Irs Form 6252

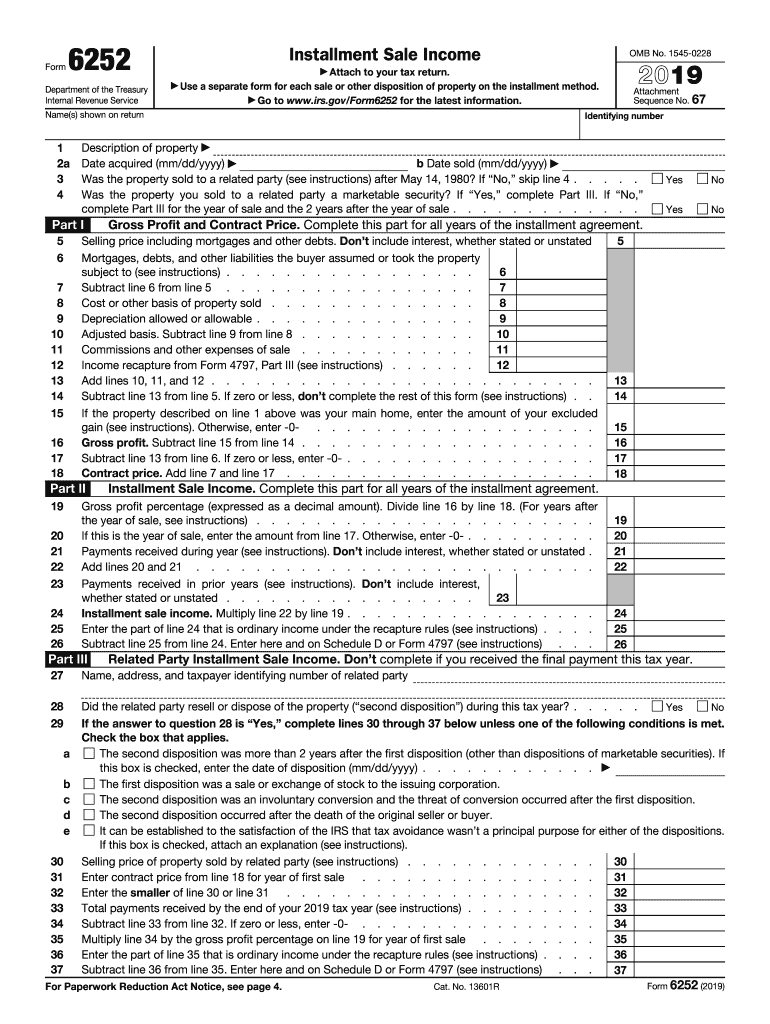

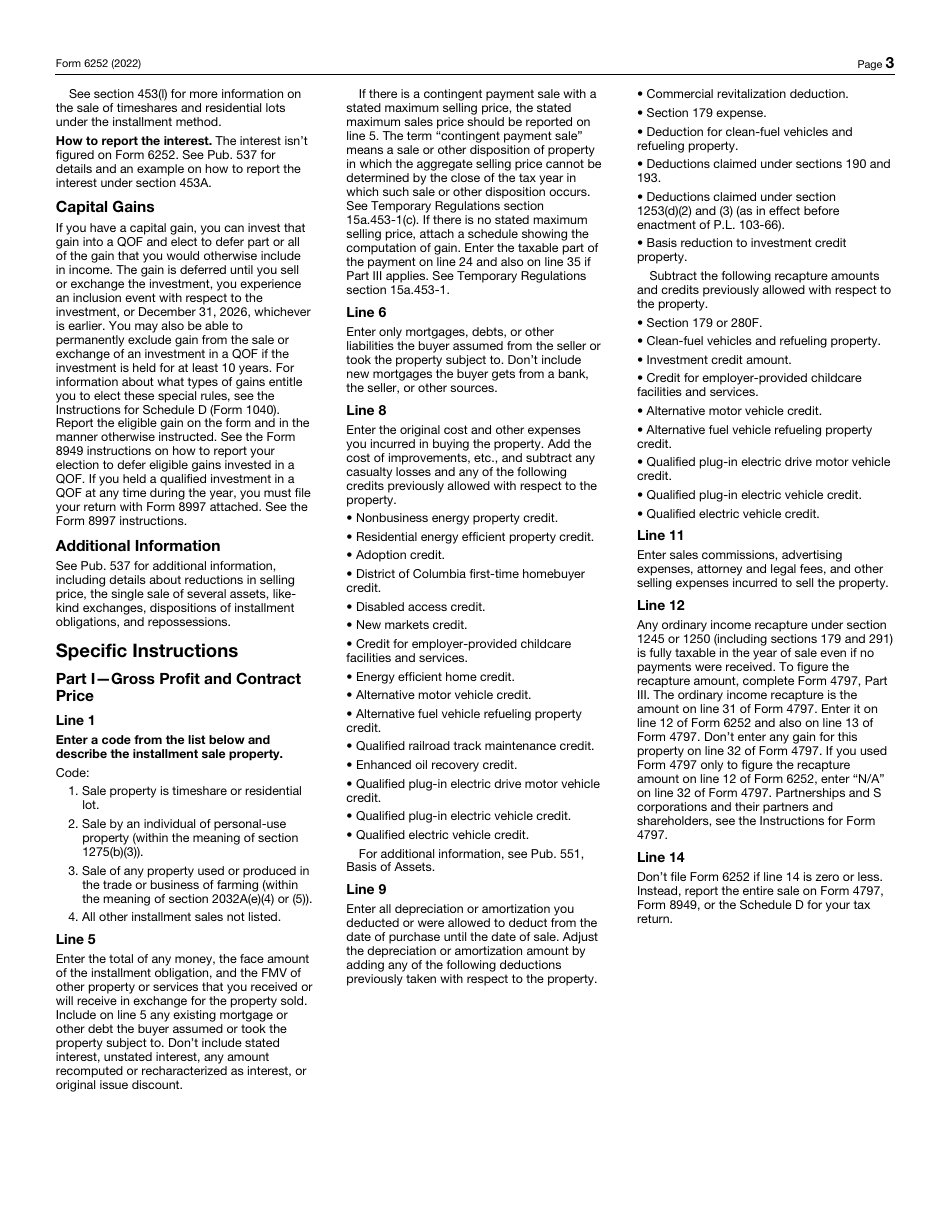

Irs Form 6252 - Ause a separate form for each sale or other disposition of property on. Complete, edit or print tax forms instantly. If form 6252 doesn't generate after. Use a separate form for each sale or other disposition of. Web recapture is the amount on line 33 of form 4797. Federal section income less common income installment sale income 6252 what is an installment sale? Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Web don’t file form 6252 for sales that don’t result in a gain, even if you will receive a payment in a tax year after the year of sale. Web to locate form 6252, installment sale income in the program go to: Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Web irs tax form 6252 includes the earnings in your taxes for the year in which the sale happened. Web department of the treasury internal revenue service installment sale income aattach to your tax return. Web. Ad access irs tax forms. Web form 6252 department of the treasury internal revenue service installment sale income attach to your tax return. Go to the input return tab. Solved•by intuit•8•updated 1 year ago. Access irs forms, instructions and publications in electronic and print media. Do not enter any gain for this property on line 34 of form 4797. Complete, edit or print tax forms instantly. Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Web don’t file form 6252 for sales that don’t result in a gain, even if. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you receive an. Web don’t file form 6252 for sales that don’t result in a gain, even if you will receive a payment in a tax year after the year of sale. Solved•by. Enter it on line 12 of form 6252 and also on line 14 of form 4797. If form 6252 doesn't generate after. Do not enter any gain for this property on line 34 of form 4797. Solved•by intuit•203•updated 1 year ago. Web to locate form 6252, installment sale income in the program go to: Complete, edit or print tax forms instantly. If form 6252 doesn't generate after. Web how to generate form 6252 for a current year installment sale in lacerte. Solved•by intuit•203•updated 1 year ago. Web purpose of irs form 6252. Do not enter any gain for this property on line 34 of form 4797. You will also have to report the installment. Complete, edit or print tax forms instantly. Taxpayers should only file this form if they realize gains. Ause a separate form for each sale or other disposition of property on. 4 min read what is irs tax form 6252? Instead, report the entire sale on form 4797, sales of. Form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much was a. Web department of the treasury internal revenue service installment sale income aattach to your. Solved•by intuit•203•updated 1 year ago. Common questions about form 6252 in proseries. Instead, report the entire sale on form 4797, sales of. Web recapture is the amount on line 33 of form 4797. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which. You will also have to report the installment. Web how to enter a prior or current year installment sale (form 6252) in proconnect tax to enter a current year installment sale follow these steps: Ad download or email form 6252 & more fillable forms, register and subscribe now! Web recapture is the amount on line 33 of form 4797. Web. Enter it on line 12 of form 6252 and also on line 14 of form 4797. Web any installment sale income for current year (form 6252, line 26), which will be included with the amount on schedule 1 (form 1040) additional income and adjustments to. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Go to the input return tab. Solved•by intuit•8•updated 1 year ago. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you receive an. Web purpose of irs form 6252. 4 min read what is irs tax form 6252? Do not enter any gain for this property on line 34 of form 4797. Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Complete, edit or print tax forms instantly. Web form 6252 department of the treasury internal revenue service installment sale income attach to your tax return. You will also have to report the installment. Web how to generate form 6252 for a current year installment sale in lacerte. Web irs tax form 6252 includes the earnings in your taxes for the year in which the sale happened. Form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much was a. Irs tax form 6252 is a form that. Ad access irs tax forms. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Solved•by intuit•203•updated 1 year ago.2019 Form IRS 6252 Fill Online, Printable, Fillable, Blank PDFfiller

Form 6252 Installment Sale (2015) Free Download

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT

IRS Form 6252 Download Fillable PDF or Fill Online Installment Sale

Form 6252Installment Sale

Form 6252 Installment Sale (2015) Free Download

Form 6252 Installment Sale (2015) Free Download

[Solved] Use the following information to fill out IRS Form 6252 Mary

Form 6252Installment Sale

IRS Form 6252 Reporting Installment Sales on Your Form 1040

Related Post: