S Corp Tax Filing Extension Form

S Corp Tax Filing Extension Form - Web most major tax software applications allow you to file extensions using form 7004 (for businesses) or form 4868 (for individuals). Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Form your s corp today. Kickstart your s corporation in minutes. Web most business tax returns can be extended by filing form 7004: The original due date for this. Complete either a form 7004 or 1120. Use form 120ext (application for automatic extension of time to file corporation,. Ad we have unmatched experience in forming businesses online. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. The final deadline to file your 2022 taxes is october 16. Web most business tax returns can be extended by filing form 7004: Web the april 18 state deadline was originally extended by gov. Web application for automatic extension of time to file certain business income tax, information, and other returns. Use form 120ext (application for automatic extension of time. There’s less than a week until the oct. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. Web there are three steps to filing an extension for s corporation taxes: Gavin newsom in march to align with the irs’s announcement to push the federal due date to oct. Web most major. Free website with formation to get you started. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. The final deadline to file your 2022 taxes is october 16. Web form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns” filers who need more. Enter code 25 in the box on form 7004, line 1. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Now, federal filers have another month to file. Web most major tax software applications allow you to file extensions using form 7004 (for businesses). Web in the wake of last winter's natural disasters, the normal spring due dates had previously been postponed to oct. Free website with formation to get you started. Web form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns” filers who need more time can. Web most major tax software applications allow. There’s less than a week until the oct. As a result, most individuals and businesses in. Submit the form to the. Enter code 25 in the box on form 7004, line 1. You can extend filing form 1120s when you file form 7004. Complete either a form 7004 or 1120. Form 7004 is used to request an automatic. Kickstart your s corporation in minutes. Web if you have requested for an extension for 2021 taxes by timely filing form 7004 with the irs. Web most major tax software applications allow you to file extensions using form 7004 (for businesses) or form 4868 (for. Web in the wake of last winter's natural disasters, the normal spring due dates had previously been postponed to oct. Time’s up for millions of americans: Submit the form to the. Kickstart your s corporation in minutes. Web most major tax software applications allow you to file extensions using form 7004 (for businesses) or form 4868 (for individuals). The original due date for this. Web october 16, 2023 is the irs’s deadline for tax return extensions this year. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. Web most major tax software applications allow you to file extensions using form 7004 (for businesses) or form 4868 (for individuals). Web. Ad we have unmatched experience in forming businesses online. Complete either a form 7004 or 1120. Web form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns” filers who need more time can. Web most business tax returns can be extended by filing form 7004: Web october 16, 2023 is the irs’s. Web most major tax software applications allow you to file extensions using form 7004 (for businesses) or form 4868 (for individuals). • an s corporation that pays wages to employees typically files irs form. Form 7004 (automatic extension of time to. You can extend filing form 1120s when you file form 7004. Form 7004 is used to request an automatic. Web there are three steps to filing an extension for s corporation taxes: Then you will have till september 15th, 2022 to file your form 1120s. Web the april 18 state deadline was originally extended by gov. Web in the wake of last winter's natural disasters, the normal spring due dates had previously been postponed to oct. Income tax return for an s corporation is the tax form s corporations (and llcs filing as s corps) use to file their federal income tax return. Gavin newsom in march to align with the irs’s announcement to push the federal due date to oct. The original due date for this. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Millions of people file every year for an. Time’s up for millions of americans: Web most business tax returns can be extended by filing form 7004: Free website with formation to get you started. Use form 120ext (application for automatic extension of time to file corporation,. Web if you have requested for an extension for 2021 taxes by timely filing form 7004 with the irs. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file.How to File an Extension for Your SubChapter S Corporation

Irs 2553 Form PDF S Corporation Irs Tax Forms

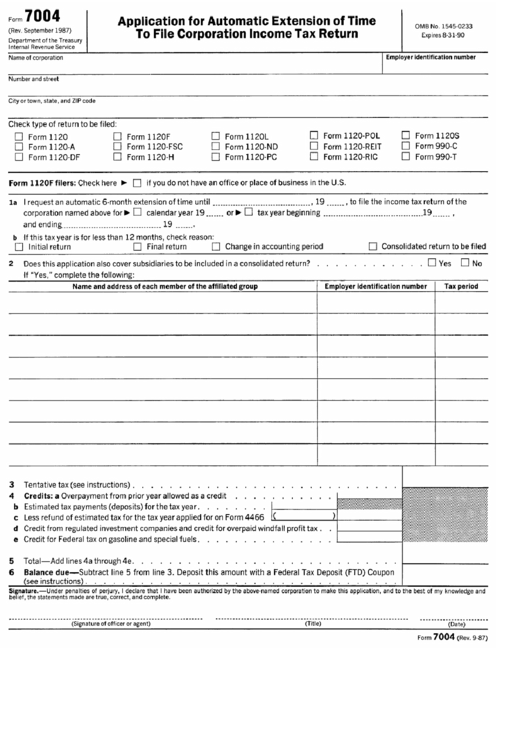

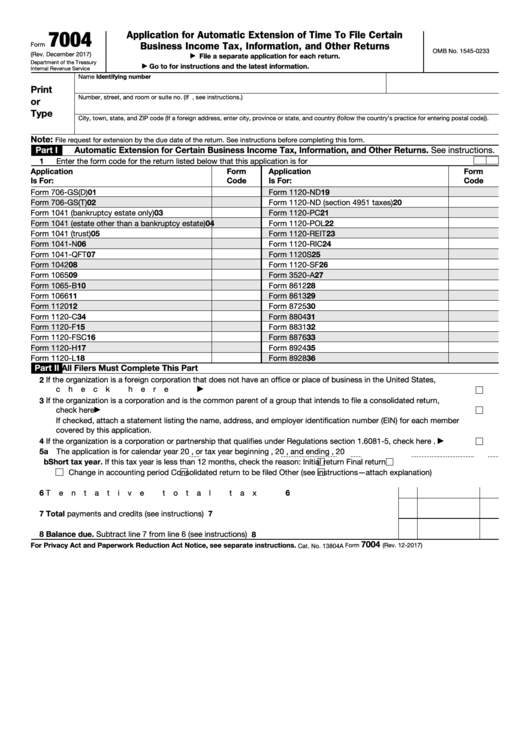

Form 7004 Application For Automatic Extension Of Time To File

s corp tax filing Fill Online, Printable, Fillable Blank

Fillable Form 7004 Application For Automatic Extension Of Time To

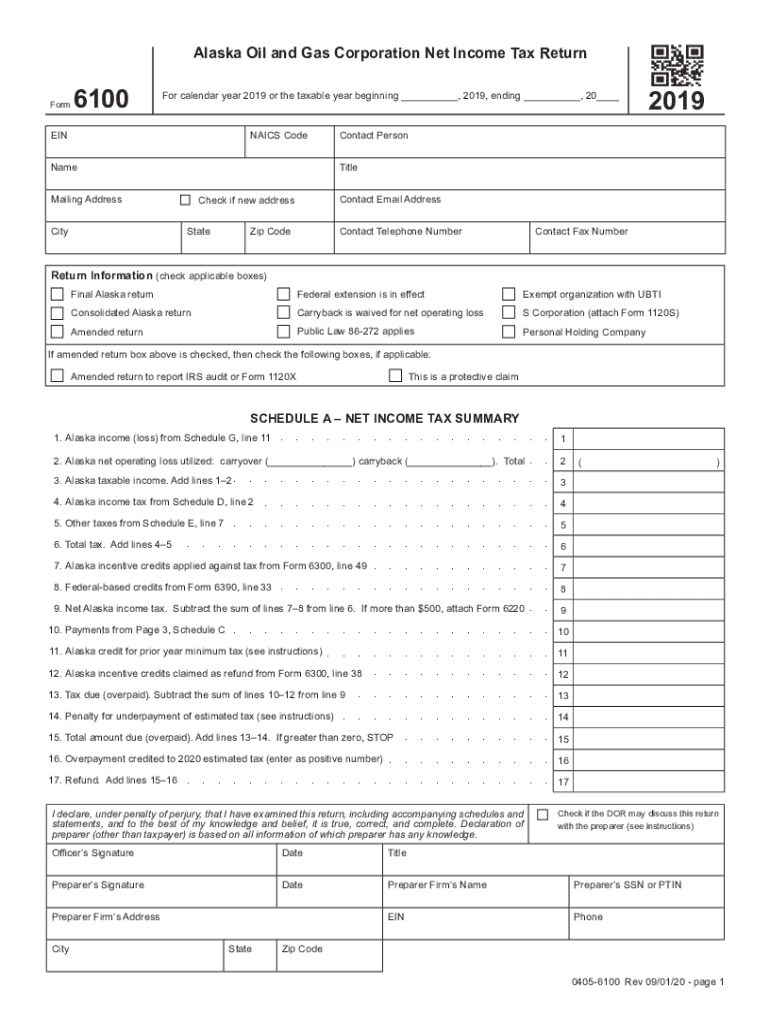

Federal Extension Is In Effect Fill Out and Sign Printable PDF

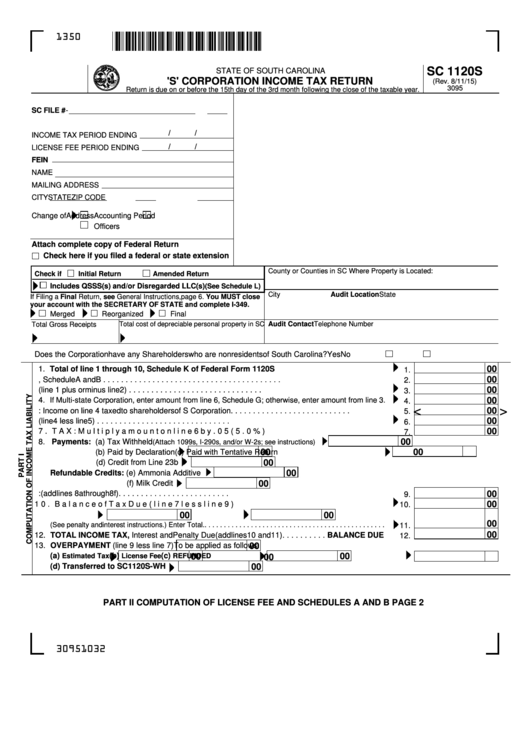

Form Sc 1120s 'S' Corporation Tax Return printable pdf download

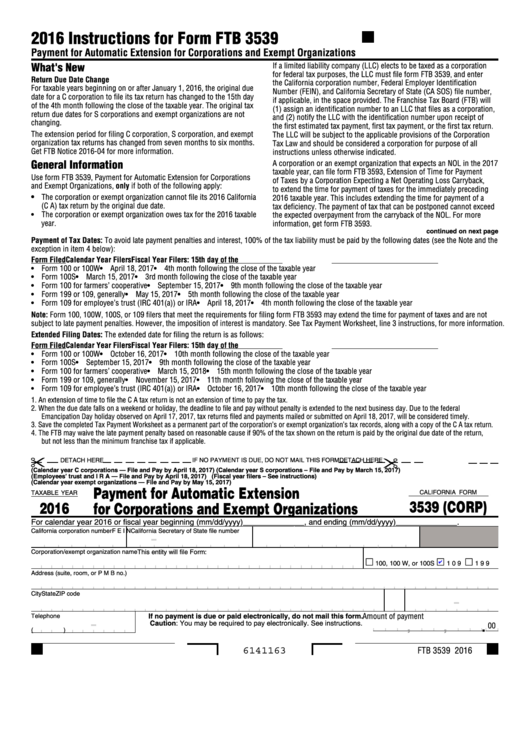

Fillable California Form 3539 (Corp) Payment For Automatic Extension

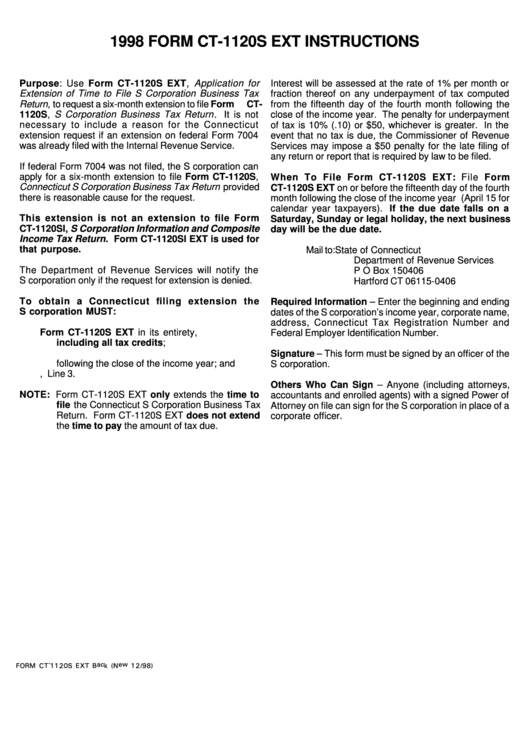

Instructions For Form Ct1120s Ext Application For Extension Of Time

Delaware S Corp Extension Form Best Reviews

Related Post: