Irs Fax Number For Form 2553

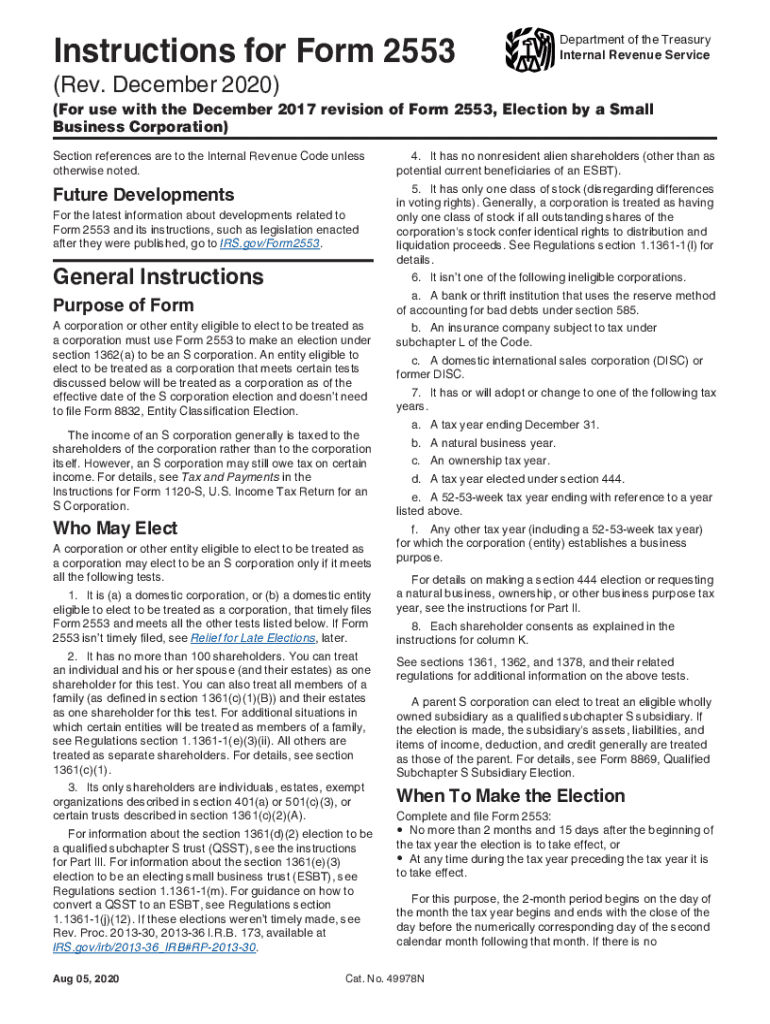

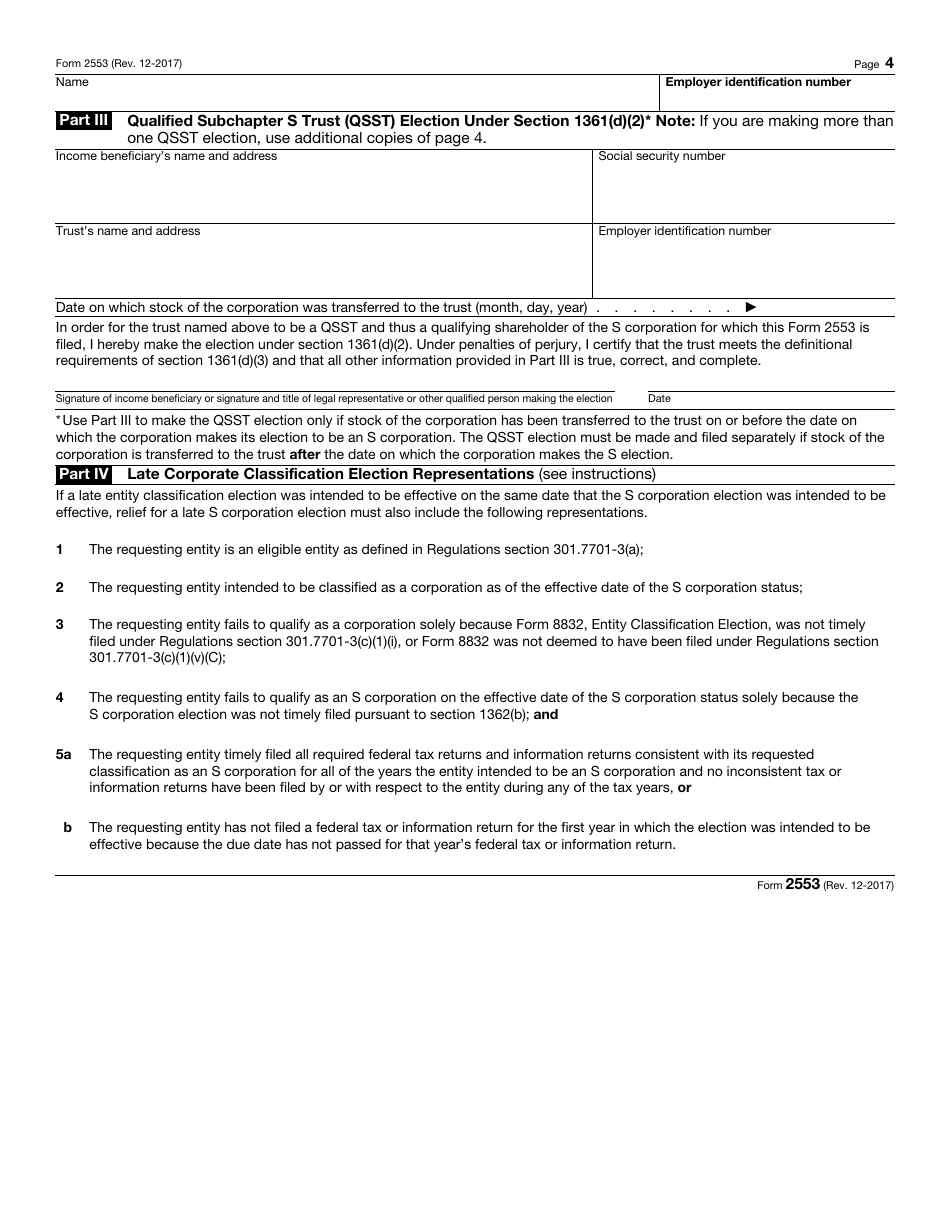

Irs Fax Number For Form 2553 - Web there are several steps to file form 2553: Web also indicate the business’s legal name and employer identification number at the top of each page of form 2553. Use the graph below to. Web department of the treasury you can fax this form to the irs. Internal revenue service go to www.irs.gov/form2553 for instructions and the latest. Web enter the fax number of the irs office where you need to send your form 2553. Fill out your company’s contact information in part i and select your tax year. Web where to file irs form 2553? Web irs form 2553 instructions: Any small business that can be treated as a corporation (llc or. Web irs form 2553 instructions: Page last reviewed or updated: Any small business that can be treated as a corporation (llc or. Web unlike many irs forms, form 2553 cannot be filed online. Web there are several steps to file form 2553: Web 2553 form instructions and how to file with the irs | gusto 2553 form: You can either mail in the original signed form or fax the form to the irs. Web form 2553 instructions: Page last reviewed or updated: A corporation or other entity. Use the graph below to. Download the form from the irs website. Web there are several steps to file form 2553: Web 2 rows internal revenue service. The irs web site provides a list that details the appropriate address or fax. Otherwise, you’ll have to do. Web 2 rows internal revenue service. Web department of the treasury you can fax this form to the irs. Web department of the treasury you can fax this form to the irs. Web form 2553 instructions: A corporation or other entity. Web fax form 2553 to irs from an online fax app. Businesses can file form 2553 either by fax or by mail. Web also indicate the business’s legal name and employer identification number at the top of each page of form 2553. Web 2 rows internal revenue service. Download the form from the irs website. Under election information, fill in the corporation's name and address, along with your ein number and date and. Web also indicate the business’s legal name and employer identification number at the top of each page of form 2553. Fill out your company’s contact information in part i and select your tax year. The. The irs web site provides a list that details the appropriate address or fax. Web 2 rows internal revenue service. Web enter the fax number of the irs office where you need to send your form 2553. Web internal revenue service center kansas city, mo 64999 fax: Web department of the treasury you can fax this form to the irs. If you want your business to be taxed as an s corp, you’ll have to fill form 2553 with the. Fill out your company’s contact information in part i and select your tax year. Web internal revenue service center kansas city, mo 64999 fax: Web 2553 form instructions and how to file with the irs | gusto 2553 form: Web. Fill out your company’s contact information in part i and select your tax year. This portion of form 2553 collects information about the business, its shareholders, and the officer or legal representative the irs can. Use the graph below to. Web fax form 2553 to irs from an online fax app. Under election information, fill in the corporation's name and. Where to file form 2553. Web 2 rows internal revenue service. Web fax form 2553 to irs from an online fax app. A corporation or other entity. This portion of form 2553 collects information about the business, its shareholders, and the officer or legal representative the irs can. Web the fax number for filing form 2553 with the cincinnati service center has changed. Web department of the treasury you can fax this form to the irs. Where you can send your tax forms document templates may 12, 2023 5 min a list of irs fax numbers 1. You can often find the fax number in the instructions for the form. Web irs form 2553 instructions: Any small business that can be treated as a corporation (llc or. Web enter the fax number of the irs office where you need to send your form 2553. This portion of form 2553 collects information about the business, its shareholders, and the officer or legal representative the irs can. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web unlike many irs forms, form 2553 cannot be filed online. Internal revenue service go to www.irs.gov/form2553 for instructions and the latest. Under election information, fill in the corporation's name and address, along with your ein number and date and. If you want your business to be taxed as an s corp, you’ll have to fill form 2553 with the. Web also indicate the business’s legal name and employer identification number at the top of each page of form 2553. Web 2 rows internal revenue service. Web form 2553 instructions: Page last reviewed or updated: Web home document templates irs fax numbers: Where to file form 2553. Form 2553 is the irs election by a small business corporation form.Form 2553 template

Where and How to Fax IRS Form 2553? Dingtone Fax

Irs form 2553 fill in 2002 Fill out & sign online DocHub

IRS Form 2553 Filing Instructions Real Check Stubs

Ir's Form 2553 Fillable Fill Out and Sign Printable PDF Template

Ssurvivor Form 2553 Irs Phone Number

20202023 Form IRS Instruction 2553Fill Online, Printable, Fillable

Form 2553 Instructions How and Where to File mojafarma

IRS Form 2553 Download Fillable PDF or Fill Online Election by a Small

Irs 2553 Form PDF S Corporation Irs Tax Forms

Related Post: