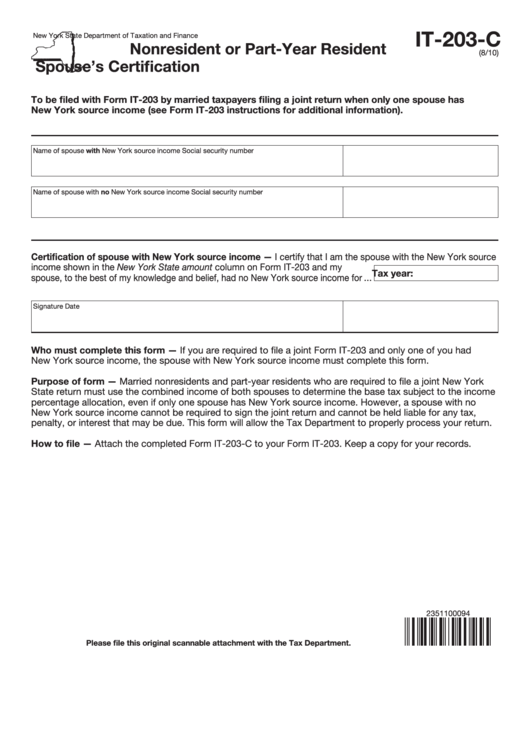

Fillable Form It203C Nonresident Or PartYear Resident Spouse'S

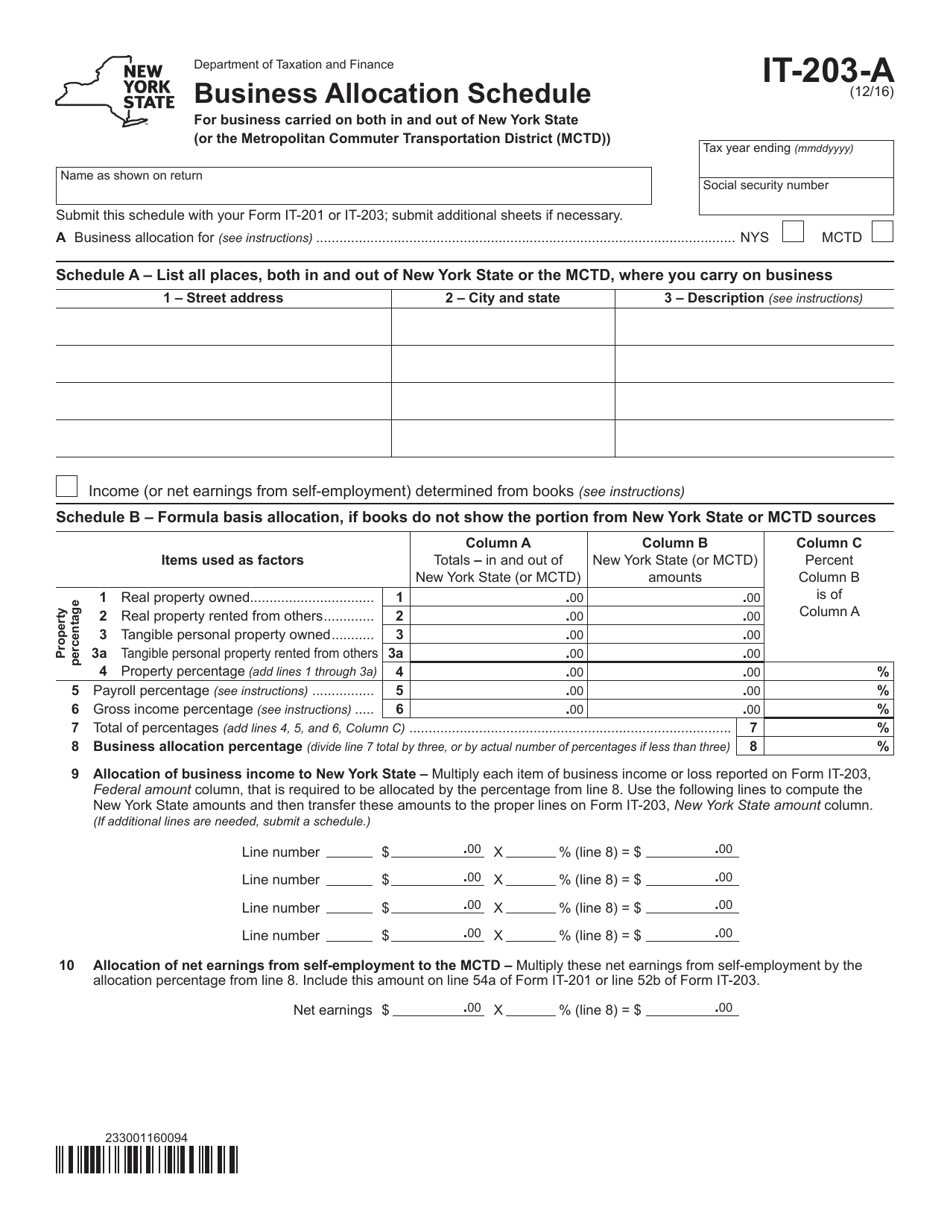

Form IT203A Download Fillable PDF or Fill Online Business Allocation

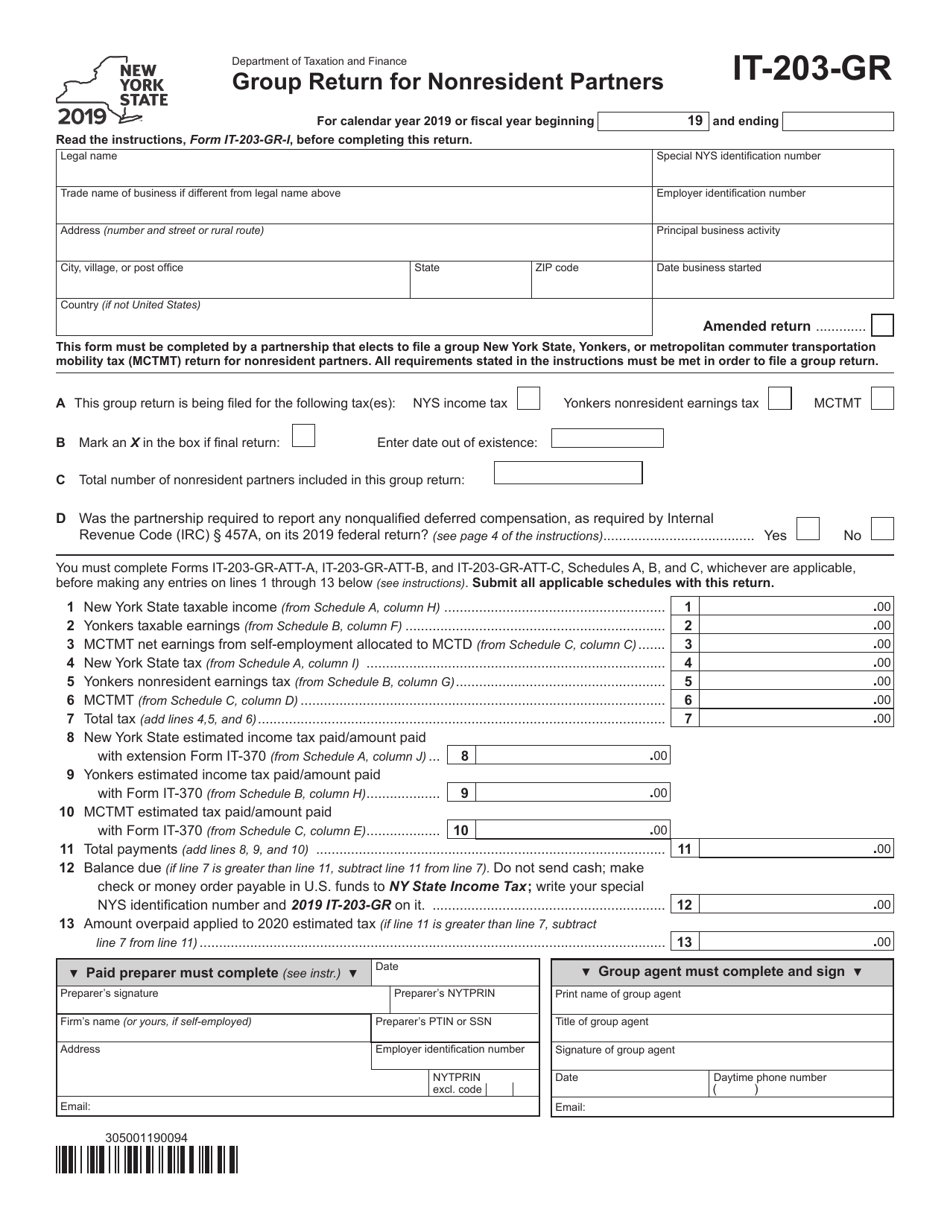

Form IT203GR 2019 Fill Out, Sign Online and Download Fillable PDF

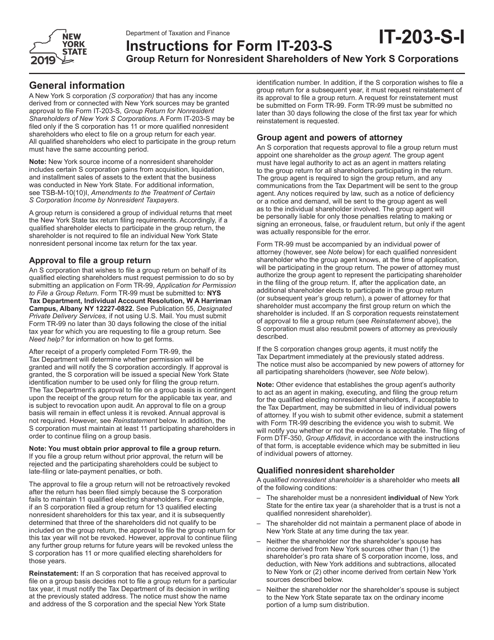

Download Instructions for Form IT203S Group Return for Nonresident

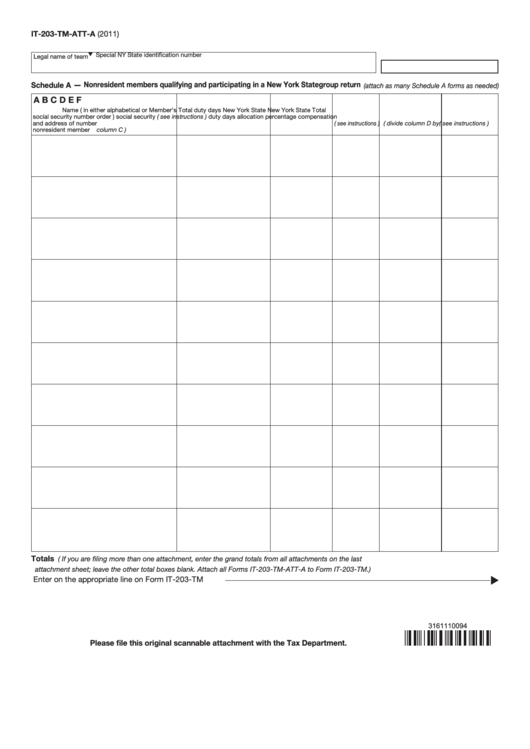

Fillable Form It203TmAttA Schedule ANonresident Members

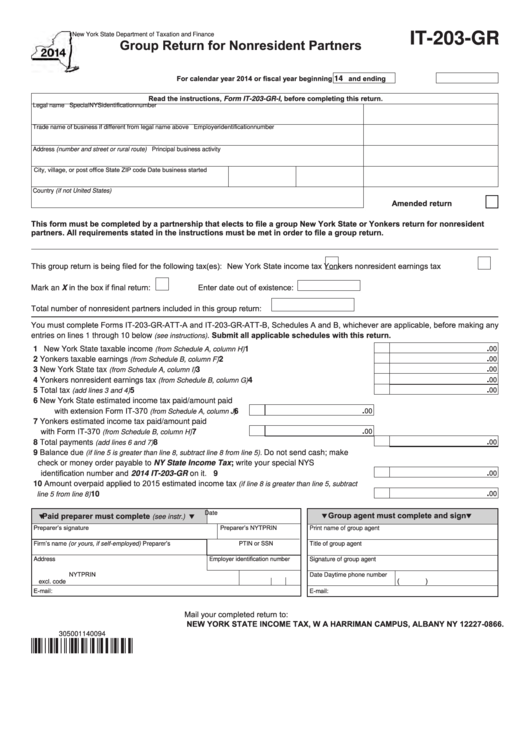

Fillable Form It203Gr Group Return For Nonresident Partners 2014

2019 Form NY IT203Fill Online, Printable, Fillable, Blank pdfFiller

(PDF) NEW YORK STATE NonResident Tax Information (Forms IT203 and IT

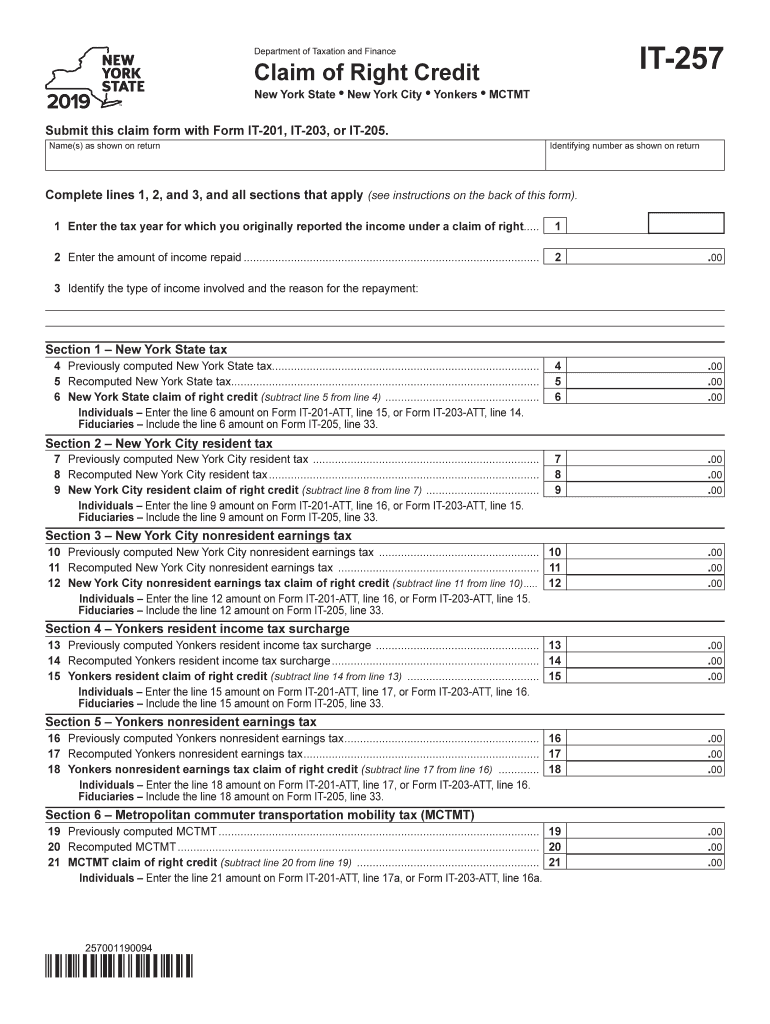

it 257 Form Fill Out and Sign Printable PDF Template signNow

Related Post: