Nc Military Spouse Tax Exemption Form

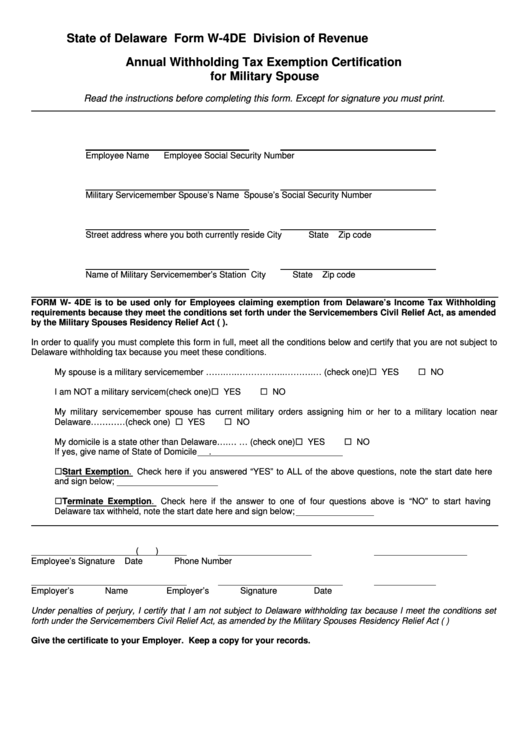

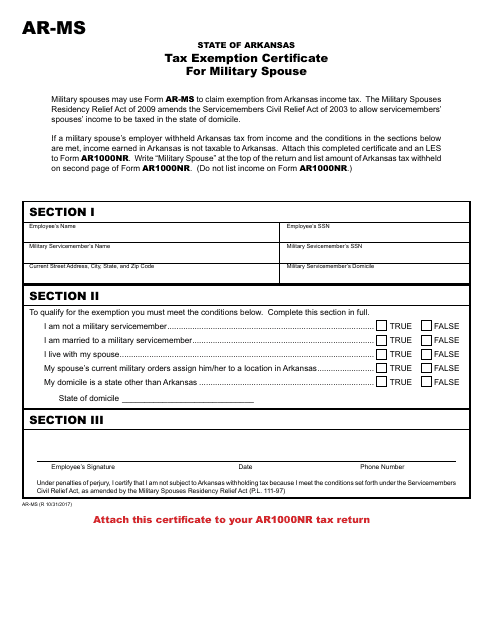

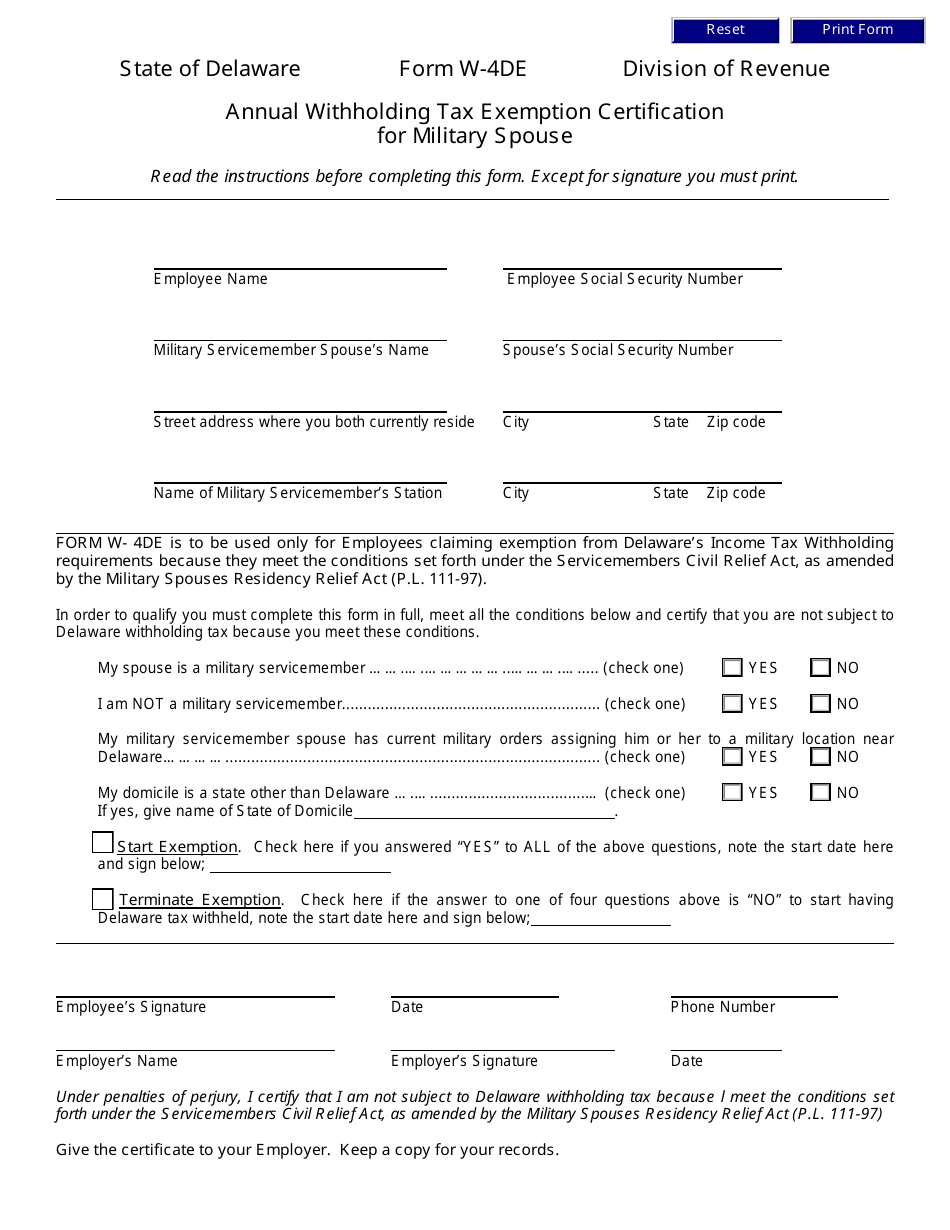

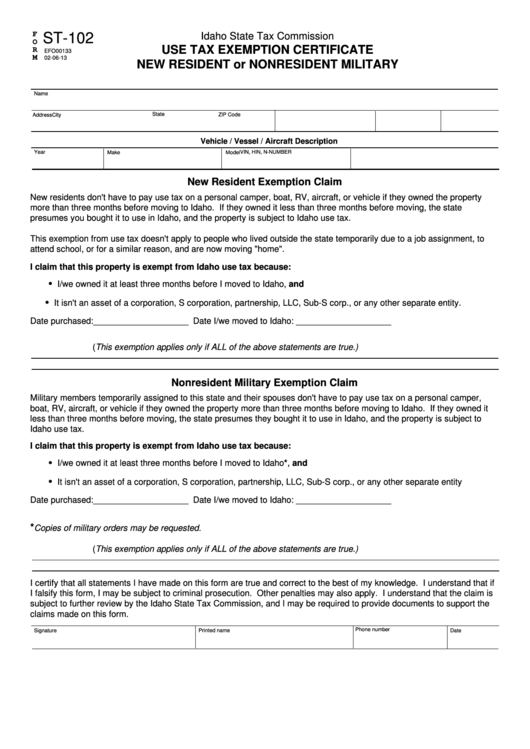

Nc Military Spouse Tax Exemption Form - Frequently asked questions regarding the military spouses. Get deals and low prices on 1096 tax forms at amazon Web what is my state of residence as a military spouse? Medically retired under 10 u.s.c. Armed forces convenient options for renewing. Ad finding it harder than ever to file efficiently without risking costly errors? What information must a servicemember's spouse provide to the employer to qualify for exemption from north carolina withholding tax? Web to apply for tax relief under themilitary spouses residency relief act please, complete the following andit subm the required documentation outlined below. Web important tax information regarding spouses of united states military servicemembers; Streamline the entire lifecycle of exemption certificate management. Web the spouse is domiciled in the same state as the servicemember. Our tax preparers will ensure that your tax returns are complete, accurate and on time. A nonresident military spouse’s income earned in north carolina is exempt from north carolina. Streamline the entire lifecycle of exemption certificate management. Standard deduction plan to claim the n.c. In order to qualify, the military spouse must provide proof of having. Web services for military personnel. Deductions) do not plan to. Web if you’re a military spouse covered by the military spouse residency relief act, you’ll file your state return in your state of legal residence. Ad collect and report on exemption certificates quickly to save your company time. Streamline the entire lifecycle of exemption certificate management. Armed forces convenient options for renewing. Ad finding it harder than ever to file efficiently without risking costly errors? Web important tax information regarding spouses of united states military servicemembers; Web what is my state of residence as a military spouse? Medically retired under 10 u.s.c. Streamline the entire lifecycle of exemption certificate management. Division of motor vehicles offers current and retired personnel of the u.s. Frequently asked questions regarding the military spouses. Streamline the entire lifecycle of exemption certificate management. Take the form to your local veteran’s service office for certification. To find the forms you will need to file your. Armed forces convenient options for renewing. Web services for military personnel. Streamline the entire lifecycle of exemption certificate management. Standard deduction plan to claim the n.c. Deductions) do not plan to. Web important tax information regarding spouses of united states military servicemembers; Ad collect and report on exemption certificates quickly to save your company time and money. Get deals and low prices on 1096 tax forms at amazon Armed forces convenient options for renewing. Web north carolina income tax exemption for nonresident military spouses: Ad finding it harder than ever to file efficiently without risking costly errors? Active duty service members have always been able to keep one state as their state of legal residency. Web served at least 20 years. A nonresident military spouse’s income earned in north carolina is exempt from north carolina. Web services for military personnel. How do i claim a. Streamline the entire lifecycle of exemption certificate management. All three of the conditions must be met to qualify for the exemption. Web if you’re a military spouse covered by the military spouse residency relief act, you’ll file your state return in your state of legal residence. Web what is my state of residence as a military spouse? Web to apply for tax relief under themilitary spouses residency relief act please, complete the following andit subm the required documentation outlined below. Deductions). Plan to claim the n.c. Get deals and low prices on 1096 tax forms at amazon Web if you’re a military spouse covered by the military spouse residency relief act, you’ll file your state return in your state of legal residence. To find the forms you will need to file your. Armed forces convenient options for renewing. Ad declutter your workspace and protect important documents with our office supplies. Medically retired under 10 u.s.c. How do i claim a. All three of the conditions must be met to qualify for the exemption. Web what is my state of residence as a military spouse? Get deals and low prices on 1096 tax forms at amazon Web north carolina income tax exemption for nonresident military spouses: This deduction does not apply to severance pay received by a member due to separation from the member's. Take the form to your local veteran’s service office for certification. To find the forms you will need to file your. What information must a servicemember's spouse provide to the employer to qualify for exemption from north carolina withholding tax? Ad finding it harder than ever to file efficiently without risking costly errors? A nonresident military spouse’s income earned in north carolina is exempt from north carolina. Division of motor vehicles offers current and retired personnel of the u.s. For tax years beginning january 1, 2018, the. Our tax preparers will ensure that your tax returns are complete, accurate and on time. Web the spouse of a servicemember is exempt from income taxation by a state when she: Standard deduction plan to claim the n.c. Plan to claim the n.c. Web the military spouses relief act does exempt qualifying military spouses from nc ad valorem taxes.Fillable Form W4de Annual Withholding Tax Exemption Certification

√ Military Spouse Residency Relief Act Tax Form Navy Docs

Form W4DE Download Fillable PDF or Fill Online Annual Withholding Tax

Fillable Form St102 Use Tax Exemption Certificate New Resident Or

√ Military Spouse Residency Relief Act Tax Form Navy Docs

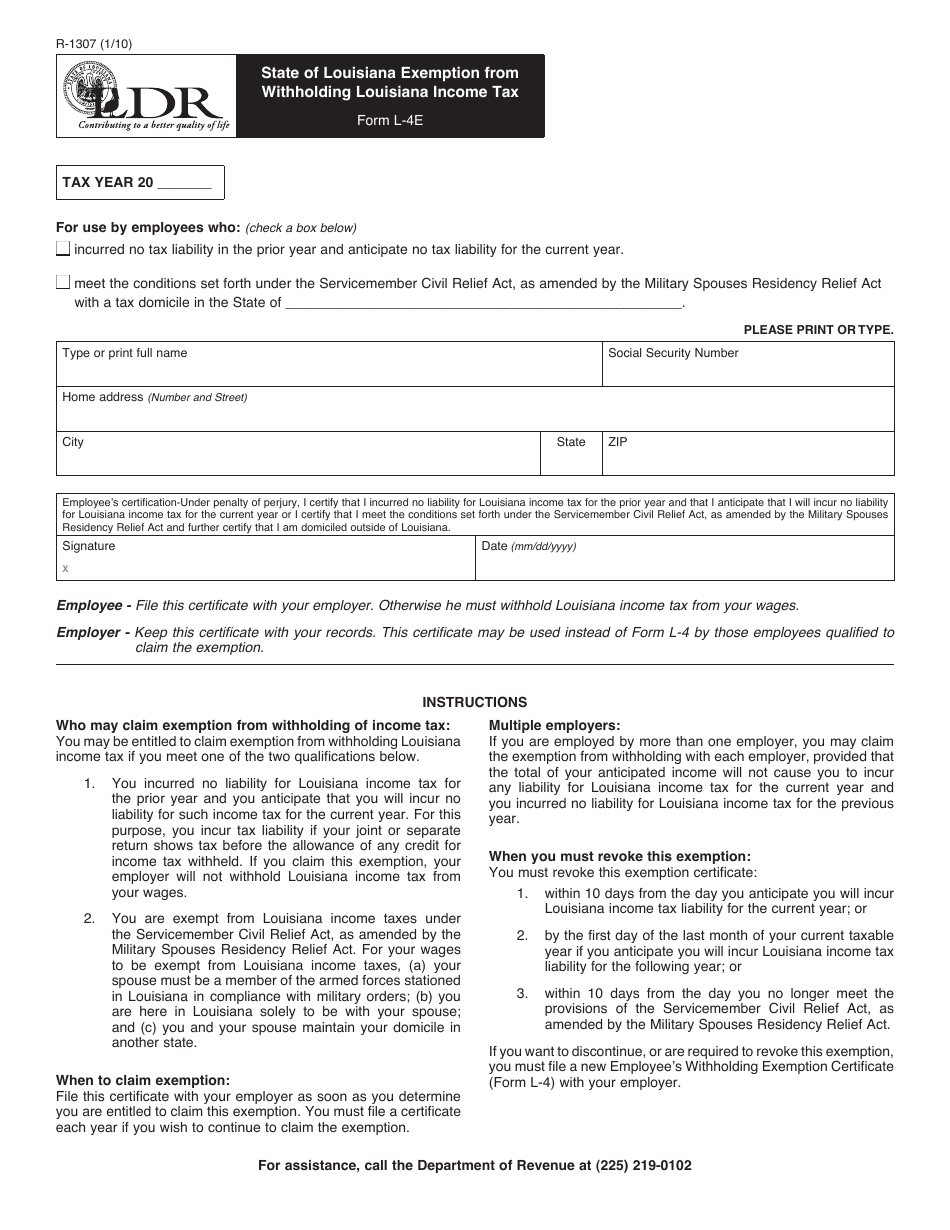

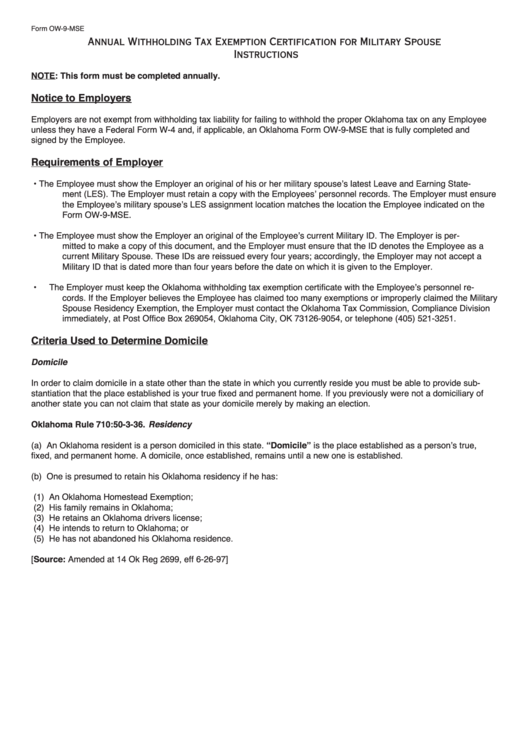

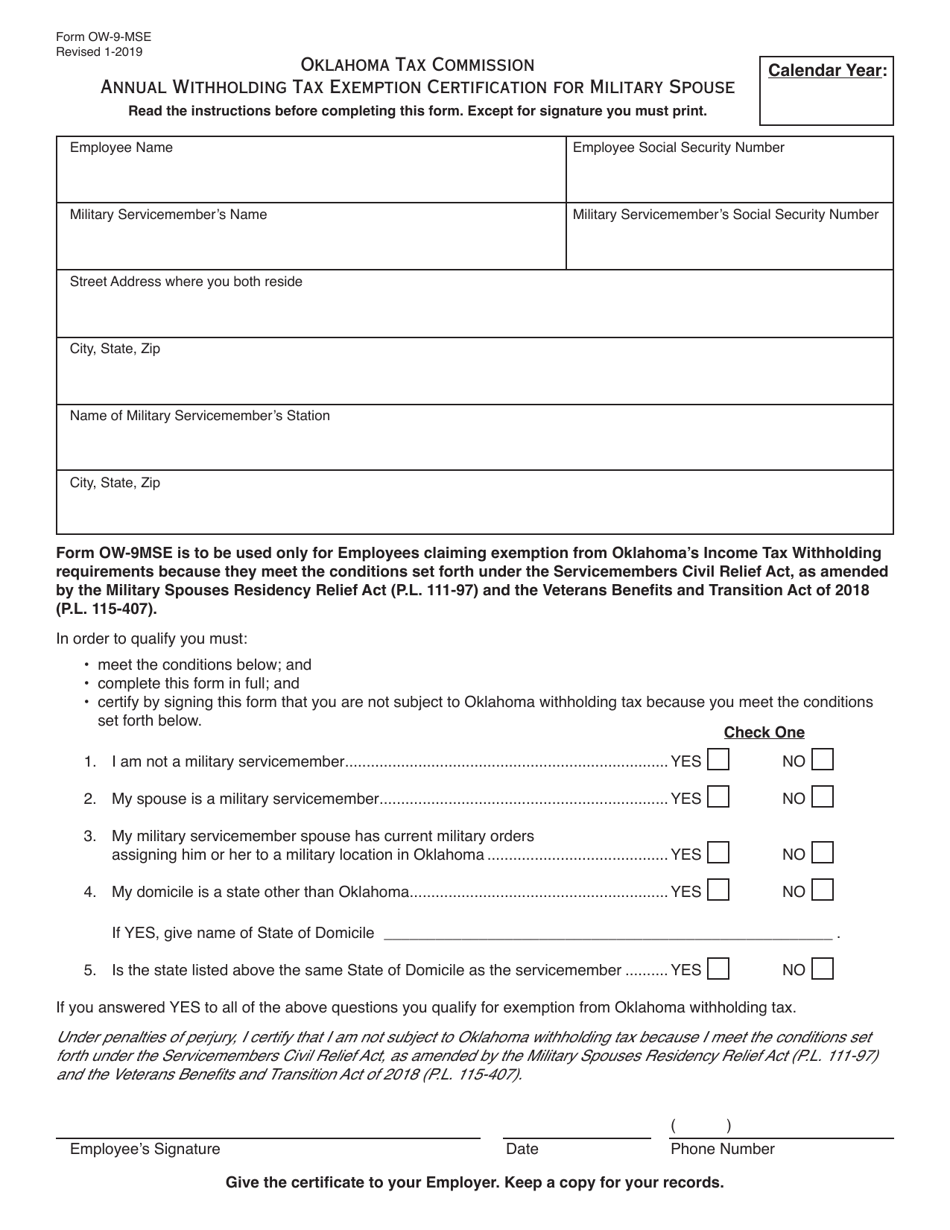

Instructions For Form Ow9Mse Annual Withholding Tax Exemption

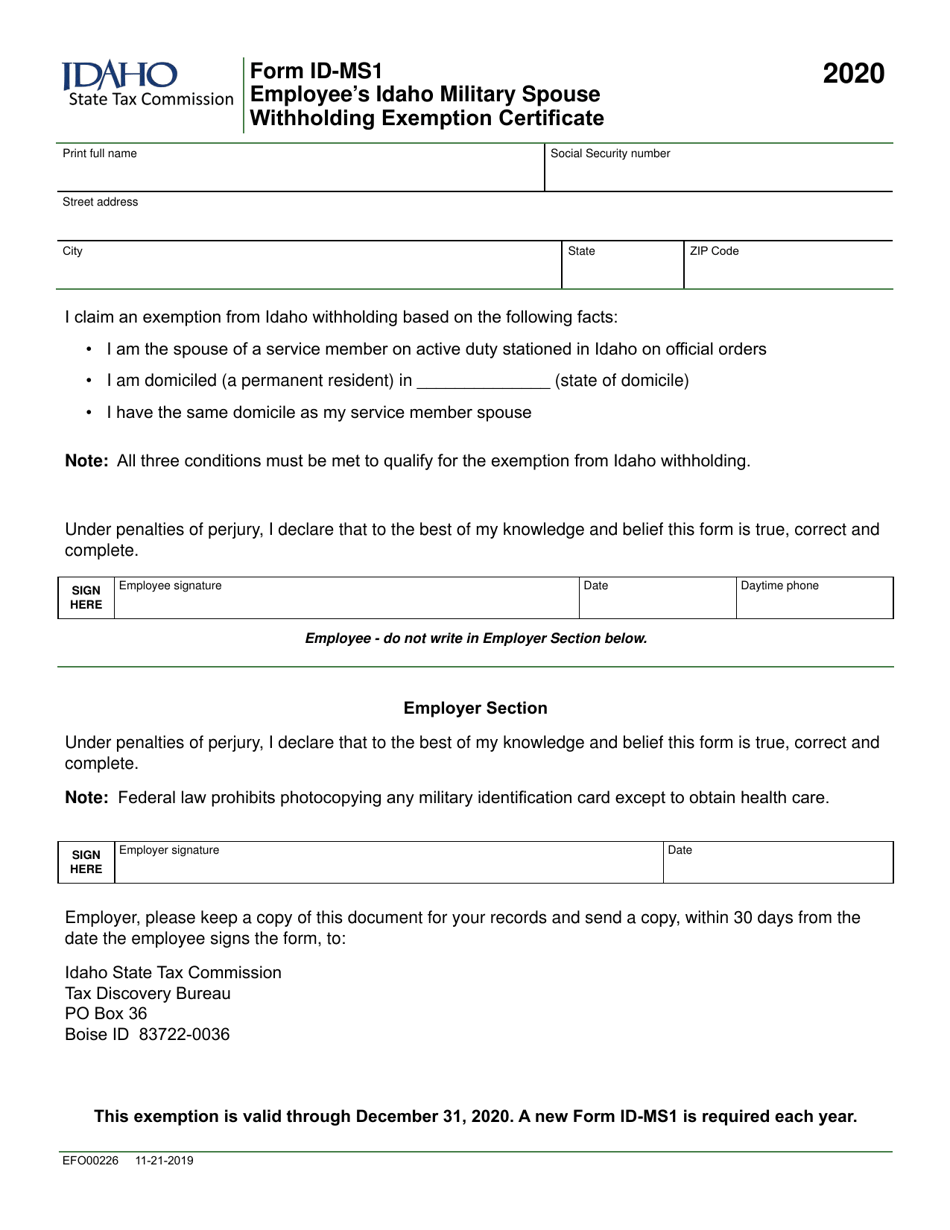

Form IDMS1 (EFO00226) Download Fillable PDF or Fill Online Employee's

√ Military Spouse Residency Relief Act Tax Form Navy Docs

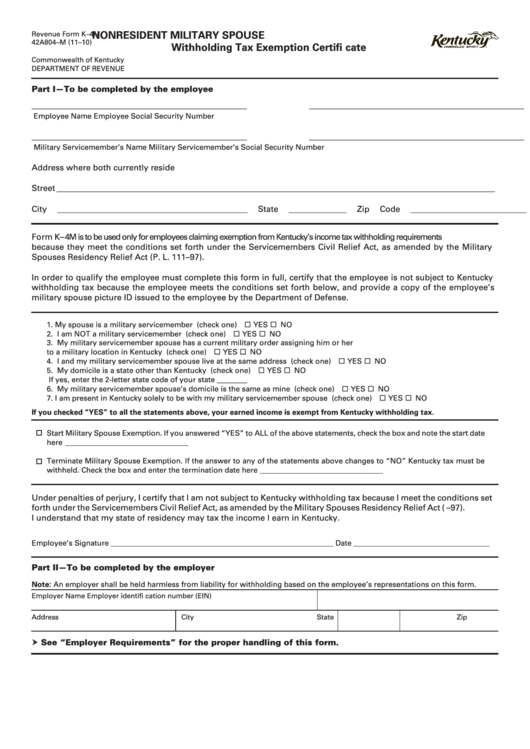

Form K4m 42a804M (1110) Nonresident Military Spouse Withholding

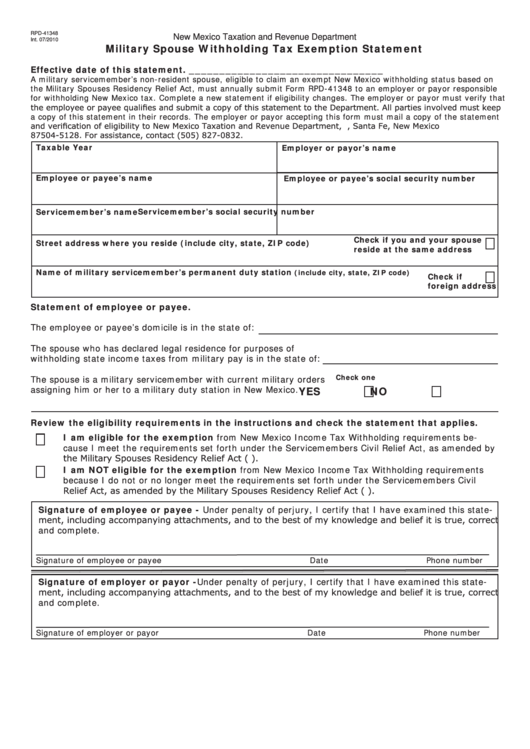

Fillable Form Rpd41348 Military Spouse Withholding Tax Exemption

Related Post: