Minnesota Tax Form M1 Instructions

Minnesota Tax Form M1 Instructions - Select the document you want to sign and click upload. Web 2021 form m1, individual income tax (minnesota department of revenue) 2021 estimated tax payment record (minnesota department of revenue) 2020. See the form 1040 instructions for more information. Minnesota individual income tax applies to residents and nonresidents. Web before you complete this schedule, read the instructions and complete lines 1 through 11 of form m1. Web an amount on line 1 of your 2021 federal schedule 1. Free printable 2022 minnesota form m1 and. See the form 1040 instructions for more information. You must file yearly by april 17. Web filing status to determine the tax amount to enter on line 10 of form m1. Subtraction limits the maximum subtraction allowed for purchases of personal. Web minnesota income tax withheld. Minnesota individual income tax applies to residents and nonresidents. From the table in the form m1 instructions. Web 2021 form m1, individual income tax (minnesota department of revenue) 2021 estimated tax payment record (minnesota department of revenue) 2020. 16 published a draft booklet on 2023 individual income tax forms and instructions, including form m1, minnesota. File unfiled tax returns & maximize deductions. Web before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your federal taxable income. Ad get deals and low prices on turbo tax. Select the document you want to sign and click upload. Web 2021 form m1, individual income tax (minnesota department of revenue) 2021 estimated tax payment record (minnesota department of revenue) 2020. 16 published a draft booklet on 2023 individual income tax forms and instructions, including form m1, minnesota. Printable state mn form m1 and mn form m1 instructions. And schedules. This form is for income earned in tax year 2022, with tax. You must file yearly by april 17. And schedules kpi, ks, and kf. See the form 1040 instructions for more information. For examples of qualifying education expenses, see the form m1 instructions. Minnesota individual income tax return. To find out how much your minnesota income tax. This form is for income earned in tax year 2022, with tax. These 2021 forms and more are available: Web minnesota income tax withheld. If line 9 of form m1 is less than $90,000, you must use the tax table on pages 28 through. Select the document you want to sign and click upload. Free printable 2022 minnesota form m1 and. Web minnesota income tax withheld. Web an amount on line 1 of your 2021 federal schedule 1. Form m1 is the most common individual income tax return filed for minnesota residents. 16 published a draft booklet on 2023 individual income tax forms and instructions, including form m1, minnesota. Web the minnesota department of revenue oct. You can get minnesota tax forms either by mail or in person. These 2021 forms and more are available: Web 2021 form m1, individual income tax (minnesota department of revenue) 2021 estimated tax payment record (minnesota department of revenue) 2020. Select the document you want to sign and click upload. If line 9 of form m1 is less than $90,000, you must use the tax table on pages 28 through. 2022 minnesota individual income tax instructions (form m1) get. See the form 1040 instructions for more information. File unfiled tax returns & maximize deductions. This form is for income earned in tax year 2022, with tax. Web before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your federal taxable income. Web 2021 form m1, individual income. Select the document you want to sign and click upload. Web an amount on line 1 of your 2021 federal schedule 1. If line 9 of form m1 is less than $90,000, you must use the tax table on pages 28 through. Web resources [+] find individual forms and instructions. This form is for income earned in tax year 2022,. Web minnesota income tax withheld. Form m1 is the most common individual income tax return filed for minnesota residents. Quickly end irs & state tax problems. File unfiled tax returns & maximize deductions. We last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year. Web you must file yearly by april 15. Additions to minnesota income from line 17 of schedule m1m (see. You must file yearly by april 17. To find out how much your minnesota income tax. Printable state mn form m1 and mn form m1 instructions. 2022 minnesota individual income tax instructions (form m1) get form m1 instructions: Web 2021 form m1, individual income tax (minnesota department of revenue) 2021 estimated tax payment record (minnesota department of revenue) 2020. Subtraction limits the maximum subtraction allowed for purchases of personal. Ad uslegalforms.com has been visited by 100k+ users in the past month Web an amount on line 1 of your 2021 federal schedule 1. These 2021 forms and more are available: Web if you received a state income tax refund in 2022 and you itemized deductions on your 2021 federal form 1040, you may need to report an amount on line 1 of your 2022 federal schedule 1. Select the document you want to sign and click upload. Web select a different state: If line 9 of form m1 is less than $90,000, you must use the tax table on pages 28 through.M1 Fillable Form Printable Forms Free Online

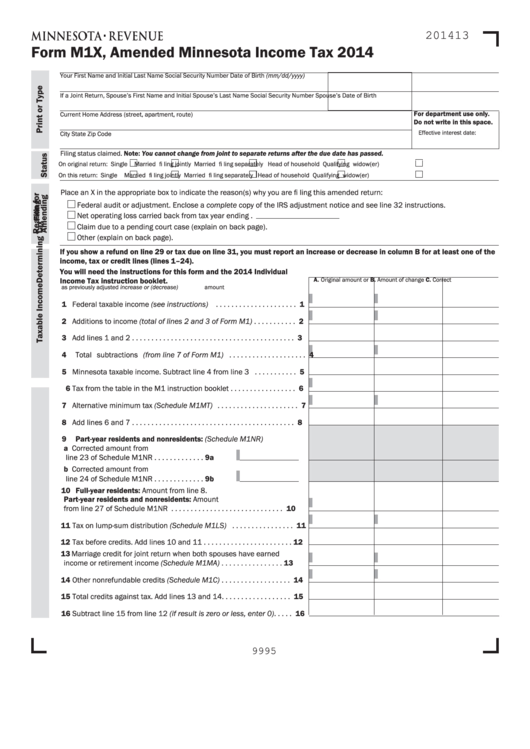

2020 Form MN DoR M1Fill Online, Printable, Fillable, Blank pdfFiller

2018 m1w form Fill out & sign online DocHub

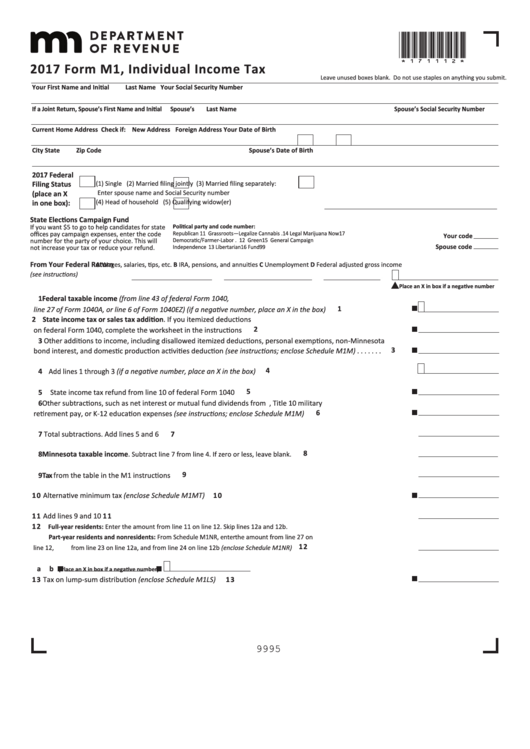

MN DoR M1 2018 Fill out Tax Template Online US Legal Forms

M1 taxes.state.mn.us

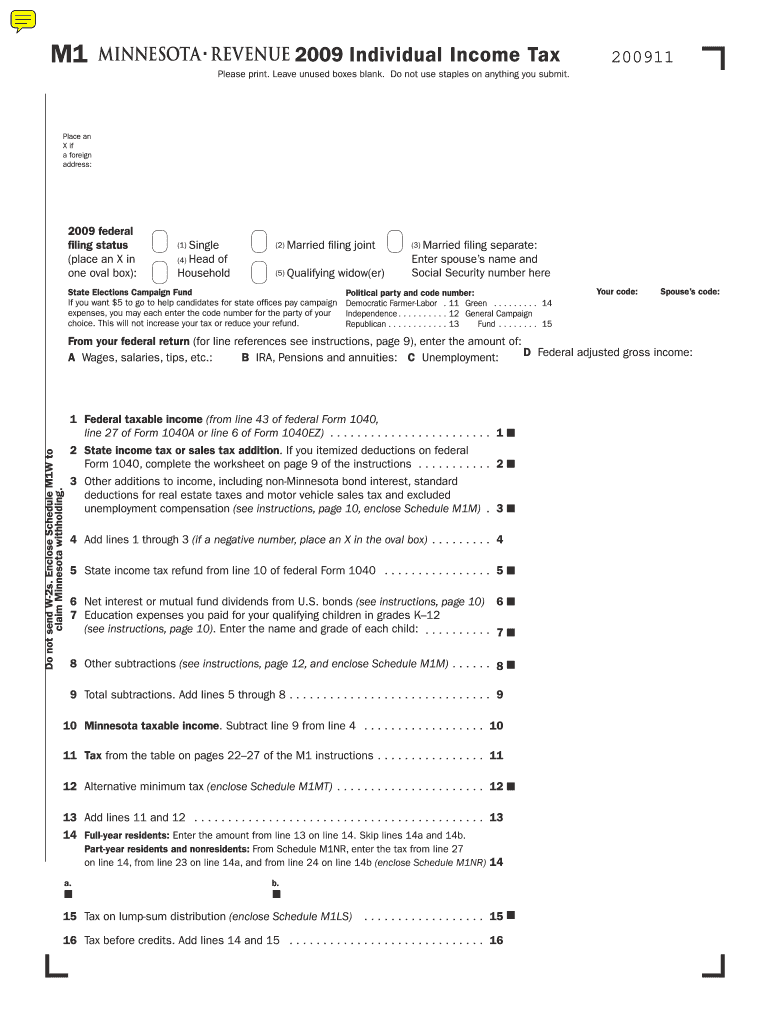

2009 M1, Individual Tax Return revenue state mn Fill out

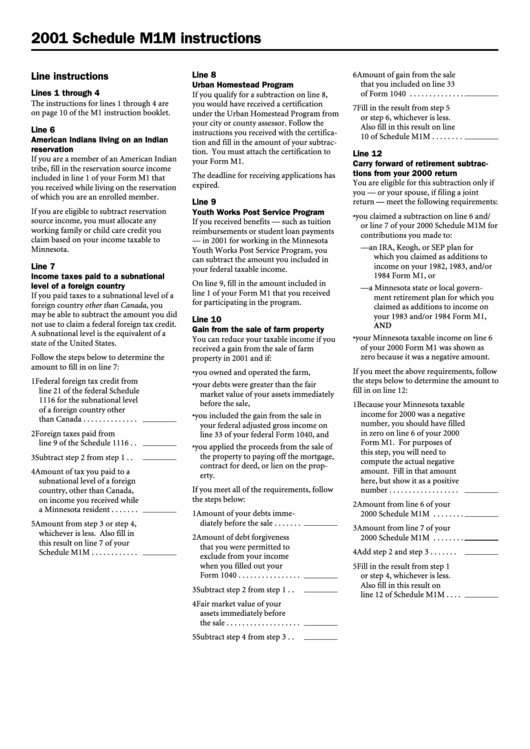

Schedule M1m Instructions 2001 printable pdf download

Minnesota Tax Table M1 Instructions 2021

Fill Free fillable Minnesota Department of Revenue PDF forms

Minnesota M1 Tax Form Printable Printable Forms Free Online

Related Post: