Irs Form 5472 Instructions

Irs Form 5472 Instructions - If you file your income tax return electronically, see the instructions for your income tax return for general information about electronic filing. Our tax preparers will ensure that your tax returns are complete, accurate and on time. The instructions for form 5472 provide detailed information on how to register for and. Corporation's income tax return, including extensions. Web when should you file form 5472? Web the penalties for not filing at all or filing an incomplete form 5472 increased greatly. Estimate how much you could potentially save in just a matter of minutes. If you file your income tax return electronically, see the instructions for your income tax return for general. Form 5472 is normally filed along with the us corporation’s annual tax return. Web thanks to a recent change in irs regulations, a new form has been added to this list: Any us corporation or disregarded entity with 25% or more foreign ownership that has a reportable transaction. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Fthese rules also apply to lines 5c, 6c, defined in section 7874 (a) (2) (b) the same reference id number. Web anyone completing a form 5472. Web up to $3 cash back instructions for form 5472 (rev. Web form 5472 must be filed on or before the due date of the u.s. While most irs international information reporting forms require us persons with an interest in, or ownership over foreign accounts, assets, investments,. Our tax preparers will ensure that your tax returns are complete, accurate and. Web electronic filing of form 5472. Web up to $3 cash back instructions for form 5472 (rev. Corporation doesn't have a tax return filing. Web anyone completing a form 5472 must understand the importance of this form and the fact that the irs often uses the form 5472 as a starting point for conducting a transfer. Corporation's income tax return,. Web form 5472 a schedule stating which members of the u.s. Web when should you file form 5472? Web irs form 5472 is a required informational return for any u.s. The instructions for form 5472 provide detailed information on how to register for and. Fthese rules also apply to lines 5c, 6c, defined in section 7874 (a) (2) (b) the. Estimate how much you could potentially save in just a matter of minutes. Fthese rules also apply to lines 5c, 6c, defined in section 7874 (a) (2) (b) the same reference id number. Web anyone completing a form 5472 must understand the importance of this form and the fact that the irs often uses the form 5472 as a starting. May 17, 2022 | llc. Web instructions for form 7004. Web thanks to a recent change in irs regulations, a new form has been added to this list: Web irs form 5472 is a required informational return for any u.s. Web form 5472 explained: If you file your income tax return electronically, see the instructions for your income tax return for general information about electronic filing. Form 5472 is normally filed along with the us corporation’s annual tax return. Fthese rules also apply to lines 5c, 6c, defined in section 7874 (a) (2) (b) the same reference id number. Our tax preparers will ensure. Web the penalties for not filing at all or filing an incomplete form 5472 increased greatly. Corporation or a foreign corporation engaged in a u.s. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web form 5472 must be filed on or before the due date of the u.s. Corporation with 25%. Electronic filing of form 5472. Corporation's income tax return, including extensions. Web form 5472 must be filed on or before the due date of the u.s. Corporations file form 5472 to provide information. Web the irs requires llc members to file form 5472 if any of the following apply: Instead of a $10,000 fine in years past, the new penalty is $25,000 per year per. If you file your income tax return electronically, see the instructions for your income tax return for general information about electronic filing. Web thanks to a recent change in irs regulations, a new form has been added to this list: Corporation's income tax return,. Web form 5472 instructions are available from the irs. While most irs international information reporting forms require us persons with an interest in, or ownership over foreign accounts, assets, investments,. Web when should you file form 5472? The instructions for form 5472 provide detailed information on how to register for and. Web form 5472 must be filed by either 1) a us corporation that is 25% (or more) owned by a foreign shareholder or 2) a foreign corporation that is engaged in a us trade. Web anyone completing a form 5472 must understand the importance of this form and the fact that the irs often uses the form 5472 as a starting point for conducting a transfer. Form 5472 is normally filed along with the us corporation’s annual tax return. Ad reduce complexity by outsourcing the preparation and filing of sales tax returns to sovos. Estimate how much you could potentially save in just a matter of minutes. Any extensions availed by the us corporation also apply. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Electronic filing of form 5472. Web the penalties for not filing at all or filing an incomplete form 5472 increased greatly. Instead of a $10,000 fine in years past, the new penalty is $25,000 per year per. Web form 5472 must be filed on or before the due date of the u.s. Web the irs requires llc members to file form 5472 if any of the following apply: Web thanks to a recent change in irs regulations, a new form has been added to this list: Web form 5472 a schedule stating which members of the u.s. Corporation doesn't have a tax return filing.form 5472 instructions 2018 Fill Online, Printable, Fillable Blank

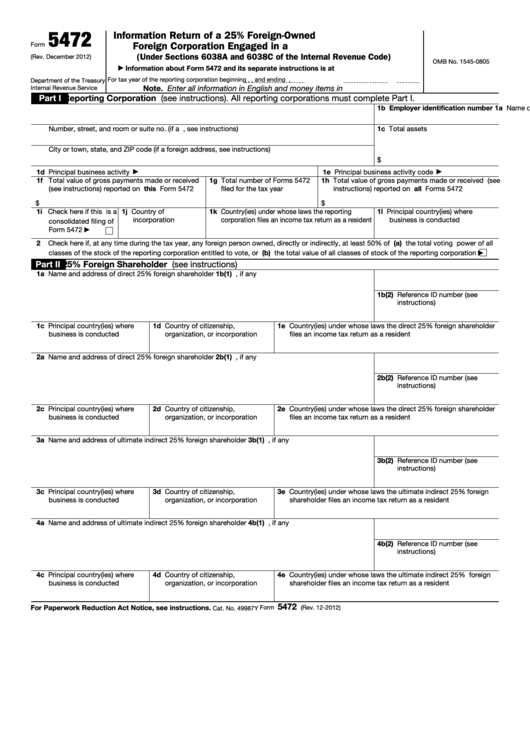

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

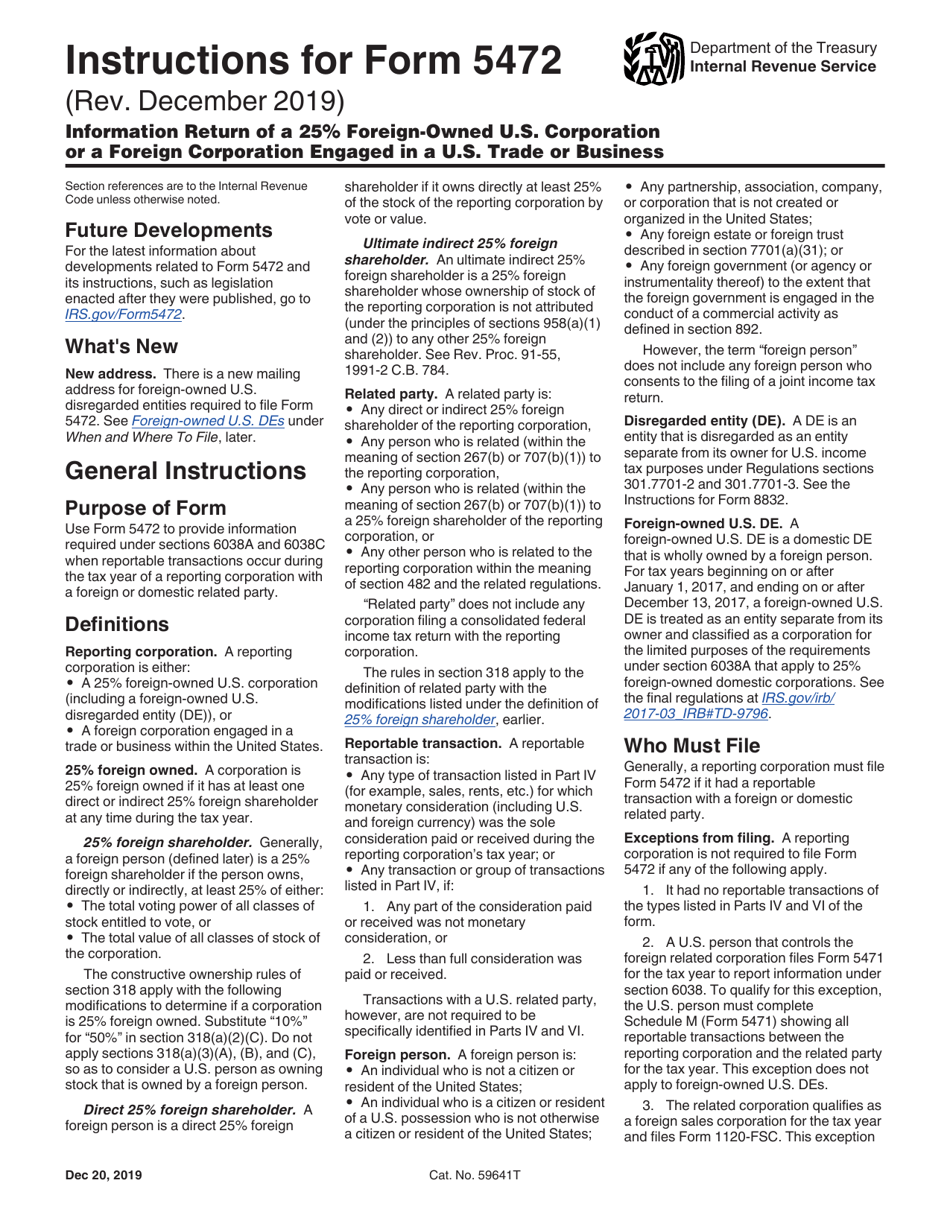

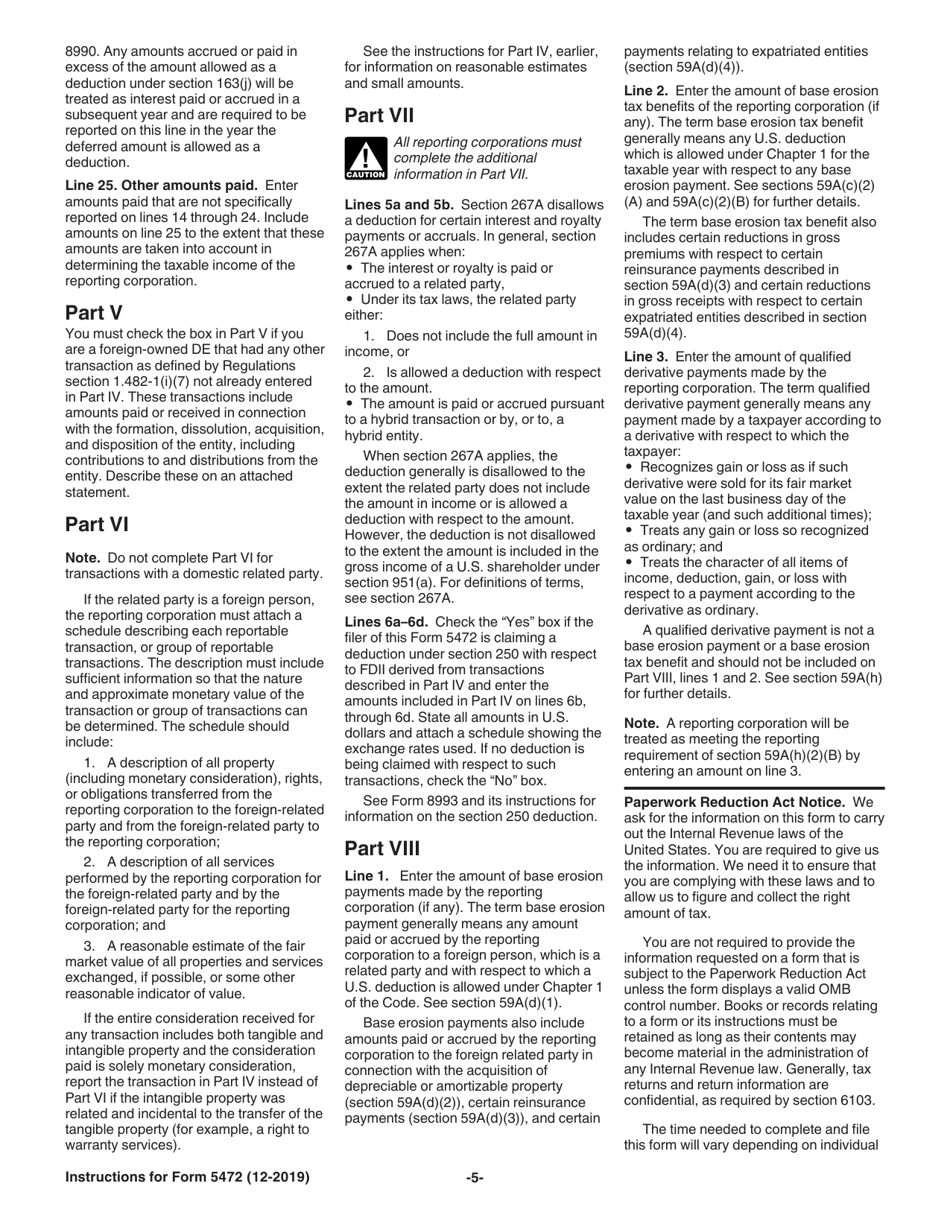

Download Instructions for IRS Form 5472 Information Return of a 25

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Download Instructions for IRS Form 5472 Information Return of a 25

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Instructions for IRS Form 5472 Information Return Of A 25 Foreign

What’s New Foreignowned singlemember LLCs now must file Form 5472

Instructions & Quick Guides on Form 5472 Asena Advisors

Related Post:

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)