Form 8886 Instructions

Form 8886 Instructions - Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web most of the forms are available in both english and spanish. Web every year, for each reportable transaction you participated in, attach reportable transaction disclosure statement (irs form 8886) with your tax return. Web when and how to file. The form must be attached to the appropriate tax return(s) as provided in. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. If this is the first time. Questions answered every 9 seconds. December 2019) department of the treasury internal revenue service. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Ask a tax professional anything right now. See participation in a reportable transaction, below, to. Purpose of form use form 8886 to disclose information for each reportable. Web 16 rows the taxpayer must attach a form 8886 disclosure statement to each tax. Generally, form 8886 must be attached to the tax return. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Use form 8886 to disclose information for each reportable transaction in which you participated. Web the form 8886. Web the form 8886 (or a successor form) is the disclosure statement required under this section. Ad complete irs tax forms online or print government tax documents. Irc 831(b) captive insurance is. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web 16 rows the taxpayer must attach a form 8886 disclosure. Complete, edit or print tax forms instantly. Web general instructions purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Attach form 8886 to your income tax return or information return (including a. Use form 8886 to disclose information for each reportable transaction in which you participated. Web in addition, a report of foreign bank and financial accounts under the bank secrecy act, fincen form 114, must be filed. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. Complete,. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. If this is the first time. Web general instructions purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web irs form 8886, reportable transaction disclosure statement, is the tax. See participation in a reportable transaction, later, to determine if you participated in a. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Web most of the forms are available in both english and spanish. Web general instructions purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. The instructions to form 8886 (available at irs.gov) provide a specific explanation. Questions answered every 9 seconds. Complete, edit or print tax forms instantly. Web in addition, a report of foreign bank and financial accounts under the bank secrecy act, fincen form 114, must be filed. Web the form 8886 (or a successor form) is the disclosure statement required under this section. Form 8886 is used to. The form must be attached to the appropriate tax return(s) as provided in. Form 8886 is used to. Irc 831(b) captive insurance is. Web as announced in today’s faqs, the irs (until further notice) is implementing a temporary procedure to allow for fax transmission of the separate office of tax. Web 16 rows the taxpayer must attach a form 8886. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Ad forms, deductions, tax filing and more. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Ad complete irs tax forms online or print government tax documents. Form 8886 is used to. Web instructions for form 8886 available on irs.gov. Generally, form 8886 must be attached to the tax return. Attach to your tax return. Web the form 8886 (or a successor form) is the disclosure statement required under this section. Web the instructions to form 8886, reportable transaction disclosure statement. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. If this is the first time. Ask a tax professional anything right now. December 2019) department of the treasury internal revenue service. The form must be attached to the appropriate tax return(s) as provided in. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. A tax agent will answer in minutes! Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web general instructions purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web when and how to file.IRS Form 8886 Instructions Reportable Transaction Disclosure

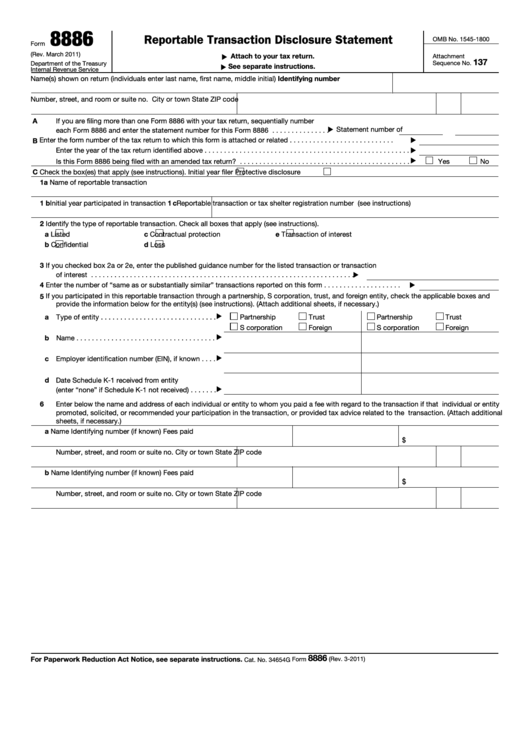

Fillable Form 8886 Reportable Transaction Disclosure Statement

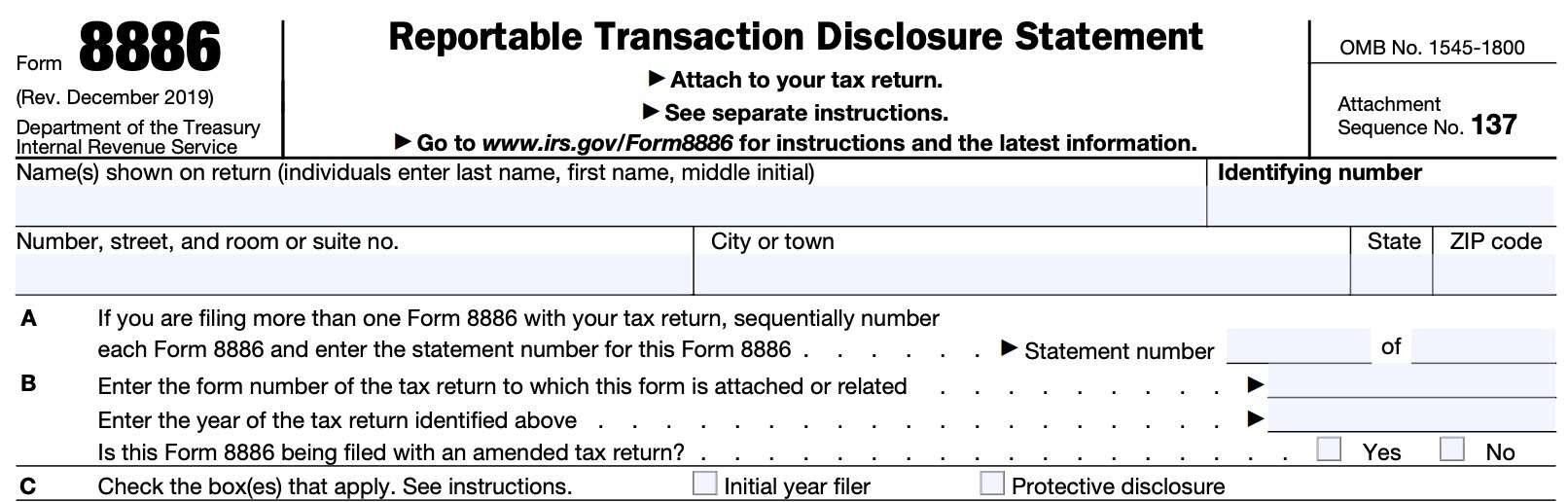

Irs Form 8886 Fillable Printable Forms Free Online

IRS Form 8886 Instructions Reportable Transaction Disclosure

IRS Form 8886 Instructions Reportable Transaction Disclosure

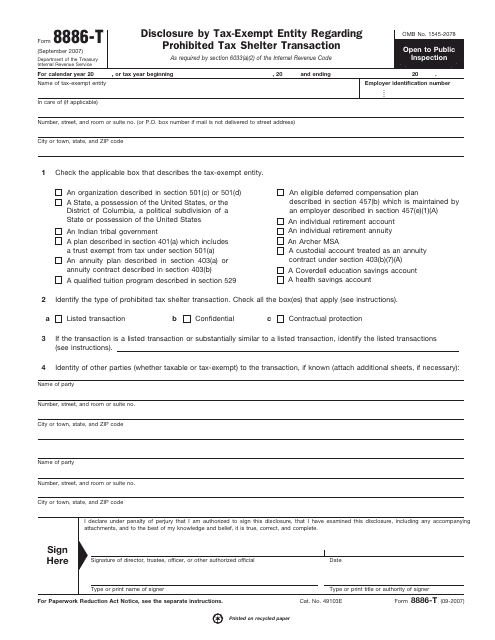

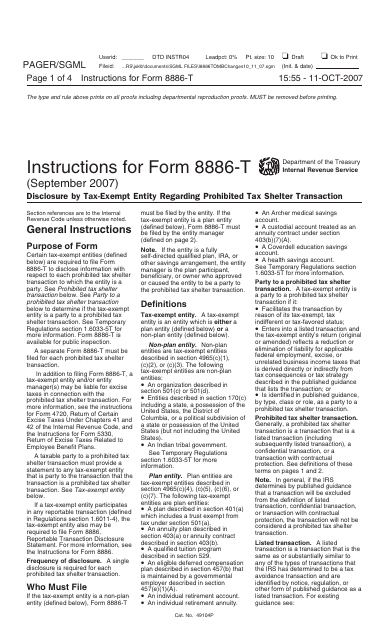

Download Instructions for IRS Form 8886T Disclosure by TaxExempt

Instructions For Form 8886T Disclosure By TaxExempt Entity

Download Instructions for IRS Form 8886 Reportable Transaction

Download Instructions for IRS Form 8886T Disclosure by TaxExempt

Download Instructions for IRS Form 8886 Reportable Transaction

Related Post: