Irs Form 6251 Instructions

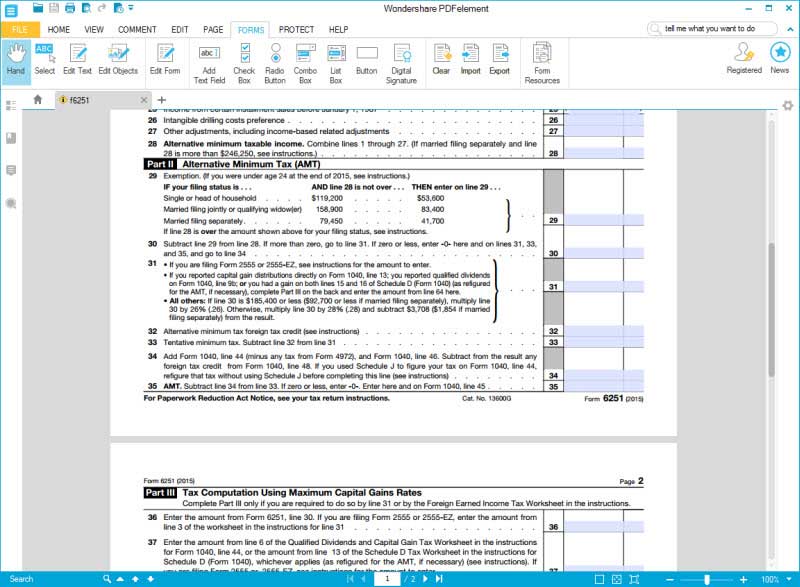

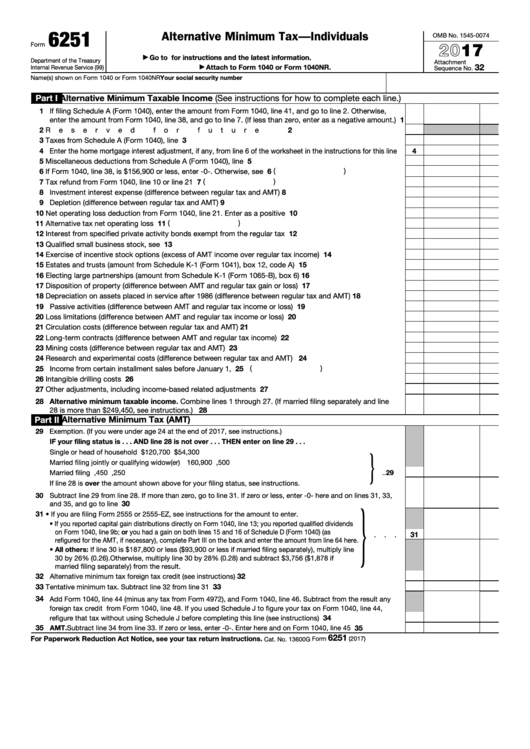

Irs Form 6251 Instructions - Ad we help get taxpayers relief from owed irs back taxes. If you are eligible for this credit in 2019, you can claim it on your 2019 return. Web tax preference items on federal form 6251; But if you bare filling form. Complete, edit or print tax forms instantly. For example, the form 1040 page is at. Web if you need to report any of the following items on your tax return, you must file form 6251, alternative minimum tax, even if you do not owe amt. Web the total of form 6251, lines 2c through 3, is negative and line 7 would be greater than line 10 if you didn’t take into account lines 2c through 3. If you claim this credit, you will need to file form 6251. Tax computation using maximum capital gains rate. Select a category (column heading) in the drop down. Web if you need to report any of the following items on your tax return, you must file form 6251, alternative minimum tax, even if you do not owe amt. You may need to know that amount to figure the tax liability limit on the credits listed. You can download or. Ad access irs tax forms. Web if you need to report any of the following items on your tax return, you must file form 6251, alternative minimum tax, even if you do not owe amt. You may need to know that amount to figure the tax liability limit on the credits listed. Form 6251 is an internal revenue service (irs). Department of the treasury internal revenue service. Select a category (column heading) in the drop down. Department of the treasury internal revenue service (99) go to. But if you bare filling form. On line 36, enter the amount on form 6251, line 30. Also use form 6251 to figure your tentative minimum tax (form 6251, line 9). Save or instantly send your ready documents. But if you bare filling form. If you are eligible to claim this. Web the total of form 6251, lines 2c through 3, is negative and line 7 would be greater than line 10 if you didn’t take into. Tax computation using maximum capital gains rate. Total of lines 1 through 4, equal to alternative minimum taxable income on line 4. If you claim this credit, you will need to file form 6251. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web use screen 40, alternative minimum tax (6251), to make adjustments and. Total of lines 1 through 4, equal to alternative minimum taxable income on line 4. On line 36, enter the amount on form 6251, line 30. Ad we help get taxpayers relief from owed irs back taxes. You may need to know that amount to figure the tax liability limit on the credits listed. Web irs form 6251 instructions. Form 6251 is an internal revenue service (irs) tax form that helps determine the alternative minimum tax (amt) amount that a taxpayer owes. Web if you need to report any of the following items on your tax return, you must file form 6251, alternative minimum tax, even if you do not owe amt. Web the total of form 6251, lines. If you are eligible to claim this. Ad we help get taxpayers relief from owed irs back taxes. Department of the treasury internal revenue service (99) go to. Also use form 6251 to figure your tentative minimum tax (form 6251, line 9). Web use screen 40, alternative minimum tax (6251), to make adjustments and overrides to the various adjustments and. Instructions for form 6251, alternative minimum. Department of the treasury internal revenue service (99) go to. Web tax preference items on federal form 6251; Also use form 6251 to figure your tentative minimum tax (form 6251, line 9). Form 6251 is an internal revenue service (irs) tax form that helps determine the alternative minimum tax (amt) amount that a taxpayer. Complete, edit or print tax forms instantly. Tax computation using maximum capital gains rate. Easily fill out pdf blank, edit, and sign them. On line 36, enter the amount on form 6251, line 30. If you are eligible to claim this. Tax computation using maximum capital gains rate. Web use screen 40, alternative minimum tax (6251), to make adjustments and overrides to the various adjustments and preferences. If you are eligible for this credit in 2019, you can claim it on your 2019 return. Form 6251 is an internal revenue service (irs) tax form that helps determine the alternative minimum tax (amt) amount that a taxpayer owes. If you are eligible to claim this. Ad we help get taxpayers relief from owed irs back taxes. Ad access irs tax forms. Estimate how much you could potentially save in just a matter of minutes. Department of the treasury internal revenue service (99) go to. Web instructions, and pubs is at irs.gov/forms. On line 36, enter the amount on form 6251, line 30. Web the total of form 6251, lines 2c through 3, is negative and line 7 would be greater than line 10 if you didn’t take into account lines 2c through 3. For example, the form 1040 page is at. Web irs form 6251 instructions. Select a category (column heading) in the drop down. Get ready for tax season deadlines by completing any required tax forms today. Also use form 6251 to figure your tentative minimum tax (form 6251, line 9). Instructions for form 6251, alternative minimum. Almost every form and publication has a page on irs.gov with a friendly shortcut. But if you bare filling form.for How to Fill in IRS Form 6251

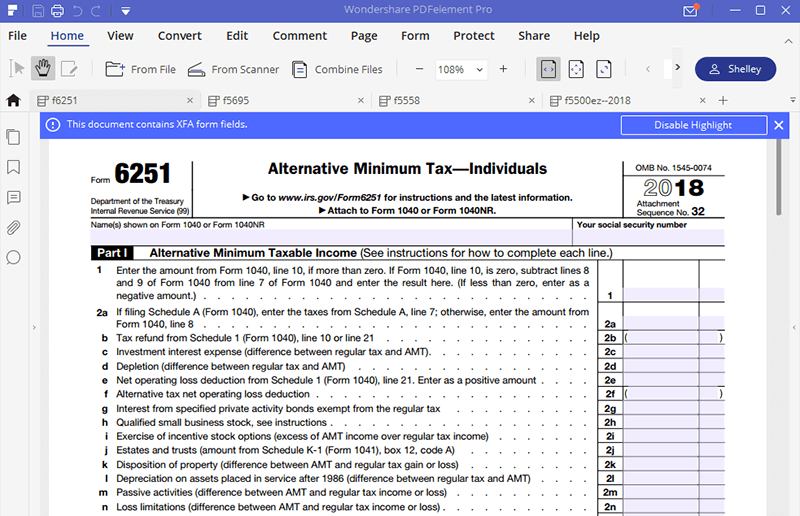

Download Instructions for IRS Form 6251 Alternative Minimum Tax

Editable IRS Form Instruction 6251 2019 2020 Create A Digital

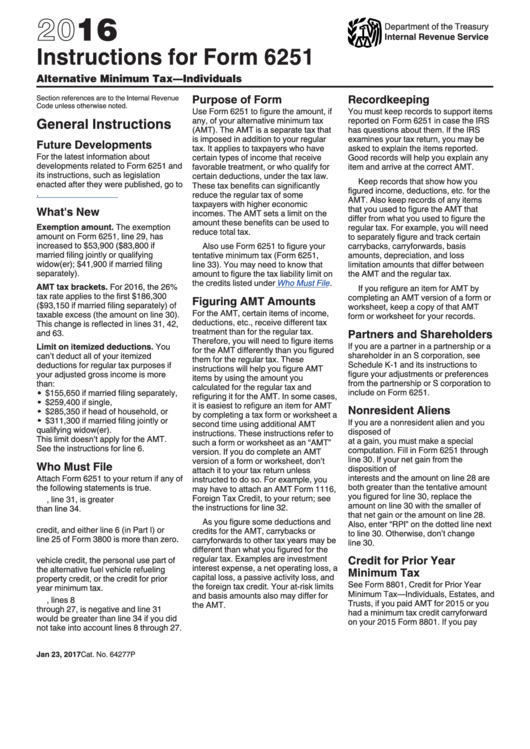

Instructions For Form 6251 2016 printable pdf download

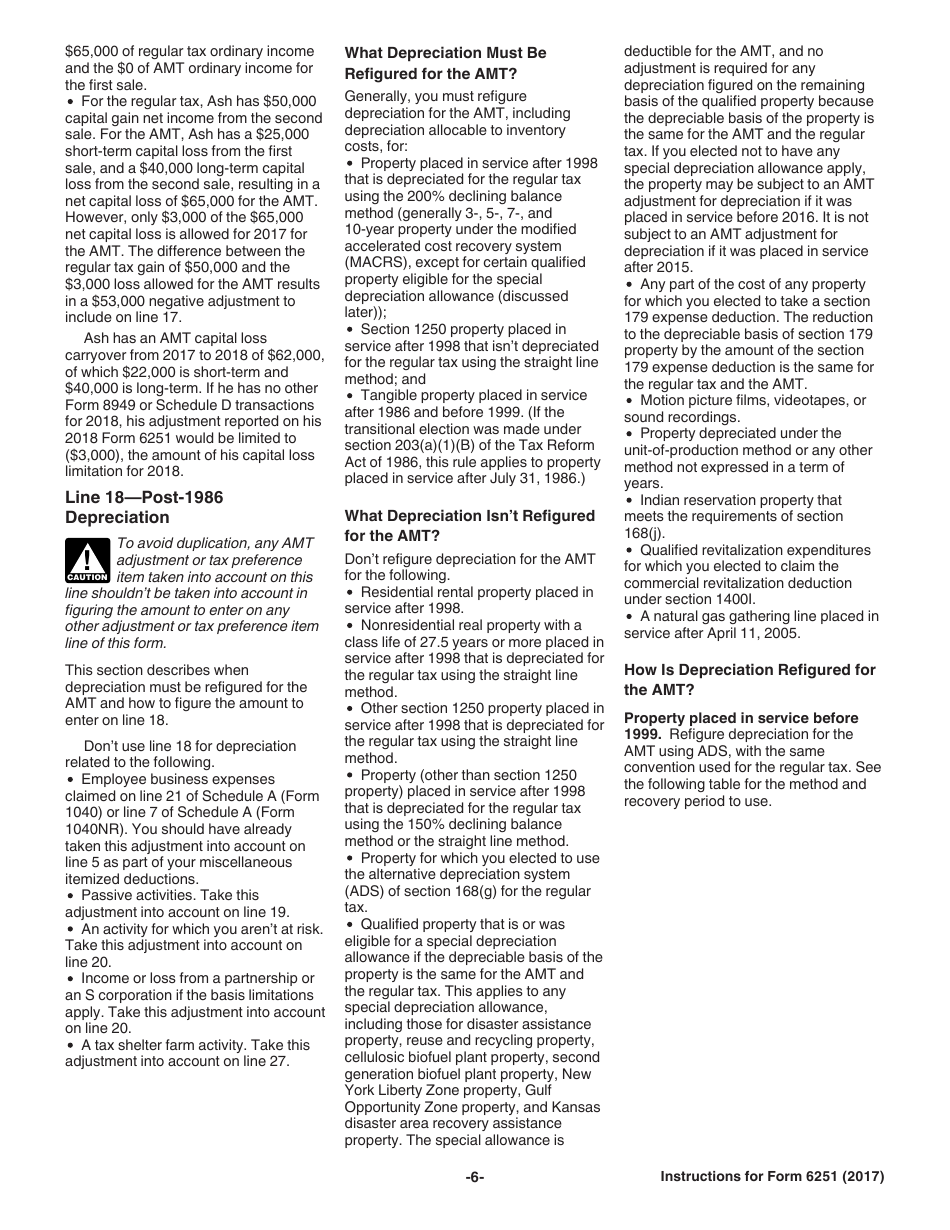

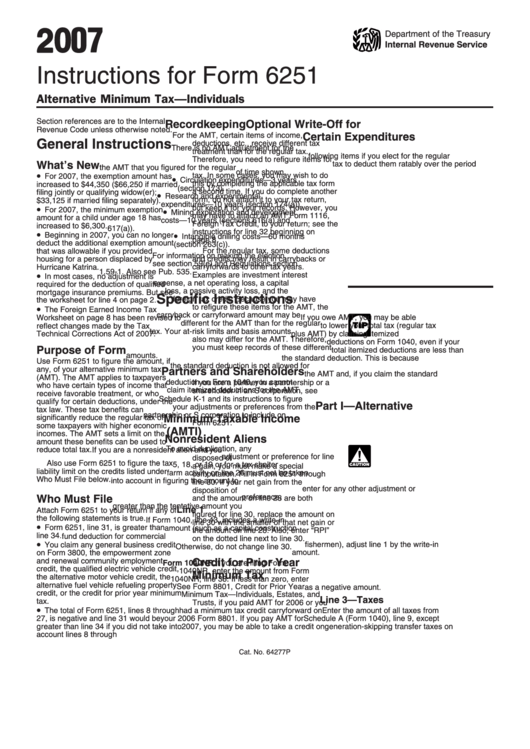

Instructions For Form 6251 Alternative Minimum Tax Individuals

Instructions for How to Fill in IRS Form 6251

irs 2020 tax form 6251 Fill Online, Printable, Fillable Blank form

2018 2019 IRS Form 6251 Editable Online Blank in PDF

Irs Form 6251 Fillable Printable Forms Free Online

for How to Fill in IRS Form 6251

Related Post: