Fillable Form 940

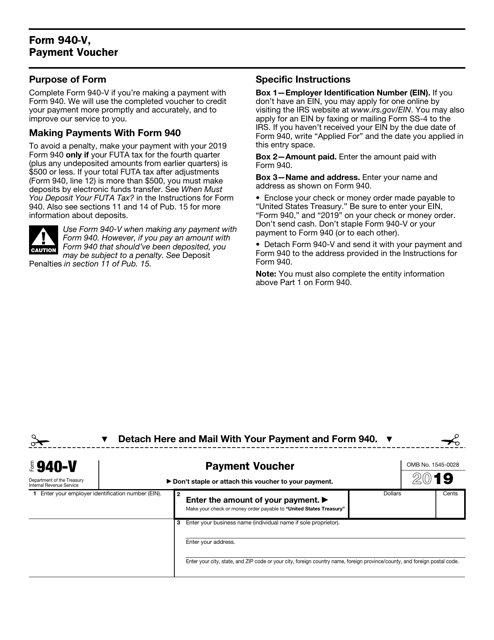

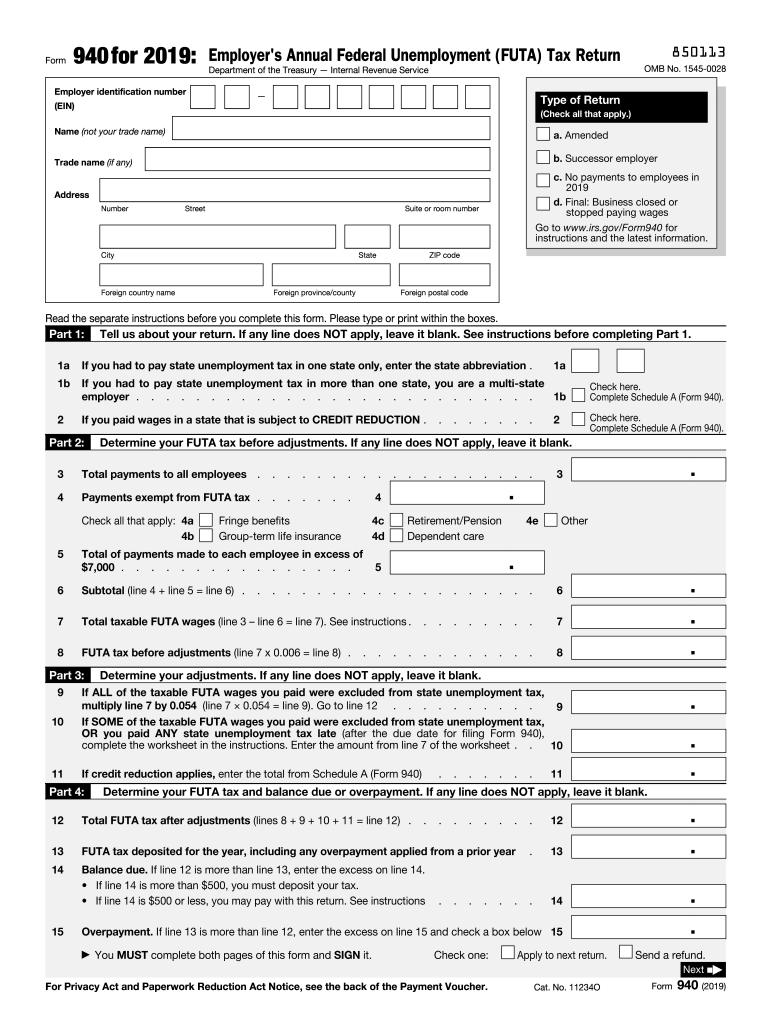

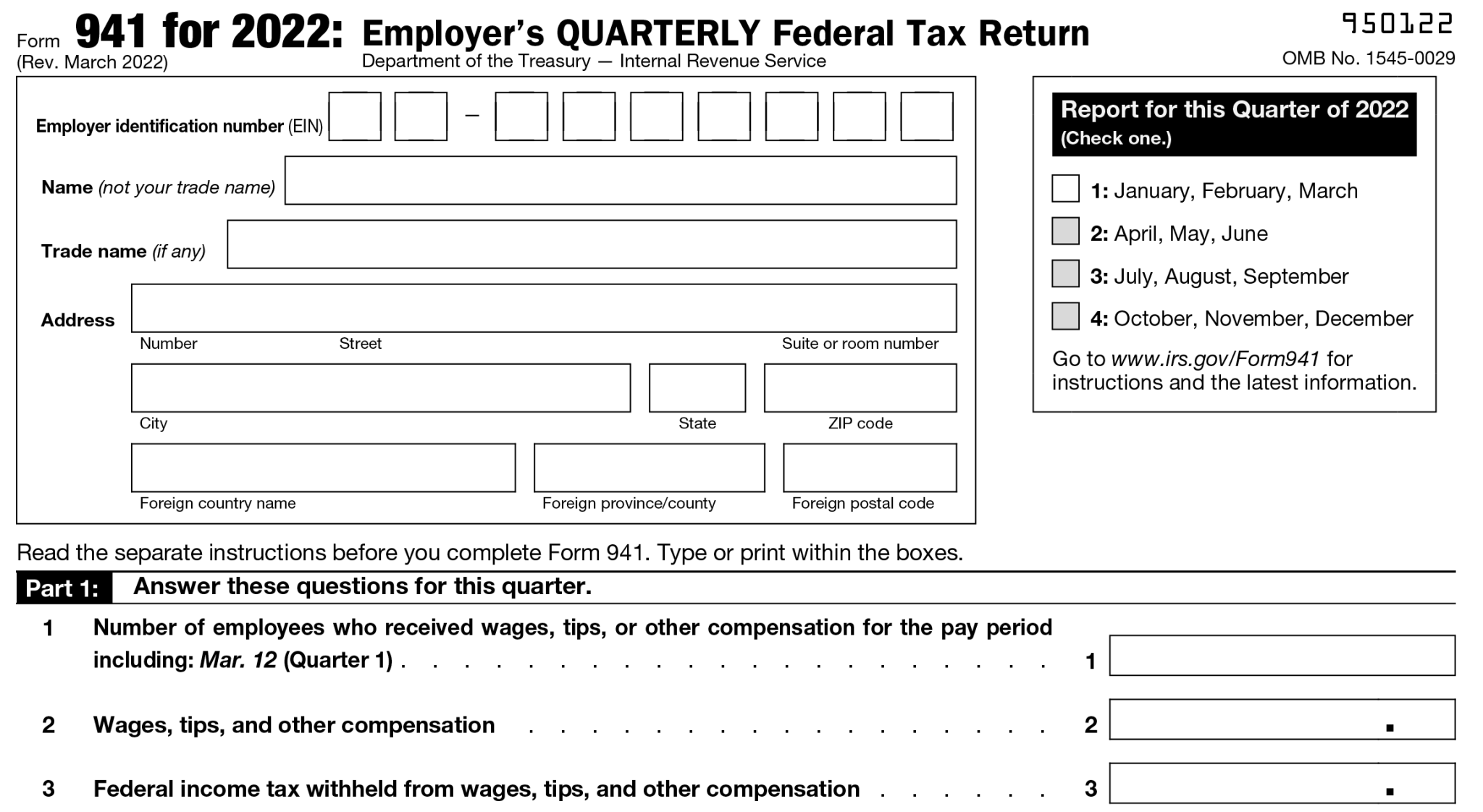

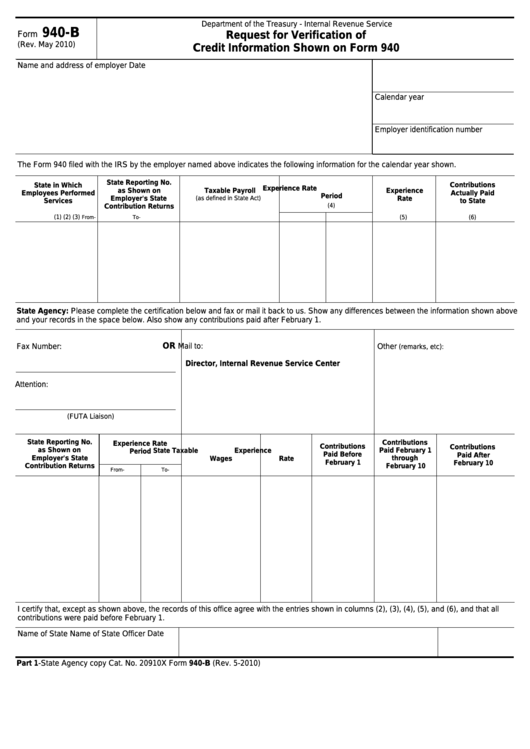

Fillable Form 940 - Once completed you can sign your fillable form or send for signing. Report for this quarter of 2023. Form 940 is used to report your annual federal unemployment tax act (futa) tax. For employers who withhold taxes from employee's paychecks or who must pay. 3 review your form 940. Create printable form 940 using our form 940 generator. All forms are printable and downloadable. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web use fill to complete blank online irs pdf forms for free. Employers must report and pay unemployment taxes to the irs for their employees. 2 enter form 940 details. Together with state unemployment tax systems, the. Web up to $32 cash back above is a fillable pdf version of form 940 that you can print or download. Web employment tax forms: Form 940, employer's annual federal unemployment tax return. 4 transmit your form 940 to the irs. Web irs form 940 is an annual tax document employers must use to report their federal unemployment taxes (futa) to the internal revenue service (irs). All forms are printable and downloadable. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web form 940 instructions. Web employment tax forms: Once completed you can sign your fillable form or send for signing. 4 transmit your form 940 to the irs. Web how to fill out form 940. Download or email irs 940 & more fillable forms, register and subscribe now! Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Web 1 choose tax year. For employers who withhold taxes from employee's paychecks or who must pay. Irs form 940 is used to report. 2 enter form 940 details. Web up to $32 cash back above is a fillable pdf version of form 940 that you can print or download. Web form 940 instructions. For employers who withhold taxes from employee's paychecks or who must pay. Irs form 940 and unemployment taxes. Web irs form 940 is an annual tax document employers must use to report their federal unemployment. Report for this quarter of 2023. Form 940 is an annual tax form that documents your. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Web irs form 940 is an annual tax document. Web employment tax forms: All forms are printable and downloadable. Additionally, the irs website provides a. Together with state unemployment tax systems, the. Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over. 3 review your form 940. Web mark can print a blank pdf or obtain a form 940 fillable version to complete it. Form 940, employer's annual federal unemployment tax return. Web form 940, employer’s annual federal unemployment tax return, is an irs form that employers use to report any futa tax payments they’ve made over the course. Web use fill. Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Irs form 940 is used to report. Web up to $32 cash back above is a fillable pdf version of form 940 that you can. Web employment tax forms: Additionally, the irs website provides a. Irs form 940 and unemployment taxes. Complete, edit or print tax forms instantly. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Irs form 940 is the federal unemployment tax annual report. Report for this quarter of 2023. Together with state unemployment tax systems, the. All forms are printable and downloadable. Once completed you can sign your fillable form or send for signing. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. 4 transmit your form 940 to the irs. Web use fill to complete blank online irs pdf forms for free. 3 review your form 940. Web up to $32 cash back above is a fillable pdf version of form 940 that you can print or download. Web how to fill out form 940. Web mark can print a blank pdf or obtain a form 940 fillable version to complete it. Web 1 choose tax year. Form 940 is used to report your annual federal unemployment tax act (futa) tax. Web form 940 (2020) employer's annual federal unemployment (futa) tax return.IRS Form 940V 2019 Fill Out, Sign Online and Download Fillable PDF

2019 Form IRS 940 Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Form 940 For 2023 Fillable Form 2023

form 940 pr 2020 Fill Online, Printable, Fillable Blank

Fillable Form 940B Request For Verification Of Credit Information

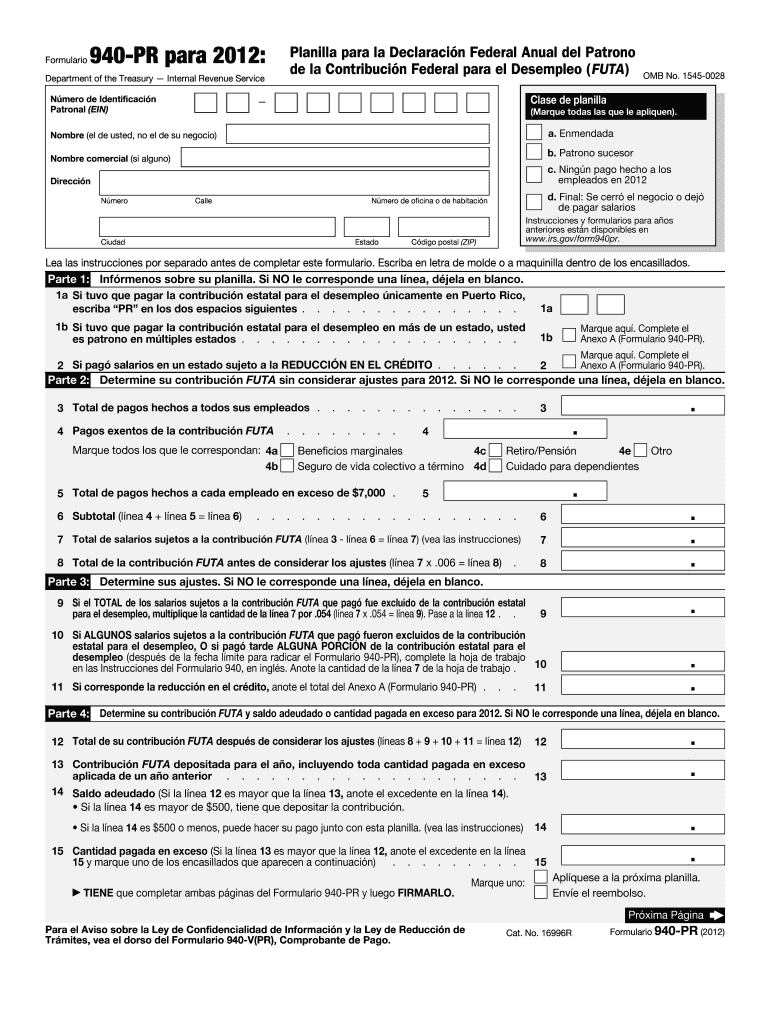

2012 940 pr form Rellena, firma y envía para firmar DocHub

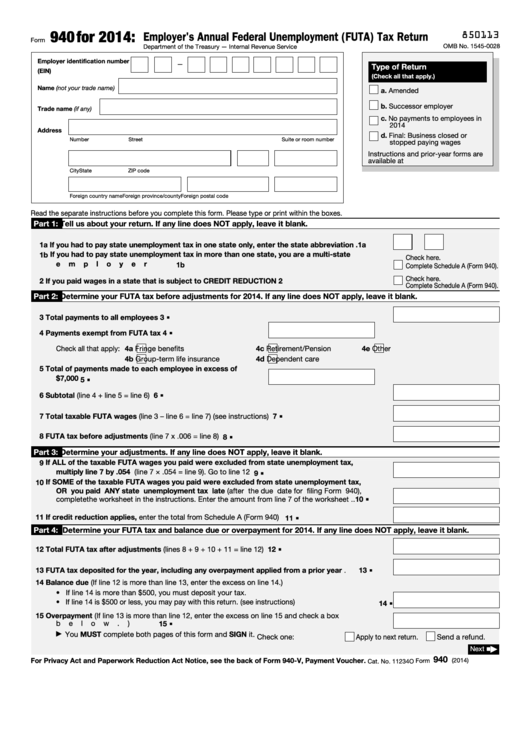

Form 940 Instructions How to Fill It Out and Who Needs to File It

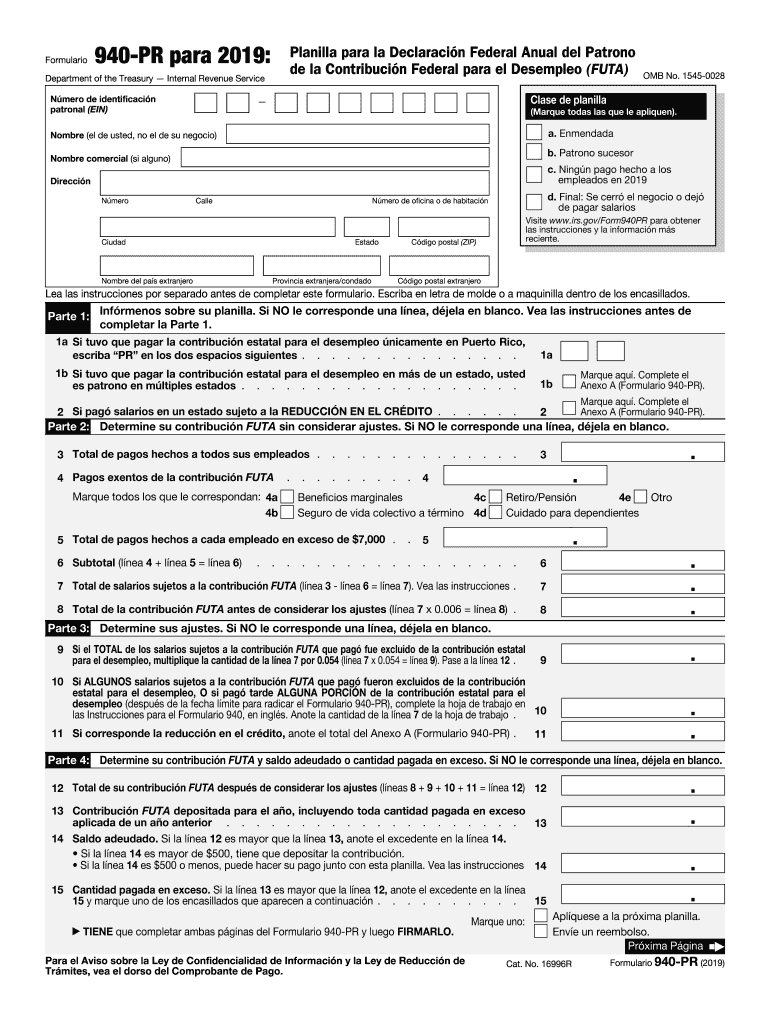

2019 con los campos en blanco IRS 940PREl formulario se puede rellenar

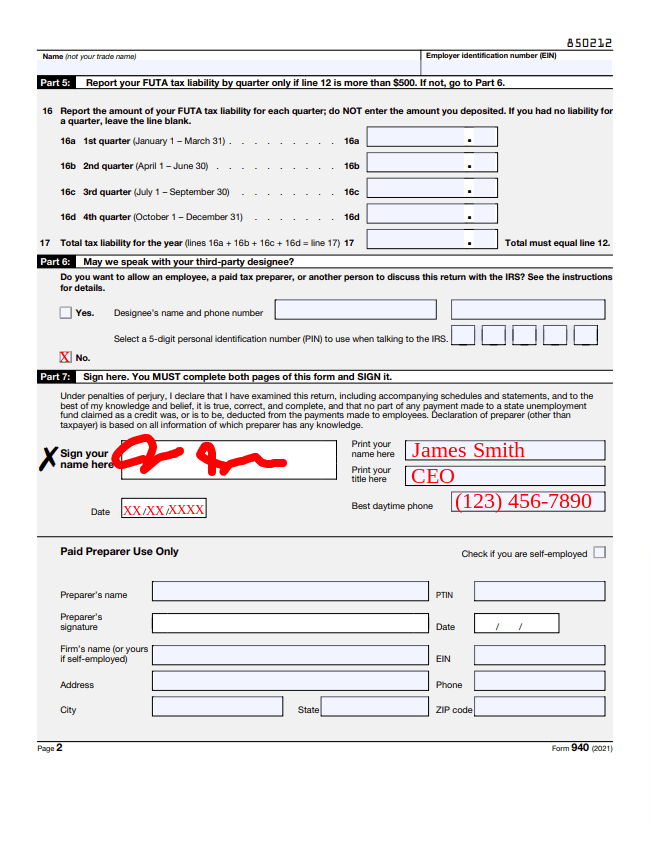

How to Fill Out Form 940 Instructions, Example, & More

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

Related Post: