How To Get Form 941 In Quickbooks Desktop

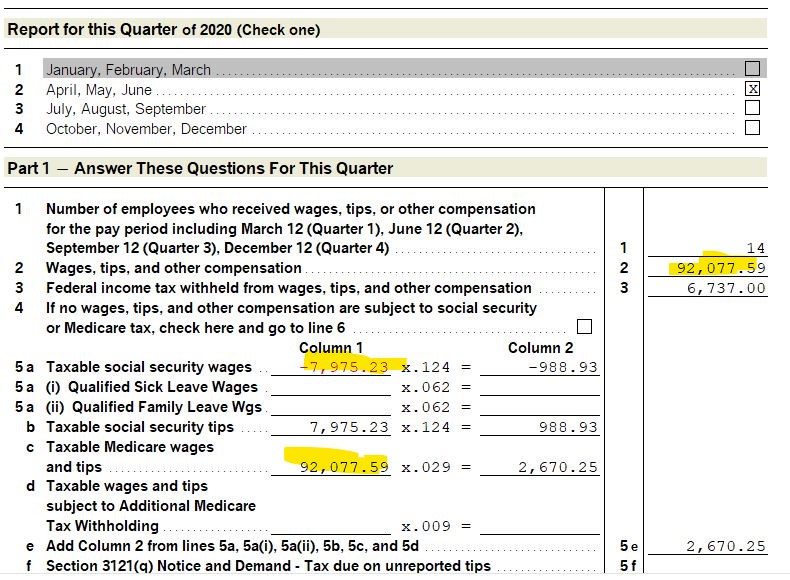

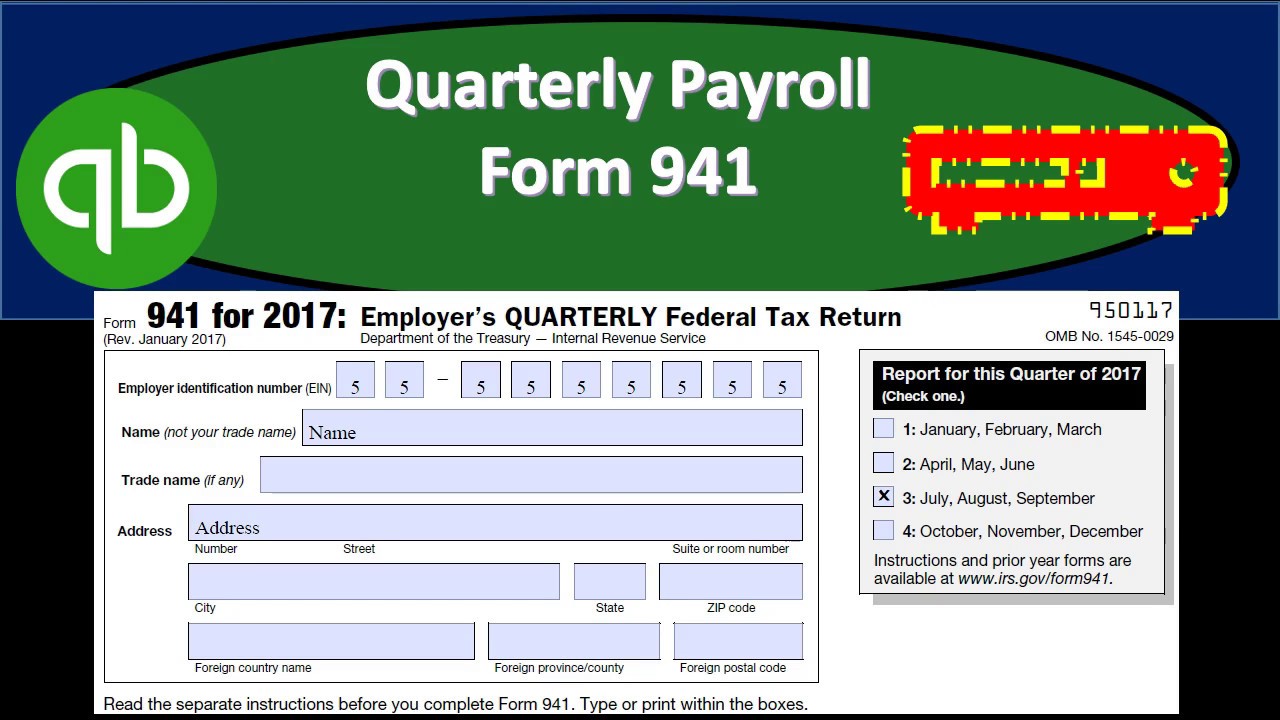

How To Get Form 941 In Quickbooks Desktop - Web in the select form window, choose form 941 from the list of available forms. Click on reports at the top menu bar. Track everything in one place. Track everything in one place. For this example, we’re going to. Web when you create your 941 form in quickbooks desktop payroll standard or enhanced, you may encounter an error, wonder why it didn’t generate a schedule b. Ad guaranteed to reduce errors, increase efficiency and handle large volumes of data. Ad manage all your business expenses in one place with quickbooks®. Explore the #1 accounting software for small businesses. Web when you're ready to pay taxes, navigate to the pay taxes & other liabilities screen and choose the tax or other liability from the list. Web you can do this through quickbooks desktop payroll enhanced. Track everything in one place. From the quickbooks desktop reports menu, choose employees & payroll, and then payroll summary. Web when you're ready to pay taxes, navigate to the pay taxes & other liabilities screen and choose the tax or other liability from the list. Solved • by quickbooks •. Web to access your archived form 941, you can go to the archived forms and filings from the payroll tax page to view and then download in pdf form. Web in the select form window, choose form 941 from the list of available forms. Go to the pay your scheduled. Solved • by quickbooks • duration 4:08 • updated 3. Web to access your archived form 941, you can go to the archived forms and filings from the payroll tax page to view and then download in pdf form. Go to the pay your scheduled. Employers must file a quarterly form 941 to report wages paid, tips your employees. Solved • by quickbooks • duration 4:08 • updated 3 hours. Explore the #1 accounting software for small businesses. From the quickbooks desktop reports menu, choose employees & payroll, and then payroll summary. Web when you create your 941 form in quickbooks desktop payroll standard or enhanced, you may encounter an error, wonder why it didn’t generate a schedule b. Go to the pay your scheduled. Web from the quickbooks tax. Switch to freshbooks and save 90% plus additional 10% off for annual subscription. Select the select filing period option and specify the desired quarter and year for. Go to the pay your scheduled. Web provide the following details: Ad manage all your business expenses in one place with quickbooks®. Click the customize report button. Explore the #1 accounting software for small businesses. For this example, we’re going to. Web select taxes from the left menu and then choose payroll tax. Web to find your form 941: Go to the pay your scheduled. The easy to use software your business needs to invoice + get paid faster. Web learn how quickbooks online and desktop populates the lines on the form 941. Ad guaranteed to reduce errors, increase efficiency and handle large volumes of data. Web to access your archived form 941, you can go to the archived. Employers must file a quarterly form 941 to report wages paid, tips your employees. Web when you create your 941 form in quickbooks desktop payroll standard or enhanced, you may encounter an error, wonder why it didn’t generate a schedule b. Web you can do this through quickbooks desktop payroll enhanced. Web provide the following details: Hit on more payroll. Track everything in one place. Ad manage all your business expenses in one place with quickbooks®. Web how to file federal forms (941) in quickbooks desktop payroll enhanced. Solved • by quickbooks • duration 4:08 • updated 3 hours ago. Web when you're ready to pay taxes, navigate to the pay taxes & other liabilities screen and choose the tax. Web how to file federal forms (941) in quickbooks desktop payroll enhanced. Select the select filing period option and specify the desired quarter and year for. Solved • by quickbooks • duration 4:08 • updated 3 hours ago. Go to the pay your scheduled. From the quickbooks desktop reports menu, choose employees & payroll, and then payroll summary. Web you can do this through quickbooks desktop payroll enhanced. From the quickbooks desktop reports menu, choose employees & payroll, and then payroll summary. Go to the pay your scheduled. For this example, we’re going to. Web to access your archived form 941, you can go to the archived forms and filings from the payroll tax page to view and then download in pdf form. Switch to freshbooks and save 90% plus additional 10% off for annual subscription. Web provide the following details: Click on reports at the top menu bar. Web how to file federal forms (941) in quickbooks desktop. Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Employers must file a quarterly form 941 to report wages paid, tips your employees. Tap on download under forms and then select each form 941 for the respective year. Web select taxes from the left menu and then choose payroll tax. Web we will discuss form 941 and how quickbooks can help up generate quarterly payroll tax forms. Web to find your form 941: Track everything in one place. Hit on more payroll reports in excel. Web select a federal form (federal 941/944/943 or federal form 940), then select edit. Ad guaranteed to reduce errors, increase efficiency and handle large volumes of data. Solved • by quickbooks • duration 4:08 • updated 3 weeks ago.2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

PPT A StepbyStep Guide to Efiling Form 941 in QuickBooks Desktop

PPT How can you Fix 941 forms in Quickbooks desktop? PowerPoint

Create IRS Tax Form 941 in QuickBooks YouTube

print 0 wages 941

How to File Your Form 8974 and Form 941 QuickBooks

How to file your federal payroll forms (941) with QuickBooks Desktop

How Do I Efile 941 Tax Forms in QuickBooks Desktop?

Quarterly Payroll Form 941 & Payroll Report Forms From QuickBooks YouTube

PPT A StepbyStep Guide to Efiling Form 941 in QuickBooks Desktop

Related Post: