Irs Form 9465 Printable

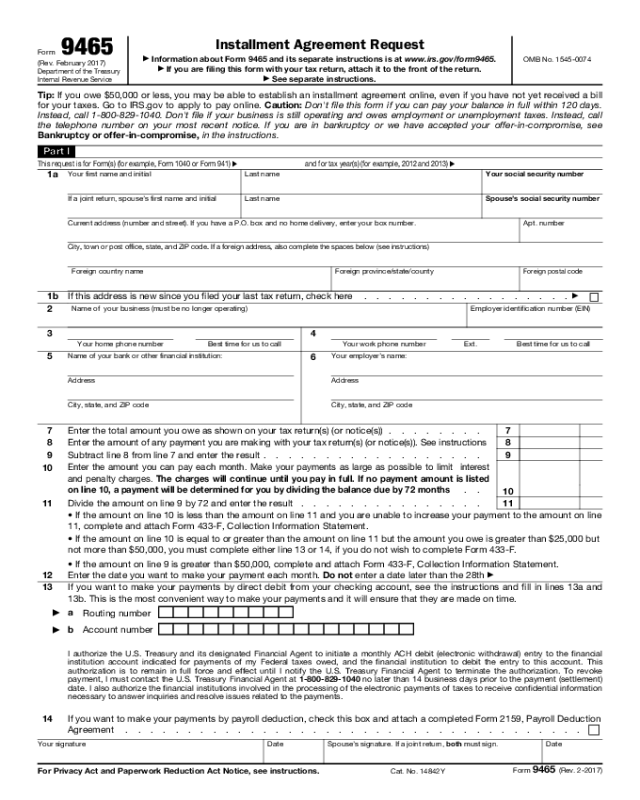

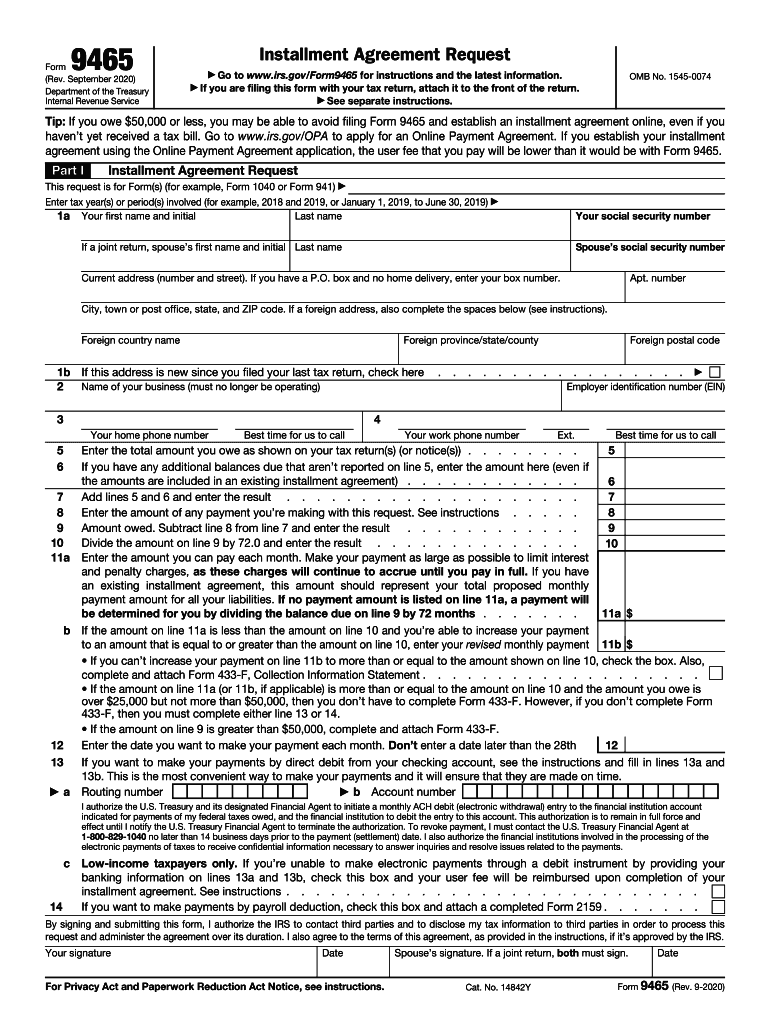

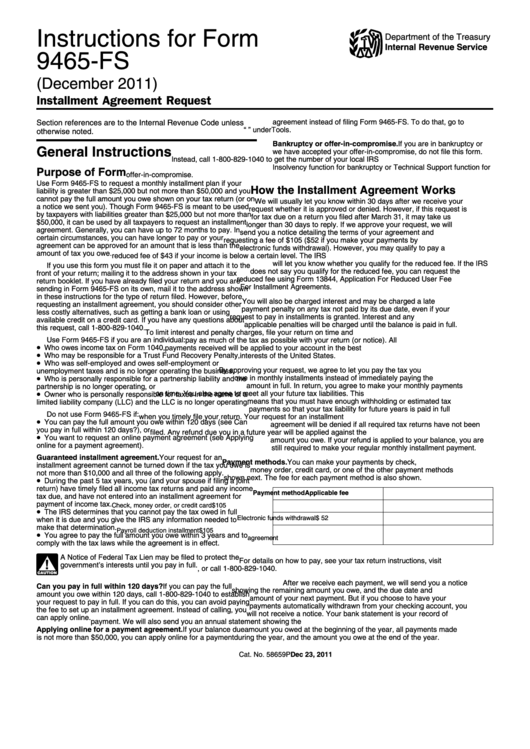

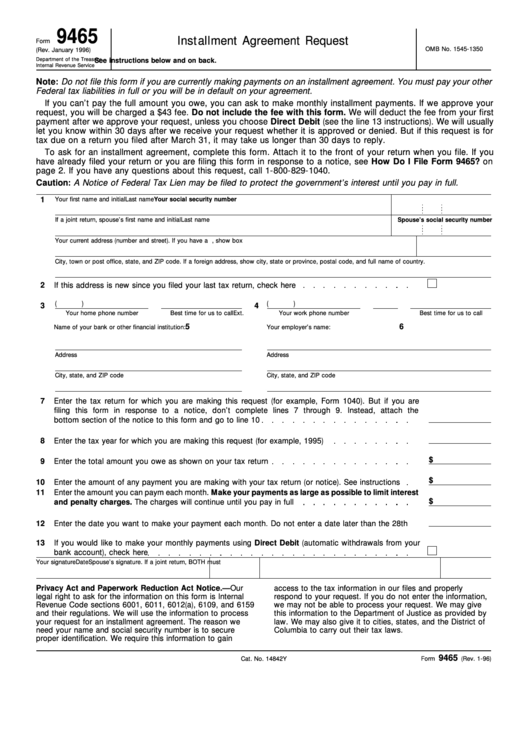

Irs Form 9465 Printable - Try it for free now! September 2020)) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Ad fill out your 2019 w9 tax form easily online. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Ad access irs tax forms. If you file your taxes with qualified tax attorneys, they can help you locate and complete this form when you file your taxes. Do not file this form if you are currently making payments on an installment agreement or can pay your. If you are filing this form with your tax return, attach it to the front of the return. In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. Estimate how much you could potentially save in just a matter of minutes. Web irs form 9465 installment agreement request is used to request a monthly installment plan if you cannot pay the full amount you owe shown on your federal tax return. Most installment agreements meet our streamlined installment agreement criteria. Ad access irs tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Web internal revenue service see separate instructions. Most installment agreements meet our streamlined installment agreement criteria. Most installment agreements meet our streamlined installment agreement criteria. If you file your taxes with qualified tax attorneys, they can help you locate and complete this form when you file your taxes. Web use irs form 9465 installment agreement request to request a monthly. For instructions and the latest information. Web all pages of form 9465 are available on the irs website. Try it for free now! Ad we help get taxpayers relief from owed irs back taxes. Try it for free now! Most installment agreements meet our streamlined installment agreement criteria. Form 9465 is available in all versions of taxact®. Web filing form 9465 does not guarantee your request for a payment plan. Ad we help get taxpayers relief from owed irs back taxes. To enter or review information for form 9465: November 2023) installment agreement request (for use with form 9465 (rev. For instructions and the latest information. The irs will contact you to approve or deny your installment plan request. If you file your taxes with qualified tax attorneys, they can help you locate and complete this form when you file your taxes. You can file form 9465 by itself,. You can download and print the form or fill it out online using the irs online payment agreement tool. Whether you owe federal income taxes or any other kind of tax, you can use form 9465 to request a payment plan, as well as use the designated irs online system to set up a plan. The irs will contact you. Ad fill out your 2019 w9 tax form easily online. The irs will contact you to approve or deny your installment plan request. This form is for income earned in tax year 2022, with tax returns due in april 2023. Do not file this form if you are currently making payments on an installment agreement or can pay your. Ad. Web irs free file online: Ad we help get taxpayers relief from owed irs back taxes. Get ready for tax season deadlines by completing any required tax forms today. If you owe $50,000 or less in taxes, penalties, and interest, it's also possible to avoid filing form 9465 and complete an online payment. If you are filing this form with. For instructions and the latest information. Carefully read the instructions provided on the form to understand the requirements and guidelines for completing it accurately. Most installment agreements meet our streamlined installment agreement criteria. To print and mail form 9465: Web irs form 9465 installment agreement request is used to request a monthly installment plan if you cannot pay the full. To enter or review information for form 9465: Whether you owe federal income taxes or any other kind of tax, you can use form 9465 to request a payment plan, as well as use the designated irs online system to set up a plan. Information about form 9465, installment agreement request, including recent updates, related forms and instructions on how. Click print, and a print dialog box appears so you can choose what printer to use and more options. November 2023) installment agreement request (for use with form 9465 (rev. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Web from within your taxact return (desktop), click file in the upper menu bar, then click custom print. Web all pages of form 9465 are available on the irs website. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Begin by downloading irs form 9465 from the official website or obtain a physical copy from a local irs office, if available. December 2018) department of the treasury internal revenue service. Most installment agreements meet our streamlined installment agreement criteria. Carefully read the instructions provided on the form to understand the requirements and guidelines for completing it accurately. Web filing form 9465 does not guarantee your request for a payment plan. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Form 9465 is available in all versions of taxact ®. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Answer the following questions to find an irs free file provider. Do not file this form if you are currently making payments on an installment agreement or can pay your. Web form 9465 is the form used for requesting a payment plan from the internal revenue service when/if you’re unable to pay your balance. Do not file this form if you are currently making payments on an installment agreement.Form 9465 Installment Agreement Request Definition

Form 9465 Edit, Fill, Sign Online Handypdf

IRS Form 9465 Instructions Your Installment Agreement Request

20202023 Form IRS 9465Fill Online, Printable, Fillable, Blank pdfFiller

Irs Power Of Attorney Form Pdf

form_9465_Installment_Agreement_Request Stop My IRS Bill

Irs form 9465 Fillable 2018 Irs Gov forms Fillable Printable Pdf

Instructions For Form 9465Fs Installment Agreement Request printable

Printable Form 9465 Printable Forms Free Online

Irs Form 9465 Form Fillable Printable Forms Free Online

Related Post:

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)