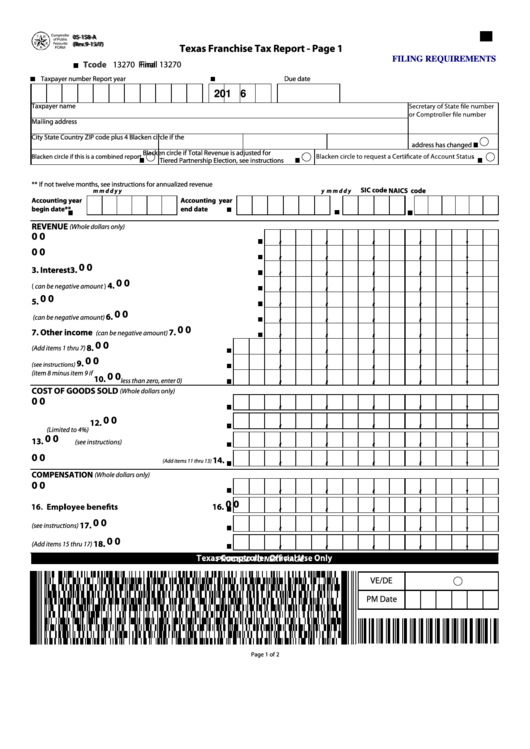

Texas Form 05-158-A Instructions

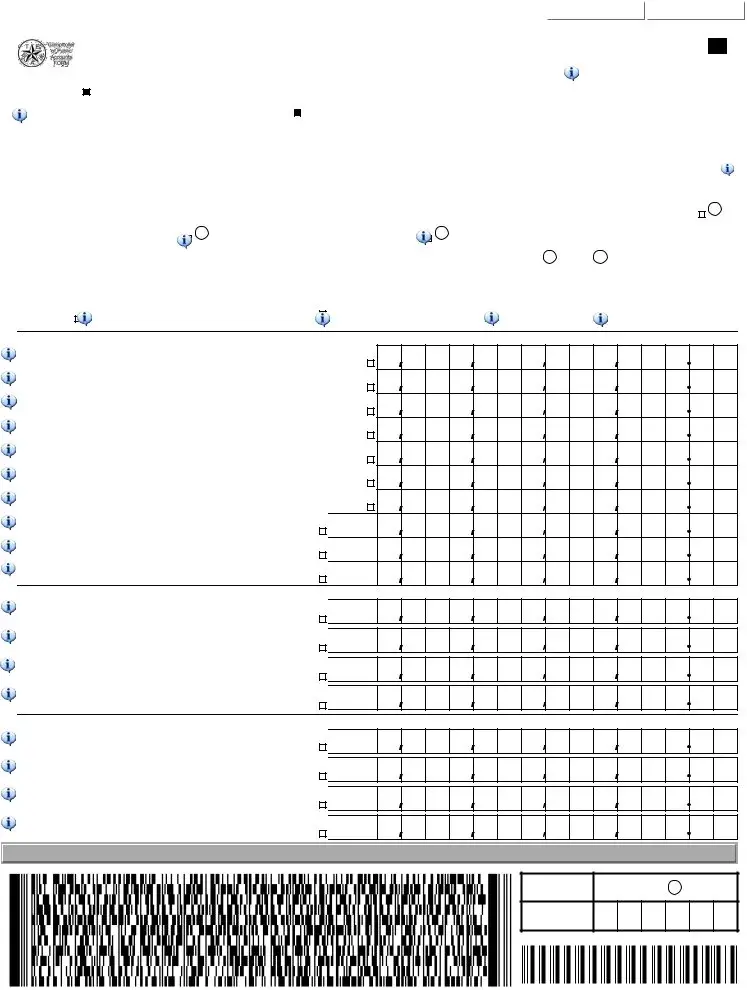

Texas Form 05-158-A Instructions - Obtain the template on the webpage in the. 0 0 cost of goods sold (whole dollars only) compensation (whole dollars only) 15. Texas comptroller of public accounts. Total cost of goods sold (add items 11 thru 13) 14. Use get form or simply click on the template preview to open it in the editor. Do not include payment if this amount is less than$1,000 or if annualized total revenue is $1,000,000 or less ($300,000 or less for report years 2008 and 2009; Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. If the entity makes a tiered partnership election, any amount. Enter dividends for the period upon which the tax is based. Total cost of goods sold (add items 11 thru 13) 14. The texas franchise tax is imposed on each taxable entity formed or organized in texas or doing business in texas. If the entity makes a tiered partnership election, any amount. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Enter interest. Do not include payment if this amount is less than$1,000 or if annualized total revenue is $1,000,000 or less ($300,000 or less for report years 2008 and 2009; The form is used to calculate the amount of taxable income and tax credits that the taxpayer is eligible for, as well as the amount of taxes owed. Texas labels their forms. Texas tax code section 171.001 imposes franchise tax on each taxable entity that is formed in or doing. Use get form or simply click on the template preview to open it in the editor. Total compensation (add items 15 thru 17). 0 0 cost of goods sold (whole dollars only) compensation (whole dollars only) 15. Web any entity that does. If the entity makes a tiered partnership election, any amount in item 34 is. Texas tax code section 171.001 imposes franchise tax on each taxable entity that is formed in or doing. Use get form or simply click on the template preview to open it in the editor. Web texas form 05 158 a is a form that taxpayers use. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Tax adjustments (dollars and cents) 32. Web franchise tax report forms should be mailed to the following address: 2021 taxes are filed in 2022, so texas. The form is used to calculate the amount of taxable income and tax credits that the taxpayer is eligible for,. Texas labels their forms based on the year you file, instead of the year you are filing for. 2021 taxes are filed in 2022, so texas. Complete, edit or print tax forms instantly. Web file your tax extension now! Start completing the fillable fields and carefully type in required information. (if may 15th falls on a weekend, the due date will be the following business day.) the no tax due information report. Forms for reporting texas franchise tax to the texas comptroller of public accounts. Do not include payment if this amount is less than$1,000 or if annualized total revenue is $1,000,000 or less ($300,000 or less for report years. 2021 taxes are filed in 2022, so texas. The texas franchise tax is imposed on each taxable entity formed or organized in texas or doing business in texas. Experience all the key benefits of submitting and completing forms online. Web file your tax extension now! Web any entity that does not elect to file using the ez computation, or that. Texas labels their forms based on the year you file, instead of the year you are filing for. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Use get form or simply click on the template preview to open it in the editor. If the entity makes a tiered partnership election, any. Web texas form 05 158 a is a form that taxpayers use to report their income and tax liability. Select texas > select texas franchise tax > select franchise tax. Texas labels their forms based on the year you file, instead of the year you are filing for. Total compensation (add items 15 thru 17). Enter dividends for the period. Do not include payment if this amount is less than$1,000 or if annualized total revenue is $1,000,000 or less ($300,000 or less for report years 2008 and 2009; Web file your tax extension now! Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Texas comptroller of public accounts. Start completing the fillable fields and carefully type in required information. Total cost of goods sold (add items 11 thru 13) 14. 2021 taxes are filed in 2022, so texas. 0 0 cost of goods sold (whole dollars only) compensation (whole dollars only) 15. Web texas comptroller o˜cial use only page 2 of 2 ve/de pm date do not include payment if item 35 is less than $1,000 or if annualized total revenue is less than the no tax due thr eshold (see instructions). No matter which form you file, your texas franchise tax report is due may 15th each year. Am i required to file a texas franchise tax return? Enter interest for the period upon which the tax. Complete, edit or print tax forms instantly. Tax adjustments (dollars and cents) 32. Experience all the key benefits of submitting and completing forms online. The texas franchise tax is imposed on each taxable entity formed or organized in texas or doing business in texas. The form is used to calculate the amount of taxable income and tax credits that the taxpayer is eligible for, as well as the amount of taxes owed. With our solution submitting texas 05 158 usually takes a matter of minutes. 2022 taxes are filed in 2023, so texas. Select texas > select texas franchise tax > select franchise tax.Texas Form 05 102 Instructions

Form 05 158 A ≡ Fill Out Printable PDF Forms Online

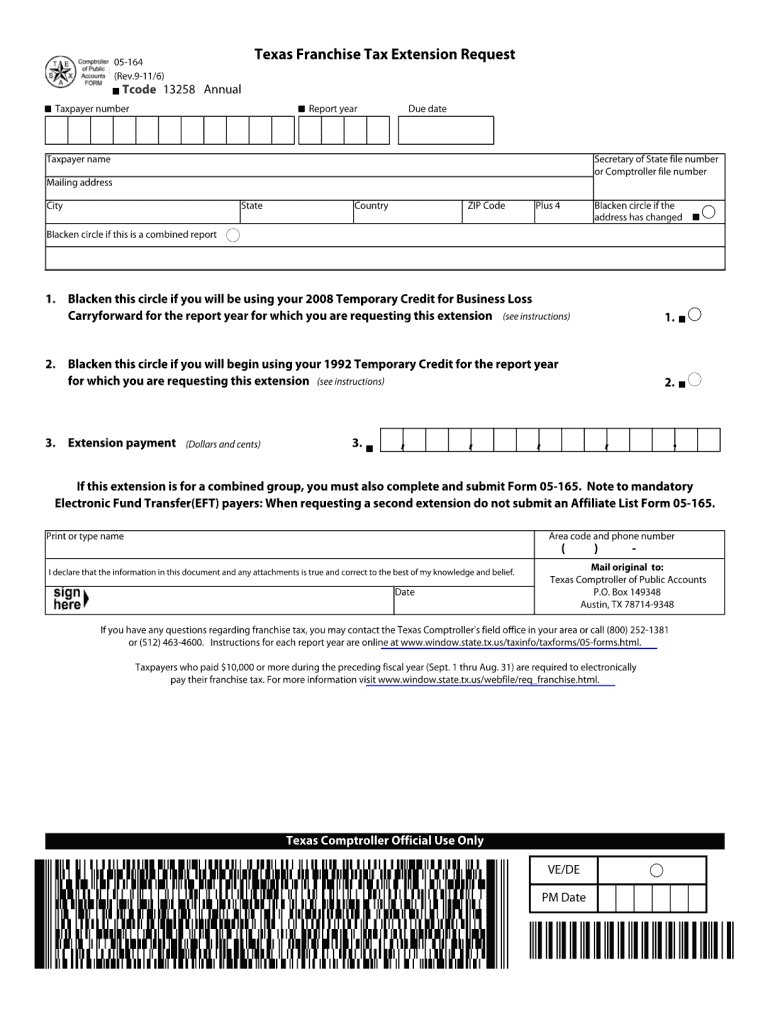

Texas form 05 164 2011 Fill out & sign online DocHub

Texas form 05 169 Fill out & sign online DocHub

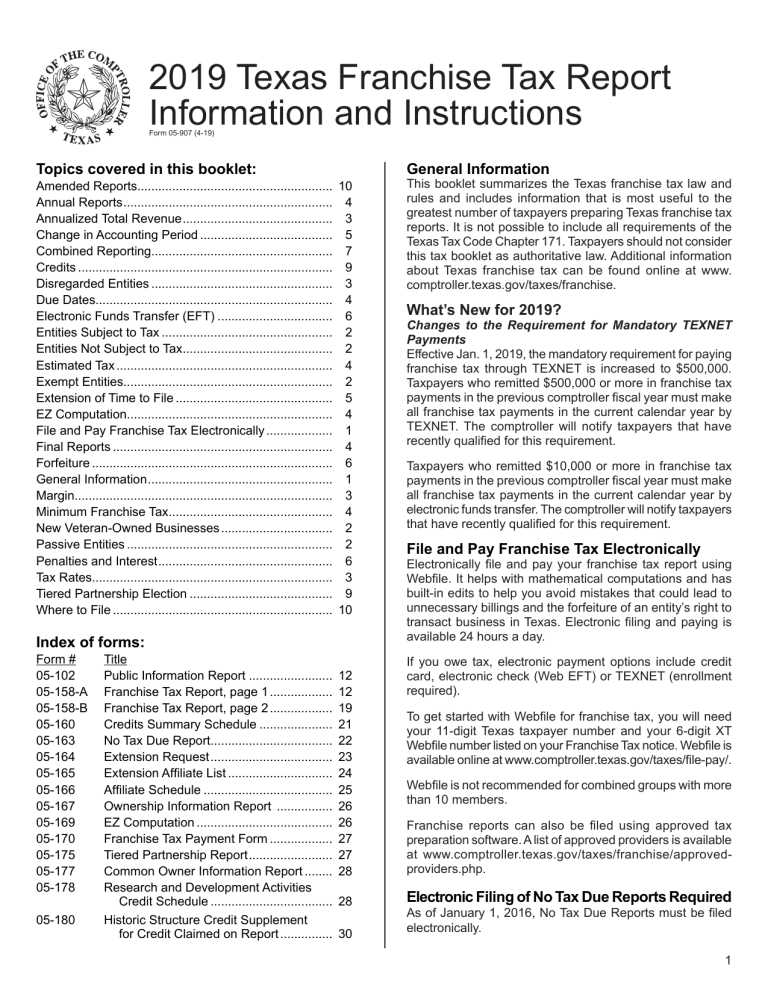

Texas Franchise Tax Instructions 2021 20192021 Form TX Comptroller

2019 Texas Franchise Tax Report Instructions

Texas Form 05 158 A ≡ Fill Out Printable PDF Forms Online

Texas form 05 163 2016 Fill out & sign online DocHub

Form 05 158 a Fill out & sign online DocHub

Fillable 05158A, 2013, Texas Franchise Tax Report printable pdf download

Related Post: