Qualified Business Income Deduction From Form 8995

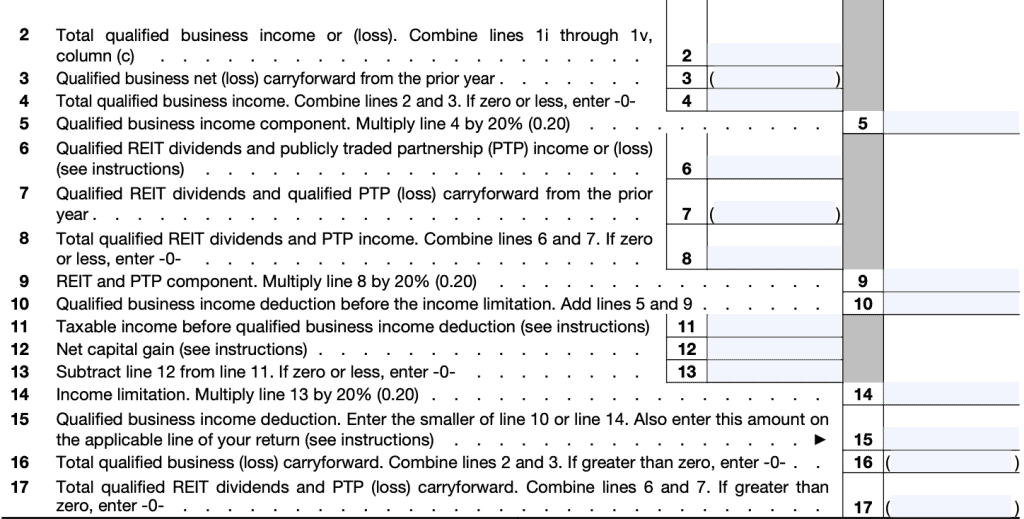

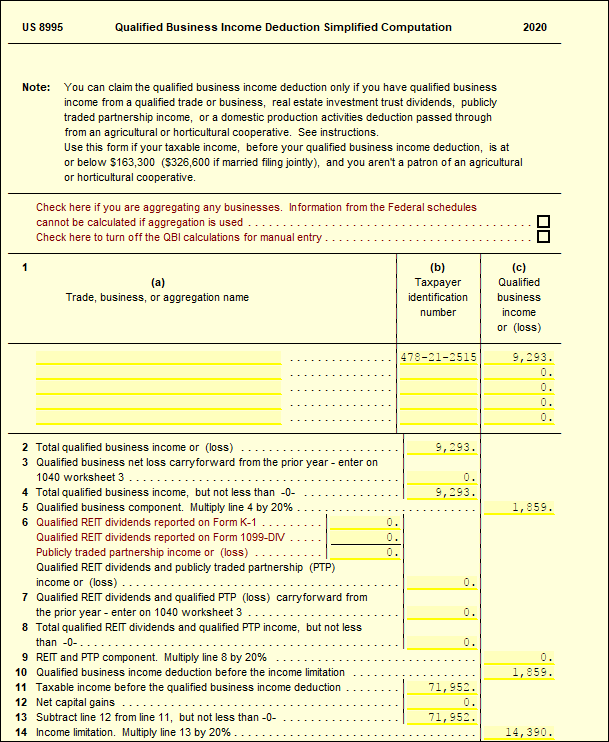

Qualified Business Income Deduction From Form 8995 - Qualified business income deduction from. Web purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web 1 best answer. Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. Web 1 best answer. Web purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Once upon a time, in the land of taxes and paperwork, there was a magical document known as irs form. Automatically track all your income and expenses. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2022 taxable income before the qualified business. Qualified business income deduction simplified computation. It appears you don't have a pdf plugin for this browser. Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. Web follow these steps for form 8995: Ad practicetestgeeks.com has been visited by 100k+ users in the past month There. On line 1, list up to five businesses, including each company’s taxpayer identification number and qualified business. Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. Once upon a time, in the land of taxes and paperwork, there was a. Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to. This is your adjusted gross income standard deduction or itemized deductions (from schedule a). Web page last reviewed or updated: Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. Web the irs form 8995 is best for simplified tax returns and a straightforward. Qualified business income deduction from. Web purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web page last reviewed or updated: The tax cuts and jobs act reduced the income tax owed by corporations. Qualified business income deduction simplified computation. Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. If you are unfamiliar with the qualified. Individual taxpayers and some trusts and estates may be entitled to a deduction of up. Web purpose of form use form 8995 to figure. Qualified business income deduction simplified computation. On line 1, list up to five businesses, including each company’s taxpayer identification number and qualified business. Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. The single family townhouse rental can be removed. On line 1, list up to five businesses, including each company’s taxpayer identification number and qualified business. Get a free guided quickbooks® setup. Web 1 best answer. Ad manage all your business expenses in one place with quickbooks®. Web federal tax form 8995: Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. It appears you don't have a pdf plugin for this browser. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to. Web follow these steps for form 8995: Individual taxpayers and some trusts and estates may be entitled to a deduction of up. Automatically track all your income and expenses. Web federal qualified business income deduction simplified computation. Qualified business income deduction from. Web page last reviewed or updated: This is your adjusted gross income standard deduction or itemized deductions (from schedule a). Ad practicetestgeeks.com has been visited by 100k+ users in the past month On line 1, list up to five businesses, including each company’s taxpayer identification number and qualified business. Ad manage all your business expenses in one place with quickbooks®. Web follow these steps for form 8995: Web use form 8995 if: Web federal tax form 8995: Individual taxpayers and some trusts and estates may be entitled to a deduction of up. Automatically track all your income and expenses. Web purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Open your turbotax return >. The tax cuts and jobs act reduced the income tax owed by corporations. Web federal qualified business income deduction simplified computation. Ad signnow.com has been visited by 100k+ users in the past month You can use this to figure out your deduction if. There should be questions upon entering the business profit and loss about qbi (section 199a) for the business. Web in essence, the qbi deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2022 taxable income before the qualified business. Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production.IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

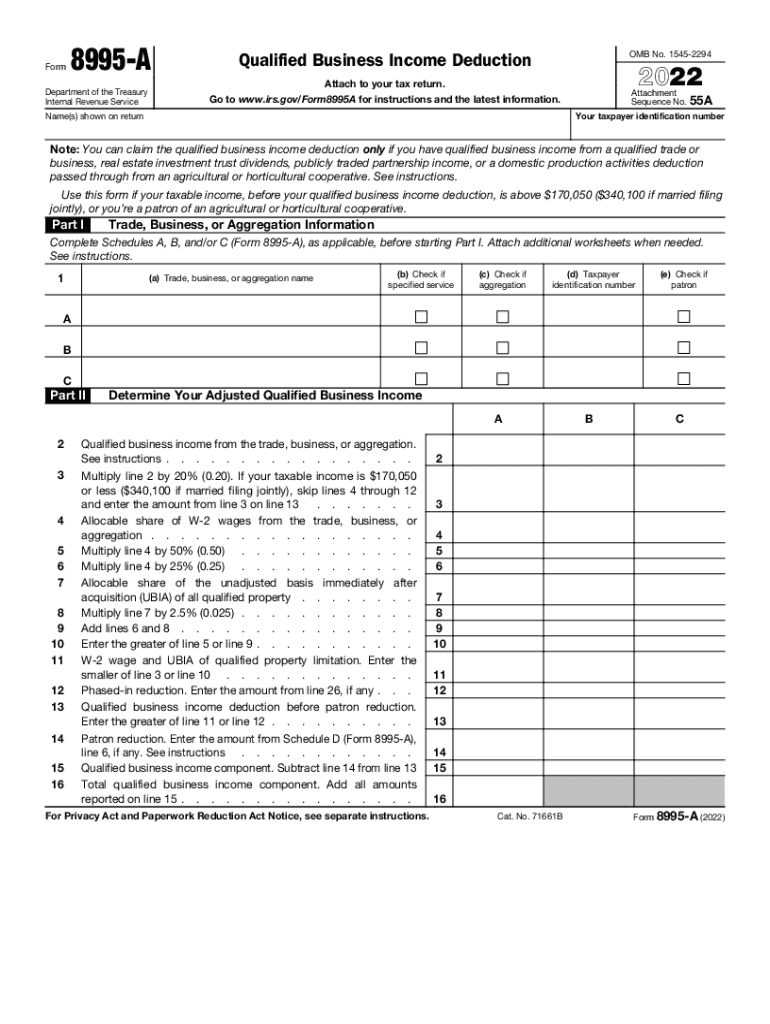

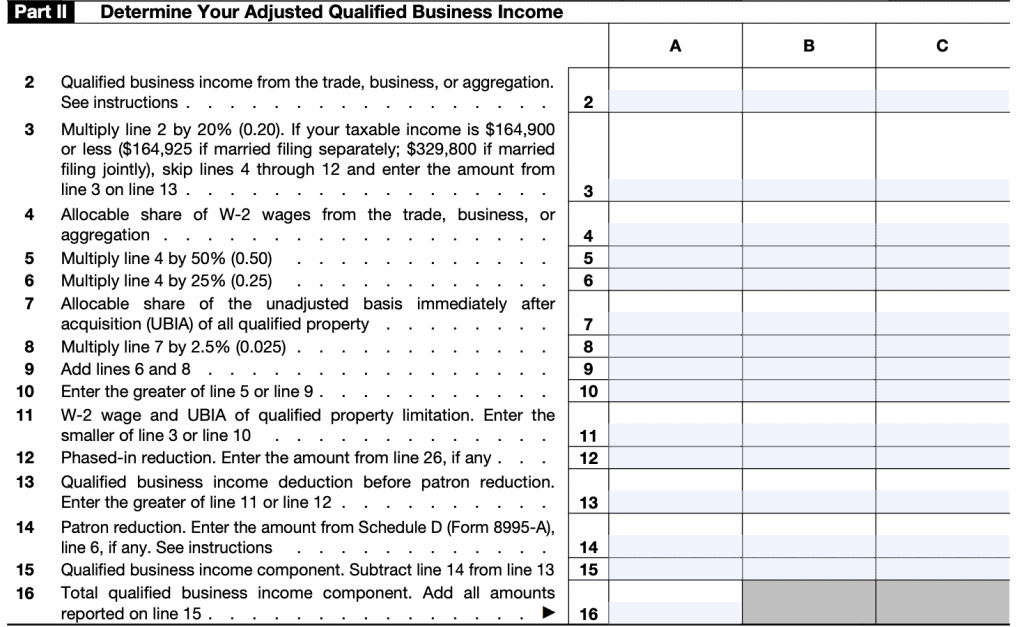

IRS Form 8995A Your Guide to the QBI Deduction

IRS Form 8995 Simplified Qualified Business Deduction

Form 8995 (Qualified Business Deduction Simplified Computation)

IRS Form 8995 walkthrough (QBI Deduction Simplified Computation) YouTube

8995/8995A Qualified business Deduction UltimateTax Solution

Irs 8995 A Form Fill Out and Sign Printable PDF Template signNow

IRS Form 8995 Simplified Qualified Business Deduction

What are REIT and PTP? Line 9 of Form 8995 Qualified Business

IRS Form 8995A Your Guide to the QBI Deduction

Related Post: