Instructions For Form 4835

Instructions For Form 4835 - Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web a form that the owner of agricultural real estate files with the irs to report income from rent of the land based upon crops grown or livestock tended. Web page last reviewed or updated: Form 4835 to report rental income based on crop or livestock shares. Use screen 4835 on the. Web the irs has created a page on irs.gov for information about form 4835 and its instructions, at www.irs.gov/form4835. You may now deduct up to $500,000 of the cost of section 179 property placed. Information about form 4835, farm rental income and expenses, including recent updates, related forms and instructions on how to file. 4835 (2020) form 4835 (2020) page. Web for the latest information about developments related to form 4835 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4835. Web for paperwork reduction act notice, see your tax return instructions. Web also, use this form to report sales of livestock held for draft, breeding, sport, or dairy purposes. Purpose of form.—use form 4835 to report farm rental income based on crops or livestock produced by the tenant if you were the landowner (or sub. Information about form 4835, farm. You may now deduct up to $500,000 of the cost of section 179 property placed. Form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web contain information that is equally applicable to form 8935. Web the farm rental income and expenses form 4835. Purpose of form.—use form 4835 to report farm rental income based on crops or livestock produced by the tenant if you were the landowner (or sub. Irs form 4835 is a fairly straightforward form. This income is taxable but is not. You may now deduct up to $500,000 of the cost of section 179 property placed. Web the irs has. Information about form 4835, farm rental income and expenses, including recent updates, related forms and instructions on how to file. Irs form 4835 is a fairly straightforward form. Purpose of form.—use form 4835 to report farm rental income based on crops or livestock produced by the tenant if you were the landowner (or sub. Web form 4835 to report rental. Web to complete form 4835, from the main menu of the tax return (form 1040) select: Web form 4835 to report rental income based on crop or livestock shares produced by a tenant if you didn't materially participate in the management or operation of a farm. Web for the latest information about developments related to form 4835 and its instructions,. Web the farm rental income and expenses form 4835 form is 1 page long and contains: Web how do i complete irs form 4835? You can download or print. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. Web the following. Web how do i complete irs form 4835? Web form 4835 department of the treasury internal revenue service farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web form 4835 to report rental income based on crop or livestock shares produced by a tenant if you didn't materially participate in the management or. Web a form that the owner of agricultural real estate files with the irs to report income from rent of the land based upon crops grown or livestock tended. Web contain information that is equally applicable to form 8935. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not. Form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web how do i complete irs form 4835? Web a form that the owner of agricultural real estate files with the irs to report income from rent of the land based upon crops grown. Web form 4835 department of the treasury internal revenue service farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Web page last reviewed or updated: Irs form. Information about any future developments. Web a form that the owner of agricultural real estate files with the irs to report income from rent of the land based upon crops grown or livestock tended. You can download or print. Web form 4835 to report rental income based on crop or livestock shares produced by a tenant if you didn't materially participate in the management or operation of a farm. This income is taxable but is not. Web form 4835 department of the treasury internal revenue service farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web the following 1099p screen fields will be reported on form 4835, line 2a. Web form 4835 department of the treasury internal revenue service (99) farm rental income and expenses (crop and livestock shares (not cash) received by landowner (or sub. Web we last updated the farm rental income and expenses in december 2022, so this is the latest version of form 4835, fully updated for tax year 2022. Web page last reviewed or updated: You may now deduct up to $500,000 of the cost of section 179 property placed. Purpose of form.—use form 4835 to report farm rental income based on crops or livestock produced by the tenant if you were the landowner (or sub. Web contain information that is equally applicable to form 8935. 4835 (2020) form 4835 (2020) page. Irs form 4835 is a fairly straightforward form. Use screen 4835 on the. Web also, use this form to report sales of livestock held for draft, breeding, sport, or dairy purposes. Web the irs has created a page on irs.gov for information about form 4835 and its instructions, at www.irs.gov/form4835. Web how do i complete irs form 4835? (crop and livestock shares (not cash) received by landowner (or sub.2023 Form 8995 Printable Forms Free Online

Tax Form 4835 Irs Printable Printable & Fillable Sample in PDF

Instructions for Form 8935, Airline Payments Report

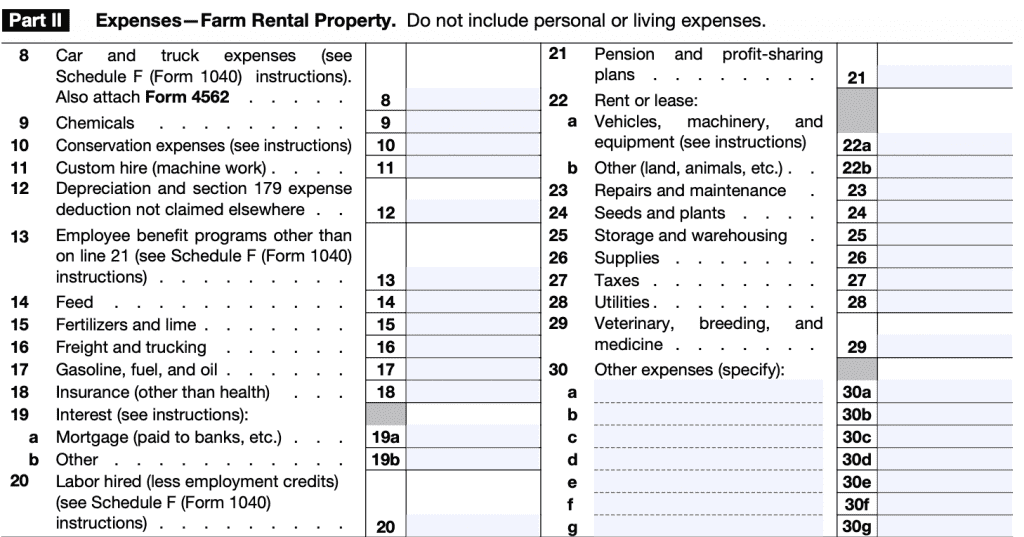

IRS Form 4835 Instructions Farm Rental & Expenses

IRS Form 4835 Instructions Farm Rental & Expenses

Form 4835 Farm Rental and Expenses (2015) Free Download

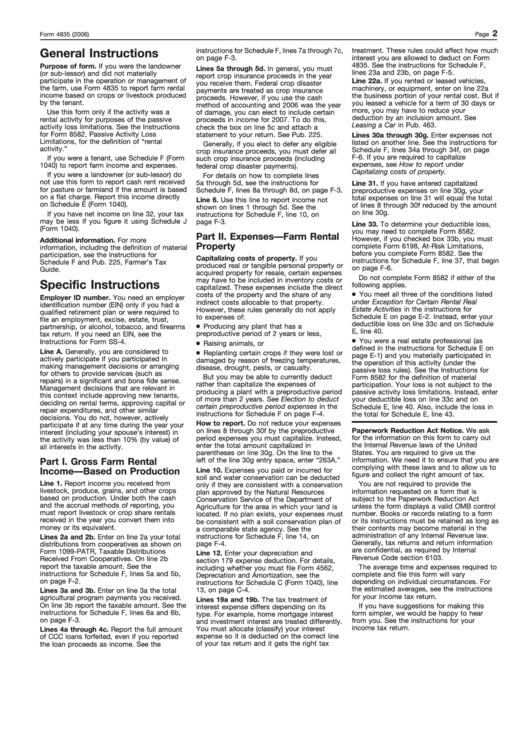

Instructions For Form 4835 2006 printable pdf download

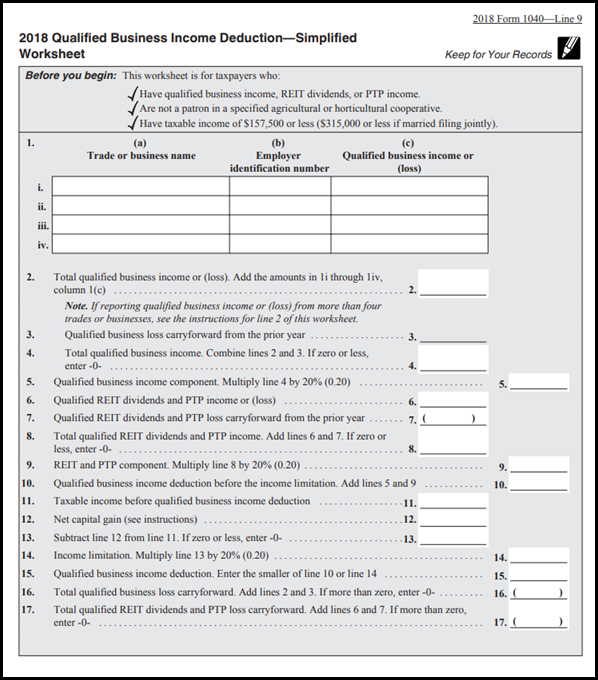

Section 199a Information Worksheet

Fill Free fillable Farm Rental and Expenses Form 4835 PDF form

Form 4835 Farm Rental and Expenses (2015) Free Download

Related Post: