Form 1065 K 1 Codes

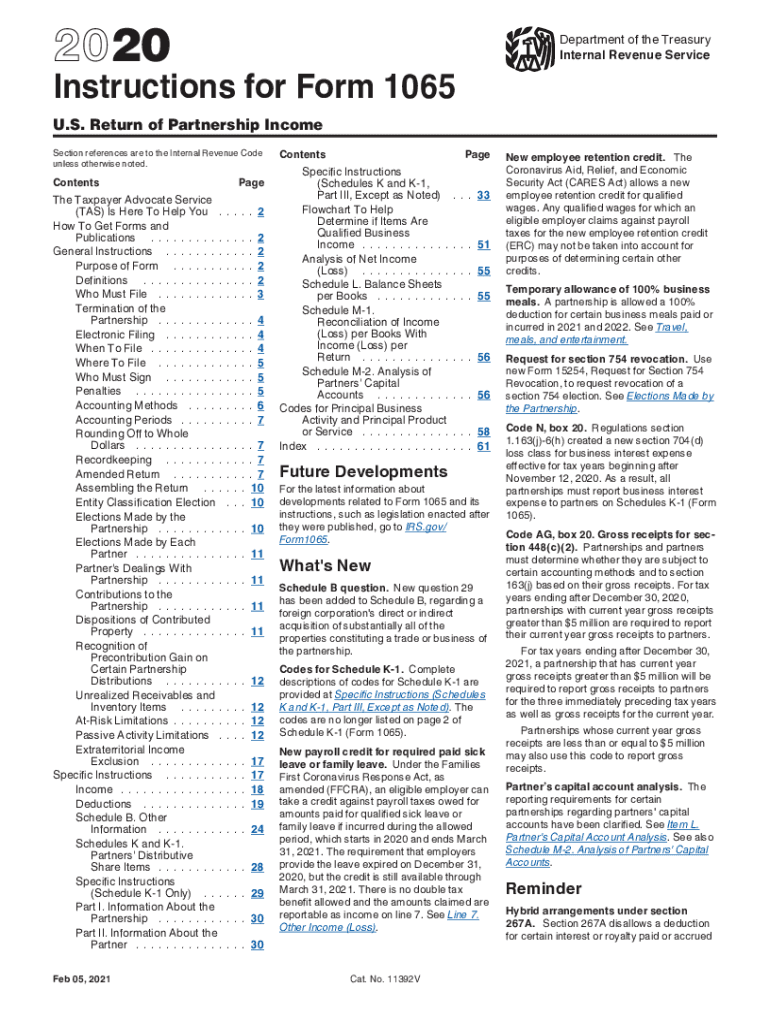

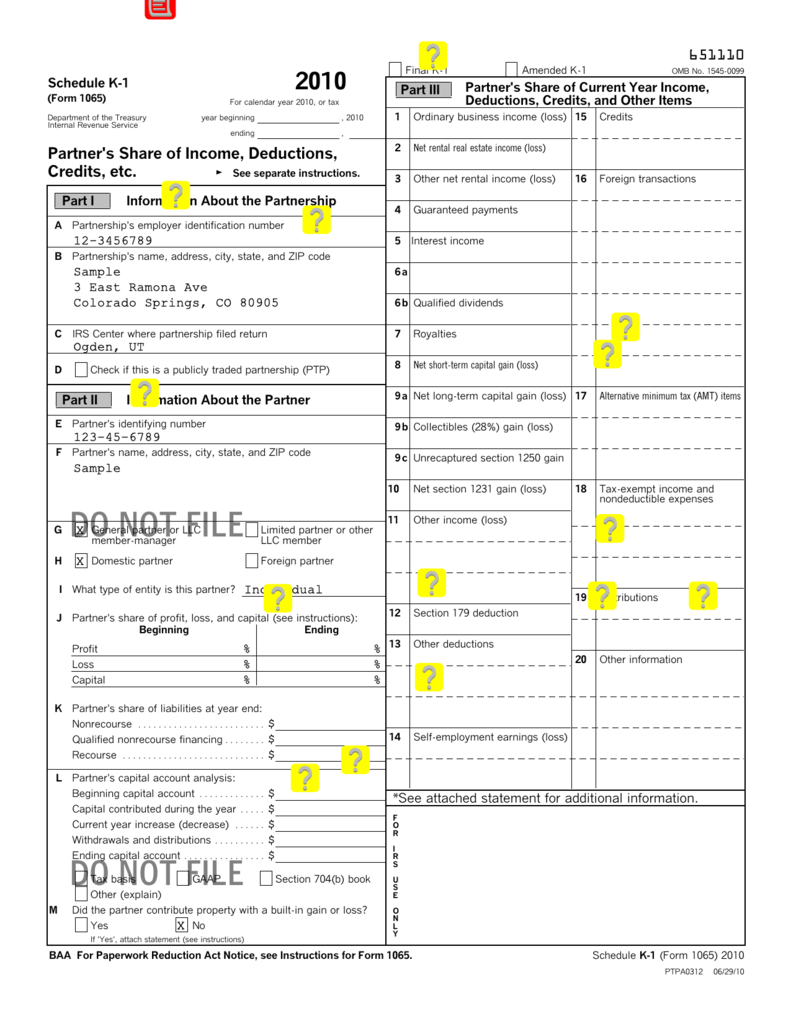

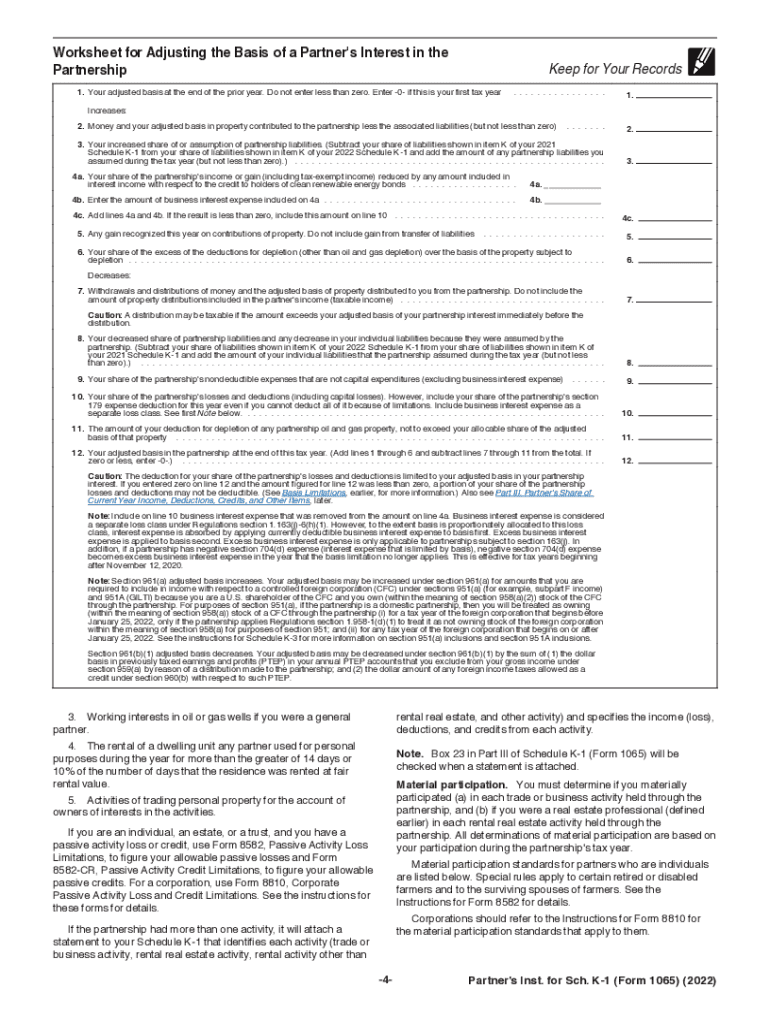

Form 1065 K 1 Codes - Page numbers refer to this instruction. Please find the specific item within box 17 that is reported on your form 1065. Box 13 has many codes, not all of which are direct entries or supported by the taxslayer program. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Select the + add button, if more box 13 entries are needed. As mike9241 posted you have until 4/15/26 to amend your 2022. Solved•by intuit•141•updated may 18, 2023. Web recovery startup business, before january 1, 2022). Code y is used to report information related to the net investment income tax. It’s provided to partners in a business partnership to report their share of a. Solved•by intuit•141•updated may 18, 2023. Web this code will let you know if you should adjust your basis and by how much. Page numbers refer to this instruction. Department of the treasury internal revenue service. Total assets (see instructions) $ g. 1 ordinary business income (loss) a, b form 8582. Ending / / partner’s share of. Web recovery startup business, before january 1, 2022). 4 digit code used to identify the software developer whose application produced the bar code. Below are the box 13. Select the + add button, if more box 13 entries are needed. Total assets (see instructions) $ g. Web recovery startup business, before january 1, 2022). Web this code will let you know if you should adjust your basis and by how much. Page numbers refer to this instruction. Code y is used to report information related to the net investment income tax. Box 13 has many codes, not all of which are direct entries or supported by the taxslayer program. Back to table of contents. 1 ordinary business income (loss) a, b form 8582. Web recovery startup business, before january 1, 2022). This will not be reported on the 1040. Department of the treasury internal revenue service. Ending / / partner’s share of. Box 13 has many codes, not all of which are direct entries or supported by the taxslayer program. Code y is used to report information related to the net investment income tax. Web this code will let you know if you should adjust your basis and by how much. Department of the treasury internal revenue service. Code y is used to report information related to the net investment income tax. Back to table of contents. Ending / / partner’s share of. Solved•by intuit•141•updated may 18, 2023. Below are the box 13. For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of. Please find the specific item within box 17 that is reported on your form 1065. Code y is used to report information related to the net investment income tax. For calendar year 2022, or tax year beginning / / 2022. For a fiscal year or a short tax year, fill in the tax. Page numbers refer to this instruction. Total assets (see instructions) $ g. Code y is used to report information related to the net investment income tax. Ending / / partner’s share of. 4 digit code used to identify the software developer whose application produced the bar code. It’s provided to partners in a business partnership to report their share of a. As mike9241 posted you have until 4/15/26 to amend your 2022. 4 digit code used to identify the software developer whose application produced the bar code. 1 ordinary business income (loss) a, b form 8582. For a fiscal year or a short tax year, fill in the tax. Box 13 has many codes, not all of which are direct entries or supported by the taxslayer program. Code y is used to. Total assets (see instructions) $ g. For a fiscal year or a short tax year, fill in the tax. For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of. This will not be reported on the 1040. Select the + add button, if more box 13 entries are needed. Code y is used to report information related to the net investment income tax. Page numbers refer to this instruction. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web recovery startup business, before january 1, 2022). Back to table of contents. As mike9241 posted you have until 4/15/26 to amend your 2022. It’s provided to partners in a business partnership to report their share of a. Solved•by intuit•141•updated may 18, 2023. Web this code will let you know if you should adjust your basis and by how much. Please find the specific item within box 17 that is reported on your form 1065. Below are the box 13. Department of the treasury internal revenue service. 4 digit code used to identify the software developer whose application produced the bar code. Box 13 has many codes, not all of which are direct entries or supported by the taxslayer program.Form 1065 K 1 Instructions 2020 Fill Out and Sign Printable PDF

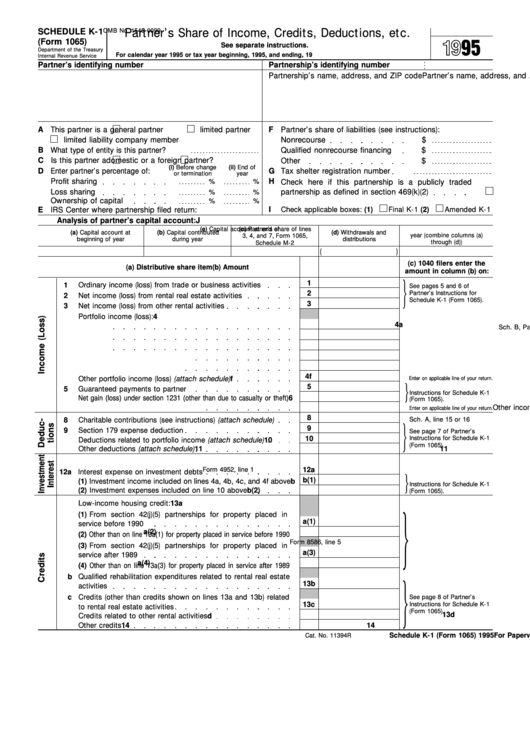

Form K1 1065 Instructions Ethel Hernandez's Templates

Schedule K1 (Form 1065) Partner'S Share Of Credits

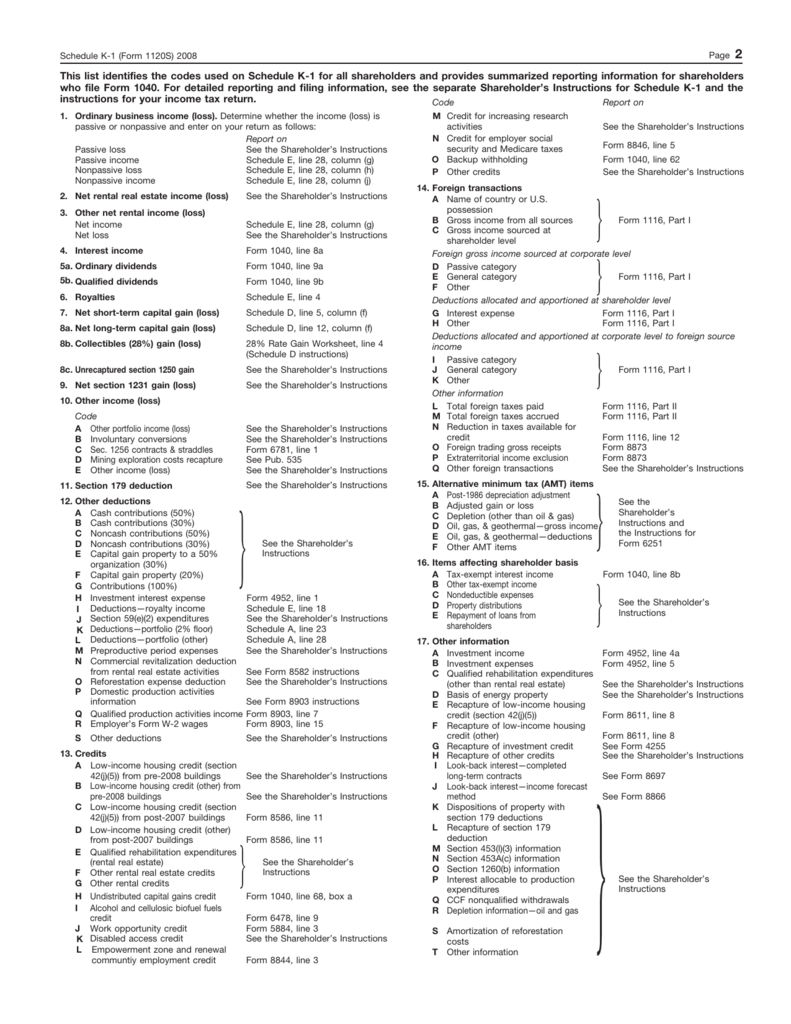

1120S K1 codes

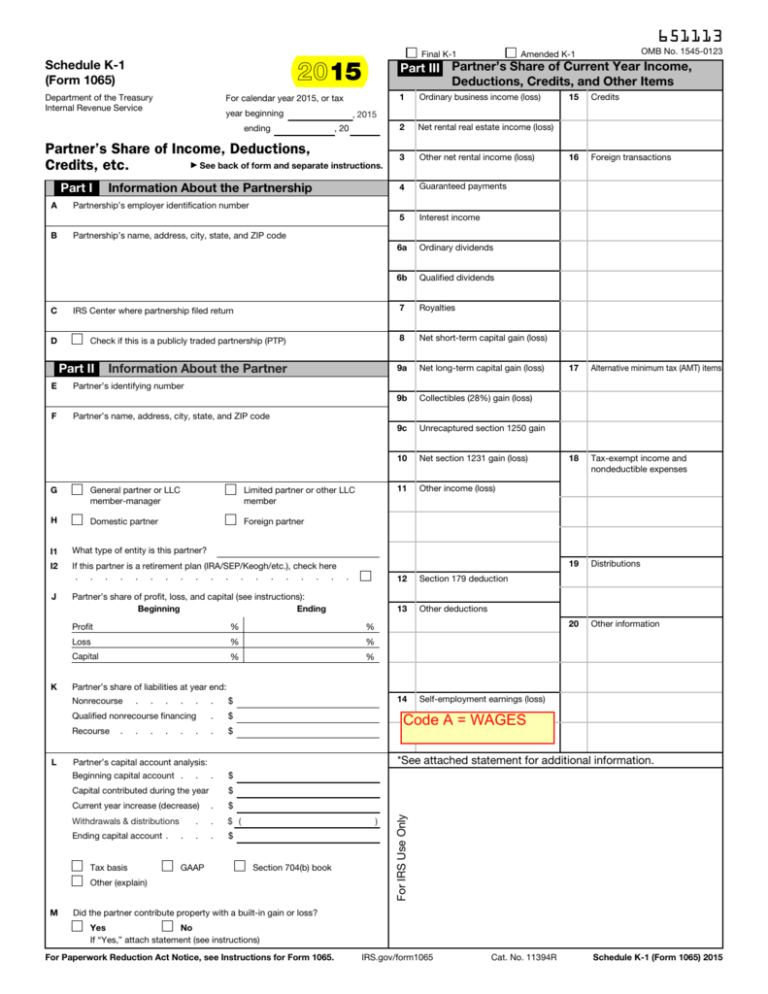

2015 Form 1065 (Schedule K1)

IRS Form 1065 Schedule K1 (2021) Partner’s Share of

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

2017 Form 1065 Instructions Fill Out and Sign Printable PDF Template

Form 1065 (Schedule K1) Partner's Share of Deductions and

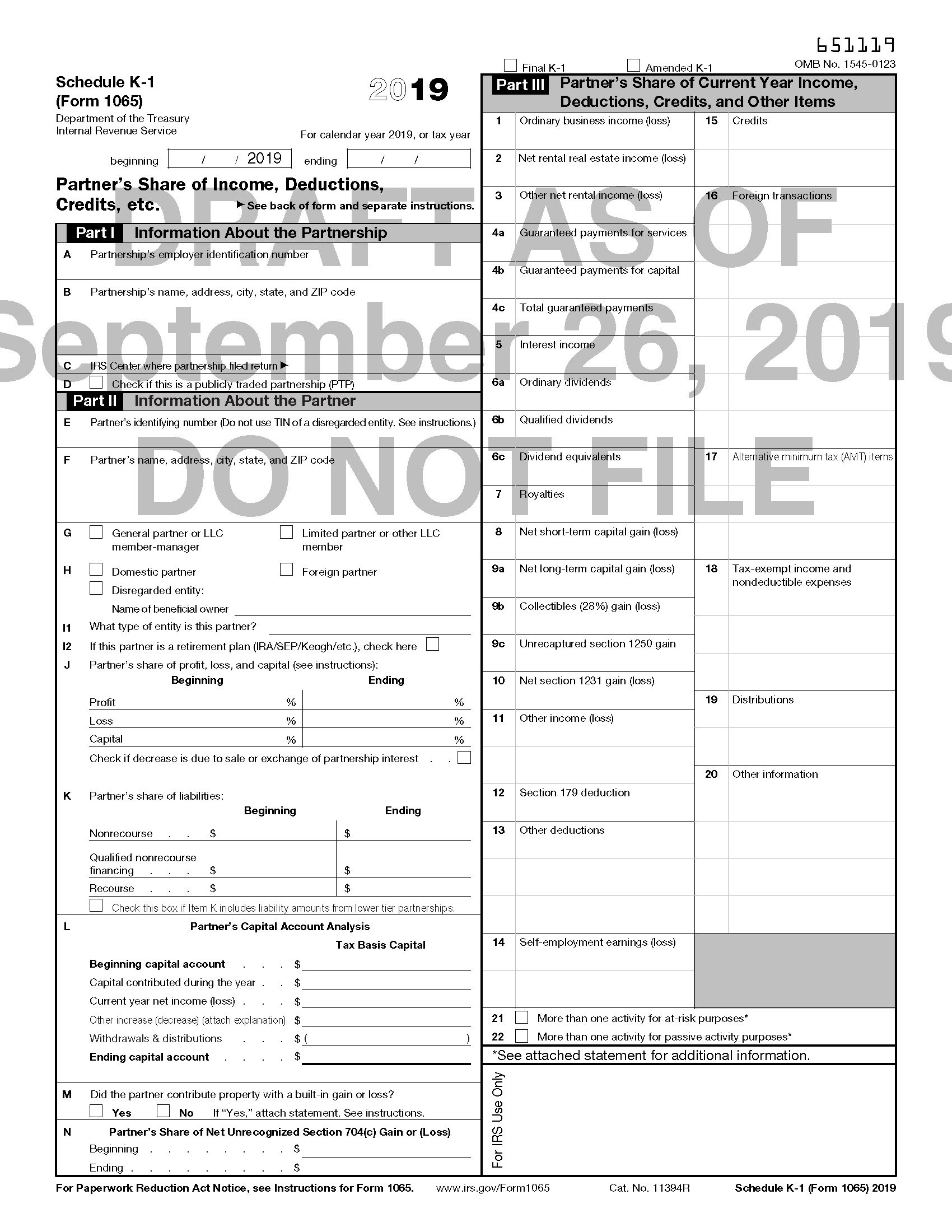

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

Related Post: