Irs Instructions Form 4562

Irs Instructions Form 4562 - Web use form 4562 to: Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Ad a tax advisor will answer you now! Web what is the irs form 4562? Learn what assets should be included on form 4562, as. Ad irs 4562 instructions & more fillable forms, register and subscribe now! Form 4562 is used to. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web irs form 4562: Questions answered every 9 seconds. Web 2018 instructions for form 4562(rev. Ad irs 4562 instructions & more fillable forms, register and subscribe now! Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file.. Web 2018 instructions for form 4562(rev. Web use form 4562 to: Depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Remember, the irs instructions for form 4562 are also an excellent. Web what is the irs form 4562? Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s depreciation or amortization. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web what is the irs form 4562? Ad outgrow.us has. Web form 4562 is the irs form used to report these deductions accurately and consistently. Web use form 4562 to: Learn what assets should be included on form 4562, as. You can clarify any further doubts by checking out the irs. Ad outgrow.us has been visited by 10k+ users in the past month Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web making section 179 election on form 4562 will enable you to claim an immediate expense deduction but only for qualifying assets whose combined value. •claim your deduction for depreciation and amortization,. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s depreciation or amortization. Learn how to fill out form 4562 step by step and depreciate/amortize asset. Remember, the irs instructions for form 4562 are also an excellent. Web irs form 4562: Ad irs 4562 instructions & more fillable forms, register and. Written by a turbotax expert • reviewed by a turbotax cpa. Learn how to fill out form 4562 step by step and depreciate/amortize asset. April 2020) depreciation and amortization (including information on listed property) department of the treasury internal. Irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web form 4562 is the irs. Individual tax return form 1040 instructions; Web what is the irs form 4562? To complete form 4562, you'll need. Form 4562 is used to. Updated for tax year 2022 • june 2, 2023 8:54 am. Depreciation and amortization (including information on listed property) department of the treasury. To complete form 4562, you'll need. Ad a tax advisor will answer you now! Depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Form 4562 is used to. Web popular forms & instructions; Depreciation and amortization (including information on listed property) department of the treasury. Remember, the irs instructions for form 4562 are also an excellent. Web the internal revenue service allows people to claim deductions on irs form 4562, depreciation and amortization. Web what is the irs form 4562? Web making section 179 election on form 4562 will enable you to claim an immediate expense deduction but only for qualifying assets whose combined value. Ad irs 4562 instructions & more fillable forms, register and subscribe now! Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s depreciation or amortization. Web what is the irs form 4562? Updated for tax year 2022 • june 2, 2023 8:54 am. Web irs form 4562: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web instructions for form 4562. Form 4562 is used to. Remember, the irs instructions for form 4562 are also an excellent. Depreciation and amortization (including information on listed property) department of the treasury. Ad outgrow.us has been visited by 10k+ users in the past month Irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web use form 4562 to: April 2020) depreciation and amortization (including information on listed property) department of the treasury internal. Web 2018 instructions for form 4562(rev. Web the internal revenue service allows people to claim deductions on irs form 4562, depreciation and amortization. Ad a tax advisor will answer you now! Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return.2022 Form IRS 4562 Fill Online, Printable, Fillable, Blank pdfFiller

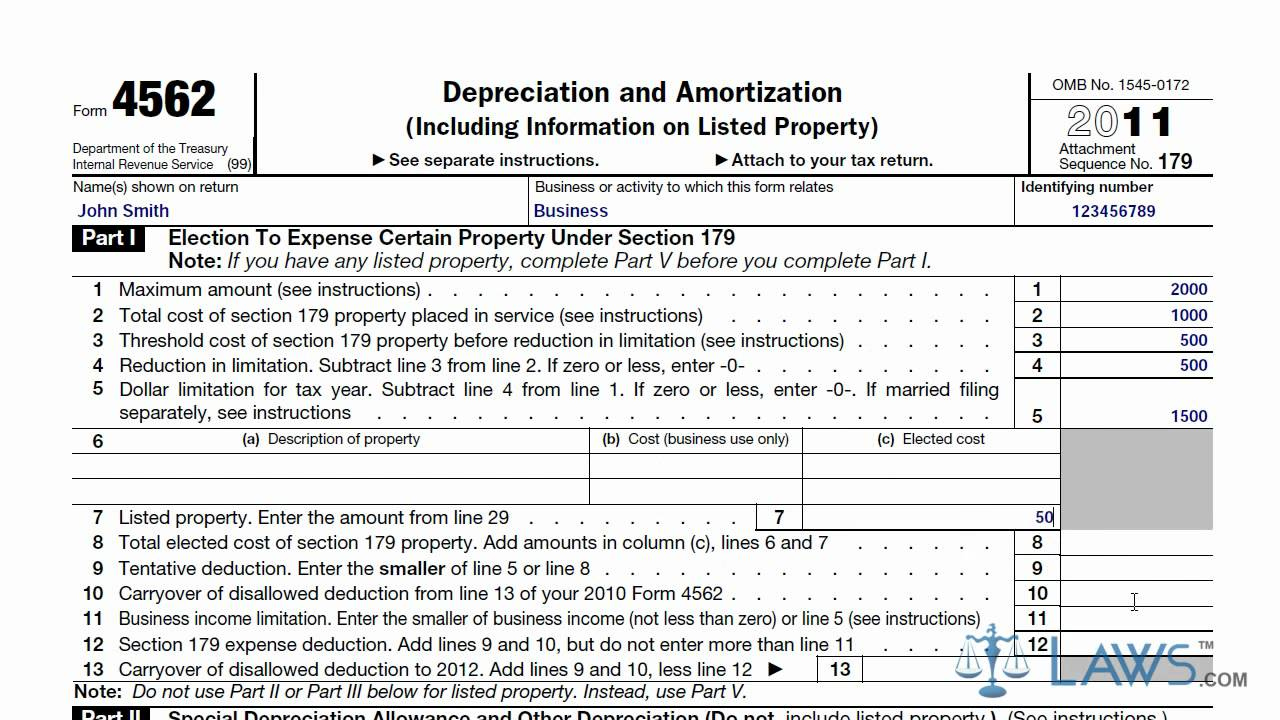

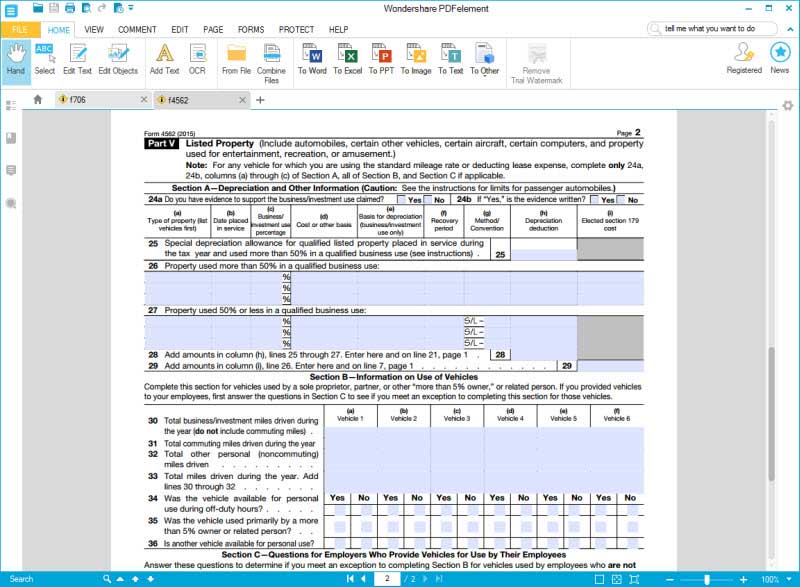

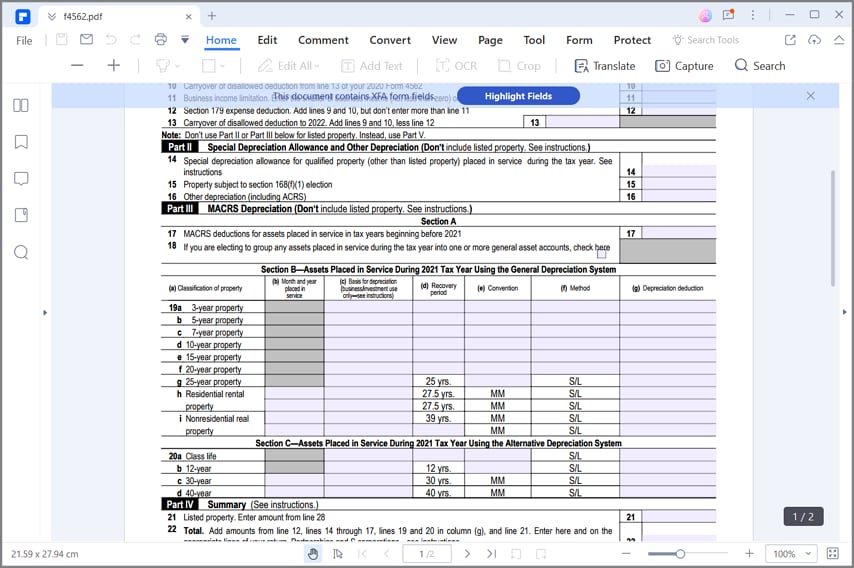

IRS Form 4562 Explained A StepbyStep Guide

IRS 4562 Instructions 2011 Fill out Tax Template Online US Legal Forms

Learn How To Fill The Form 4562 Depreciation And 2021 Tax Forms 1040

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Irs Form 4562 Instructions 2014 prosecution2012

Instructions for How to Fill in IRS Form 4562

Irs Form 4562 Instructions 2012 Universal Network

for Fill how to in IRS Form 4562

Related Post: