Mo Withholding Form

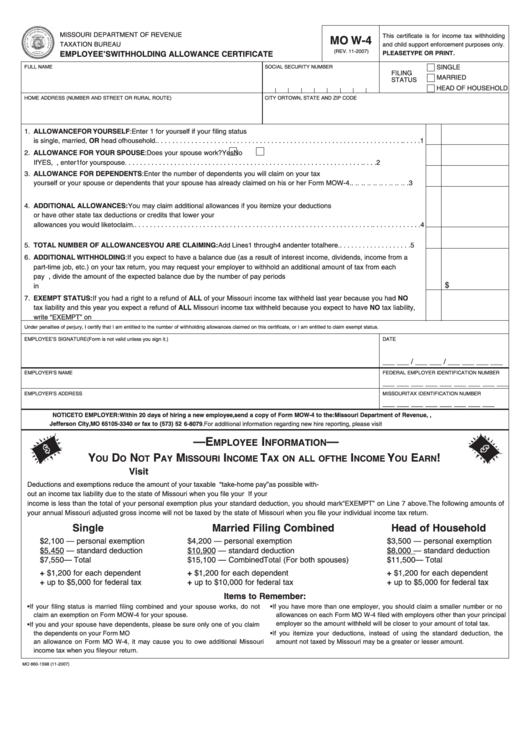

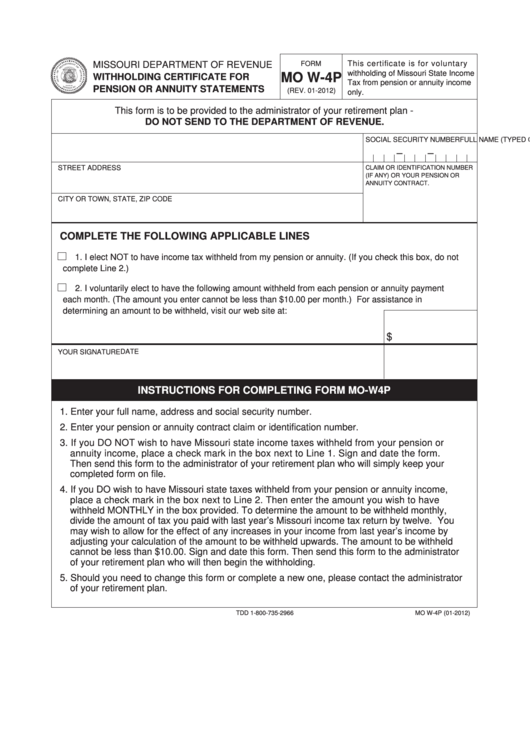

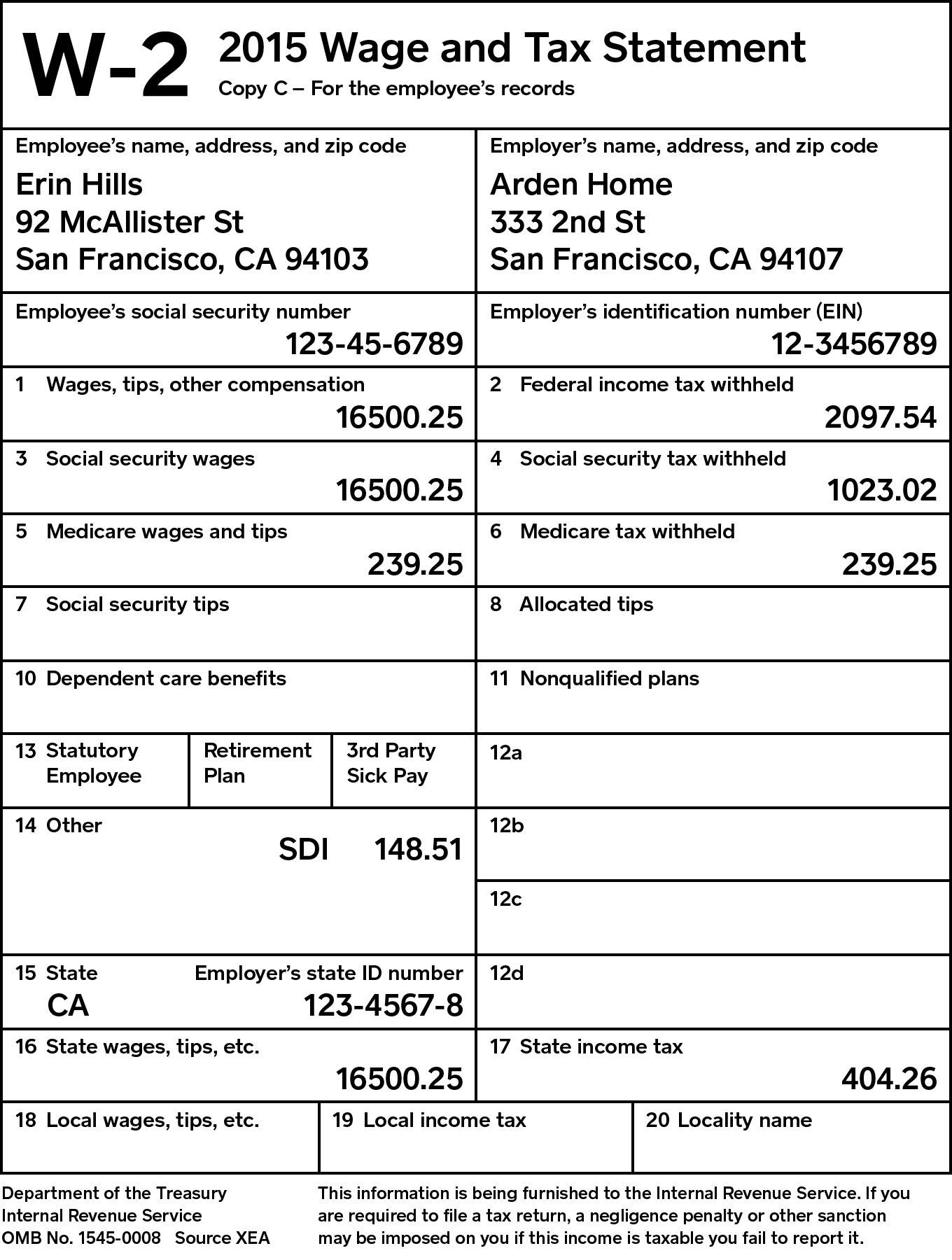

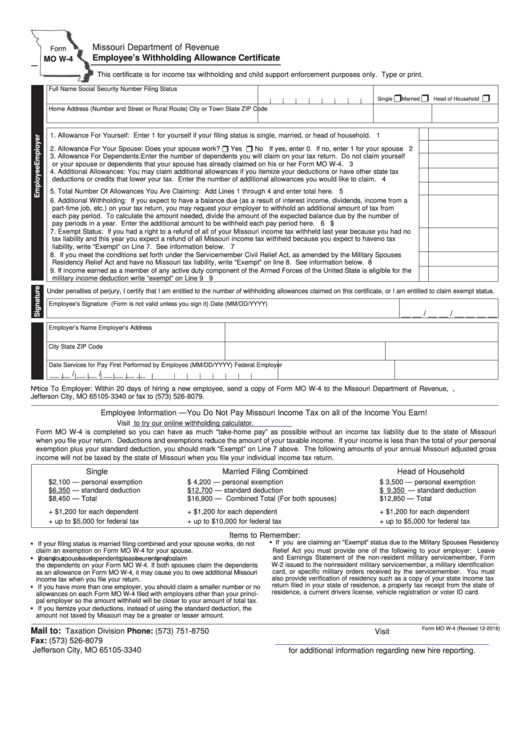

Mo Withholding Form - If too little is withheld, you will generally owe tax when you file your tax return. Web all new employees are required to complete a paper form for federal and state withholding. The individual must be authorized to. Web (section 143.191, rsmo) withholding is the tax that an employer deducts and withholds from employees’ wages every pay period. The withholding is based on the employee’s. How do i make payments and file my return? And the filing status is: Web request for mail order forms may be used to order one copy or several copies of forms. Web all transactions provide a confirmation number which you can keep for your records to verify that your filing has been received. What is the timely compensation deduction? You must provide the contact information for the individual filing this return. Web georgia department of revenue. This certificate is for income tax withholding and child support enforcement purposes only. Department of the treasury internal revenue service. If the payroll is daily: This certificate is for income tax withholding and child support enforcement purposes only. Forms claiming more than 14 allowances or exempt from withholding must be mailed to the taxpayer services division, p. 2,790 2,820 79 51 23 2,820 2,850 81 53 25 2,850 2,880 83 55 26 2,880 2,910 84 56 28 2,910 2,940 86 58 29 2,940. You must. Web what should i do? Complete, edit or print tax forms instantly. At least but less than. Otherwise, skip to step 5. What is the timely compensation deduction? What is the timely compensation deduction? Web request for mail order forms may be used to order one copy or several copies of forms. Web all new employees are required to complete a paper form for federal and state withholding. The withholding is based on the employee’s. Failure to provide payroll with a valid withholding certificate will. Please use the link below. Department of the treasury internal revenue service. Otherwise, skip to step 5. Web 2021 missouri income tax withholding table. This certificate is for income tax withholding and child support enforcement purposes only. You must provide the contact information for the individual filing this return. Web 2021 missouri income tax withholding table. 2,790 2,820 79 51 23 2,820 2,850 81 53 25 2,850 2,880 83 55 26 2,880 2,910 84 56 28 2,910 2,940 86 58 29 2,940. Get ready for tax season deadlines by completing any required tax forms today. If the. Web (section 143.191, rsmo) withholding is the tax that an employer deducts and withholds from employees’ wages every pay period. Complete, edit or print tax forms instantly. Employee's withholding certificate form 941; This certificate is for income tax withholding and child support enforcement purposes only. Please use the link below. Employers engaged in a trade or business who. Employee's withholding certificate form 941; Web estimate your federal income tax withholding; The individual must be authorized to. If too little is withheld, you will generally owe tax when you file your tax return. Web the missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals. Web (section 143.191, rsmo) withholding is the tax that an employer deducts and withholds from employees’ wages every pay period. Get ready for tax season deadlines by completing any required tax forms today. The individual must be authorized to.. If the payroll is daily: Please use the link below. See page 2 for more information on each step, who can claim. Complete, edit or print tax forms instantly. Web (section 143.191, rsmo) withholding is the tax that an employer deducts and withholds from employees’ wages every pay period. Failure to provide payroll with a valid withholding certificate will. Web (section 143.191, rsmo) withholding is the tax that an employer deducts and withholds from employees’ wages every pay period. Box 3340, jefferson city, mo 65105. Web all transactions provide a confirmation number which you can keep for your records to verify that your filing has been received. See page 2 for more information on each step, who can claim. The withholding is based on the employee’s. What is the timely compensation deduction? Web all new employees are required to complete a paper form for federal and state withholding. Web estimate your federal income tax withholding; 2,790 2,820 79 51 23 2,820 2,850 81 53 25 2,850 2,880 83 55 26 2,880 2,910 84 56 28 2,910 2,940 86 58 29 2,940. And the filing status is: Web 2021 missouri income tax withholding table. Otherwise, skip to step 5. Web missouri department of revenue withholding certificate for pension or annuity statements this form is to be provided to the administrator of your retirement plan. Employee's withholding certificate form 941; Please use the link below. Employers engaged in a trade or business who. At least but less than. Forms claiming more than 14 allowances or exempt from withholding must be mailed to the taxpayer services division, p. Web what should i do?Fillable Form Mo W4 Employee'S Withholding Allowance Certificate

Missouri Form MO W4 App

Fillable Form Mo W4p Withholding Certificate For Pension Or Annuity

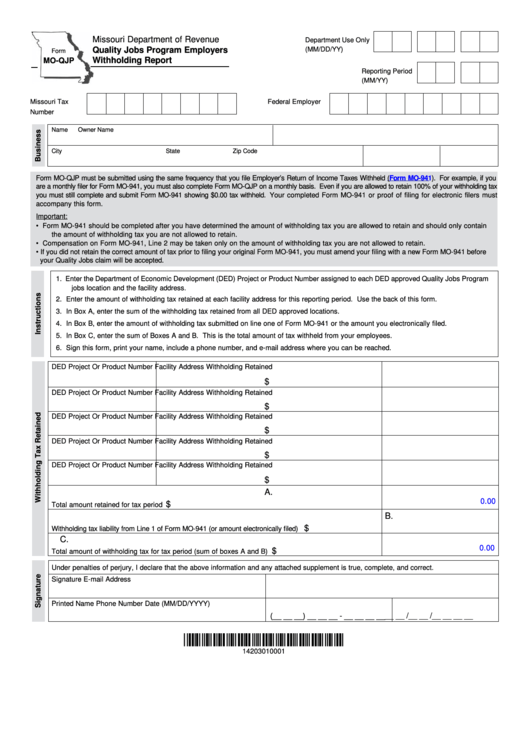

Missouri Employer Withholding Tax Form

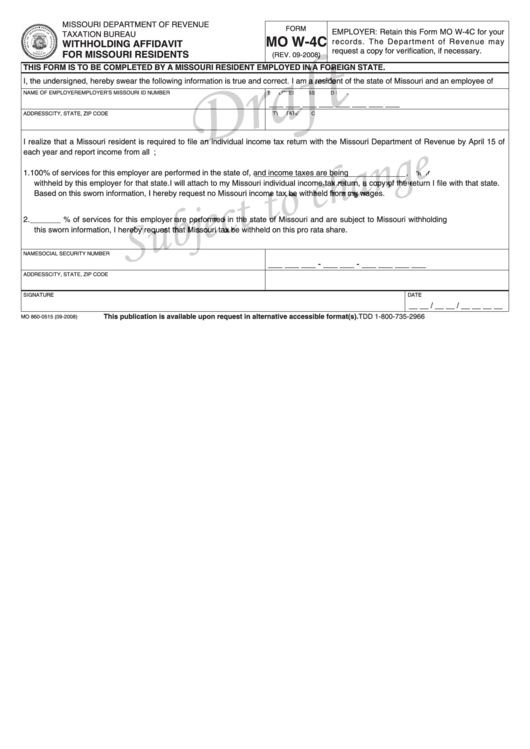

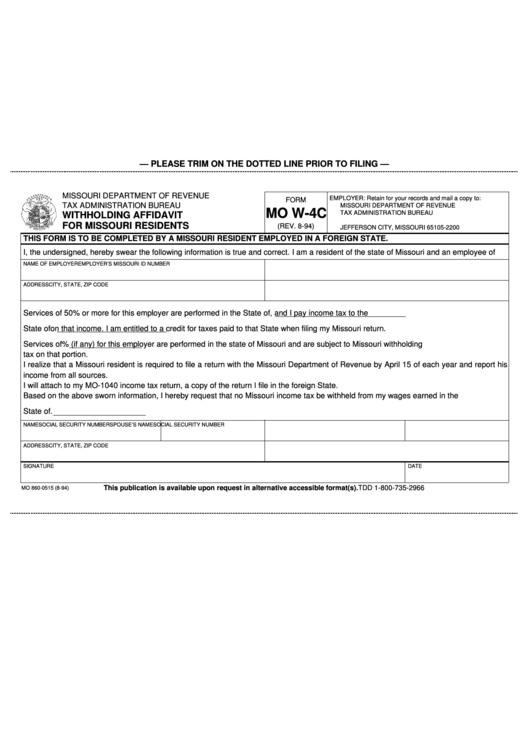

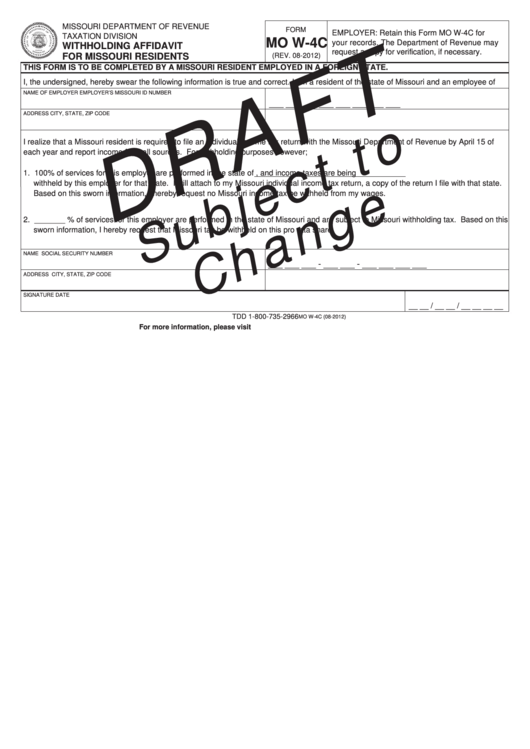

Form Mo W4c Withholding Affidavit For Missouri Residents printable

Fillable Form Mo W4c Withholding Affidavit For Missouri Residents

Form Mo W4c Withholding Affidavit For Missouri Residents printable

Fillable Form Mo W 4 Employee S Withholding Allowance Certificate

Top 42 Missouri Withholding Form Templates free to download in PDF format

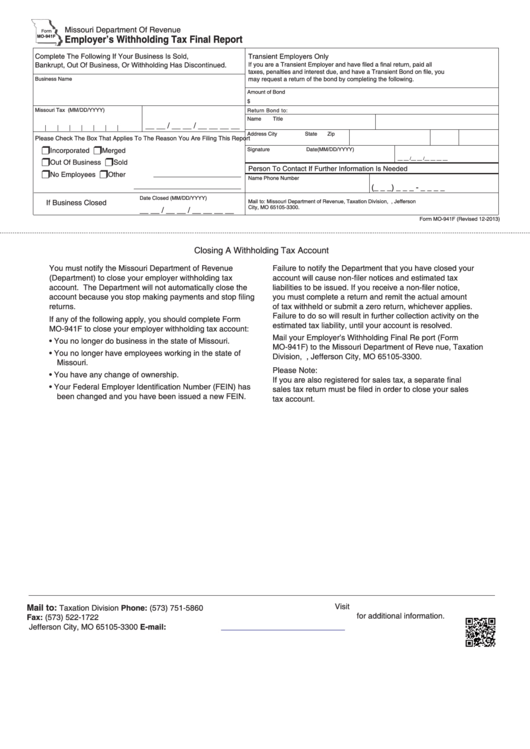

Fillable Form Mo941f Employer'S Withholding Tax Final Report 2013

Related Post: