What Is An Ero On A Tax Form

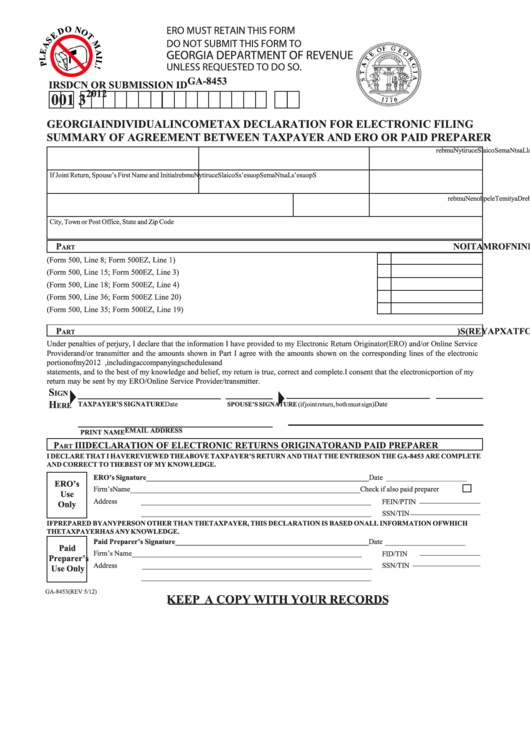

What Is An Ero On A Tax Form - Direct file will be a mobile. Ero stands for electronic return originator. As stated above, an ero is a company that files electronic tax returns and usually helps prepare them. Web what is an ero pin and where should i enter it? Web what is ero on your tax form? Adjust the amounts of credits claimed in the claimed column in part i. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Ero stands for electronic return originator, an individual or business authorized by the irs to electronically. Web eligible taxpayers may choose to participate in the pilot next year to file their tax year 2023 federal tax return for free, directly with the irs. In many cases, the ero also prepares. Web eligible taxpayers may choose to participate in the pilot next year to file their tax year 2023 federal tax return for free, directly with the irs. The ero is usually the. This is the person or firm who signs the actual return and agrees to electronically file the return with the irs. Time’s up for millions of americans: Web. Ero stands for electronic return originator, an individual or business authorized by the irs to electronically. The final deadline to file your 2022 taxes is october 16. It’s a person or firm authorized by the irs to. Web ero definition and importance what is ero? Web what is an ero pin and where should i enter it? Time’s up for millions of americans: Web irs form 9325 is the official form that the irs uses to inform taxpayers that their federal return was accepted. In this article, we’ll take a closer look at irs form. The final deadline to file your 2022 taxes is october 16. The ero is usually the. Eros cannot file or submit tax. Millions of people file every year for an. Web no, form 1040 and form 1099 are two different federal tax forms. Adjust the amounts of credits claimed in the claimed column in part i. About the ero pinan electronic return originator (ero) pin is a numeric representation of the preparer's. The ero is usually the. Web irs form 9325 is the official form that the irs uses to inform taxpayers that their federal return was accepted. Web eligible taxpayers may choose to participate in the pilot next year to file their tax year 2023 federal tax return for free, directly with the irs. The business taxpayer (irs authorized signer) must. In many cases, the ero also prepares. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return. In many cases, the ero also prepares. Web no,. The business taxpayer (irs authorized signer) must sign their own return via the approved software and should not disclose the pin to. Officially, the ero is the person. Web the ero is the person or firm who collects the actual return from the taxpayer or preparer for the purpose of electronically filing it with the irs. Direct file will be. Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. This is the person or firm who signs the actual return and agrees to electronically file the return with the irs. Adjust the amounts of credits claimed in the claimed column in part i. Web the ero is. Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. The irs only allows e. Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return. Web ero definition and importance what is ero? Web what. This is the person or firm who signs the actual return and agrees to electronically file the return with the irs. The irs only allows e. Web the electronic return originator, ero, is a person or business that originates federal income tax returns electronically for the internal revenue service,. In this article, we’ll take a closer look at irs form.. Web ero definition and importance what is ero? Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. About the ero pinan electronic return originator (ero) pin is a numeric representation of the preparer's. Web the ero is the person or firm who collects the actual return from the taxpayer or preparer for the purpose of electronically filing it with the irs. Web what is ero on your tax form? Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. As stated above, an ero is a company that files electronic tax returns and usually helps prepare them. In this article, we’ll take a closer look at irs form. Officially, the ero is the. In many cases, the ero also prepares. Eros cannot file or submit tax. The irs only allows e. Time’s up for millions of americans: Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. It’s a person or firm authorized by the irs to. Adjust the amounts of credits claimed in the claimed column in part i. Web definition an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. This is the person or firm who signs the actual return and agrees to electronically file the return with the irs. Direct file will be a mobile. Web eligible taxpayers may choose to participate in the pilot next year to file their tax year 2023 federal tax return for free, directly with the irs.Fillable Form Ga8453 Individual Tax Declaration For

ERO eFiling 94x Completing Form 8879EMP (DAS)

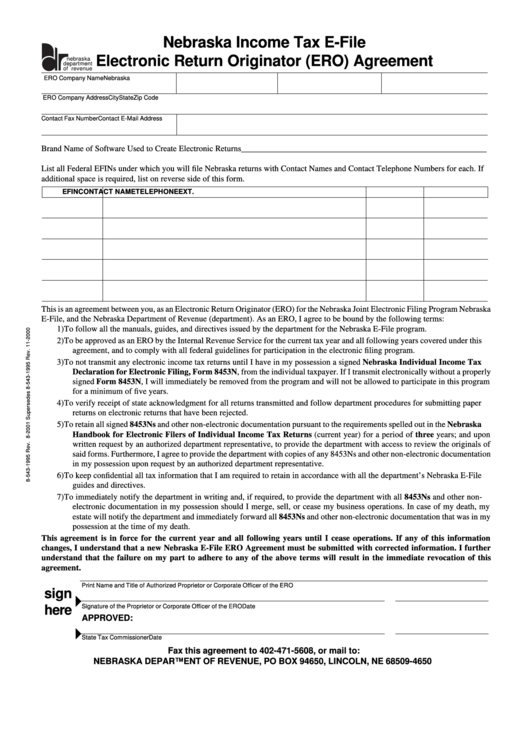

Form 85431999 Nebraska Tax EFile Electronic Return

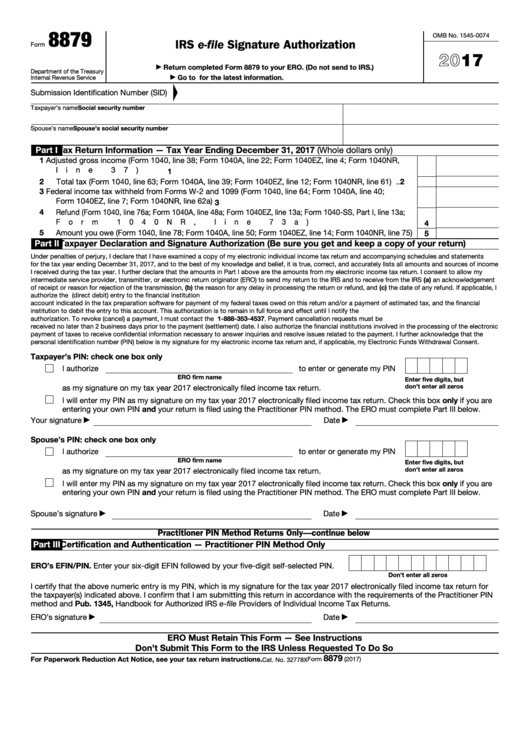

Fillable Form 8879 Irs E File Signature Authorization 2017 Free Nude

ERO eFiling 94X Completing Form 8879EMP (CWU)

Form 8879 IRS efile Signature Authorization (2014) Free Download

IRS Form 941 Payroll Taxes errors late payroll taxes

PA8879 2010 EFile Signature Authorization Free Download

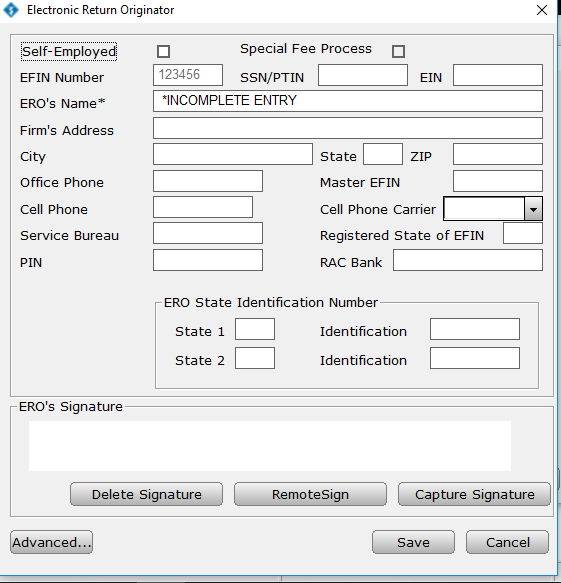

How to manually add ERO information in the EF Originators database in

How to manually add ERO information in the EF Originators database in

Related Post:

.jpg)