Gov Bc Ca Spectax Declaration Form

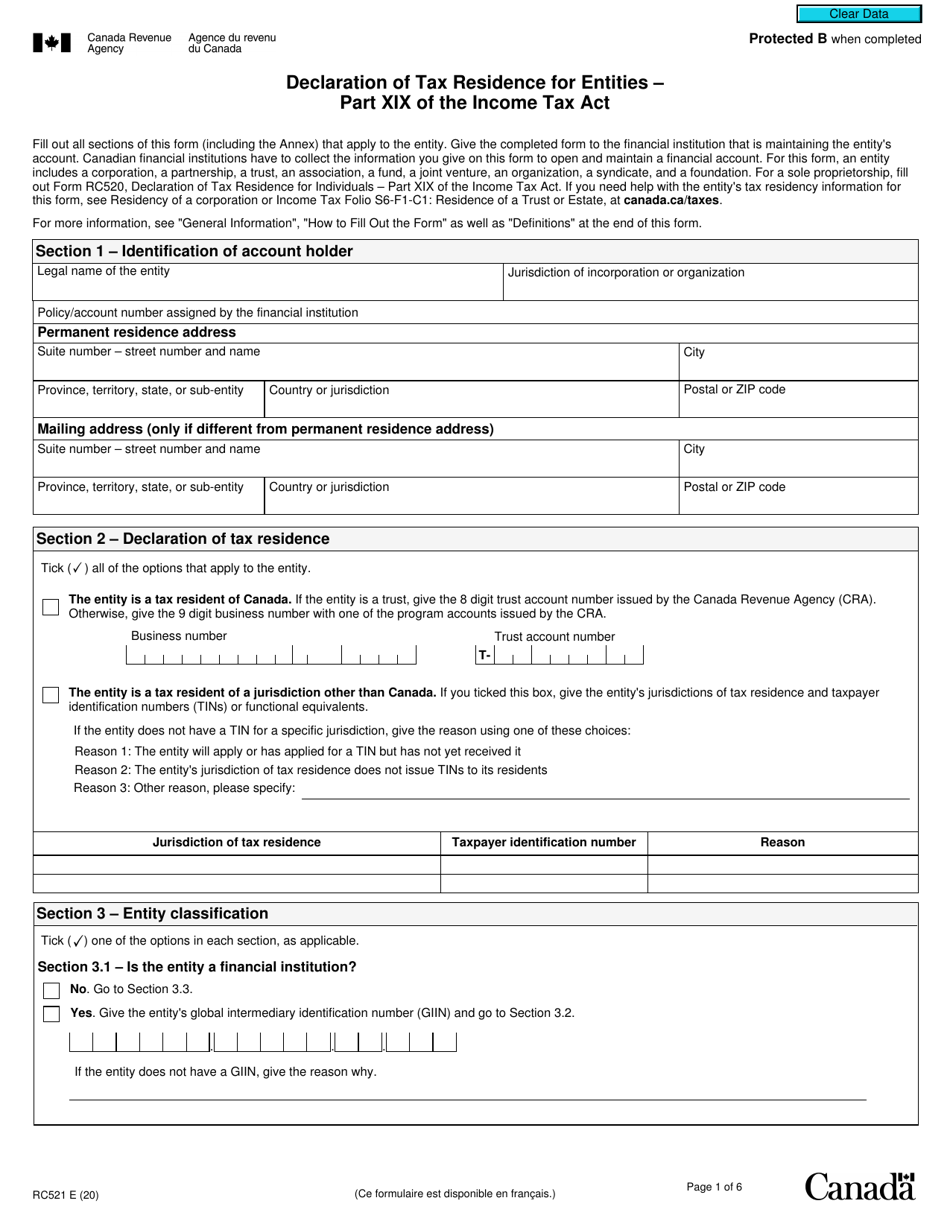

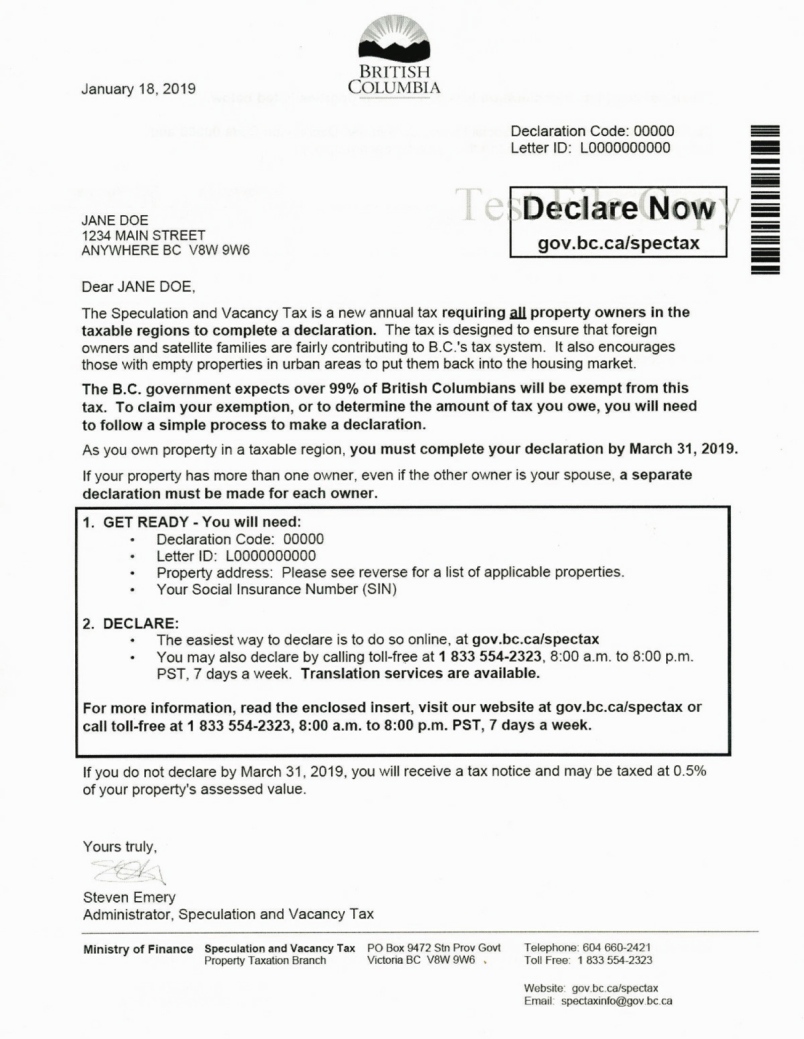

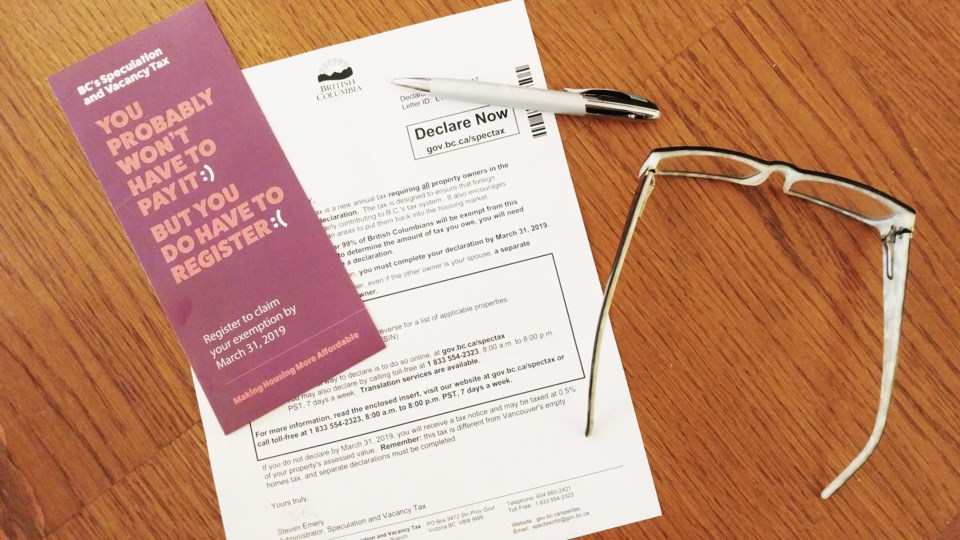

Gov Bc Ca Spectax Declaration Form - Residents, you must have submitted a declaration and meet all of the following qualifications: Web your declaration letter will include the following information: The declaration is easy to. Want to claim an exemption you didn’t claim in a. Pst, 7 days a week. More than 99% of british columbians are expected to be exempt from paying the tax. Web you may correct your speculation and vacancy tax declaration if you: Web speculation tax exemption declaration form. Owners in these areas will need to declare by march 31, 2024. Your letter id, declaration code and other information you need to declare. If your residential property falls within one of the “designated taxable regions”, as identified by the bc provincial government (below),. Web speculation tax exemption declaration form. Government announced the expansion of areas where the speculation and vacancy tax applies, beginning in the 2023 tax year (declarations for the expanded areas. The declaration is easy to. Web you may correct your. Web all owners on title must complete the declaration. Web to be eligible for the tax credit for b.c. Web the quickest way to complete a declaration is online at: If your residential property falls within one of the “designated taxable regions”, as identified by the bc provincial government (below),. Web after you declare, a notice of assessment will be. Owners in these areas will need to declare by march 31, 2024. Web all owners on title must complete the declaration. Web all owners on the title, including spouses and relatives, must complete a declaration in order to claim an exemption or to determine eligibility for a tax credit. Will receive “declaration” packages real a prompt to claim an exemption. Will receive “declaration” packages real a prompt to claim an exemption from the specific and vacancy tax. Try it for free now! If your residential property falls within one of the “designated taxable regions”, as identified by the bc provincial government (below),. Web your declaration letter will include the following information: Web the following forms are available for the speculation. You can pay the tax: Web exemptions for the speculation and vacancy tax. Web all owners on the title, including spouses and relatives, must complete a declaration in order to claim an exemption or to determine eligibility for a tax credit. Web for the purposes of the speculation and vacancy tax declaration, use income from the year before the speculation. Web the quickest way to complete a declaration is online at: Web the following forms are available for the speculation and vacancy tax. The declaration is easy to. Government announced the expansion of areas where the speculation and vacancy tax applies. Over 99 percent of people in british columbia are exempt from the speculation and vacancy tax. For example, if you’re declaring in 2020 for. Web to be eligible for the tax credit for b.c. Upload, modify or create forms. Upload, modify or create forms. Web all owners on the title, including spouses and relatives, must complete a declaration in order to claim an exemption or to determine eligibility for a tax credit. For example, if you’re declaring in 2020 for. Web how to complete your bc speculation and vacancy tax declaration | if you’re a residential property owner who hasn’t yet registered to claim your exemption to bc’s speculation. Residents, you must have submitted a declaration and meet all of the following qualifications: Depending on your circumstance, you may need to submit. Web after you declare, a notice of assessment will be generated and mailed to you only if you owe the tax. Depending on your circumstance, you may need to submit certain forms with your declaration: Web for the purposes of the speculation and vacancy tax declaration, use income from the year before the speculation and vacancy tax year. Web your. Web the quickest way to complete a declaration is online at: Web your declaration letter will include the following information: More than 99% of british columbians are expected to be exempt from paying the tax. Upload, modify or create forms. Depending on your circumstance, you may need to submit certain forms with your declaration: Try it for free now! You can pay the tax: For example, if you’re declaring in 2020 for. Web your declaration letter will include the following information: Web all owners on title must complete the declaration. Pst, 7 days a week. Owners in these areas will need to declare by march 31, 2024. Through your bank or financial. Web you may correct your speculation and vacancy tax declaration if you: More than 99% of british columbians are expected to be exempt from paying the tax. As of december 31, you were a resident of. Web after you declare, a notice of assessment will be generated and mailed to you only if you owe the tax. A list of all the residential properties. Will receive “declaration” packages real a prompt to claim an exemption from the specific and vacancy tax. Made an error to a declaration you already submitted. Government announced the expansion of areas where the speculation and vacancy tax applies, beginning in the 2023 tax year (declarations for the expanded areas. Want to claim an exemption you didn’t claim in a. Residential property owners who do not complete their declaration before april 1, 2019, will receive a tax notice of. Web the quickest way to complete a declaration is online at: Government announced the expansion of areas where the speculation and vacancy tax applies.Form RC521 Download Fillable PDF or Fill Online Declaration of Tax

Canada ICBC MV2943 British Columbia 20182022 Fill and Sign

Medical Declaration Form 3 Free Templates in PDF, Word, Excel Download

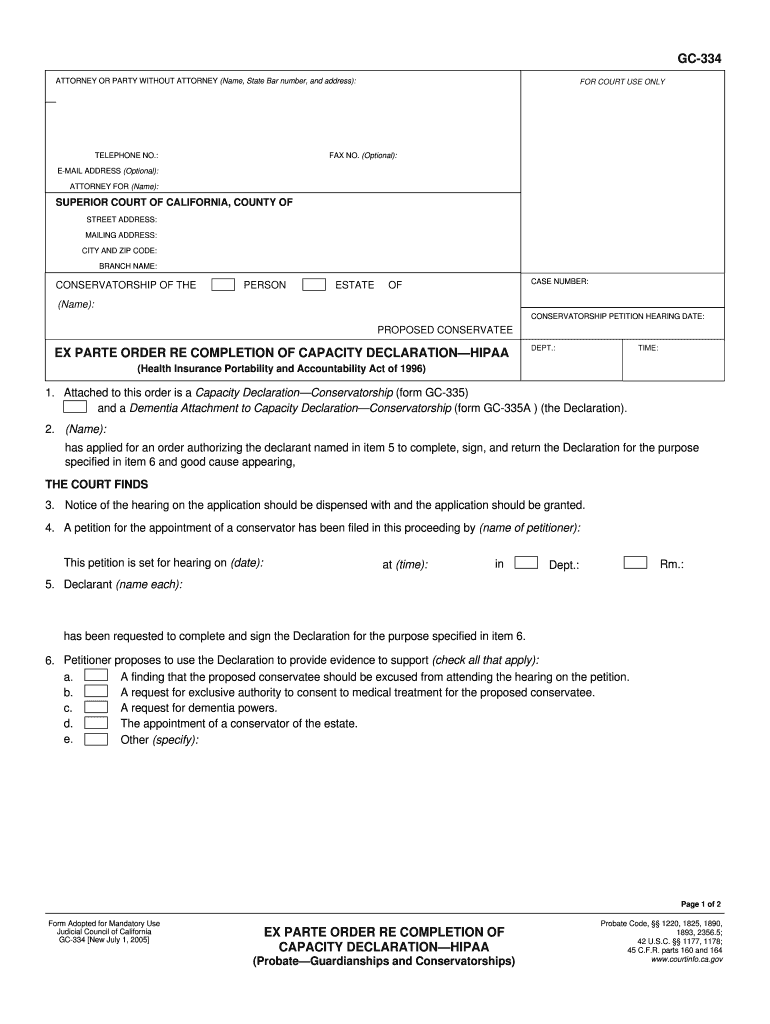

California Capacity Declaration Pdf Fill Online, Printable, Fillable

Employer Declaration Canada Free Download

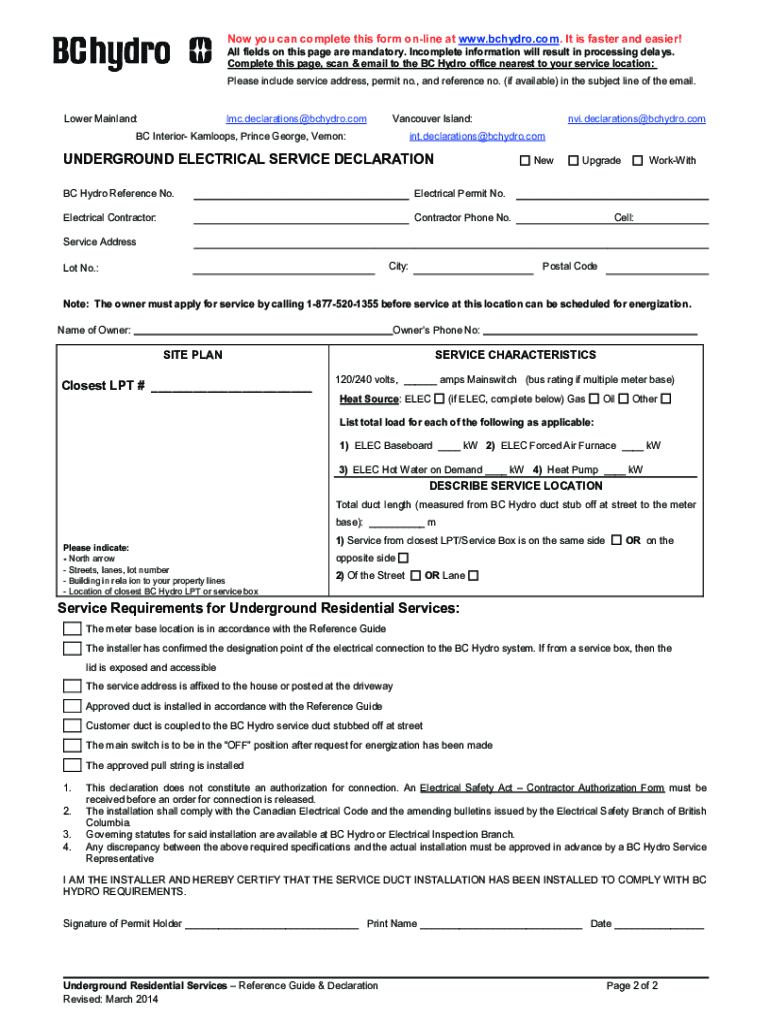

Bc Hydro Declaration Form Fill Online, Printable, Fillable, Blank

Declaration Letter Sample

British Columbia realestate and foreign buyer taxes Page 38

Mc 031 Form California Fill Online, Printable, Fillable, Blank

Letter B.C. government committing a SIN in speculation tax form Tri

Related Post: