Irs Form 5405 Instructions

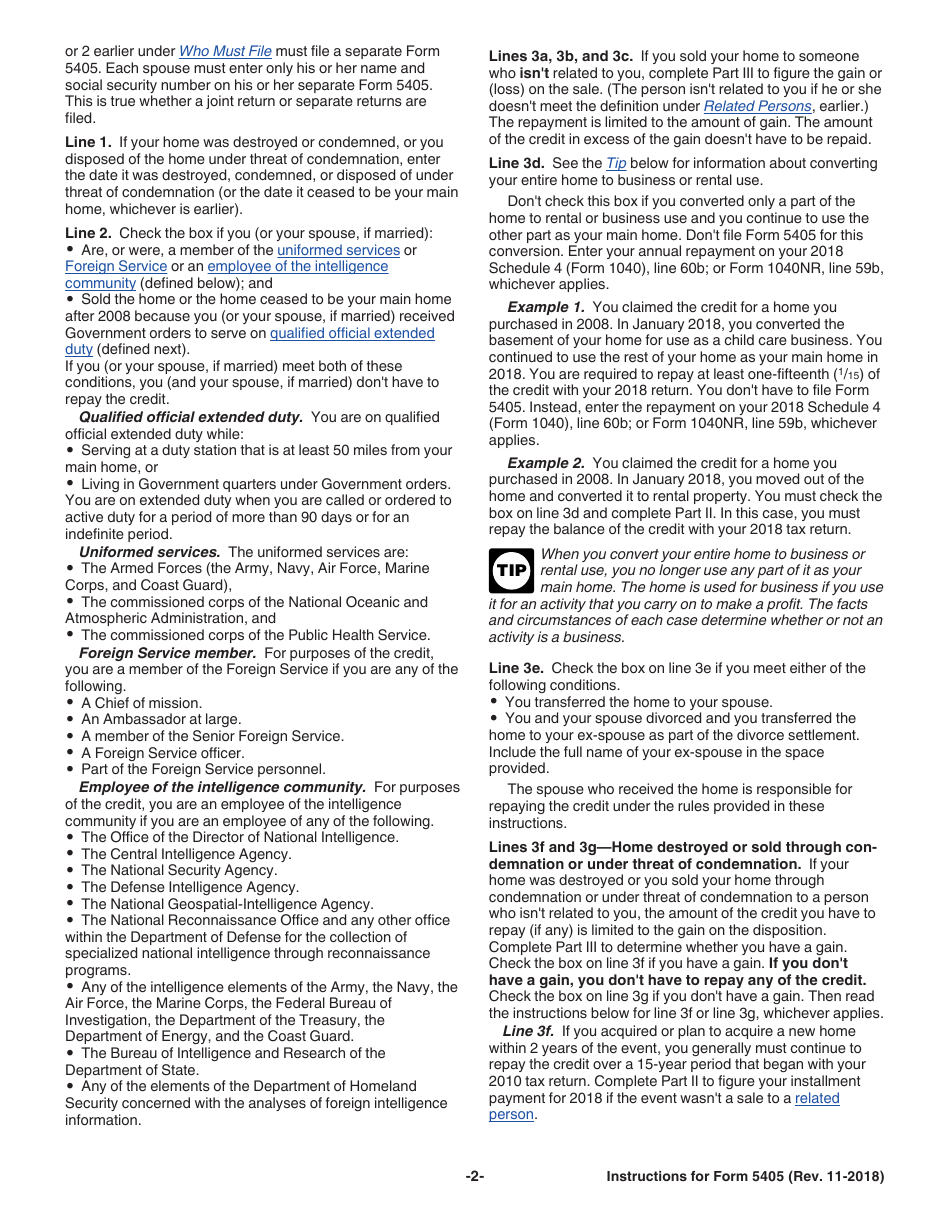

Irs Form 5405 Instructions - Form 4137, social security and medicare tax on unreported tip income: In the case of a sale, including through foreclosure, this is the year in which. Download them from irs.gov order online and have them delivered by. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or ceased to be your main home in 2022. Use form 5405 to do the following: Fill in the requested boxes. Ad outgrow.us has been visited by 10k+ users in the past month Complete part i and, if applicable, parts ii and iii. Either way, you need to provide accurate. Web how to complete form 5405. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2014. Use form 5405 to do the following: Form 5329, additional taxes on qualified plans. Per the irs instructions for form 5405: Form 5329, additional taxes on qualified plans. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Ad thecountyoffice.com has been visited by 100k+ users in the past month Web the irs requires you to prepare irs form 5405 before you can claim the. Fill in the requested boxes. Web use form 5405 to do the following. Either way, you need to provide accurate. Web a joint return for 2012 with the deceased taxpayer, see instructions. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Per the irs instructions for form 5405: Form 5329, additional taxes on qualified plans. Web a joint return for 2012 with the deceased taxpayer, see instructions. Part ii repayment of the credit. Complete part i and, if applicable, parts ii and iii. Form 4137, social security and medicare tax on unreported tip income: Web get the current filing year’s forms, instructions, and publications for free from the irs. You can complete form 5405 yourself or have a tax pro do it for you at jackson hewitt. Form 5405 is the form you have to fill out to notify the irs if you. Web use form 5405 to do the following. Ad browse & discover thousands of business & investing book titles, for less. Web get the current filing year’s forms, instructions, and publications for free from the irs. Form 4137, social security and medicare tax on unreported tip income: Complete part i and, if applicable, parts ii and iii. Part ii repayment of the credit. You disposed of it in 2022. Form 4137, social security and medicare tax on unreported tip income: You can complete form 5405 yourself or have a tax pro do it for you at jackson hewitt. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be. Web what is form 5405? You disposed of it in 2022. Fill in the requested boxes. Either way, you need to provide accurate. Download them from irs.gov order online and have them delivered by. Form 5405 is the form you have to fill out to notify the irs if you sold your main home that you purchased in 2008, or to calculate the amount of. Enter the amount of the credit you claimed on form. Complete part i and, if applicable, parts ii and iii. Web you must file form 5405 with your 2022. Fill in the requested boxes. Part ii repayment of the credit. Enter the amount of the credit you claimed on form. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2014. You disposed of it in 2022. Enter the amount of the credit you claimed on form. Part ii repayment of the credit. Per the irs instructions for form 5405: Ad browse & discover thousands of business & investing book titles, for less. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and. In the case of a sale, including through foreclosure, this is the year in which. You disposed of it in 2022. Form 5405 is the form you have to fill out to notify the irs if you sold your main home that you purchased in 2008, or to calculate the amount of. Download them from irs.gov order online and have them delivered by. Ad thecountyoffice.com has been visited by 100k+ users in the past month Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web who must file form 5405? Use form 5405 to do the following: Form 5329, additional taxes on qualified plans. Either way, you need to provide accurate. Web the following tips can help you fill out form 5405 instructions pdf quickly and easily: Web use form 5405 to do the following. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. Web get the current filing year’s forms, instructions, and publications for free from the irs. Complete part i and, if applicable, parts ii and iii.IRS Publication Form Instructions 5405 Supplemental Security

Download Instructions for IRS Form 5405 Repayment of the FirstTime

Home Buyer Tax Credit Can I Sell the Homestead to My Children

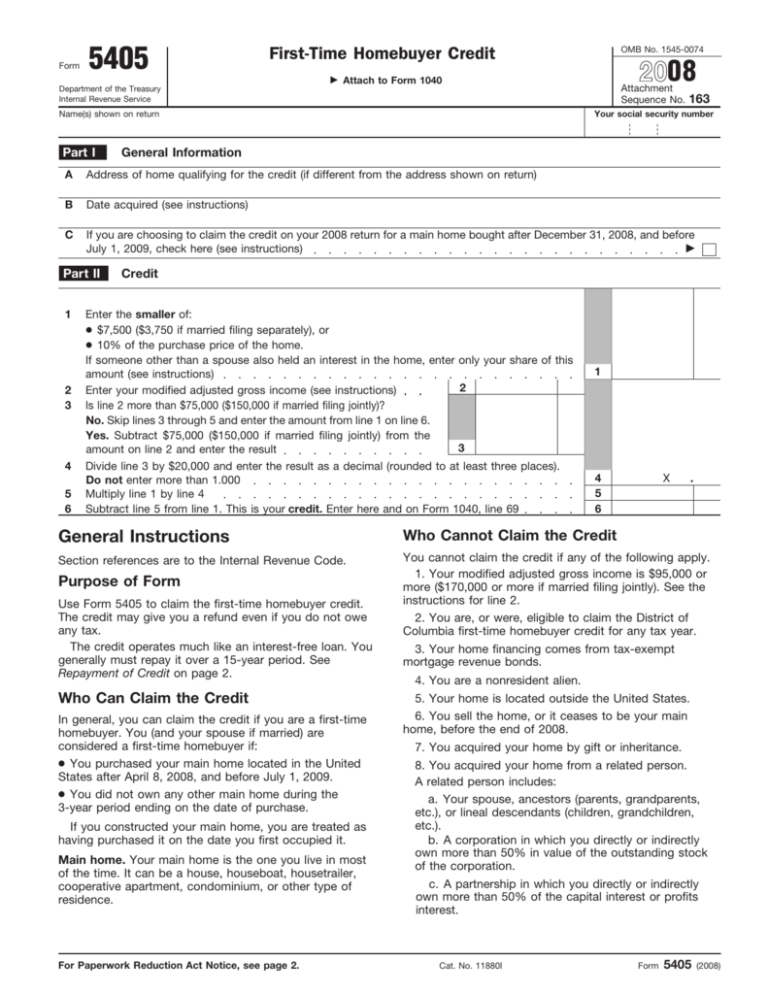

FirstTime Homebuyer Credit General Instructions

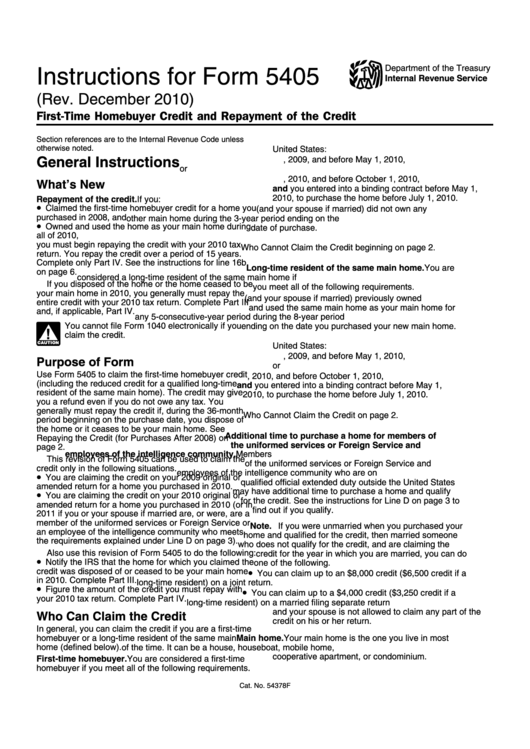

Draft Instructions For Form 5405 FirstTime Homebuyer Credit And

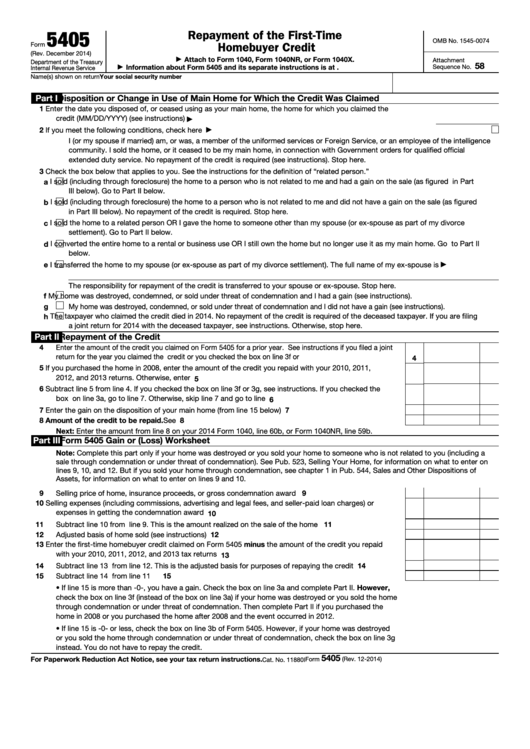

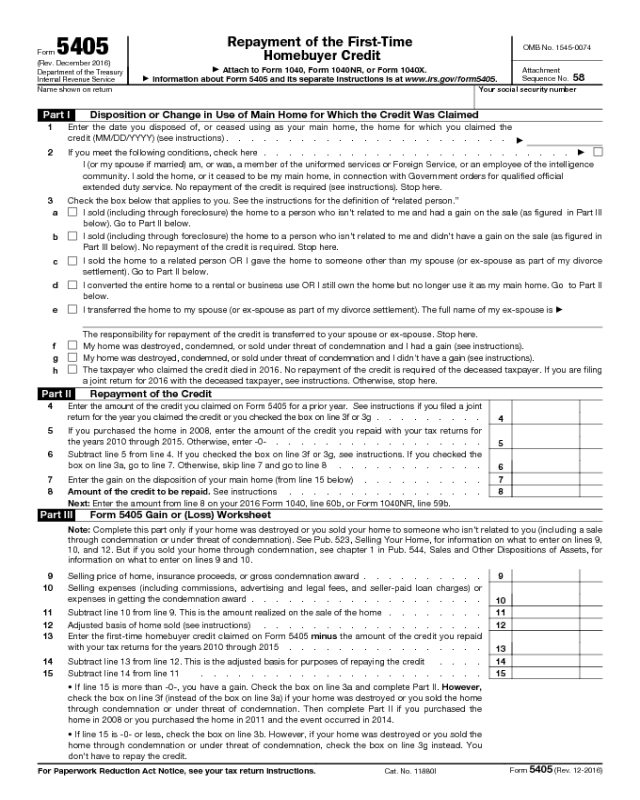

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

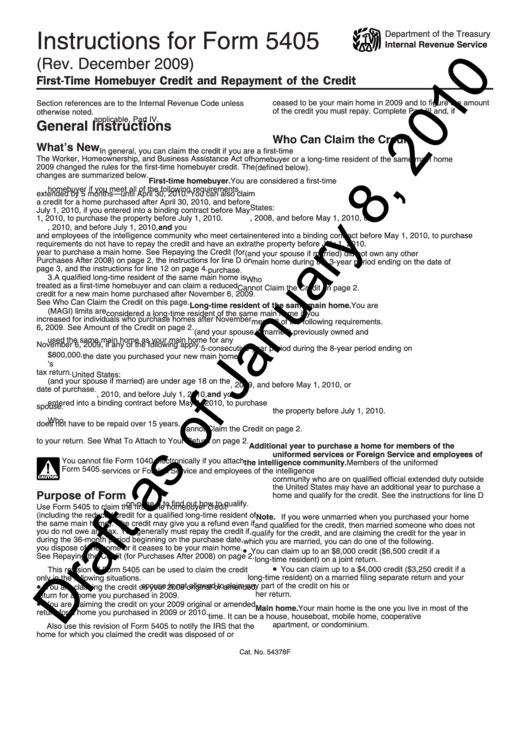

Instructions For Form 5405 2009 printable pdf download

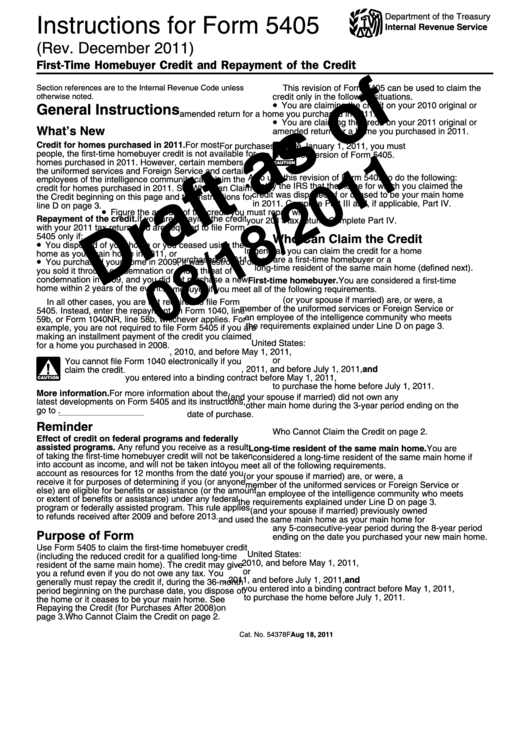

Instructions For Form 5405 Draft (Rev. December 2011) printable pdf

Form 5405 Edit, Fill, Sign Online Handypdf

Form 5405 FirstTime Homebuyer Credit

Related Post: