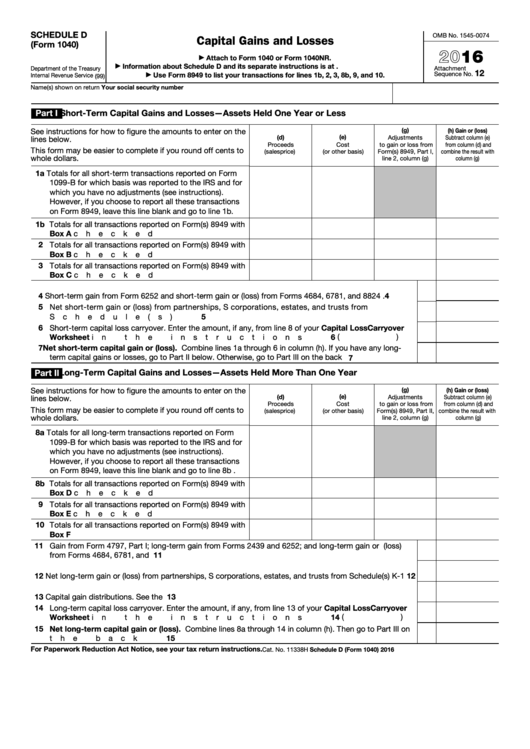

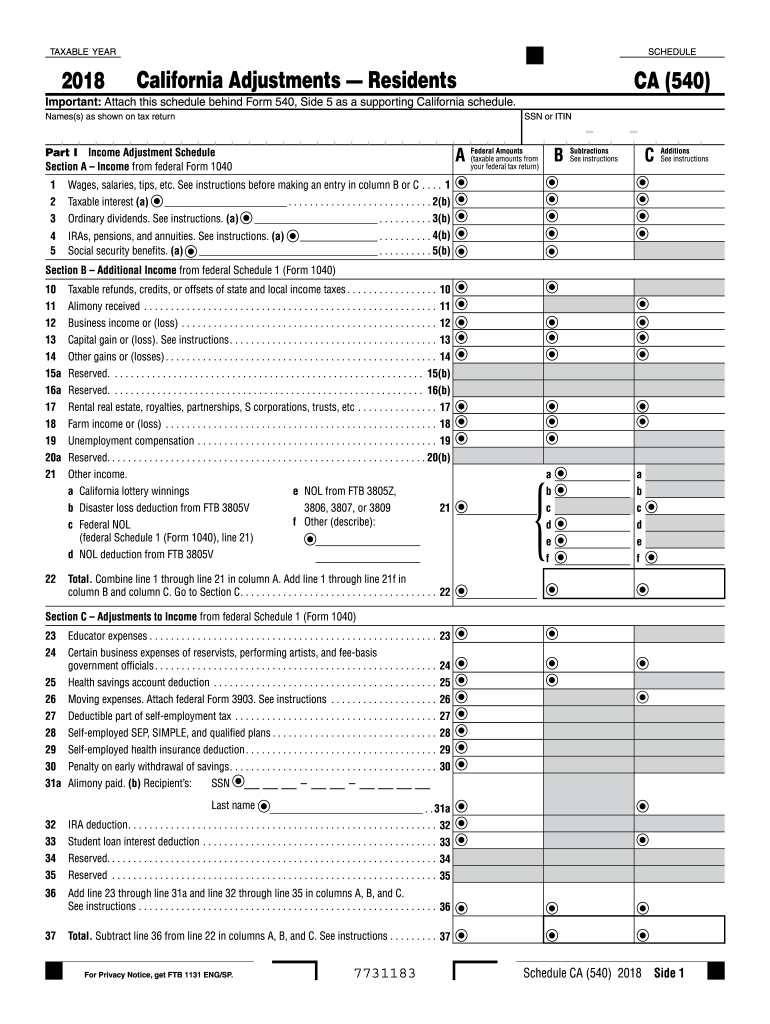

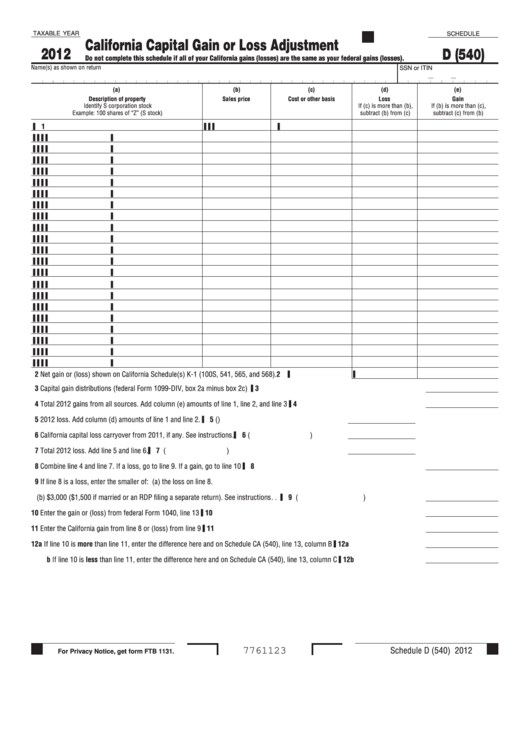

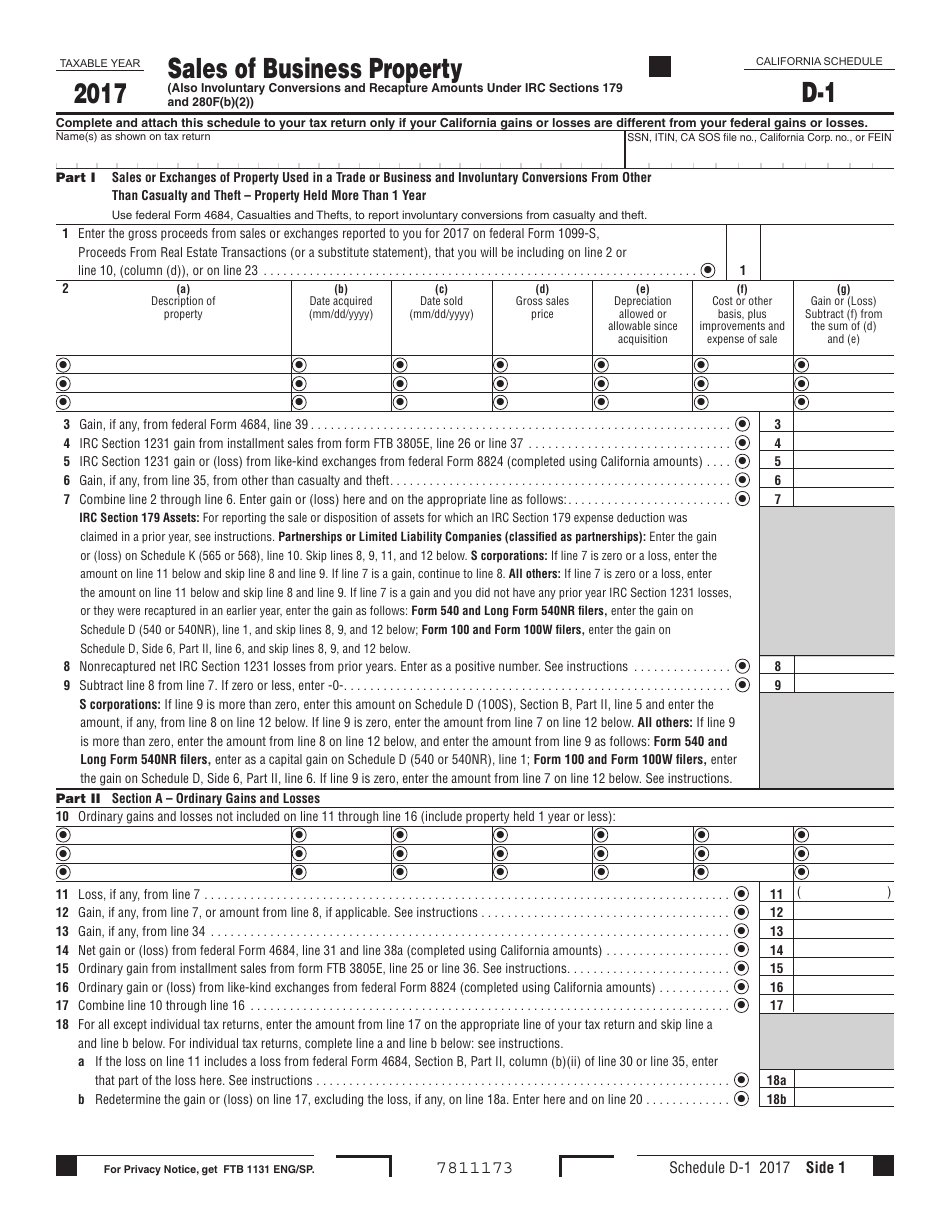

California Form 540 Schedule D Capital Loss Carryover

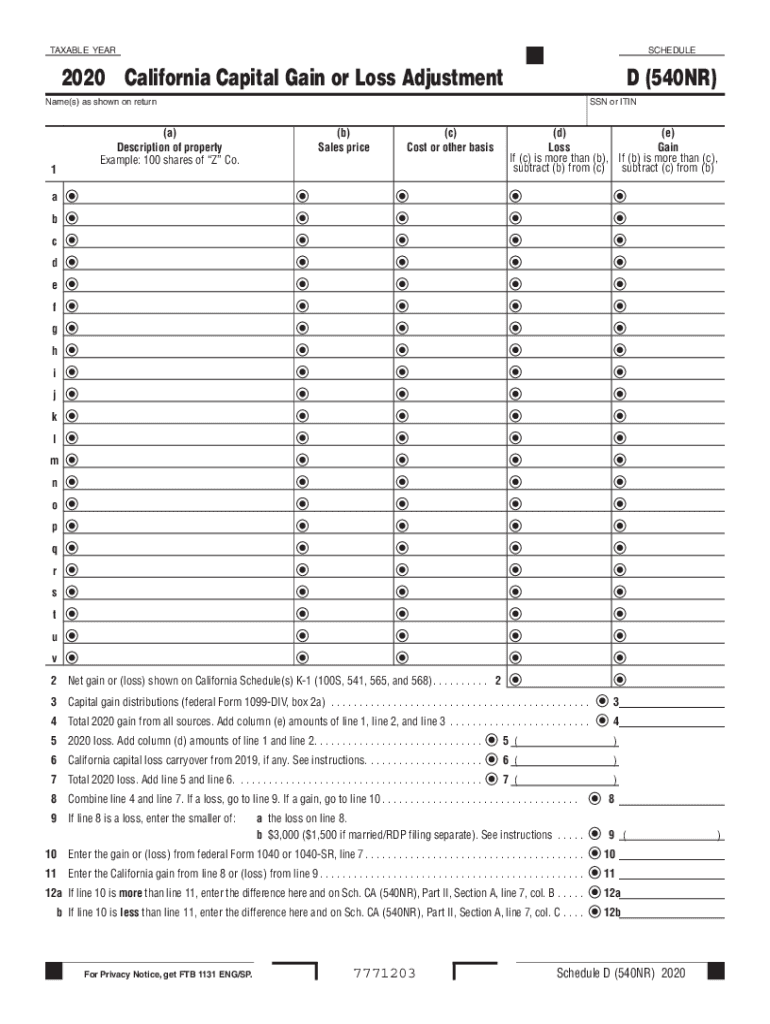

California Form 540 Schedule D Capital Loss Carryover - 100 shares of “z” co. Disposition of property inherited before 1987. This form is for income earned in tax year 2022, with tax returns. Web the 2020 capital loss carryover to 2021 is computed using the california capital loss carryover worksheet in the 2020 instructions for california schedule d. Web so you have to enter the capital loss carryover manually in the worksheet using 2018's line 11 on schedule d (540) based on my reading of the 2018 and 2017. 2021 schedule d (540) california is. Schedule d (540) taxable year 2021 (a) description of. Schedule d (540) taxable year 2020 (a) description of. Web do not complete this schedule if all of your california gains (losses) are the same as your federal gains (losses). Ultratax cs uses this data together with information from screens cainc and caamt to complete forms. Web f rivac , 1131. Web do not complete this schedule if all of your california gains (losses) are the same as your federal gains (losses). 7761193 schedule d (540) 2019 side 1 taxable year 2019 california capital gain or loss adjustment schedule do not complete this schedule if all of. Web the field header says now look at your. Schedule d (540) taxable year 2021 (a) description of. Ultratax cs uses this data together with information from screens cainc and caamt to complete forms. Web f rivac , 1131. 2021 schedule d (540) california is. Gain on the sale or disposition of a. Use california schedule d (540), california capital gain or loss adjustment, onlyif there is a difference between your california and federal capital gains and losses. 1001, for more information about the following: The short term capital loss carryover on line 6, and long term on line 14. Web if neither condition is met, there are no carryovers if the taxpayer. Web if neither condition is met, there are no carryovers if the taxpayer and spouse once filed a joint return and are filing separate returns for 2021, any capital loss carryover from the. Web the field header says now look at your california form 540, schedule d and enter your capital loss carryover, if any, as a positive amount. The. To figure the overall gain or loss from transactions reported on form 8949; (b) sales price (c) cost or other basis (d) loss. Use california schedule d (540), california capital gain or loss adjustment, only if there is a difference between your california and federal capital gains and. Web so you have to enter the capital loss carryover manually in. Web for 2002, the maximum amount is $24,000. Web the 2020 capital loss carryover to 2021 is computed using the california capital loss carryover worksheet in the 2020 instructions for california schedule d. 2021 schedule d (540) california is. Disposition of property inherited before 1987. D (540) (a) description of property. Use california schedule d (540), california capital gain or loss adjustment, only if there is a difference between your california and federal capital gains and. D (540) (a) description of property. Web the 2019 capital loss carryover to 2020 is computed using a worksheet in the 2019 instructions for california schedule d (540), california capital gain or loss. Web the. This form is for income earned in tax year 2022, with tax returns. Web the 2020 capital loss carryover to 2021 is computed using the california capital loss carryover worksheet in the 2020 instructions for california schedule d. Web do not complete this schedule if all of your california gains (losses) are the same as your federal gains (losses). Web. Web so you have to enter the capital loss carryover manually in the worksheet using 2018's line 11 on schedule d (540) based on my reading of the 2018 and 2017. Ultratax cs uses this data together with information from screens cainc and caamt to complete forms. The short term capital loss carryover on line 6, and long term on. 1001, for more information about the following: Gain on the sale or disposition of a. The short term capital loss carryover on line 6, and long term on line 14. Web the 2020 capital loss carryover to 2021 is computed using the california capital loss carryover worksheet in the 2020 instructions for california schedule d. Web so you have to. This form is for income earned in tax year 2022, with tax returns. Web the field header says now look at your california form 540, schedule d and enter your capital loss carryover, if any, as a positive amount. Web capital loss carryovers from a prior year may be entered on the d2 screen (on the income tab). (b) sales price (c) cost or other basis (d) loss. Schedule d (540) taxable year 2020 (a) description of. Qualified opportunity zone funds the tcja established opportunity zones. Use california schedule d (540), california capital gain or loss adjustment, only if there is a difference between your california and federal capital gains and. Web california capital gain or loss adjustment. Web we last updated california form 540 schedule d in february 2023 from the california franchise tax board. Web the 2019 capital loss carryover to 2020 is computed using a worksheet in the 2019 instructions for california schedule d (540), california capital gain or loss. Web for 2002, the maximum amount is $24,000. Web f rivac , 1131. Web do not complete this schedule if all of your california gains (losses) are the same as your federal gains (losses). Web we last updated the california capital gain or loss adjustment in february 2023, so this is the latest version of form 540 schedule d, fully updated for tax year 2022. Web so you have to enter the capital loss carryover manually in the worksheet using 2018's line 11 on schedule d (540) based on my reading of the 2018 and 2017. Schedule d (540) taxable year 2021 (a) description of. To figure the overall gain or loss from transactions reported on form 8949; Web the 2020 capital loss carryover to 2021 is computed using the california capital loss carryover worksheet in the 2020 instructions for california schedule d. 2021 schedule d (540) california is. Web in addition, with our service, all of the information you provide in the 2021 schedule d (540) california capital gain or loss adjustment.2013 Schedule D (540) California Capital

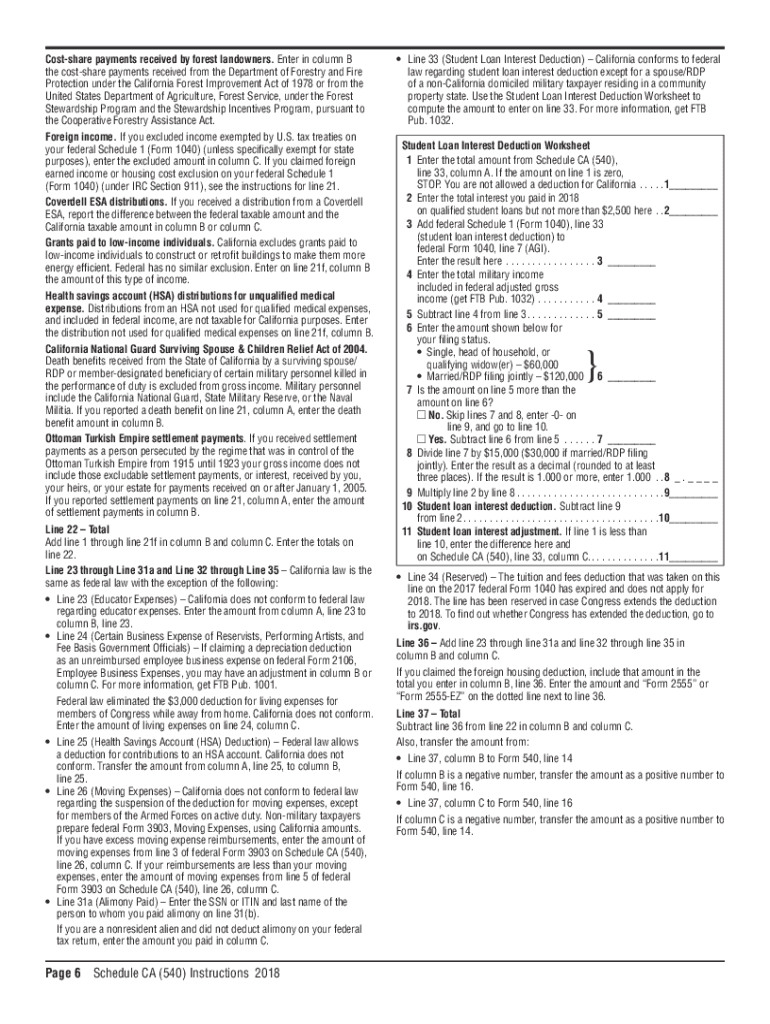

2018 Form CA Schedule CA (540) InstructionsFill Online, Printable

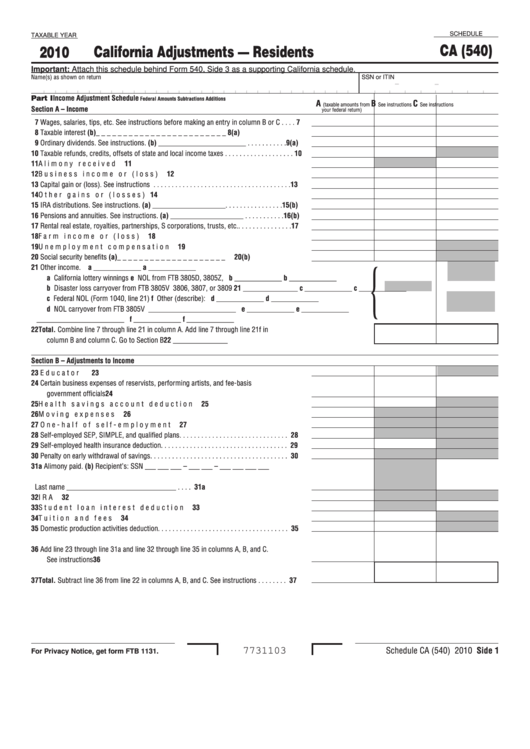

Fillable Schedule Ca (540) California Adjustments Residents 2010

Printable California Form 540 NR Schedule D California Capital Gain or

Carryover Worksheet Turbotax

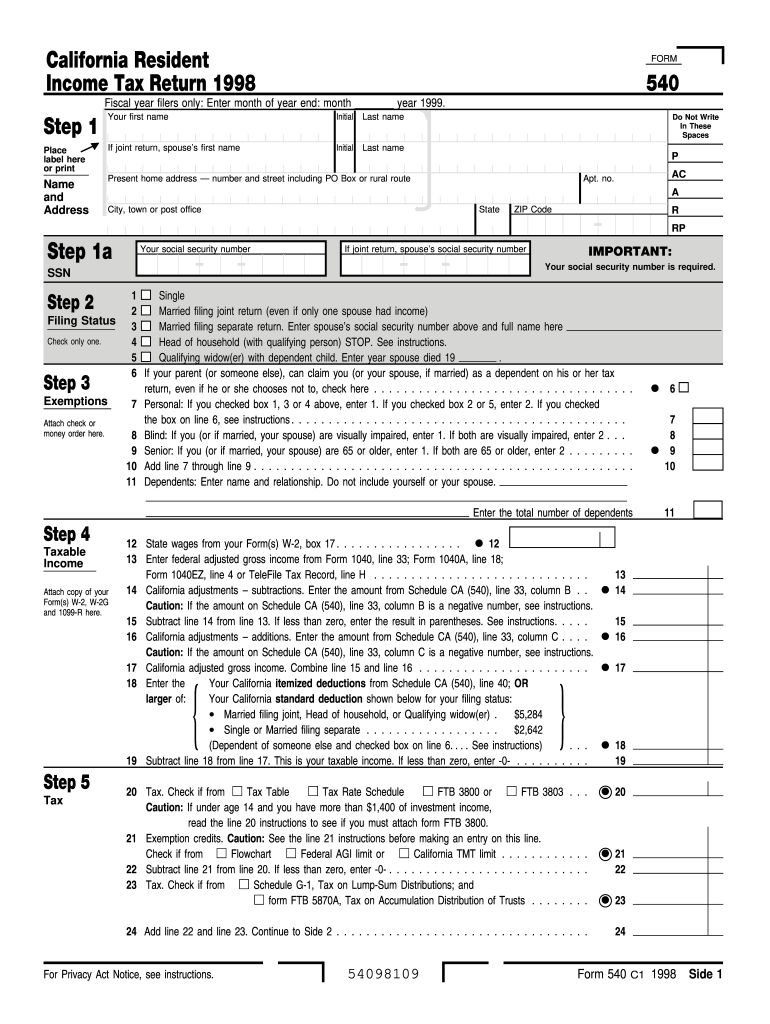

Form 540 California Resident Tax Return Fill Out and Sign

Schedule D Form Fillable Printable Forms Free Online

20182020 Form CA FTB Schedule CA (540) Fill Online, Printable

Fillable Schedule D (540) California Capital Gain Or Loss Adjustment

Form 540 Schedule D1 Download Printable PDF or Fill Online Sales of

Related Post: