Form 4797 Sale Of Rental Property Example

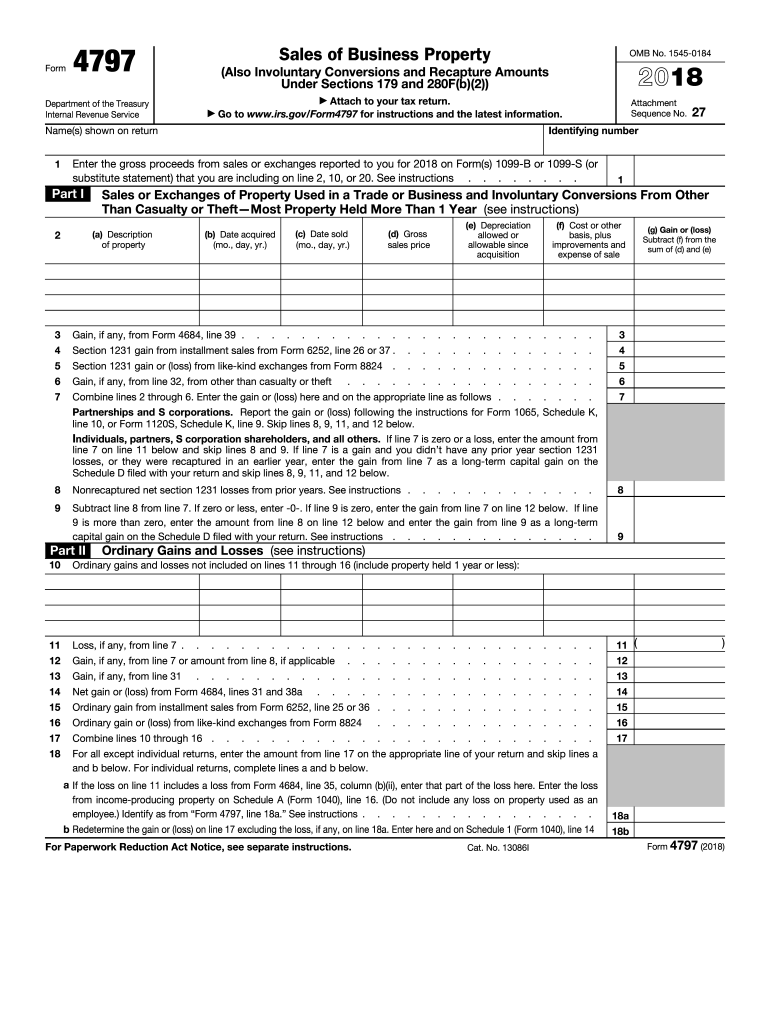

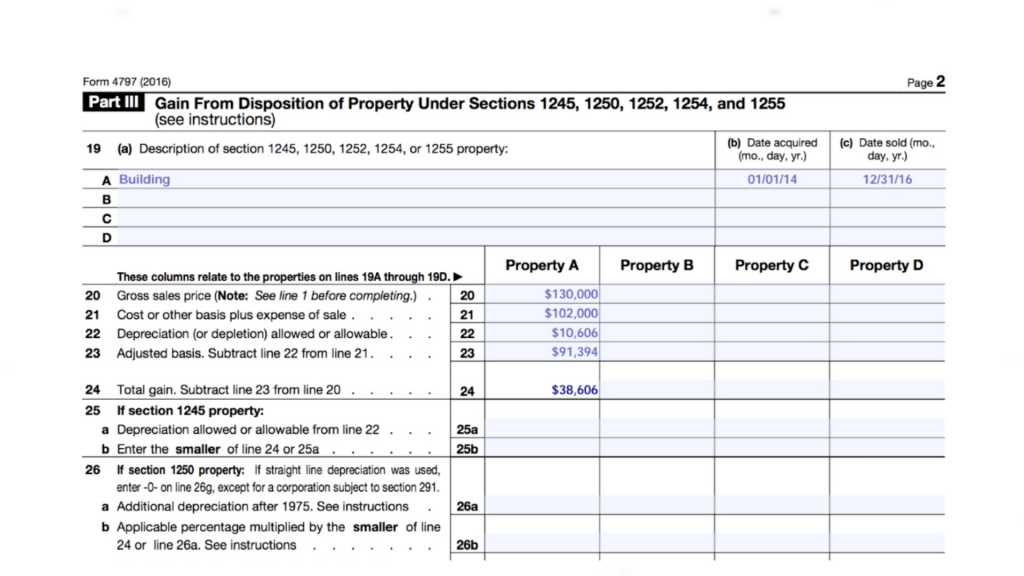

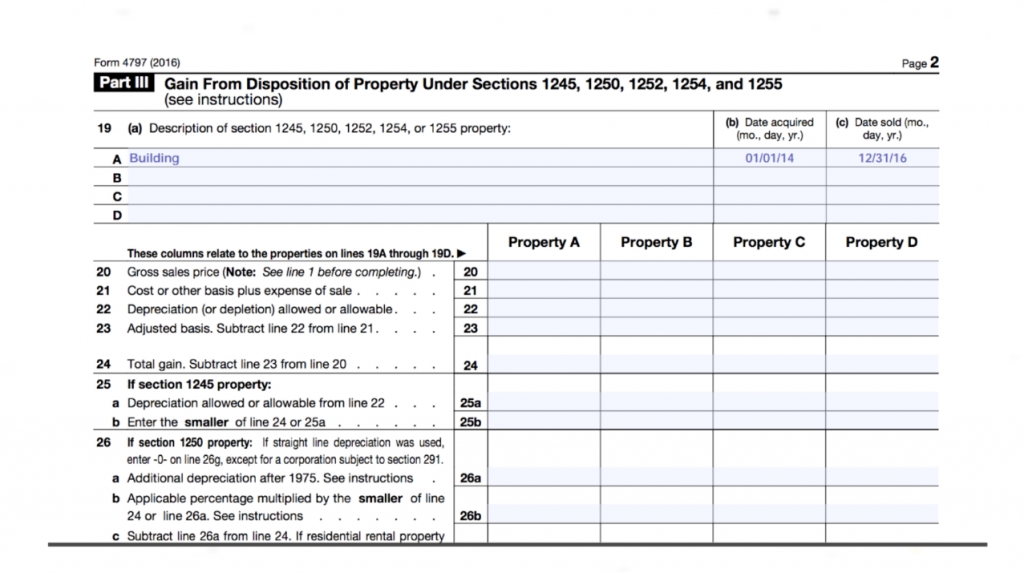

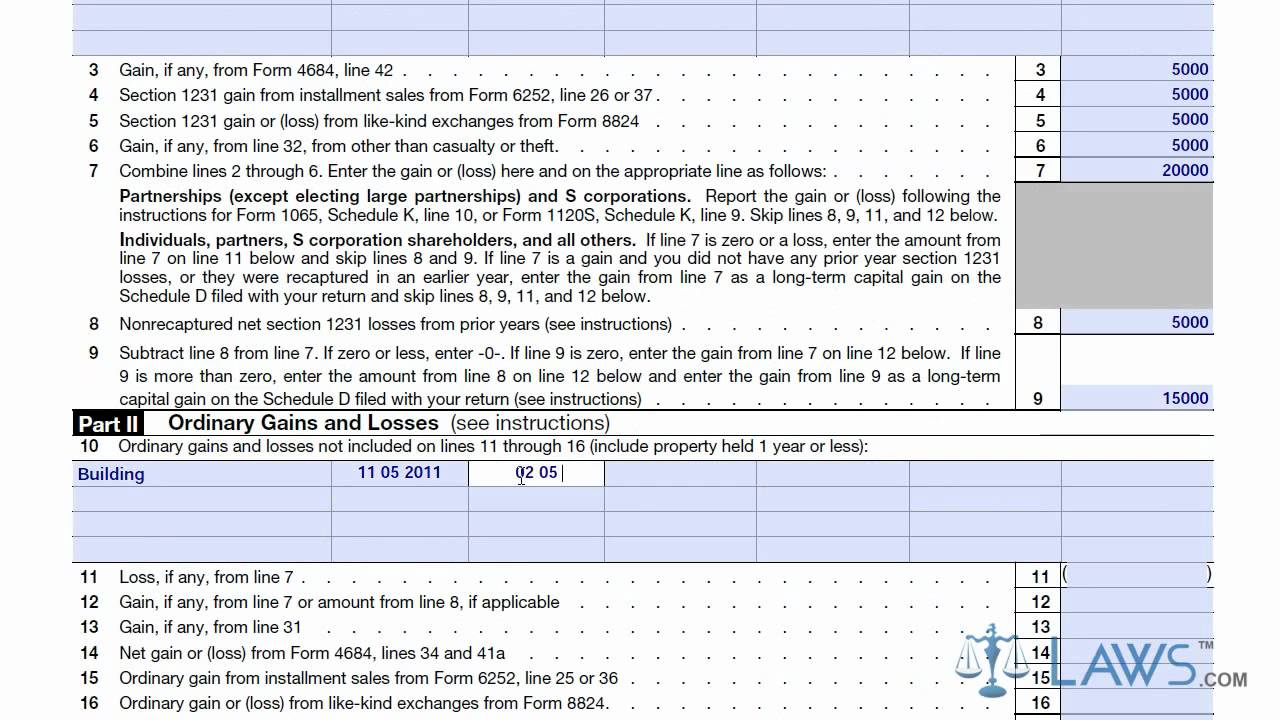

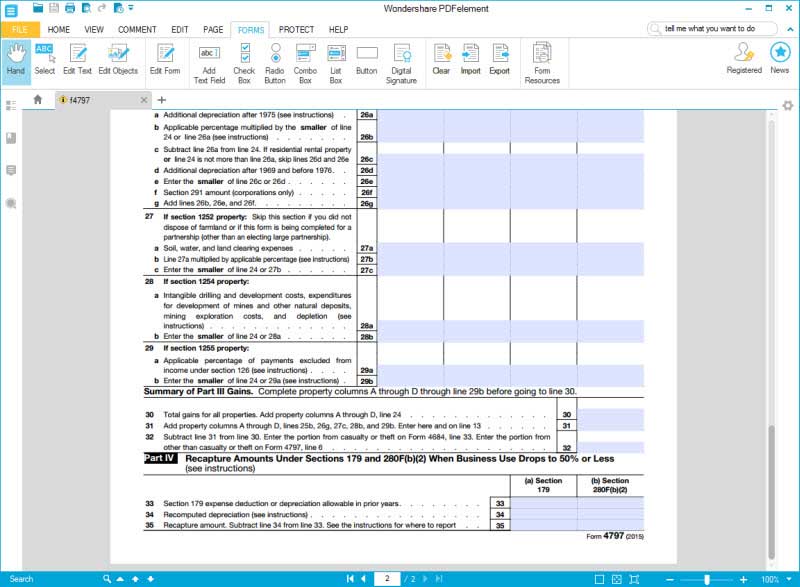

Form 4797 Sale Of Rental Property Example - If you disposed of both depreciable property and other property (for example, a building and. Depreciable and amortizable tangible property used in your. Web don’t use form 4797 to report the sale of personal property, just property used as a business. Web a detailed example on the sale of rental property will be provided. Web how do i fill out tax form 4797 after sale of a rental property? Web when form 4797 is used • sale or exchange of: Ad uslegalforms.com has been visited by 100k+ users in the past month Web #3;correct;$251.9k needs to be reported here; Web updated june 14, 2023. Web if you sold property that was your home and you also used it for business, you may need to use form 4797 to report the sale of the part used for business (or the sale of the entire. Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the. Web who can file form 4797: Web updated june 14, 2023. Web don’t use form 4797 to report the sale of personal property, just property used as a business. In. If you disposed of both depreciable property and other property (for example, a building and. Depreciable and amortizable tangible property used in your. Web if you sold property that was your home and you also used it for business, you may need to use form 4797 to report the sale of the part used for business (or the sale of. Ad uslegalforms.com has been visited by 100k+ users in the past month Web form 4797, sales of business property is used to report the following transactions: Ad quick way to create the key documents necessary for owning or managing rental property. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture. Web taxpayers use this form to report any gains made during the sale of business property. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from. Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the. If you are selling a. The sale or exchange of: 13k views 1 year ago real estate investing and taxes. Ad uslegalforms.com has been visited by 100k+ users in the. Web the irs form 4797 is a tax form distributed by the irs that is used to report the income generated by the sale or exchange of a business property. This course will provide you with the confidence to deal with these situations. Real property used in your trade or business; For some other videos on these topics, see below:. Depreciable and amortizable tangible property used in your. Property used in a trade or business. The sale or exchange of: Web don’t use form 4797 to report the sale of personal property, just property used as a business. If you disposed of both depreciable property and other property (for example, a building and. This course will provide you with the confidence to deal with these situations. Web when form 4797 is used • sale or exchange of: Web don’t use form 4797 to report the sale of personal property, just property used as a business. Ad uslegalforms.com has been visited by 100k+ users in the past month If you disposed of both depreciable. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179. • property used in trade or business • depreciable or amortizable property • oil, gas, geothermal or other mineral property •. Web updated june 14, 2023. Web when form 4797 is used • sale or exchange of:. Web don’t use form 4797 to report the sale of personal property, just property used as a business. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or. Web form 4797, sales of business property is used to report the following transactions: Web if you sold. Am i a real estate professional: Depreciable and amortizable tangible property used in your. Ad uslegalforms.com has been visited by 100k+ users in the past month 13k views 1 year ago real estate investing and taxes. The sale or exchange of: Web updated june 14, 2023. Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the. This course will provide you with the confidence to deal with these situations. Ad quick way to create the key documents necessary for owning or managing rental property. Real property used in your trade or business; If you are selling a. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or. Web a detailed example on the sale of rental property will be provided. •the sale or exchange of: Web who can file form 4797: Web how do i fill out tax form 4797 after sale of a rental property? Web taxpayers use this form to report any gains made during the sale of business property. If you disposed of both depreciable property and other property (for example, a building and.Form 4797 Fill Out and Sign Printable PDF Template signNow

How to Report the Sale of a U.S. Rental Property Madan CA

How to Report the Sale of a U.S. Rental Property Madan CA

Learn How to Fill the Form 4797 Sales of Business Property YouTube

Form 4797 Sales of Business Property YouTube

How to Complete IRS Form 4797 For the Sale of Real Estate YouTube

How to Report the Sale of a U.S. Rental Property Madan CA

IRS Form 4797 Guide for How to Fill in IRS Form 4797

4797 Basics & Beyond

Form 4797Sales of Business Property

Related Post: