Irs 4972 Form

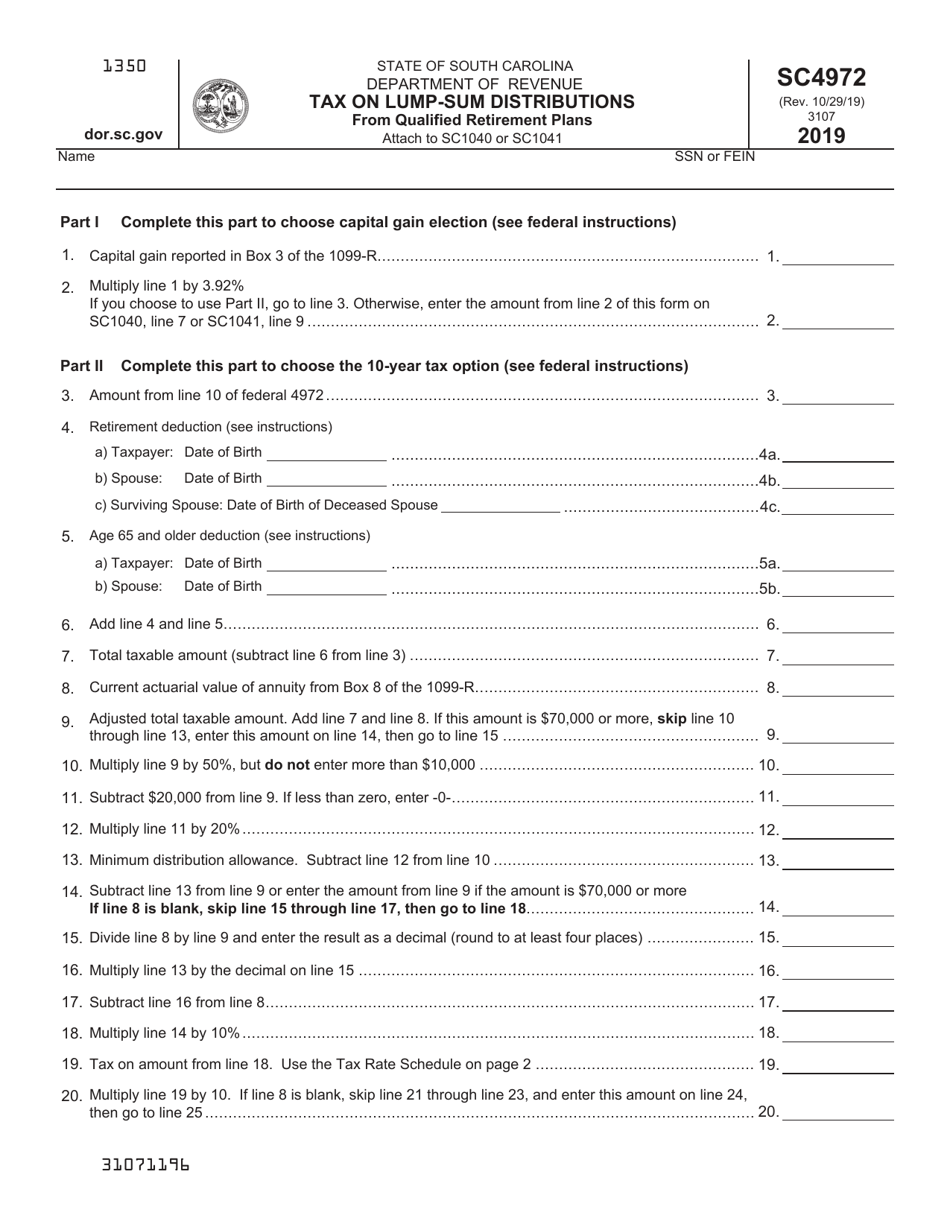

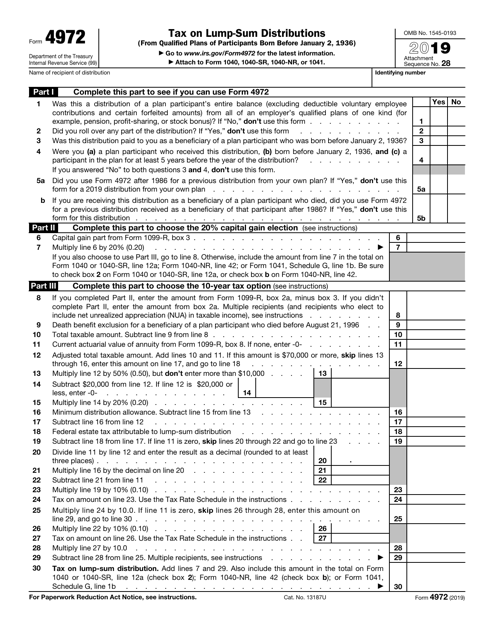

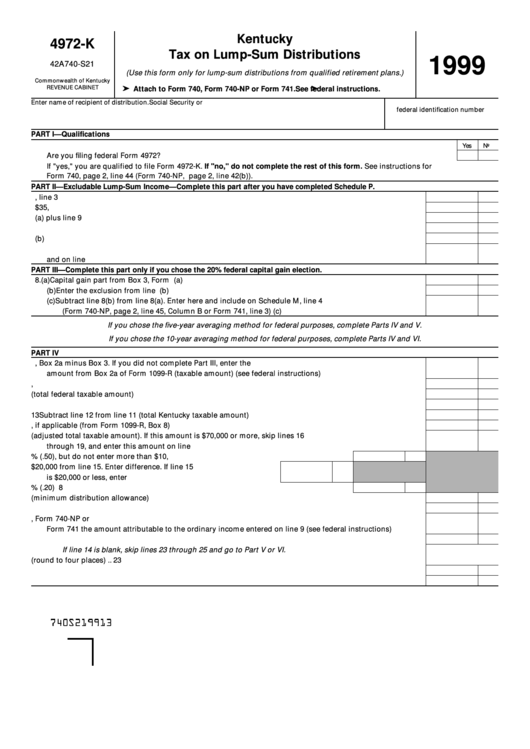

Irs 4972 Form - Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. It allows beneficiaries to receive their entire benefit in. Use this form to figure the. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web chapter 43 § 4972 sec. Web 2017 form 4972 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 170 votes how to fill out and sign 2020 4972 online? The following choices are available. Get your online template and fill it in using. He had a pension plan. Estimate how much you could potentially save in just a matter of minutes. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Web what is irs form 4972 used for? Get ready for tax season deadlines by completing any required tax. Use this form to figure the. Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. Being born before january 2, 1936, is. Web what is irs form 4972 used for? Ad we help get taxpayers relief from owed irs back taxes. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. § 4972 (a). My brother died in 2019. I was the beneficiary of the pension plan. Web up to 10% cash back do not use any form without first having an attorney review the form and determine that it is suitable for the purpose for which you intend it. Ad download or email irs 4972 & more fillable forms, register and subscribe now!. See capital gain election, later. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Get your online template and fill it in using. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Being born before january 2, 1936, is. Use screen 1099r in the income folder to complete form 4972. Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. Ad download or email irs 4972 & more fillable forms, register and subscribe now! To claim these benefits, you must file irs. Use distribution code a. My brother died in 2019. Web 2017 form 4972 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 170 votes how to fill out and sign 2020 4972 online? Tax on nondeductible contributions to qualified employer plans i.r.c. Web form 4972 is an irs form with stipulated terms and conditions that. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Use distribution code a and answer. He had a pension plan. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Tax on nondeductible contributions to qualified employer plans. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Use this form to figure the. § 4972 (a) tax imposed — in the case of any qualified employer plan, there. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the. He had a pension plan. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web up to 10% cash back do not use any form without first having an attorney review the form and determine that it is suitable for the purpose for which you intend it. § 4972 (a) tax. Web if you do meet a number of unique requirements, irs form 4972 then it does allow you to claim preferential tax treatment. Estimate how much you could potentially save in just a matter of minutes. Ad we help get taxpayers relief from owed irs back taxes. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Use distribution code a and answer. If you were older than. Being born before january 2, 1936, is. The form is used to take advantage of special grandfathered taxation options. Get your online template and fill it in using. Get ready for tax season deadlines by completing any required tax forms today. The following choices are available. Use screen 1099r in the income folder to complete form 4972. It allows beneficiaries to receive their entire benefit in. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. To claim these benefits, you must file irs. Web up to 10% cash back do not use any form without first having an attorney review the form and determine that it is suitable for the purpose for which you intend it. Web chapter 43 § 4972 sec. Web employer's quarterly federal tax return. He had a pension plan.Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

IRS Form 4972 Instructions Lump Sum Distributions

Fill Free fillable IRS PDF forms

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Form 4972 Papers Tax On Lumpsum Stock Illustration 2131946327

IRS Form 4972 2019 Fill Out, Sign Online and Download Fillable PDF

2019 IRS Form 4972 Fill Out Digital PDF Sample

Kentucky Tax On LumpSum Distributions (Form 4972K 1999) printable pdf

File IRS Form 4972

Related Post: