Where To Mail Form W-4V

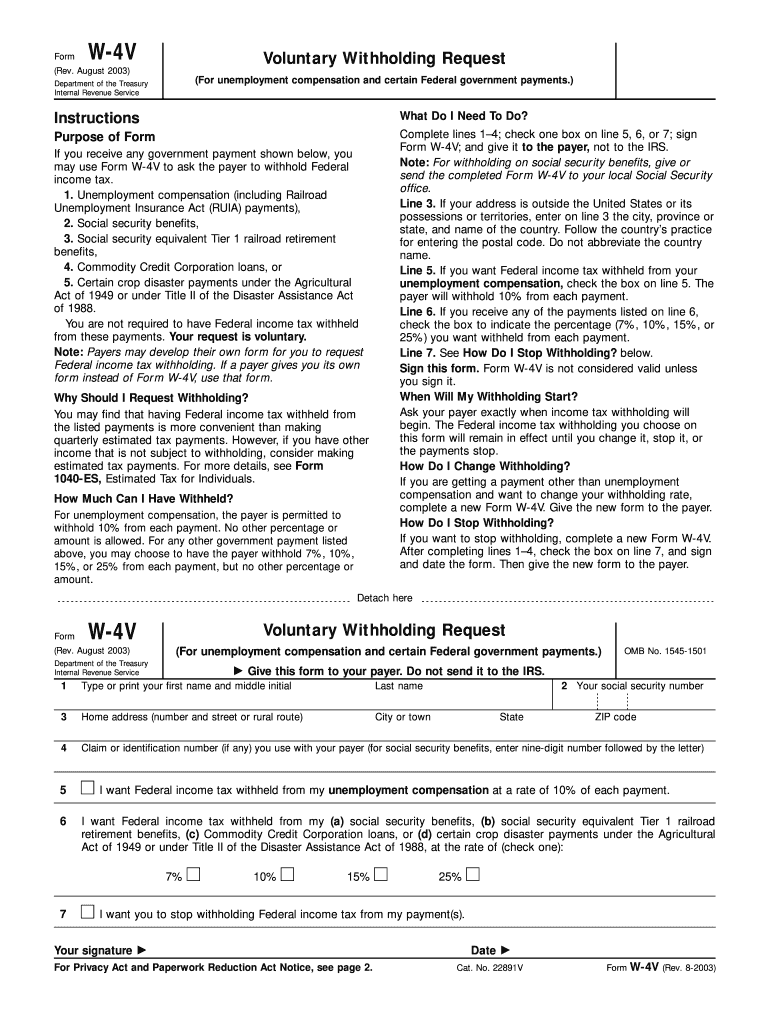

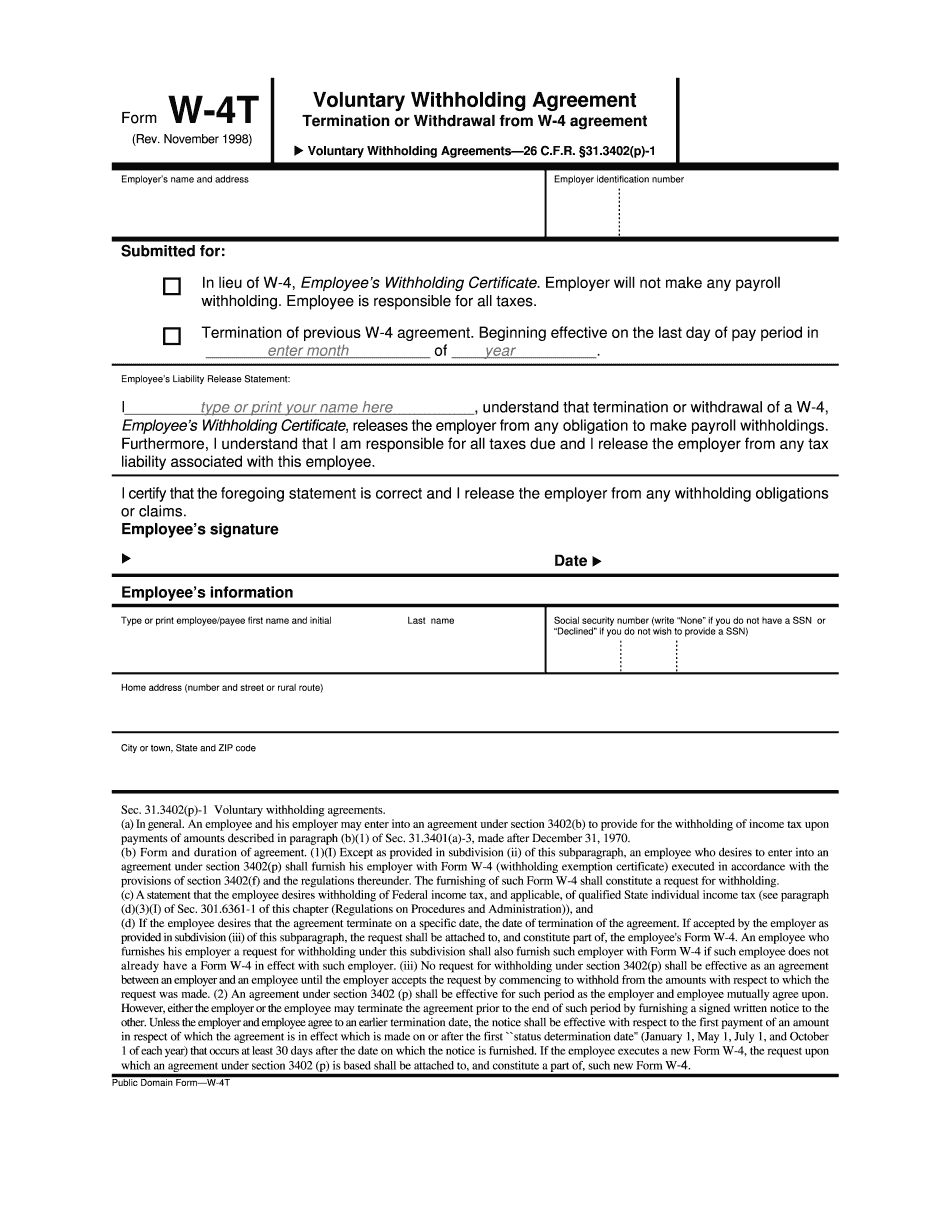

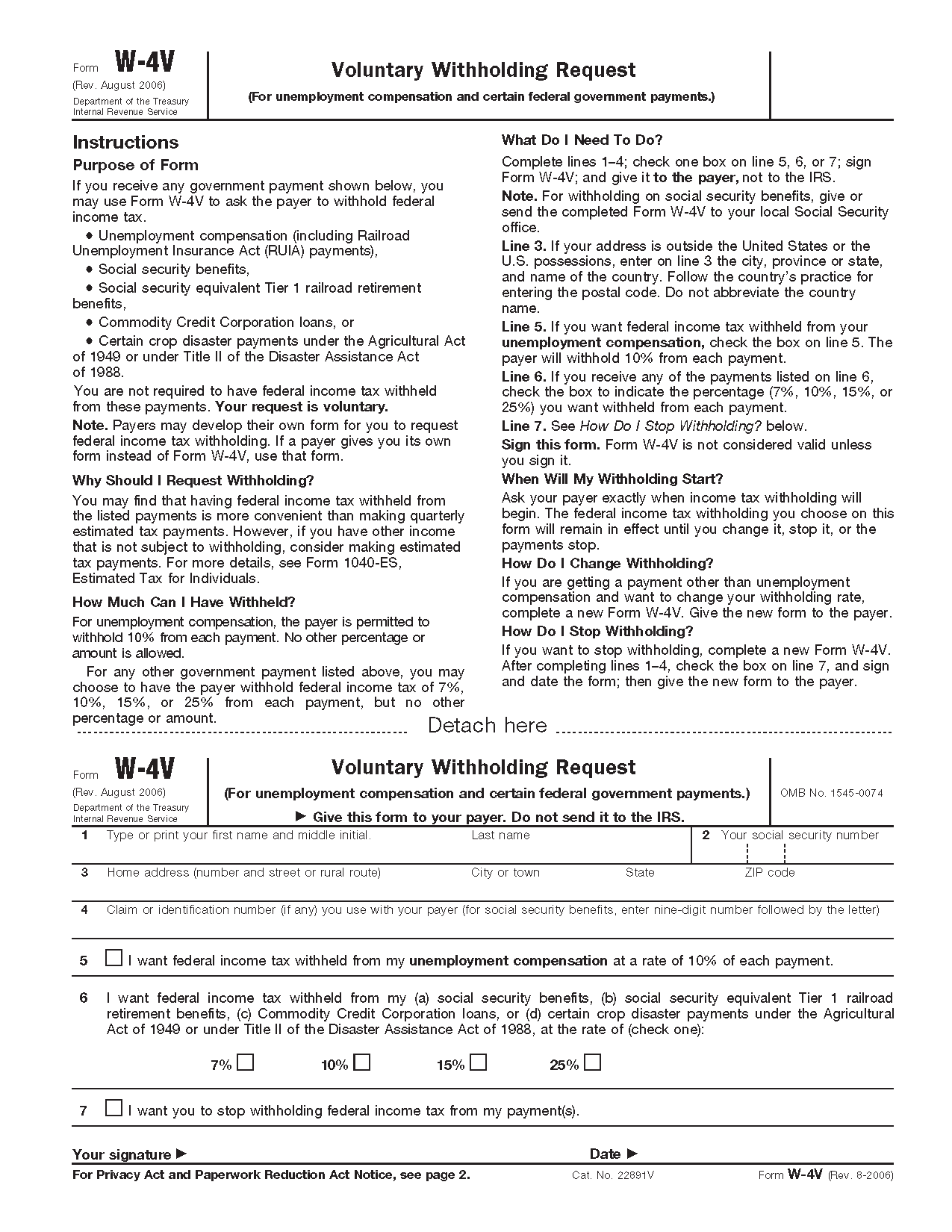

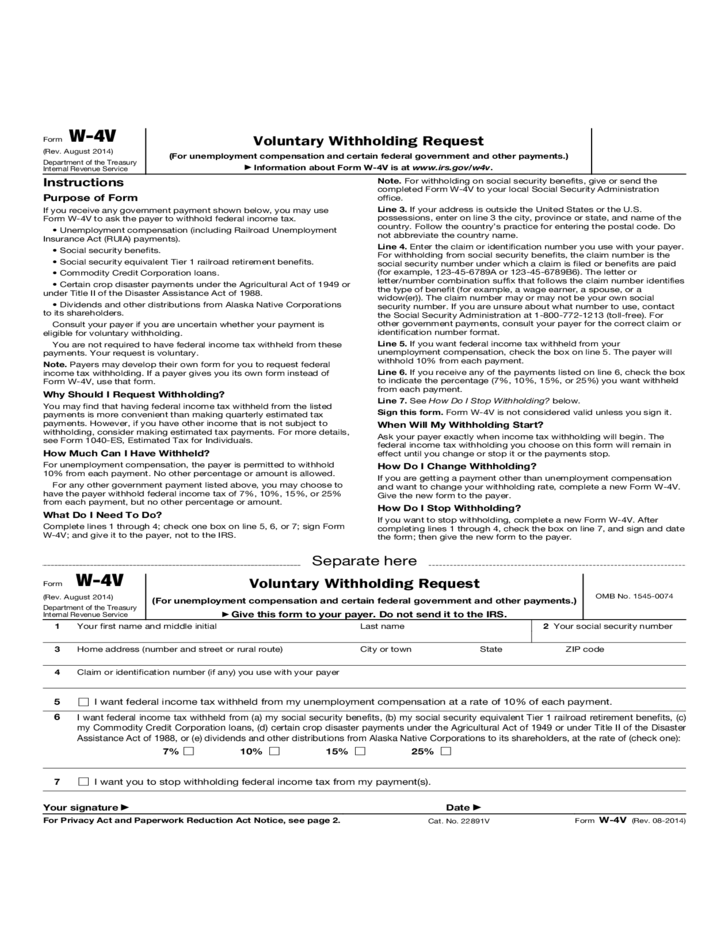

Where To Mail Form W-4V - Web sign the form and return it to your local social security office by mail or in person. Give the new form to the payer. Some addresses may not match a particular instruction booklet or publication. Web see answers (3) best answer. If you need more information if you have questions about your tax liability or want to request a. Complete lines 1 through 4; This form is for income earned in tax year. Ad uslegalforms.com has been visited by 100k+ users in the past month You can find the address of your local. Check one box on line 5, 6, or 7; If you need more information if you have questions about your tax liability or want to request a. Give the new form to the payer. And give it to the payer, not to the irs. If a customer service representatives (csr) representative (tsr) or spike mails out the form to a. You can find the office using the social security. You can find the address of your local. Web sign the form and return it to your local social security office by mail or in person. February 2018) department of the treasury internal revenue service. Ad uslegalforms.com has been visited by 100k+ users in the past month Web what do i need to do? Web see answers (3) best answer. Check one box on line 5, 6, or 7; Give the new form to the payer. Web mail or fax us a request to withhold taxes. And give it to the payer, not to the irs. Check one box on line 5, 6, or 7; Ad uslegalforms.com has been visited by 100k+ users in the past month Voluntary withholding request from the irs' website. Some addresses may not match a particular instruction booklet or publication. If you need more information if you have questions about your tax liability or want to request a. Give the new form to the payer. Ad uslegalforms.com has been visited by 100k+ users in the past month Check one box on line 5, 6, or 7; Web sign the form and return it to your local social security office by mail or in person. This form is for income earned in tax year. And give it to the payer, not to the irs. Web sign the form and return it to your local social security office by mail or in person. Check one box on line 5, 6, or 7; Web mail or fax us a request to withhold taxes. Voluntary withholding request from the irs' website. Web sign the form and return it to your local social security office by mail or in person. Check one box on line 5, 6, or 7; Voluntary withholding request from the irs' website. Web what do i need to do? When you complete the form, you can choose to have 7, 10, 12, or 22. Web through october 31, 2023, you and your authorized representatives may electronically sign documents and email documents to us during an audit or collection. This form is for income earned in tax year. You can find the address of your local. This is due to changes. Give the new form to the payer. And give it to the payer, not to the irs. Complete lines 1 through 4; Ad pdffiller.com has been visited by 1m+ users in the past month Web where to file. You can find the address of your local. You can find the office using the social security web. Web mail or fax us a request to withhold taxes. Give the new form to the payer. Web what do i need to do? When you complete the form, you can choose to have 7, 10, 12, or 22. Ad uslegalforms.com has been visited by 100k+ users in the past month This form is for income earned in tax year. Web what do i need to do? February 2018) department of the treasury internal revenue service. Web see answers (3) best answer. Check one box on line 5, 6, or 7; Complete lines 1 through 4; Give the new form to the payer. This is due to changes. When you complete the form, you can choose to have 7, 10, 12, or 22. Web through october 31, 2023, you and your authorized representatives may electronically sign documents and email documents to us during an audit or collection. If you need more information if you have questions about your tax liability or want to request a. Ad pdffiller.com has been visited by 1m+ users in the past month Some addresses may not match a particular instruction booklet or publication. If a customer service representatives (csr) representative (tsr) or spike mails out the form to a. And give it to the payer, not to the irs. Then, find the social security office closest to your home and mail or fax us the completed form. Web what do i need to do? Give the new form to the payer. Some addresses may not match a particular instruction booklet or publication.Irs Form W4V Printable where do i mail my w 4v form for social

Irs Form W4V Printable where do i mail my w 4v form for social

Printable W4v Form Printable World Holiday

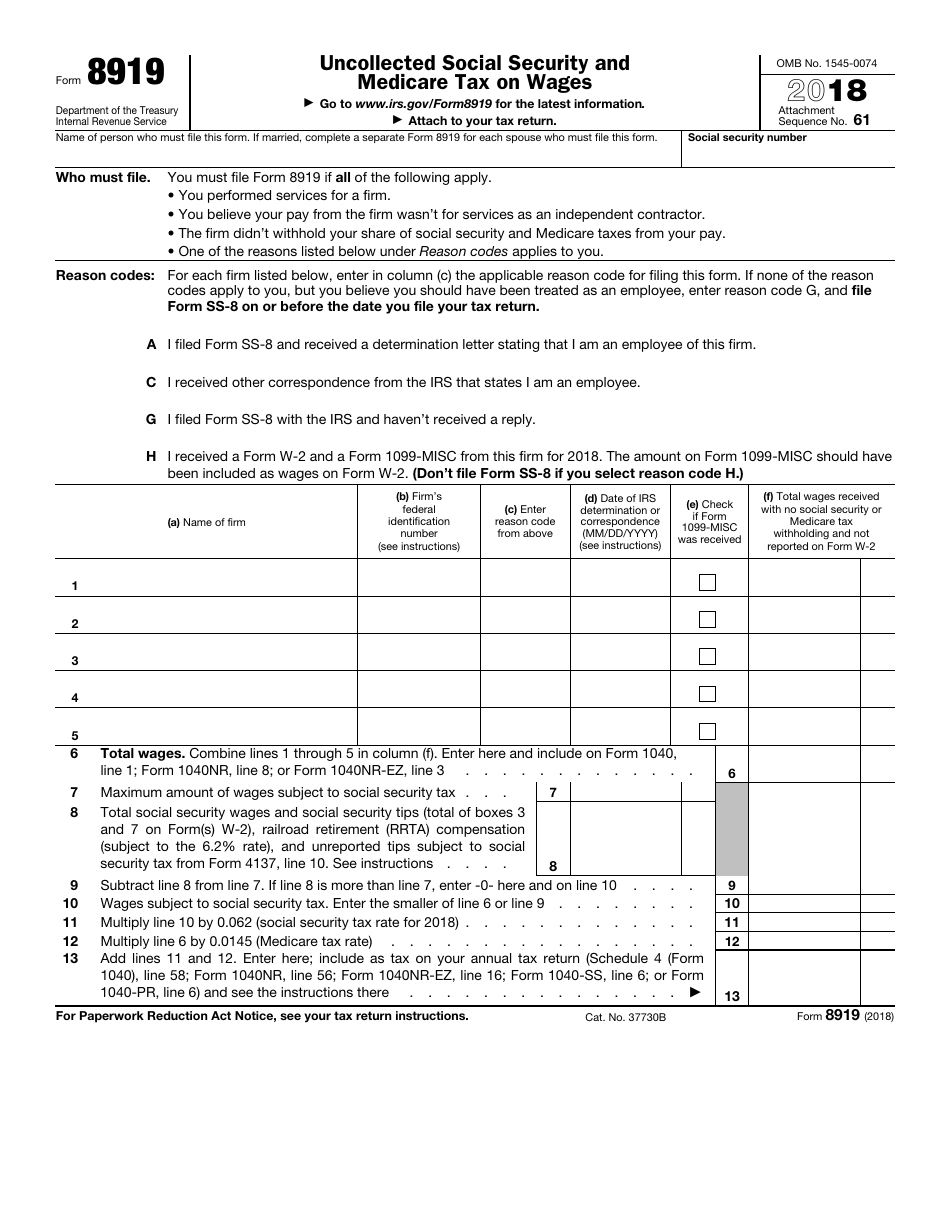

IRS Form W 4V Printable

Irs Form W 4V Printable

W 4V Form SSA Printable 2022 W4 Form

Form W 4V Printable

Form W 4v Printable Printable World Holiday

W4v Form 2022 Printable Printable World Holiday

W4v Fill out & sign online DocHub

Related Post: