Form 3911 Instructions

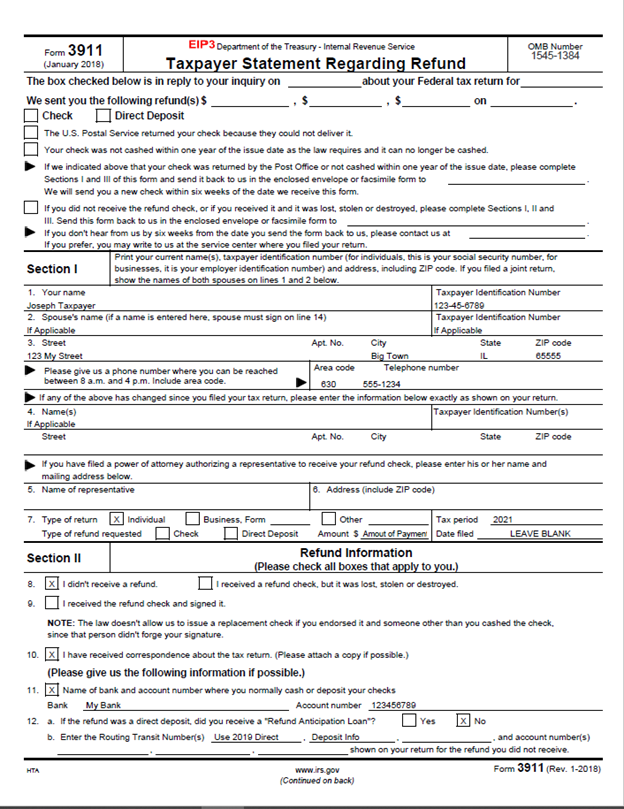

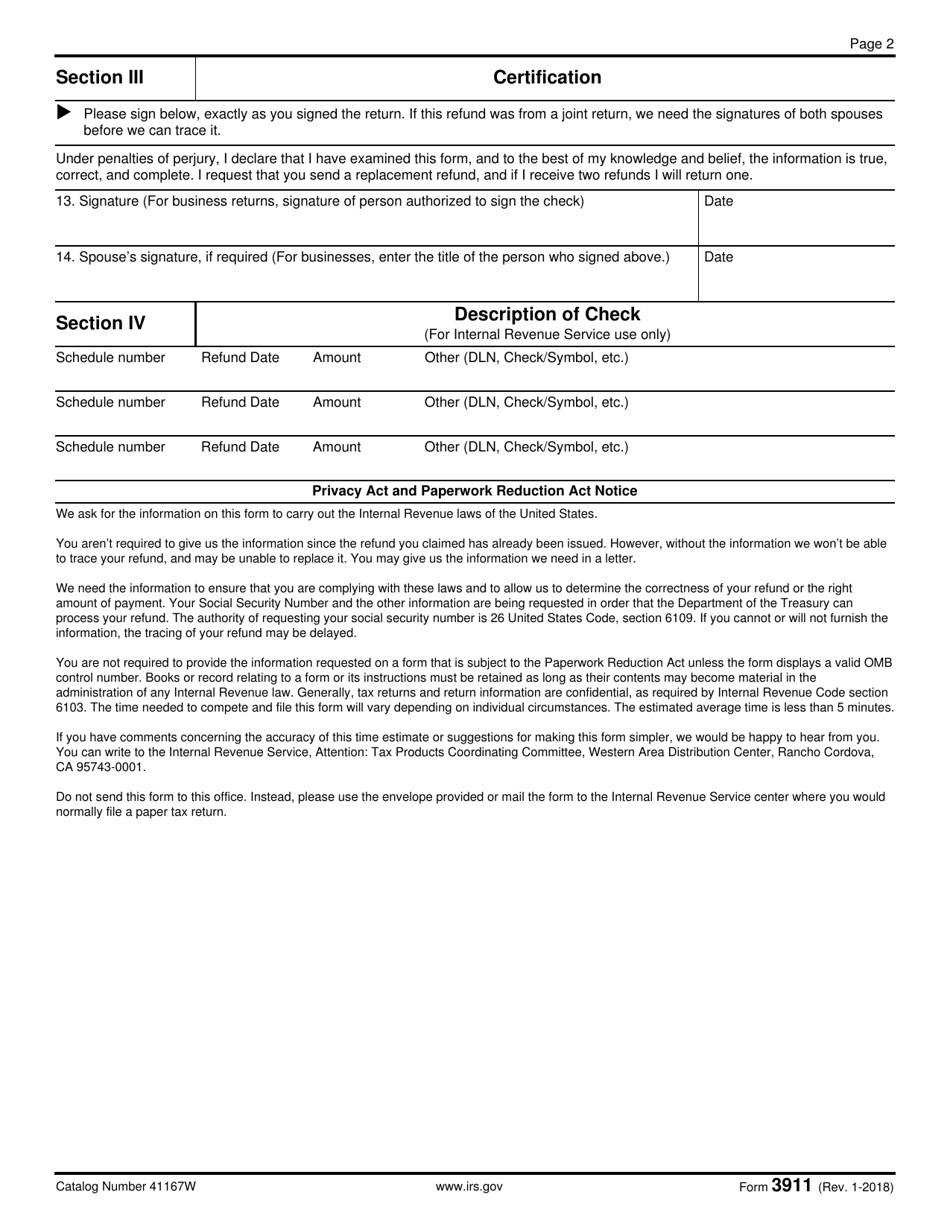

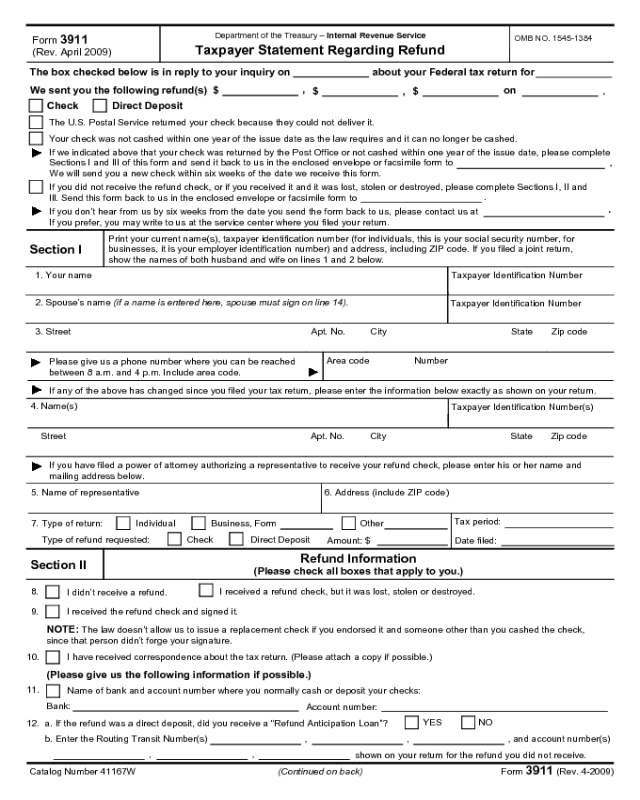

Form 3911 Instructions - Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. If needed, the irs will issue a replacement check. In this video, i cover. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process. Web forms, instructions and publications search. Bfs will review your claim and the signature on the canceled check before determining whether they can issue you a replacement check. Web if you were eligible to receive a stimulus check, but did not receive one or more payments, you can apply for a new check via irs form 3911. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer. Web to complete the irs form 3911, you need to know the amount of your tax return, as well as the date you filed the taxes. Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount. Web 21.4.2.4.1 form 3911, taxpayer statement regarding refund 21.4.2.4.2 input command code (cc) chkcl 21.4.2.4.3 processing the command code (cc) chkcl trace. Moreover, you are required to include the. Ad download or email irs 3911 & more fillable. Web the irs will send you a form 3911, taxpayer statement regarding refund pdf to get the process started or you can download the form. The box checked below is in. You should only file form 3911 if a. Access irs forms, instructions and publications in electronic and print media. If needed, the irs will issue a replacement check. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. Web to complete the irs form 3911, you need to know the amount of your tax return, as well as the date you filed the taxes. Web a form that one files with the irs to update contact information in. Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount. Web form 3911 should be used as a last resort for the suspected fraudulent activity. Moreover, you are required to include the. Write eip3 on the top of the form (eip stands for economic. In this video, i. Web form 3911 should be used as a last resort for the suspected fraudulent activity. Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount. Access irs forms, instructions and publications in electronic and print media. Web form 3911 can be filed with the irs to inquire about. Web you must complete a separate form 3911 for each refund for which you are requesting information. In this video, i cover. Write eip3 on the top of the form (eip stands for economic. You should only file form 3911 if a. Web 21.4.2.4.1 form 3911, taxpayer statement regarding refund 21.4.2.4.2 input command code (cc) chkcl 21.4.2.4.3 processing the command. Web follow the instructions. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer. Web a form that one files with the irs to. Web to complete the irs form 3911, you need to know the amount of your tax return, as well as the date you filed the taxes. Web the irs will send you a form 3911, taxpayer statement regarding refund pdf to get the process started or you can download the form. Books or record relating to a form or its. Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or paper check and. Web follow the instructions. Web a form that one files with the irs to update contact information in order to receive a tax refund.the irs sends form 3911 to a taxpayer if a previous attempt to send the refund. Web. Ad download or email irs 3911 & more fillable forms, register and subscribe now! Web the irs will send you a form 3911, taxpayer statement regarding refund pdf to get the process started or you can download the form. In this video, i cover. Bfs will review your claim and the signature on the canceled check before determining whether they. Moreover, you are required to include the. Access irs forms, instructions and publications in electronic and print media. In this video, i cover. Web the irs will send you a form 3911, taxpayer statement regarding refund pdf to get the process started or you can download the form. Web form 3911 should be used as a last resort for the suspected fraudulent activity. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer. You should only file form 3911 if a. Web to complete the irs form 3911, you need to know the amount of your tax return, as well as the date you filed the taxes. Ad download or email irs 3911 & more fillable forms, register and subscribe now! Web to complete form 3911 for your third stimulus check, the irs provides the following instructions: Web forms, instructions and publications search. Bfs will review your claim and the signature on the canceled check before determining whether they can issue you a replacement check. Web if you were eligible to receive a stimulus check, but did not receive one or more payments, you can apply for a new check via irs form 3911. Web a form that one files with the irs to update contact information in order to receive a tax refund.the irs sends form 3911 to a taxpayer if a previous attempt to send the refund. Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero. Web information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on how to file. Form 3911 is used by a taxpayer who was issued a refund either by direct deposit or paper check and. Web form 3911 can be filed with the irs to inquire about a lost, damaged, stolen, or otherwise missing federal tax refund payment. Web you must complete a separate form 3911 for each refund for which you are requesting information. Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount.How To Complete IRS Form 3911 To Get Your Tax Refund!

Fillable Online IRS Form 3911 Instructions Replacing A Lost Tax

Irs Form 3911 Printable

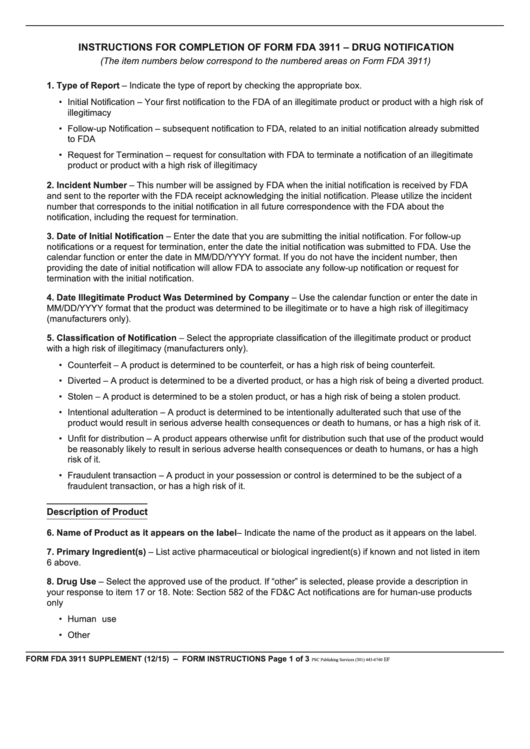

Form 3911 Instructions Drug Notification printable pdf download

IRS Form 3911 Instructions Replacing A Lost Tax Refund Check

Third Round Economic Impact Payment Discrepancy

IRS Form 3911 Instructions Replacing A Lost Tax Refund Check

IRS Form 3911 Download Fillable PDF or Fill Online Taxpayer Statement

Form 3911 Edit, Fill, Sign Online Handypdf

Printable 3911 Tax Form Printable Forms Free Online

Related Post: