Robinhood Form 8949

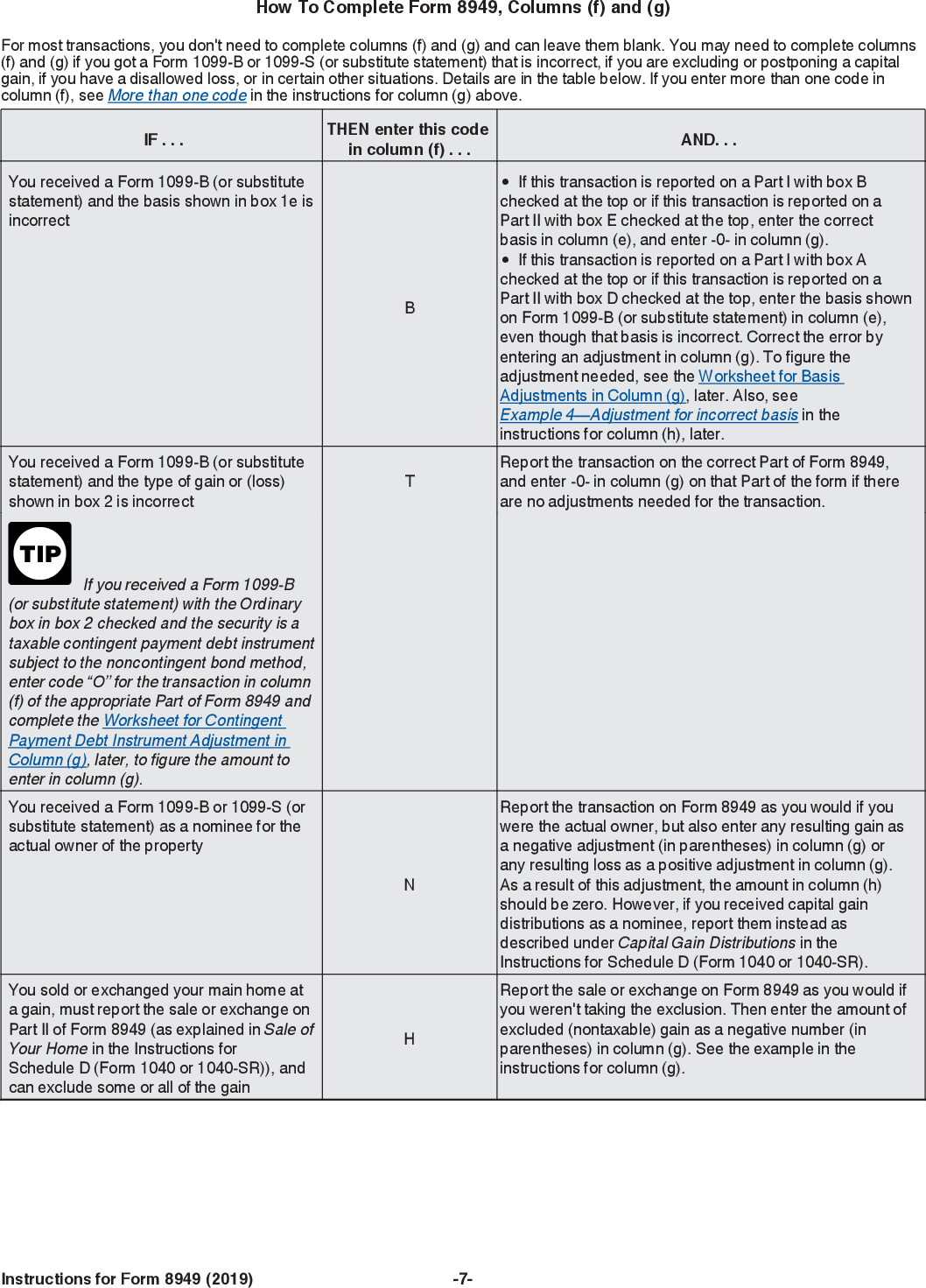

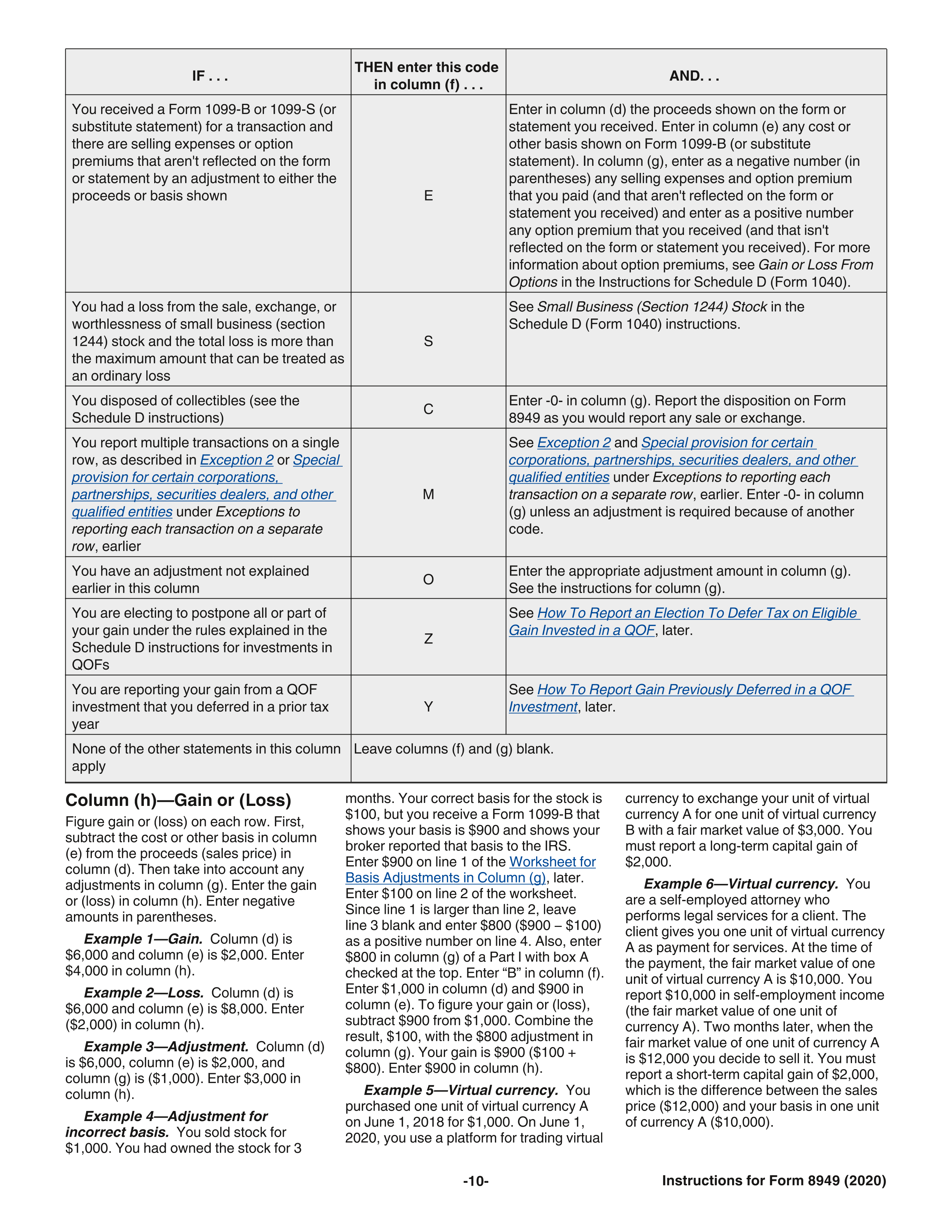

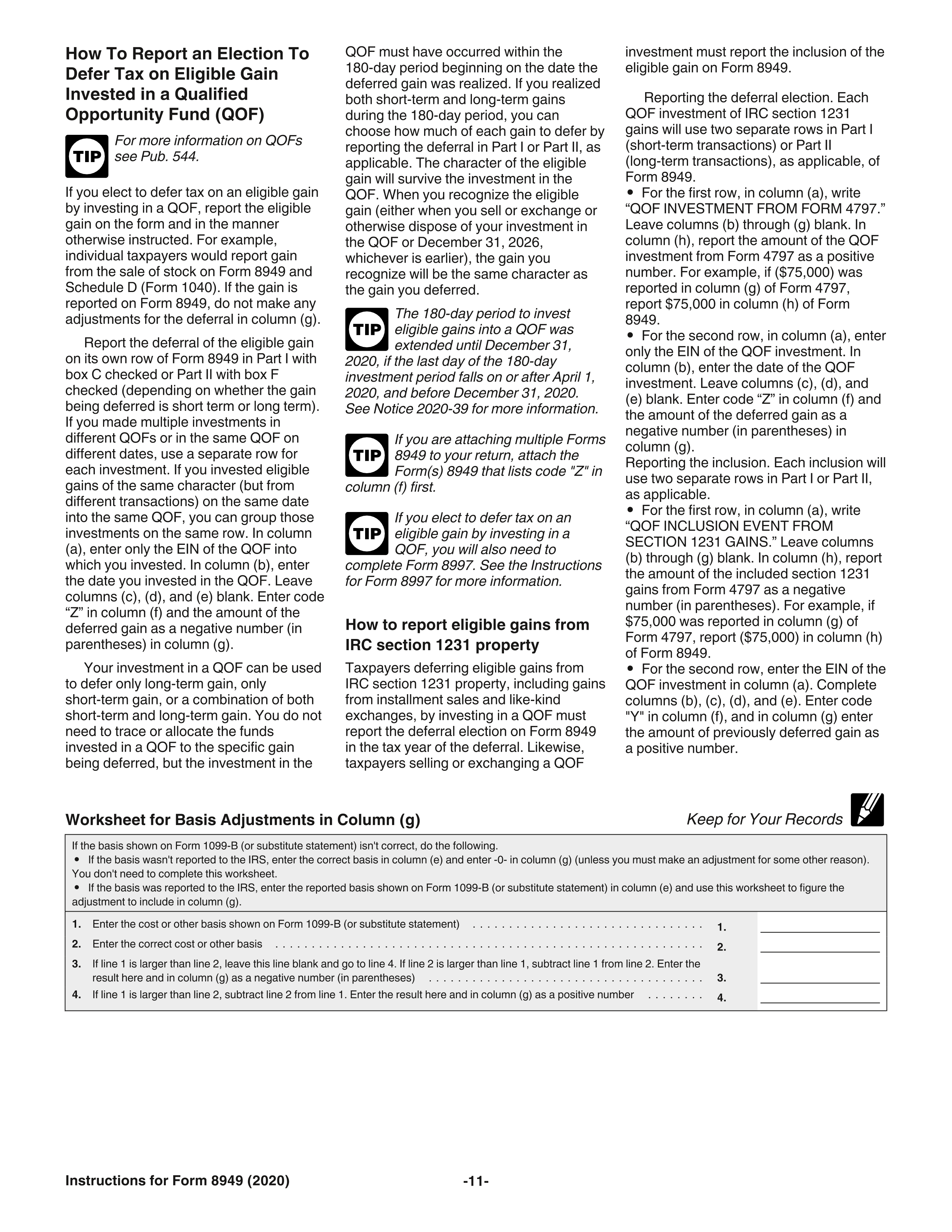

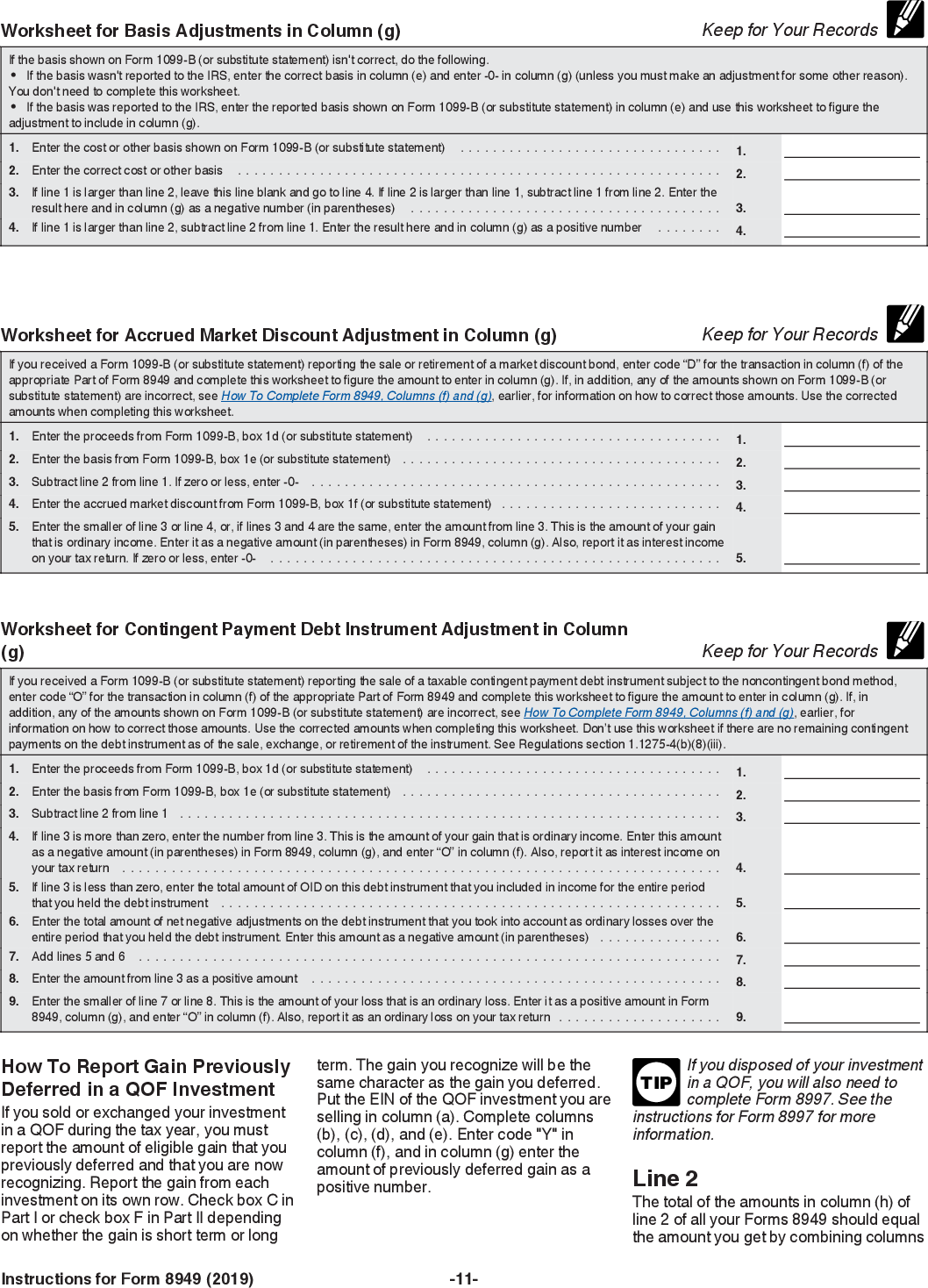

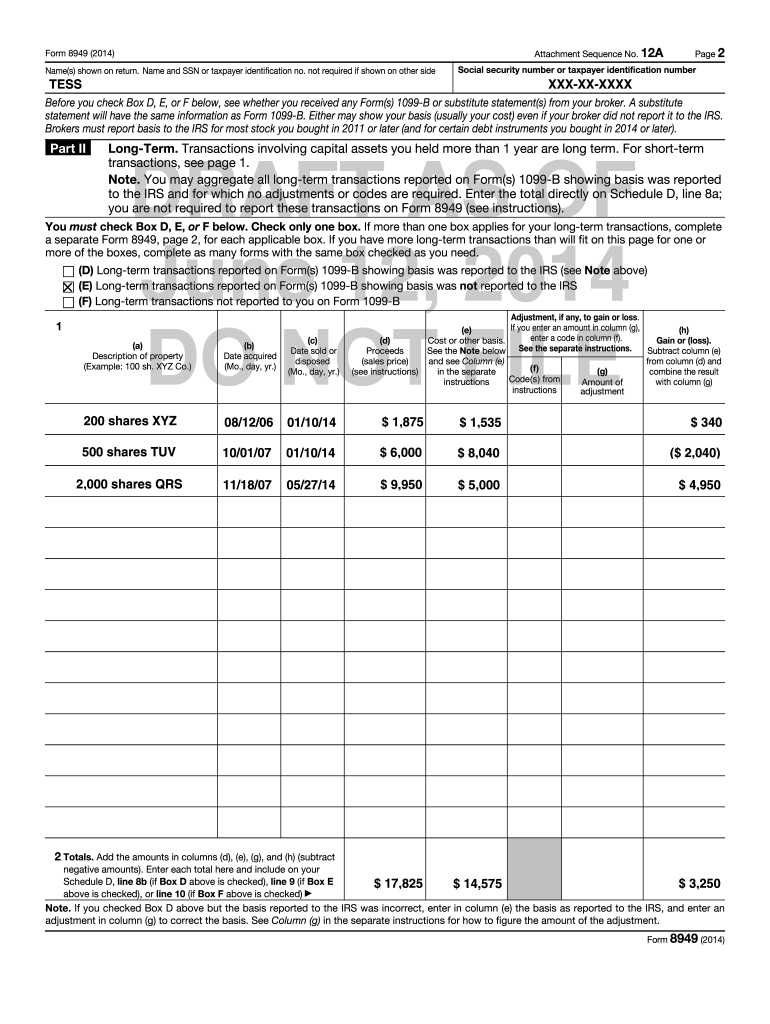

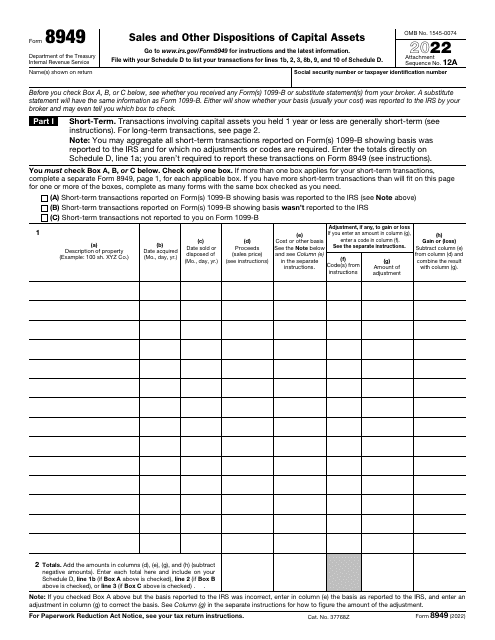

Robinhood Form 8949 - Limitations and fees may apply. Web department of the treasury internal revenue service. Use form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Sales and other dispositions of capital assets. For concerns or complaints specifically related to robinhood crypto, please reach out to. Go to www.irs.gov/form8949 for instructions and the latest information. Web cryptocurrency held through robinhood crypto is not fdic insured or sipc protected. The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. This basically means that, if you’ve sold a. Web who should use form 8949? Use form 8949 to reconcile amounts that were reported to you and the. It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. Limitations and fees may apply. The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. Use form 8949 to report sales and exchanges of capital assets. Web for as little as $12.00, clients. Web who should use form 8949? Web • reporting your crypto activity requires using form 1040 schedule d as your crypto tax form to reconcile your capital gains and losses and form 8949 if. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. About form 8949, sales and other dispositions of. About form 8949, sales and other dispositions of capital assets. Web 1 best answer. Web forms and instructions. Sign up and get your first stock free. Web for as little as $12.00, clients of robinhood securities llc can use the services of form8949.com to generate irs schedule d and form 8949. Web who should use form 8949? Use form 8949 to reconcile amounts that were reported to you and the. It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. Whether you received a robinhood tax form or a tax form from another. Ad irs 8949 instructions & more fillable forms, register. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Use form 8949 to reconcile amounts that were reported to you and the. The solution to your issue will be to consolidate your stock transactions into blocks of data summaries, such that you only. Web for. Web for as little as $12.00, clients of robinhood securities llc can use the services of form8949.com to generate irs schedule d and form 8949. Web taxact® will complete form 8949 for you and include it in your tax return submission. Web department of the treasury internal revenue service. Limitations and fees may apply. Web cryptocurrency held through robinhood crypto. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Web who should use form 8949? Web taxact® will complete form 8949 for you and include it in your tax return submission. Web cryptocurrency held through robinhood crypto is not fdic insured or sipc protected. About form 8949, sales and other dispositions of capital assets. Web what is form 8949 used for? Web cryptocurrency held through robinhood crypto is not fdic insured or sipc protected. If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. Sales and other dispositions of capital assets. Web for as little as $12.00, clients of robinhood securities llc can. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Use form 8949 to reconcile amounts that were reported to you and the. Web who should use form 8949? This basically means that, if you’ve sold a. Web you'll use this form to report capital gains and losses on schedule d and form 8949. If you sold stock at a loss, you can use the loss to offset capital gains you had from similar sales. Web department of the treasury internal revenue service. Web what is form 8949 used for? Web you'll use this form to report capital gains and losses on schedule d and form 8949. Use form 8949 to reconcile amounts that were reported to you and the. Web for as little as $12.00, clients of robinhood securities llc can use the services of form8949.com to generate irs schedule d and form 8949. Web who should use form 8949? Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. It’s important to understand that you won’t owe any tax on cryptocurrency if you haven’t realized a taxable gain. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. Use form 8949 to report sales and exchanges of capital assets. Web 1 best answer. Sales and other dispositions of capital assets. Go to www.irs.gov/form8949 for instructions and the latest information. Web for as little as $12.00, clients of robinhood crypto can use the services of form8949.com to generate irs schedule d and form 8949. Limitations and fees may apply. Web taxact® will complete form 8949 for you and include it in your tax return submission. About form 8949, sales and other dispositions of capital assets. Web use form 8949 to report sales and exchanges of capital assets. To get the transaction information into your return, select from the 6 options described.IRS Form 8949 instructions.

IRS Form 8949 instructions.

IRS Form 8949 instructions.

irs form 8949 instructions 2022 Fill Online, Printable, Fillable

Form 8949 Fillable Printable Forms Free Online

Irs Form 8949 Printable Printable Forms Free Online

IRS Form 8949 instructions.

Printable Form 8949 Printable Forms Free Online

IRS Form 8949 Download Fillable PDF or Fill Online Sales and Other

IRS Form 8949 instructions.

Related Post: