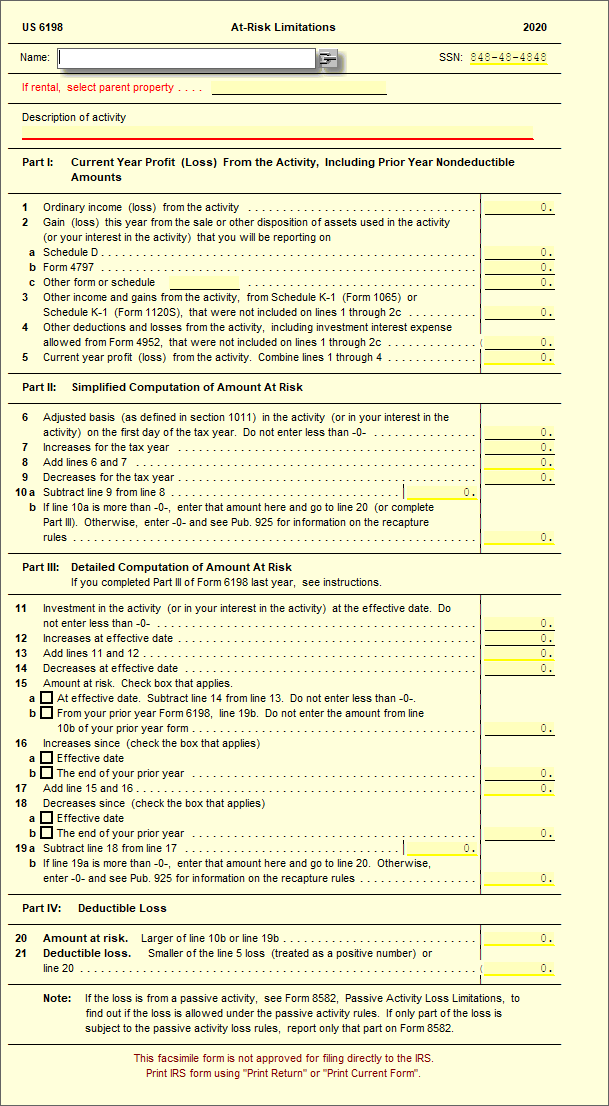

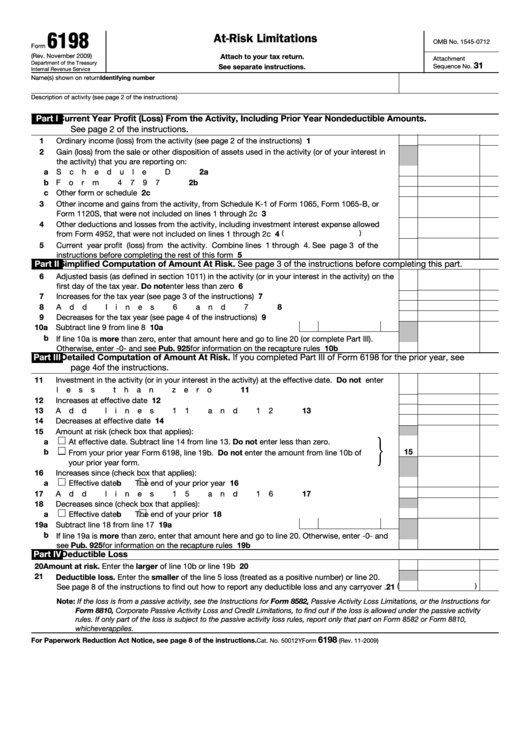

At Risk Limitations Form 6198

At Risk Limitations Form 6198 - December 2020) department of the treasury internal revenue service. If you completed part iii of form 6198 for the prior year, see the instructions. Second, the partner's amount at risk under. Form 6198 is used by individuals, estates, trusts, and certain corporations to. Web at risk for qualified nonrecourse under amounts not at risk. The following rules apply to amounts borrowed after may 3, 2004. Generally, any loss from an activity (such as a. Investment in the activity (or in your interest in the. Ad iluvenglish.com has been visited by 10k+ users in the past month Form 6198 should be filed when a taxpayer has a loss in a. Form 6198 should be filed when a taxpayer has a loss in a. December 2020) department of the treasury internal revenue service. Generally, any loss from an activity (such as a. Web form 6198 consists of four sections and allows you to: Make an assessment of the amount at risk in the business. You must file form 6198 if you are engaged in an activity included in (6) financing secured by real property used. Web part iii detailed computation of amount at risk. Estimate your current year's business losses. Form 6198 should be filed when a taxpayer has a loss in a. Generally, any loss from an activity (such as a. Generally, any loss from an activity (such as a. December 2020) department of the treasury internal revenue service. Second, the partner's amount at risk under. The following rules apply to amounts borrowed after may 3, 2004. Ad iluvenglish.com has been visited by 10k+ users in the past month Web part iii detailed computation of amount at risk. Go to the income/deductions > business. Generally, any loss from an activity (such as a. Form 6198 isn't currently supported in the fiduciary module, and must be. Investment in the activity (or in your interest in the. Investment in the activity (or in your interest in the. Ad iluvenglish.com has been visited by 10k+ users in the past month Attach to your tax return. 345 views 1 month ago tax forms. You can download or print current or past. 345 views 1 month ago tax forms. Estimate your current year's business losses. December 2020) department of the treasury internal revenue service. Web page last reviewed or updated: Generally, any loss from an activity (such as a. Go to the income/deductions > business. Attach to your tax return. December 2020) department of the treasury internal revenue service. If you completed part iii of form 6198 for the prior year, see the instructions. Web these rules and the order in which they apply are: Go to the income/deductions > business. You must file form 6198 if you are engaged in an activity included in (6) financing secured by real property used. Web part iii detailed computation of amount at risk. Generally, any loss from an activity (such as a. Generally, any loss from an activity (such as a. Ad iluvenglish.com has been visited by 10k+ users in the past month Web part iii detailed computation of amount at risk. Generally, any loss from an activity (such as a. Second, the partner's amount at risk under. Attach to your tax return. Web at risk for qualified nonrecourse under amounts not at risk. Web these rules and the order in which they apply are: Form 6198 isn't currently supported in the fiduciary module, and must be. Make an assessment of the amount at risk in the business. The following rules apply to amounts borrowed after may 3, 2004. December 2020) department of the treasury internal revenue service. Form 6198 should be filed when a taxpayer has a loss in a. Form 6198 isn't currently supported in the fiduciary module, and must be. The following rules apply to amounts borrowed after may 3, 2004. Investment in the activity (or in your interest in the. Form 6198 is used by individuals, estates, trusts, and certain corporations to. Make an assessment of the amount at risk in the business. Go to the income/deductions > business. Attach to your tax return. First, the adjusted tax basis of the partnership interest under sec. Web page last reviewed or updated: Ad iluvenglish.com has been visited by 10k+ users in the past month Generally, any loss from an activity (such as a. If you completed part iii of form 6198 for the prior year, see the instructions. Web form 6198 consists of four sections and allows you to: Estimate your current year's business losses. Attach to your tax return. Ad pdffiller.com has been visited by 1m+ users in the past month 345 views 1 month ago tax forms. You can download or print current or past.6198 AtRisk Limitations UltimateTax Solution Center

IRS "AtRisk" Overview TaxBuzz

Form 6198 Instructions Fill Out and Sign Printable PDF Template signNow

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Form 6198 AtRisk Limitations (2009) Free Download

2007 Tax Form 6198 At

Medical restrictions form Fill out & sign online DocHub

IRS Form 6198 walkthrough (AtRisk Limitations) YouTube

FREE 10+ Acknowledgment of Risks Forms in PDF MS Word

Fillable Form 6198 AtRisk Limitations printable pdf download

Related Post: