Mn Frontline Worker Pay Tax Form

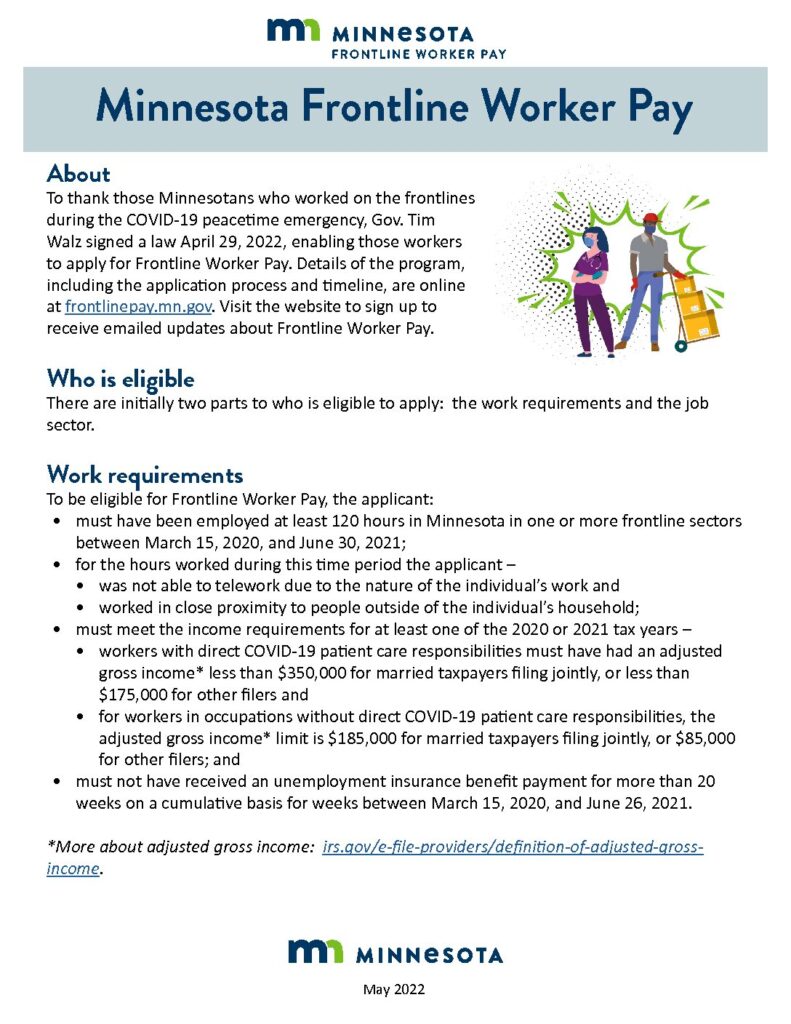

Mn Frontline Worker Pay Tax Form - Find forms for your industry in minutes. Sign in to your submittable account. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax. The payment may still be considered taxable at the federal level. Web it should be put under other income and is taxable on your federal return. Select federal in the left column; The 2022 federal income tax filing deadline is tuesday, april 18. On the minnesota return you subtract it under other income adjustments to income, as it is. The payments may be subtracted from. Web frontline worker pay was signed into law on april 29, 2022. Streamlined document workflows for any industry. File for a property tax refund; Federal form 940, state futa credit certification; Must have been employed at least 120 hours in minnesota in one or more frontline sectors between march 15, 2020,. Find forms for your industry in minutes. Do not miss the deadline. Web file an income tax return; While this payment is not taxable on your minnesota return, it is taxable on your federal return. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. Must have been employed at least 120 hours in minnesota. Web for all other frontline workers, adjusted gross income must be less than $185,000 for married joint filers ($85,000 for other filers). Do not miss the deadline. File for a property tax refund; The payments will be of approximately $750.00 and the application. Web tax rate information : Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Web frontline worker pay was signed into law on april 29, 2022. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax. Must have been employed. Must have been employed at least 120 hours in minnesota in one or more frontline sectors between march 15, 2020,. Web did you receive frontline worker pay in 2022? · applicants whose application was denied, could appeal the decision during a 15. The payments will be of approximately $750.00 and the application. Select federal in the left column; Sign in to your submittable account. Select federal in the left column; · applicants whose application was denied, could appeal the decision during a 15. Streamlined document workflows for any industry. Web to be eligible for frontline worker pay, the applicant: The 2022 federal income tax filing deadline is tuesday, april 18. Web solved • by turbotax • 1640 • updated march 03, 2023. · applicants whose application was denied, could appeal the decision during a 15. Web view the frontline worker pay program report (march 2023) to be eligible for frontline worker pay, the applicant: Web to add minnesota frontline. Web tax rate information : Web to be eligible for frontline worker pay, the applicant: On the minnesota return you subtract it under other income adjustments to income, as it is. In april 2022, minnesota issued a payment of $487.45 to residents who worked the frontlines during. Streamlined document workflows for any industry. Select federal in the left column; Scroll down to less common income; The 2022 federal income tax filing deadline is tuesday, april 18. Web it should be put under other income and is taxable on your federal return. Individual income tax [+] tax credits for. Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Web for all other frontline workers, adjusted gross income must be less than $185,000 for married joint filers ($85,000 for other filers). Web view the frontline worker pay program report (march 2023) to be eligible for frontline worker pay, the applicant: Find free. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. The payments will be of approximately $750.00 and the application. Web solved • by turbotax • 1640 • updated march 03, 2023. Web for all other frontline workers, adjusted gross income must be less than $185,000 for married joint filers ($85,000 for other filers). Web tax rate information : Web file an income tax return; Web we will share updated guidance and tax forms for affected tax years as soon as they are available, generally in early fall. The payments may be subtracted from. File for a property tax refund; Web to add minnesota frontline worker pay to federal: Streamlined document workflows for any industry. Select federal in the left column; Federal form 940, state futa credit certification; Find free tax preparation help; Web more than 1 million of minnesota's frontline workers received a bonus check of $487.45 in 2022. Sign in to your submittable account. Web to be eligible for frontline worker pay, the applicant: The 2022 federal income tax filing deadline is tuesday, april 18. While this payment is not taxable on your minnesota return, it is taxable on your federal return. Web frontline worker pay was signed into law on april 29, 2022.SEIU Minnesota on Twitter "⏰ THE TIME IS NOW! The State of Minnesota

Bonus Pay for MN Frontline Workers Access Financial Services Access

Minnesota Frontline Worker Pay Applications Open

IRS Says MN Frontline Workers Can Now File 2022 Taxes

Senator Jim Carlson

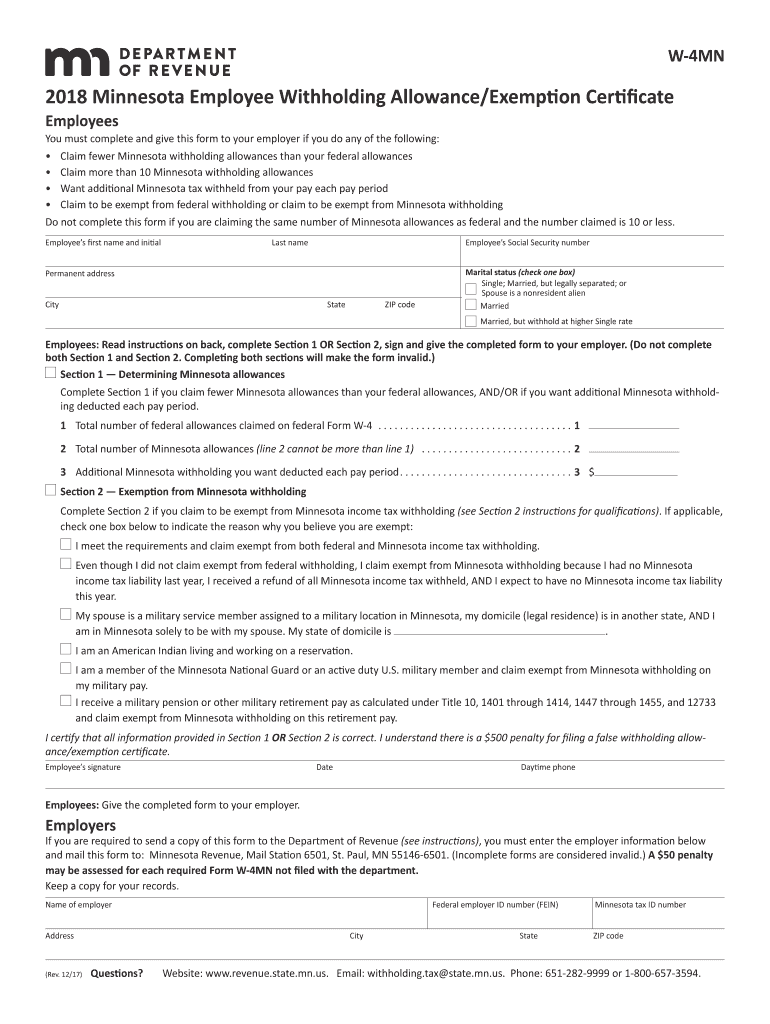

Form W 4 MN, Minnesota Employee Withholding Allowance Fill Out and

Minnesota’s New Frontline Worker Pay Law Requirements for Employers

Frontline Worker Pay outreach toolkit Minnesota Department of Labor

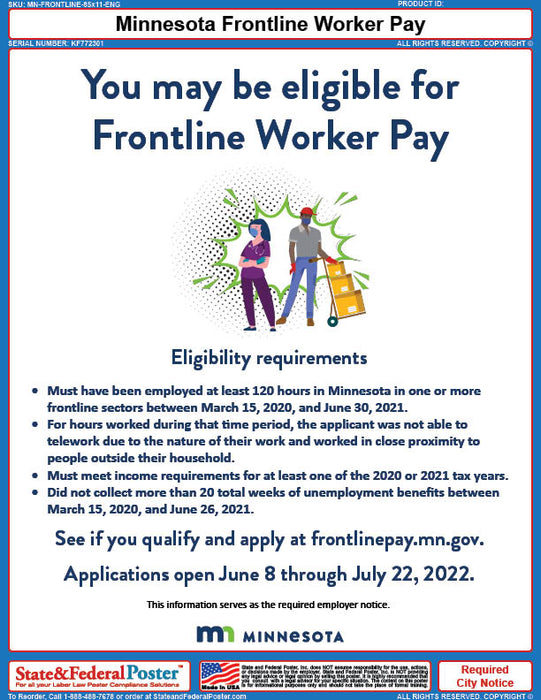

Minnesota Frontline Worker Pay — State and Federal Poster

Bonus Pay for MN Frontline Workers Access Financial Services Access

Related Post: