Can You Submit Form W 4V Online

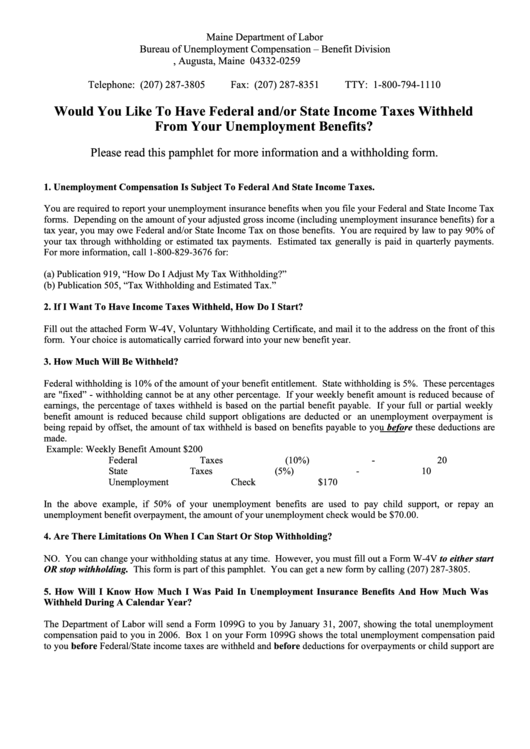

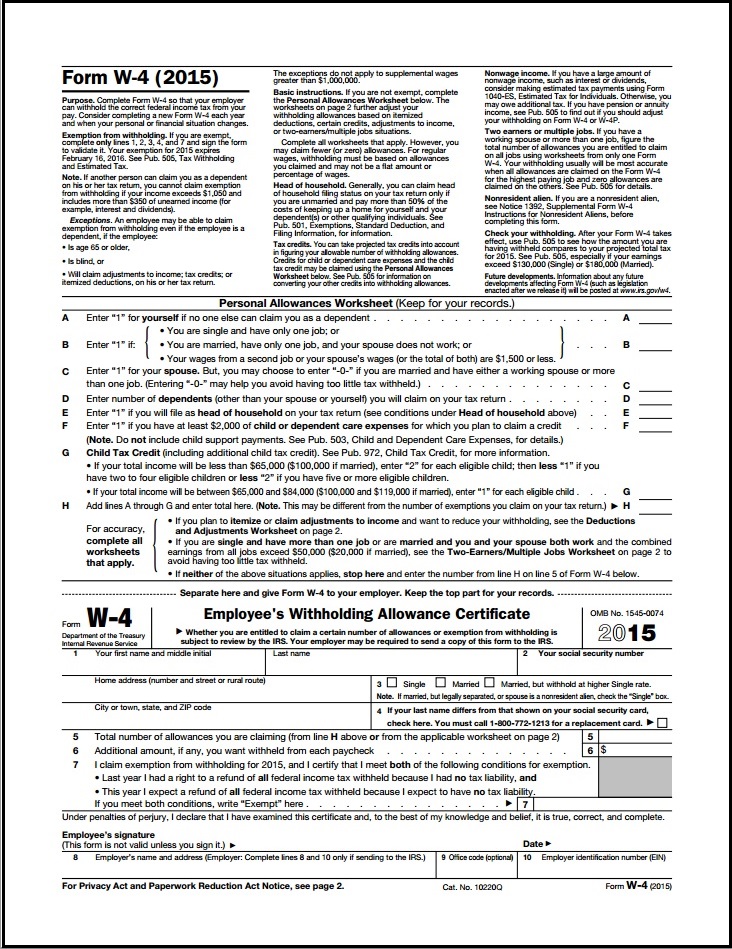

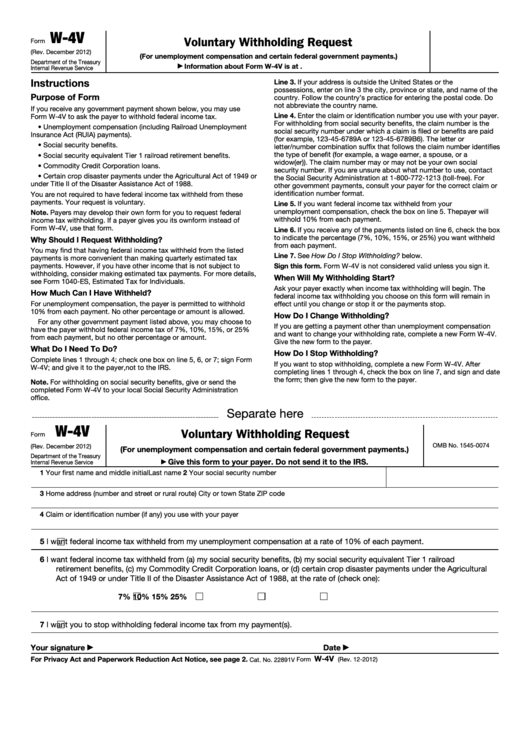

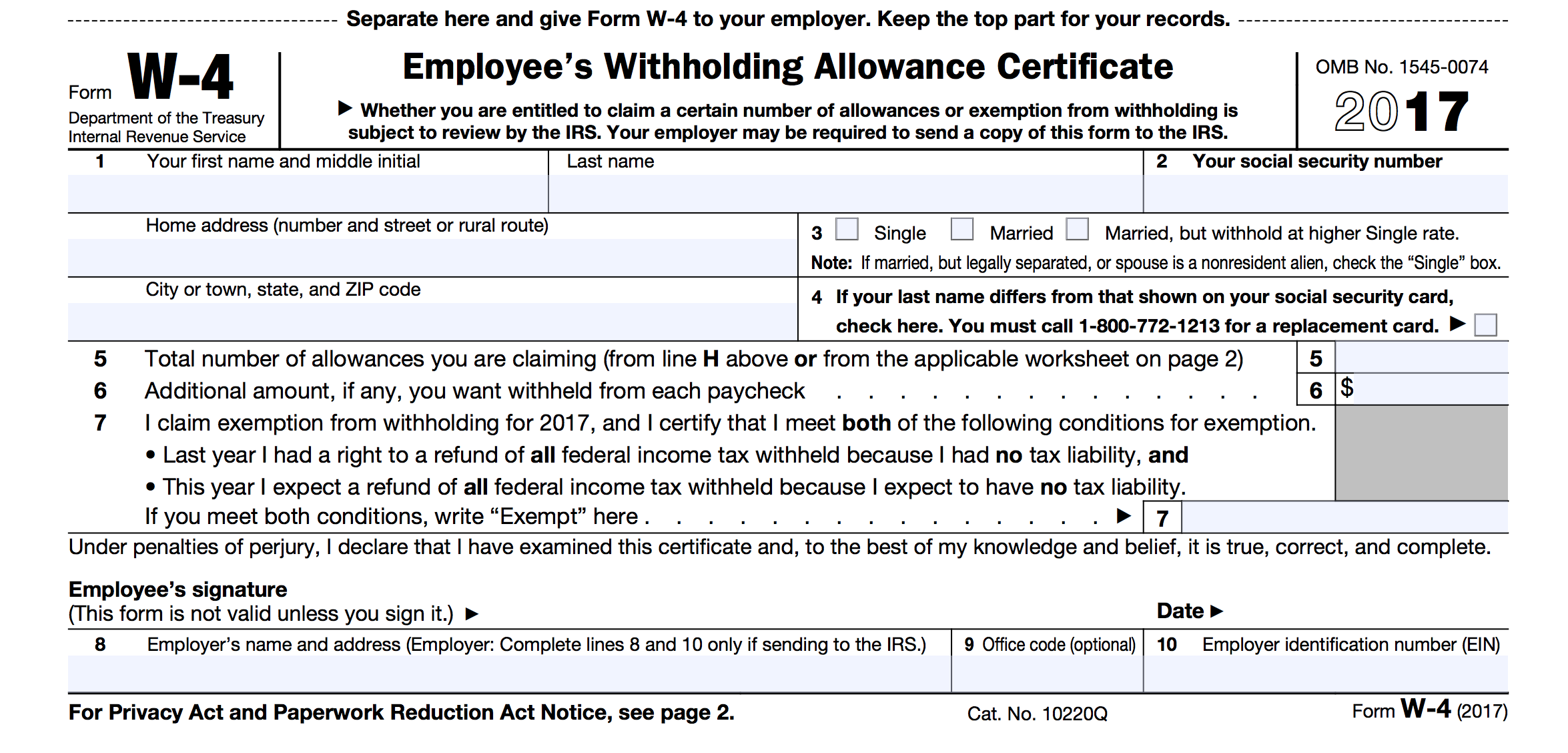

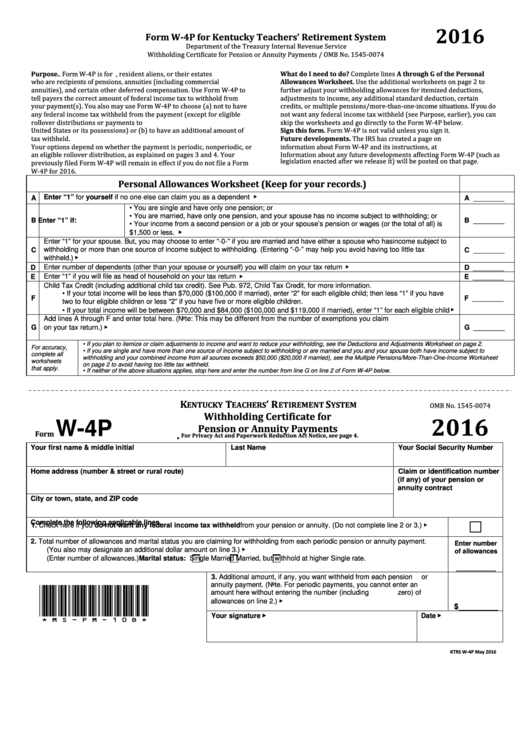

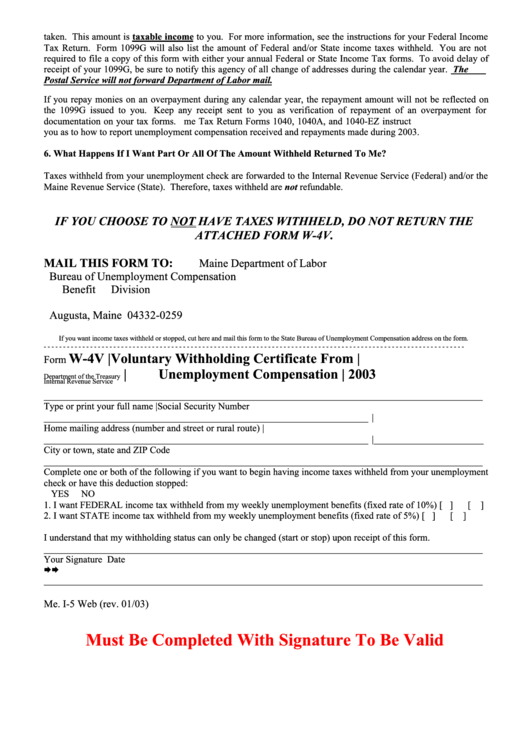

Can You Submit Form W 4V Online - This form is submitted to the. Try it for free now! This option is accurate for jobs with similar pay; No other steps are needed. Visit the official social security website. And input the request on the full de payment claim account number (can)/beneficiary identification code (bic) via. Web if there are only two jobs total, you may check this box. Upload, modify or create forms. Then, find the social security office closest to your home and mail or fax us the completed form. Web page last reviewed or updated: Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Web page last reviewed or updated: Payers may develop their own form for you to request. Ad access irs tax forms. This option is accurate for jobs with similar pay; Ad access irs tax forms. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Upload, modify or create forms. And input the request on the full de payment claim account number (can)/beneficiary identification code (bic) via. Use this form to ask payers to withhold federal income tax from certain. You can download or print current or. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. (for unemployment compensation and certain federal government payments.) internal revenue service. Estimate how much you could potentially save in just a matter of minutes. Payers may develop their own form for you to request. And input the request on the full de payment claim account number (can)/beneficiary identification code (bic) via. Voluntary withholding request from the irs' website. Web voluntary withholding request (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. Visit the official social security website. You can download or print current or. (for unemployment compensation and certain federal government payments.) internal revenue service. Web page last reviewed or updated: Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Payers may develop their own form for you to request. Web if there are only two jobs total, you may check this. Upload, modify or create forms. Web page last reviewed or updated: Complete the required fields in the online application for voluntary withholding request. Web you are not required to have federal income tax withheld from these payments. Web voluntary withholding request (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. This form is submitted to the. Complete the required fields in the online application for voluntary withholding request. Estimate how much you could potentially save in just a matter of minutes. Then, find the social security office closest to. No other steps are needed. Use this form to ask payers to withhold federal income tax from certain. Web voluntary withholding request (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. This option is accurate for jobs with similar pay; Visit the official social security website. Upload, modify or create forms. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web you are not required to have federal income tax withheld from these payments. Then, find the social security office closest to your home and mail or fax us the completed form. Complete the required fields in. Complete, edit or print tax forms instantly. Use this form to ask payers to withhold federal income tax from certain. And input the request on the full de payment claim account number (can)/beneficiary identification code (bic) via. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. You can. Payers may develop their own form for you to request. And input the request on the full de payment claim account number (can)/beneficiary identification code (bic) via. Try it for free now! This form is submitted to the. (for unemployment compensation and certain federal government payments.) internal revenue service. Ad access irs tax forms. Web voluntary withholding request (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest. Voluntary withholding request from the irs' website. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Estimate how much you could potentially save in just a matter of minutes. This option is accurate for jobs with similar pay; You can download or print current or. Web if there are only two jobs total, you may check this box. Use this form to ask payers to withhold federal income tax from certain. Then, find the social security office closest to your home and mail or fax us the completed form. Web page last reviewed or updated: Complete the required fields in the online application for voluntary withholding request. Complete, edit or print tax forms instantly. Web you are not required to have federal income tax withheld from these payments.W4v Fill out & sign online DocHub

Fillable Form W 4v Printable Forms Free Online

Irs Form W4V Printable Irs W 4v 2003 Fill Out Tax Template Online Us

Irs Form W4V Printable W4v Printable 2019 cptcode.se

How to Fill Out Form W4V for Unemployment Withholding Taxes YouTube

Fillable Form W4v Voluntary Withholding Request printable pdf download

Irs Form W 4V Printable

Irs Form W4V Printable / Irs Form W 4s Download Fillable Pdf Or Fill

Irs Form W4V Printable Tax Forms Archives Taxgirl You can print

Form W 4V Printable

Related Post: