Whats A 8862 Form

Whats A 8862 Form - Try it for free now! Complete, edit or print tax forms instantly. Upload, modify or create forms. December 2022) department of the treasury internal revenue service. It indicates a way to close an interaction, or dismiss a notification. Web the terrestrial planets ( mercury, venus, earth, and mars) are characterized by their rocky composition and solid surfaces. How do i enter form 8862? Web how to file eitc and child tax credit for free: Turbotax can help you fill out your. Web it takes only a few minutes. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Form 8862, officially known as the information to claim earned income credit after disallowance, is an internal revenue service (irs) form. Web it takes only a few minutes. Find the sample you want in. Web under the plea deal, powell will serve six years of probation, pay a $6,000 fine, pay restitution of $2,700 to the state that covers the cost of replacing election. More than 100 israeli companies are listed. December 2022) department of the treasury internal revenue service. Download or email irs 8862 & more fillable forms, try for free now! Web. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web 3 rows form 8862 (rev. December 2022) department of the treasury internal revenue service. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for. Web how to file eitc and child tax credit for free: Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Complete, edit or print tax forms instantly. March 23, 2022 6:03 pm. Web form 8862 is a document that you attach to your tax. Form 8862, officially known as the information to claim earned income credit after disallowance, is an internal revenue service (irs) form. You can find tax form 8862 on the irs website. Web it takes only a few minutes. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Turbotax can help. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Upload, modify or create forms. Web march 26, 2020 7:26 am. Find the sample you want in our library of legal forms. Download or email irs 8862 & more fillable forms, try for free. Find the sample you want in our library of legal forms. Follow these simple guidelines to get 8862 tax form prepared for sending: Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web 3 rows form 8862 (rev. More. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Ad access irs tax forms. Web form 8862, information to claim certain credit after disallowance. Download or email irs 8862 & more fillable forms, try for free now! Upload, modify or create forms. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Home it indicates an expandable. Web march 26, 2020 7:26 am. Upload, modify or create forms. Web two crossed lines that form an 'x'. Form 8862, officially known as the information to claim earned income credit after disallowance, is an internal revenue service (irs) form. Web the terrestrial planets ( mercury, venus, earth, and mars) are characterized by their rocky composition and solid surfaces. Find the sample you want in our library of legal forms. Web what is form 8862? Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or. Form 8862, officially known as the information to claim earned income credit after disallowance, is an internal revenue service (irs) form. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. It indicates a way to close an interaction, or dismiss a notification. Form 8962 is used either (1) to reconcile a premium tax. Web cnn’s jacob lev and david close contributed to this report. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Web once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Web the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and families. Web 3 rows form 8862 (rev. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web how do i enter form 8862? Turbotax can help you fill out your. Web march 26, 2020 7:26 am. Web form 8862 is a document that you attach to your tax return if you want to claim the eitc or the actc after being disallowed by the irs in a previous year.How to Fill out IRS Form 8962 Correctly?

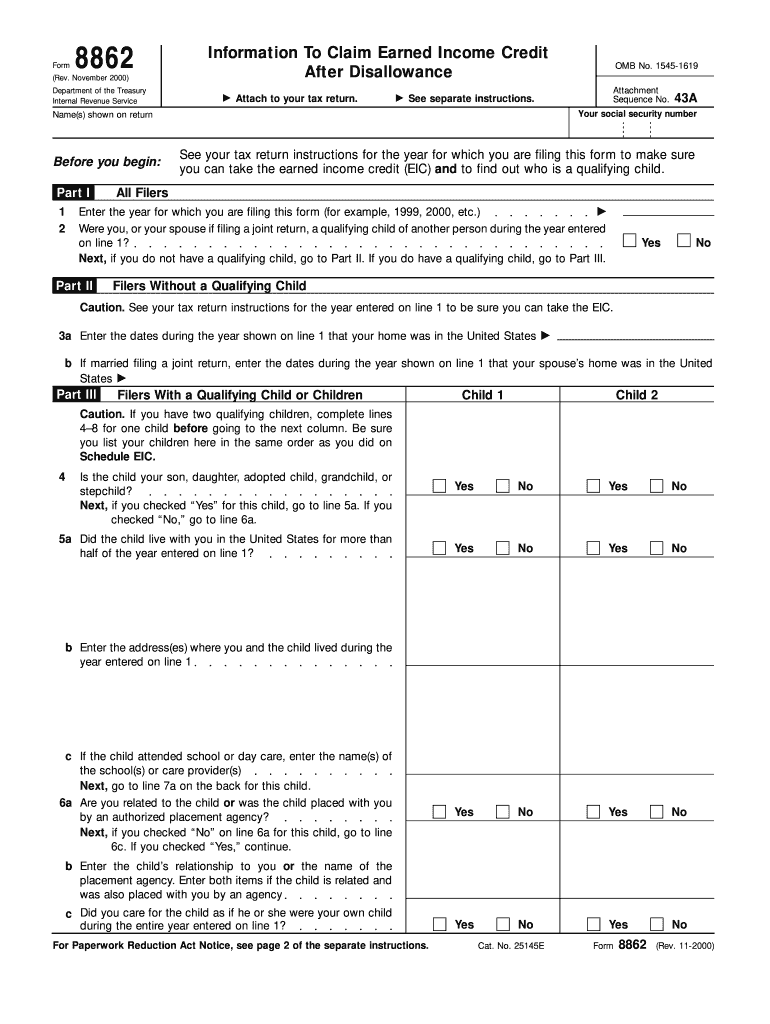

Form 8862Information to Claim Earned Credit for Disallowance

IRS Formulario 8862(SP) Fill Out, Sign Online and Download Fillable

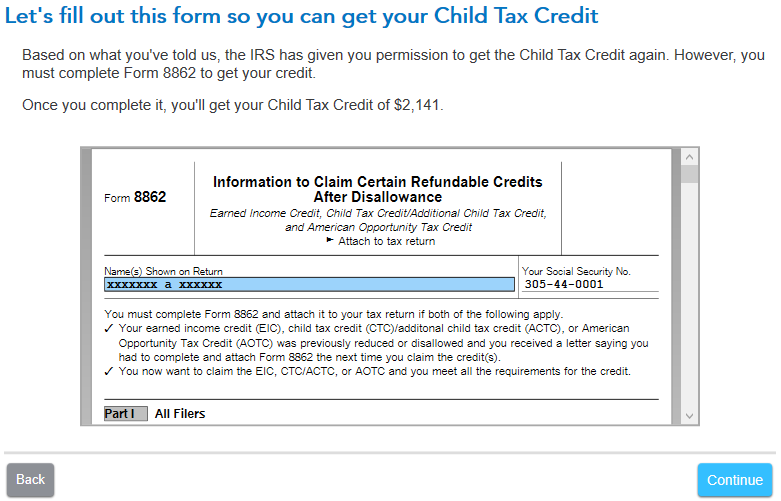

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 Fill out & sign online DocHub

Form 8862 For 2019 PERINGKAT

how do i add form 8862 TurboTax® Support

8862 Form Fill Out and Sign Printable PDF Template signNow

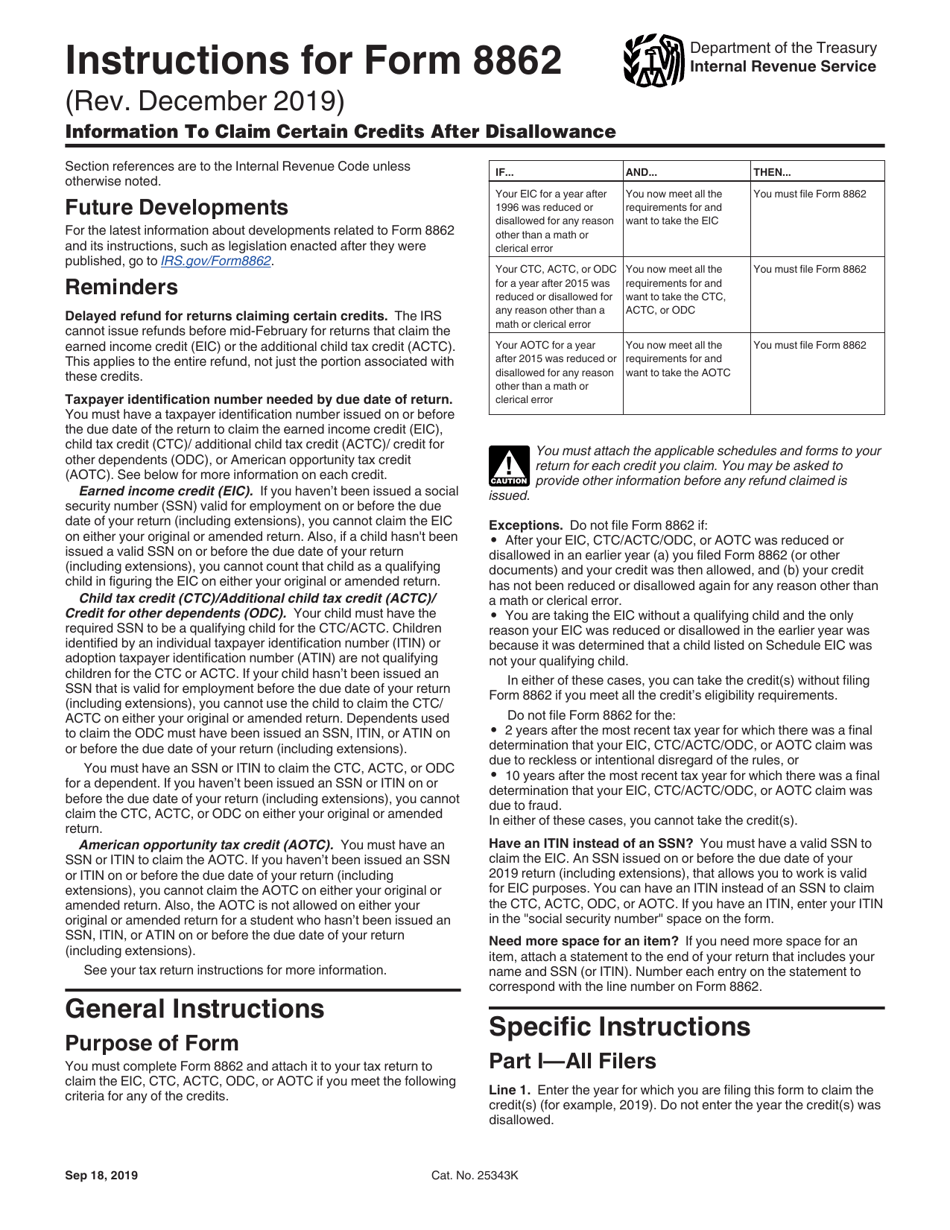

Download Instructions for IRS Form 8862 Information to Claim Certain

Form 8862 Information to Claim Earned Credit After

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737-768x501.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)