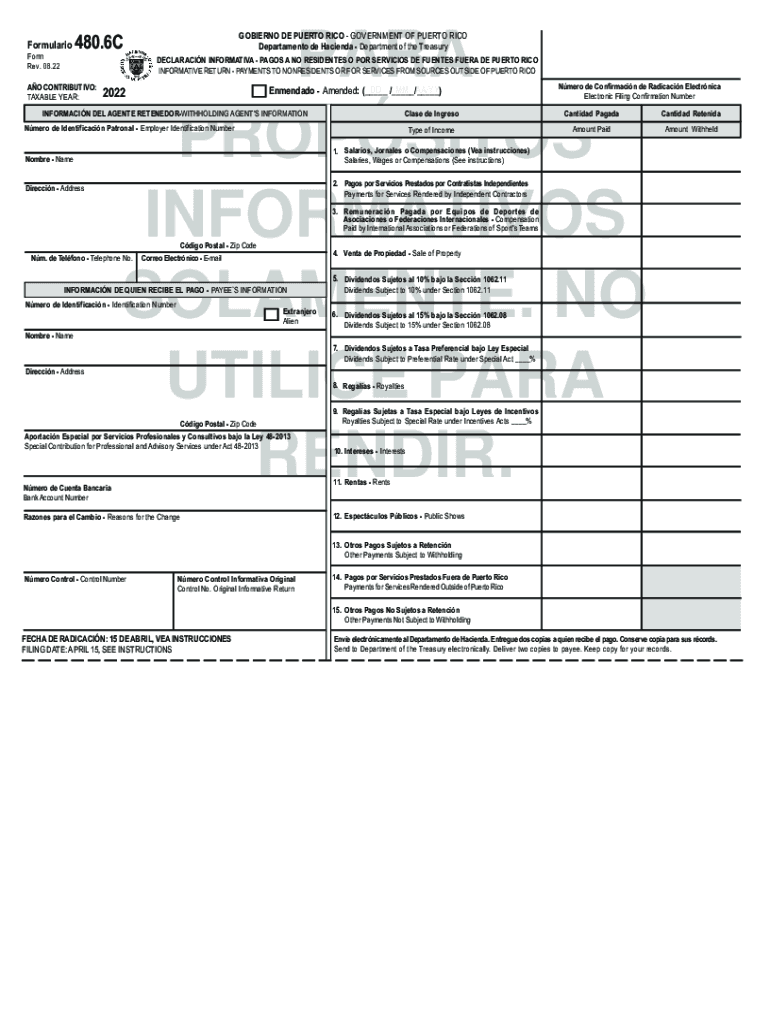

Form 480.6C

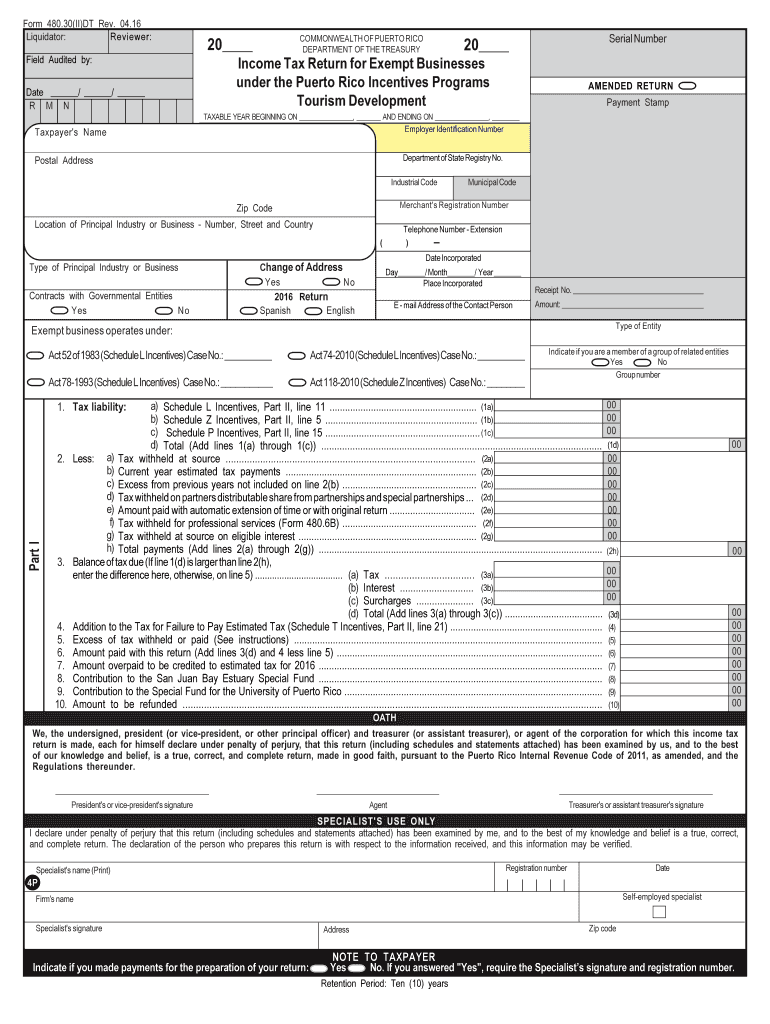

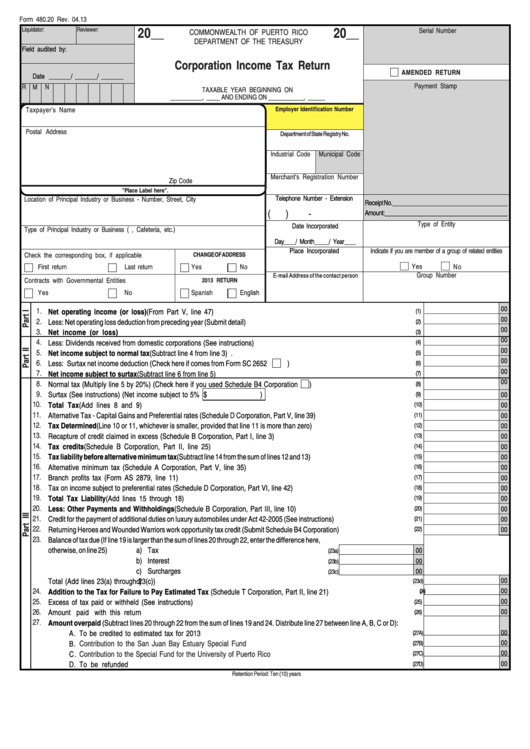

Form 480.6C - Y ou may enter this data at the end of. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. You can include this pr interest under the 1099. F o l d l i n e f o l d l i n e. Rate free da 2406 form. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Web up to $40 cash back dd form 1833 isoprep · gtc credit limit increase form · passport photo requirement · travel health form · tricare contact card. Web form 480.6c, informative return payments to nonresidents or for services from sources outside of puerto rico, and form 480.30, nonresident annual return for income tax. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web setting up form 480.6c. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. You can include this pr interest under the 1099. Web prepare. Web reverse of da form 2406, apr 1993. Nonresident annual return for income tax. Web setting up form 480.6c. F o l d l i n e f o l d l i n e. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the. Web reverse of da form 2406, apr 1993. Web up to $40 cash back dd form 1833 isoprep · gtc credit limit increase form · passport photo requirement · travel health form · tricare contact card. Web setting up form 480.6c. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web any natural or legal. Web form 480.6c, informative return payments to nonresidents or for services from sources outside of puerto rico, and form 480.30, nonresident annual return for income tax. Web setting up form 480.6c. Nonresident annual return for income tax. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Web form 480.6c, informative return payments to nonresidents or for services from sources outside of puerto rico, and form. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Web form 480.6c, informative return payments to nonresidents. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. You can include this pr interest under the 1099. Rate free da 2406 form. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web reverse of da form 2406, apr 1993. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric. Web yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Web up to $40 cash back dd form 1833 isoprep · gtc credit limit increase form · passport photo requirement · travel health form · tricare contact card. Web prepare form 480.6c for each nonresident individual or fiduciary. Y ou may enter this data at the end of. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. You can include this pr interest under the 1099. Rate free da 2406 form. Web up to $40 cash back dd form 1833 isoprep · gtc credit limit increase form · passport photo requirement · travel health form · tricare contact card. Nonresident annual return for income tax. Web reverse of da form 2406, apr 1993. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web form 480.6c, informative return payments to nonresidents or for services from sources outside of puerto rico, and form 480.30, nonresident annual return for income tax. F o l d l i n e f o l d l i n e. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Web setting up form 480.6c. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Dividends earned in traditional iras are not taxed when they are paid or reinvested,.Hcd certification Fill out & sign online DocHub

2022 Form PR 480.6C Fill Online, Printable, Fillable, Blank pdfFiller

Form 480 6c Instructions Fill Out and Sign Printable PDF Template

480 7a 2018 Fill Online, Printable, Fillable, Blank pdfFiller

Table Structure for Informative Returns data

Form 480.20 Corporation Tax Return 2013 printable pdf download

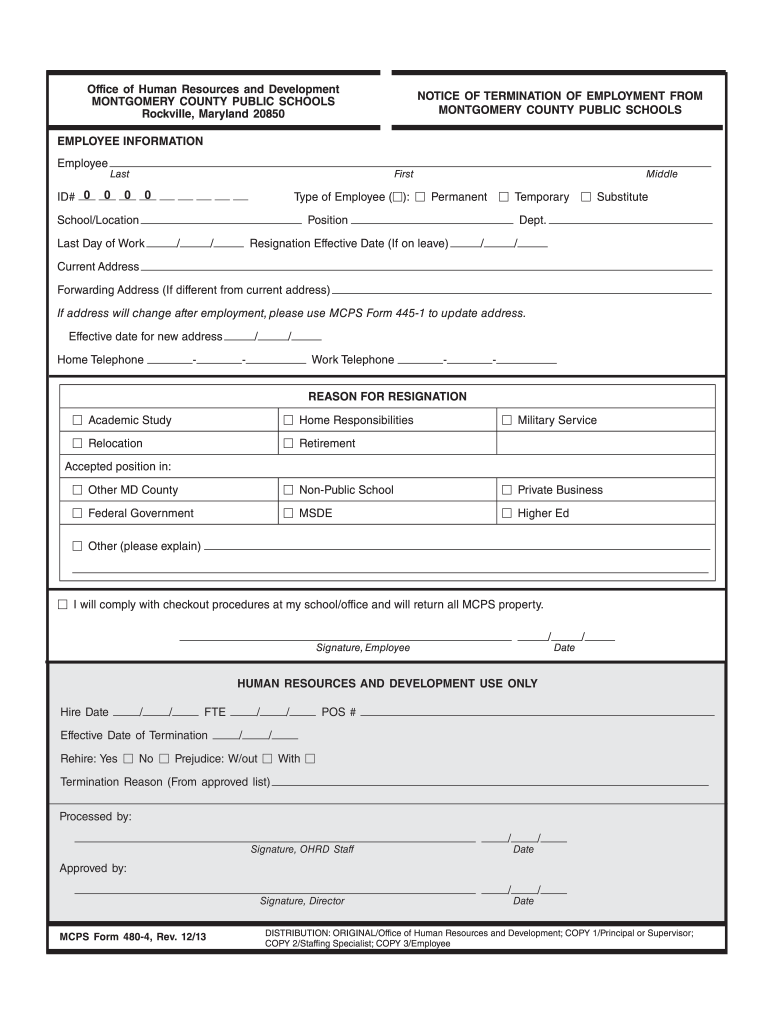

MCPS Form 480 4 Notice of Termination of Employment from

Form 480 Puerto Rico Fill Out and Sign Printable PDF Template signNow

480.6SP 2019 Public Documents 1099 Pro Wiki

puerto rico form 480 20 instructions 2018 Fill out & sign online DocHub

Related Post: