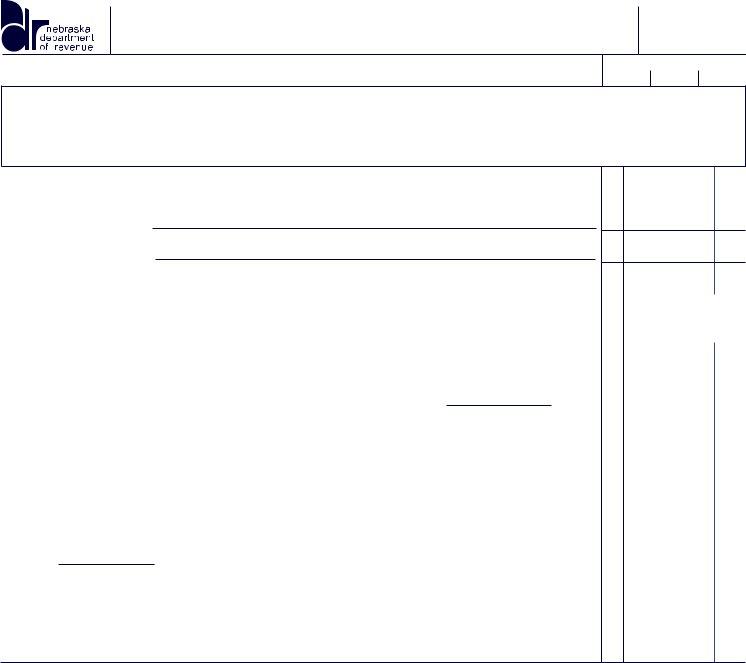

Nebraska Form 1040N

Nebraska Form 1040N - 2022 form 1040n, schedules i, ii, and iii. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available. Get ready for tax season deadlines by completing any required tax forms today. Download or email form 1040n & more fillable forms, try for free now! Easily sign the form with your finger. For the taxable year january 1, 2023 through december 31, 2023 or other taxable year:, 2023 through, form 1040n. 2019 please do not write in this. Web 2021 form 1040n, nebraska individual income tax return. Open form follow the instructions. Otherwise, enter $7,000 if single; Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. Web form 1040n is the general income tax return for nebraska residents. Copy of your federal return 1040. Click here to verify your eligibility. If you file your 2019 nebraska individual income tax return, form 1040n, on or before march 1, 2020, and pay the total income. Copy of your federal return 1040. Web 20 rows 2022 nebraska individual income tax return (12/2022) 1040n. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the nebraska individual. 2021 form 1040n, schedules i, ii, and iii. 2022 form 1040n, schedules i, ii, and iii. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. Click here to verify your eligibility. Adjusted gross income derived from another state (do not enter amount of taxable income from. 2021 form 1040n, conversion chart for schedule ii. Total nebraska tax (line 17, form 1040n). You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. If you file your 2019 nebraska individual income tax return,. We will update this page with a new version of the form for 2024 as soon as it is made available. Complete, edit or print tax forms instantly. Download or email form 1040n & more fillable forms, try for free now! Otherwise, enter $7,000 if single; For the taxable year january 1, 2022 through december 31, 2022 or other taxable. Click here to verify your eligibility. Web penalty for underpayment of estimated income tax. 2019 please do not write in this. Nebraska itemized deductions (line 7 minus line 8) 10. Web 2022 form 1040n, nebraska individual income tax return. Complete, edit or print tax forms instantly. Total nebraska tax (line 17, form 1040n). Web nebraska individual income tax return. Web 2022 form 1040n, nebraska individual income tax return. Get ready for tax season deadlines by completing any required tax forms today. Last name please do not. Total nebraska tax (line 17, form 1040n). Web penalty for underpayment of estimated income tax. Web 2022 form 1040n, nebraska individual income tax return. For the taxable year january 1, 2022 through december 31, 2022 or other taxable year: Web nebraska individual income tax return form 1040n for the taxable year january 1, 2019 through december 31, 2019 or other taxable year: Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. $14,000 if married, filing jointly or qualified. Open form. Easily sign the form with your finger. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web a farmer or rancher who files the 2021 form 1040n and pays the nebraska income tax due on or before march 1, 2022, is not required to make estimated income tax payments. Nebraska individual. Web 2022 form 1040n, nebraska individual income tax return. Nebraska itemized deductions (line 7 minus line 8) 10. Web nebraska individual income tax return. Web 20 rows 2022 nebraska individual income tax return (12/2022) 1040n. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2019 through december 31, 2019 or other taxable year: $14,000 if married, filing jointly or qualified. Web 2021 form 1040n, nebraska individual income tax return. Get ready for tax season deadlines by completing any required tax forms today. Web the form 1040n: Last name please do not. Complete, edit or print tax forms instantly. Click here to verify your eligibility. 2022 form 1040n, schedules i, ii, and iii. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. 2021 form 1040n, conversion chart for schedule ii. You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. Web penalty for underpayment of estimated income tax. Complete, edit or print tax forms instantly. Web nebraska standard deduction (if you checked any boxes on line 2a or 2b above, see instructions; Send filled & signed form or save.Nebraska Form 1040N ≡ Fill Out Printable PDF Forms Online

Printable state nebraska 1040n form Fill out & sign online DocHub

Fill FORM 1040N Nebraska Schedule I Nebraska Adjustments to (Nebraska)

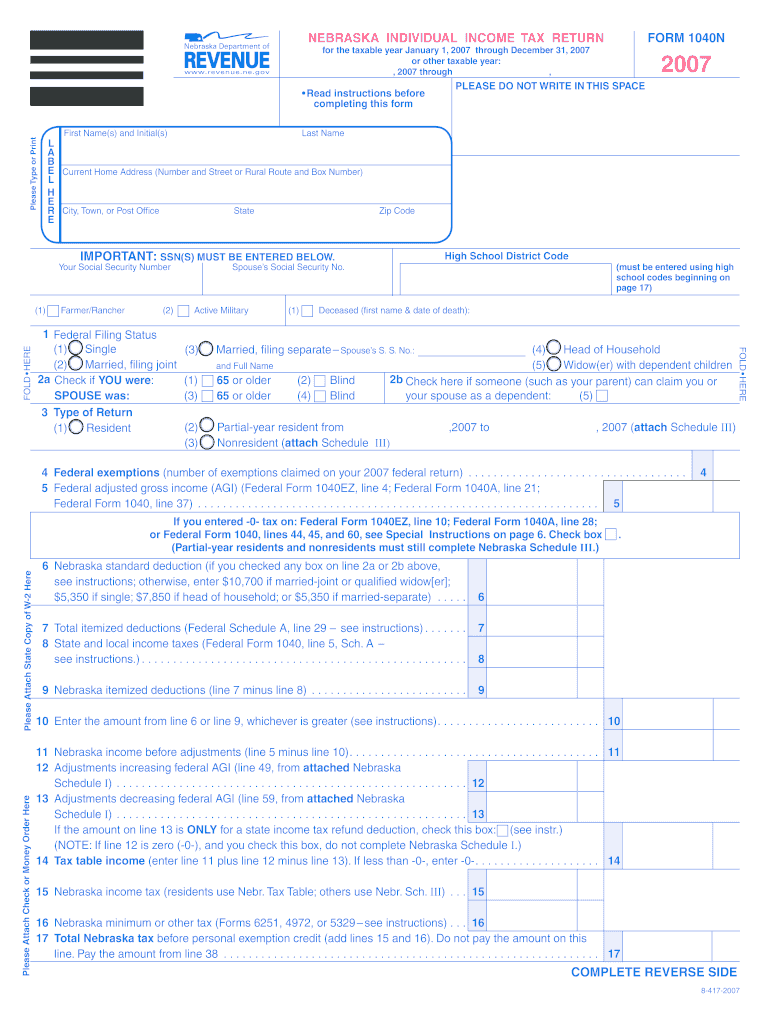

Fillable Form 1120xn Amended Nebraska Corporation Tax Return

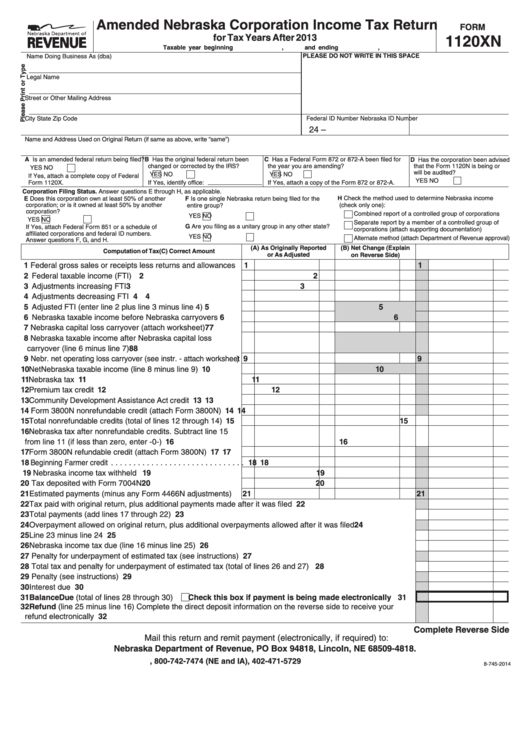

Form 1040nV Nebraska Individual Tax Payment Voucher 2000

Nebraska Form 1040NV (Nebraska Individual Tax Payment Voucher

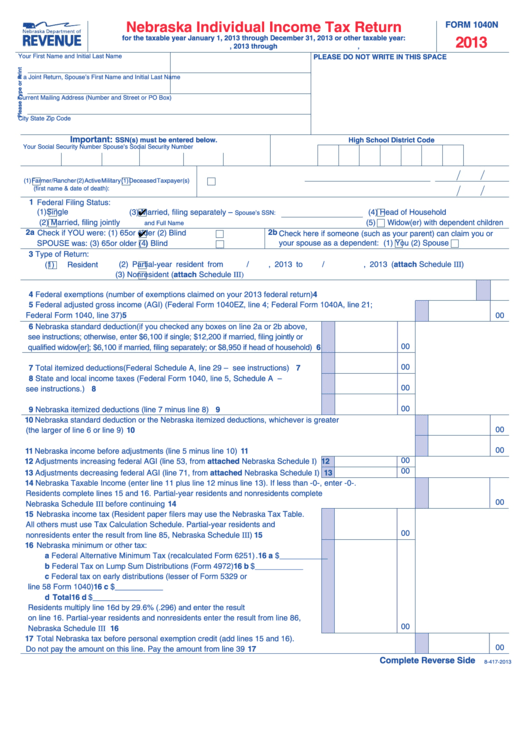

Fillable Form 1040n Nebraska Individual Tax Return 2013

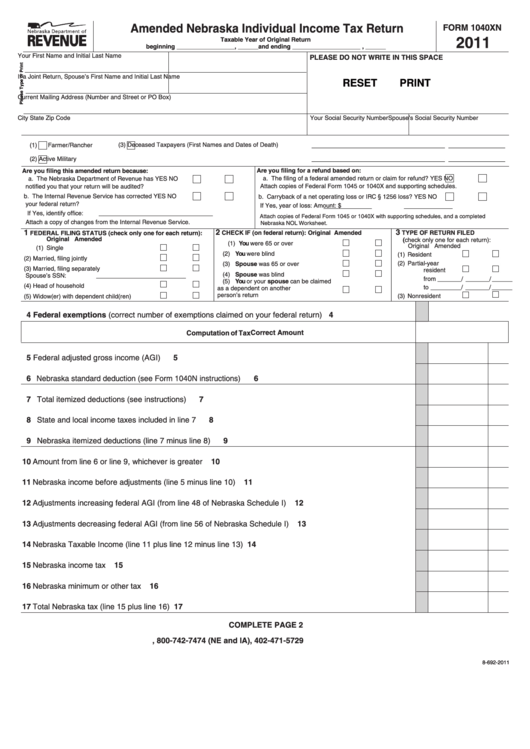

Fillable Form 1040xn Amended Nebraska Individual Tax Return

2020 NE Form 10 Fill Online, Printable, Fillable, Blank pdfFiller

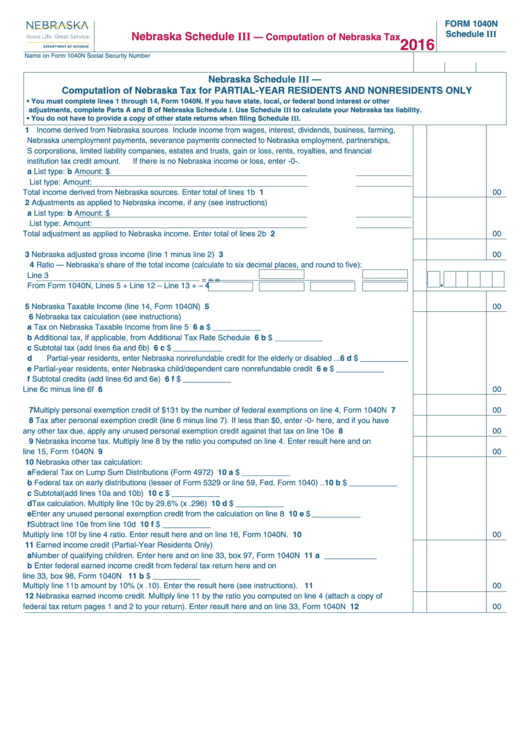

Form 1040n Nebraska Schedule Iii Computation Of Nebraska Tax 2016

Related Post: