Form 4563 Irs

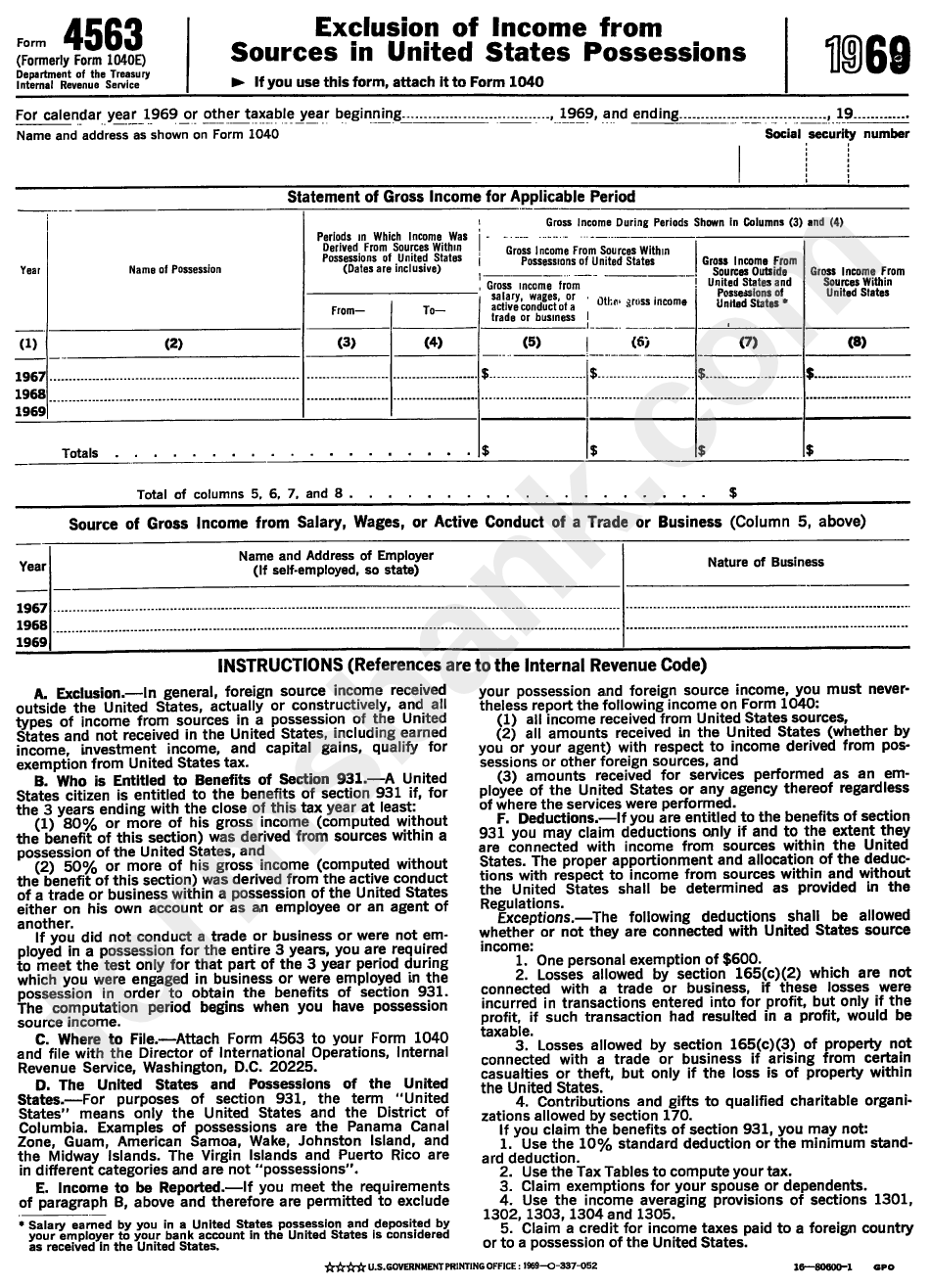

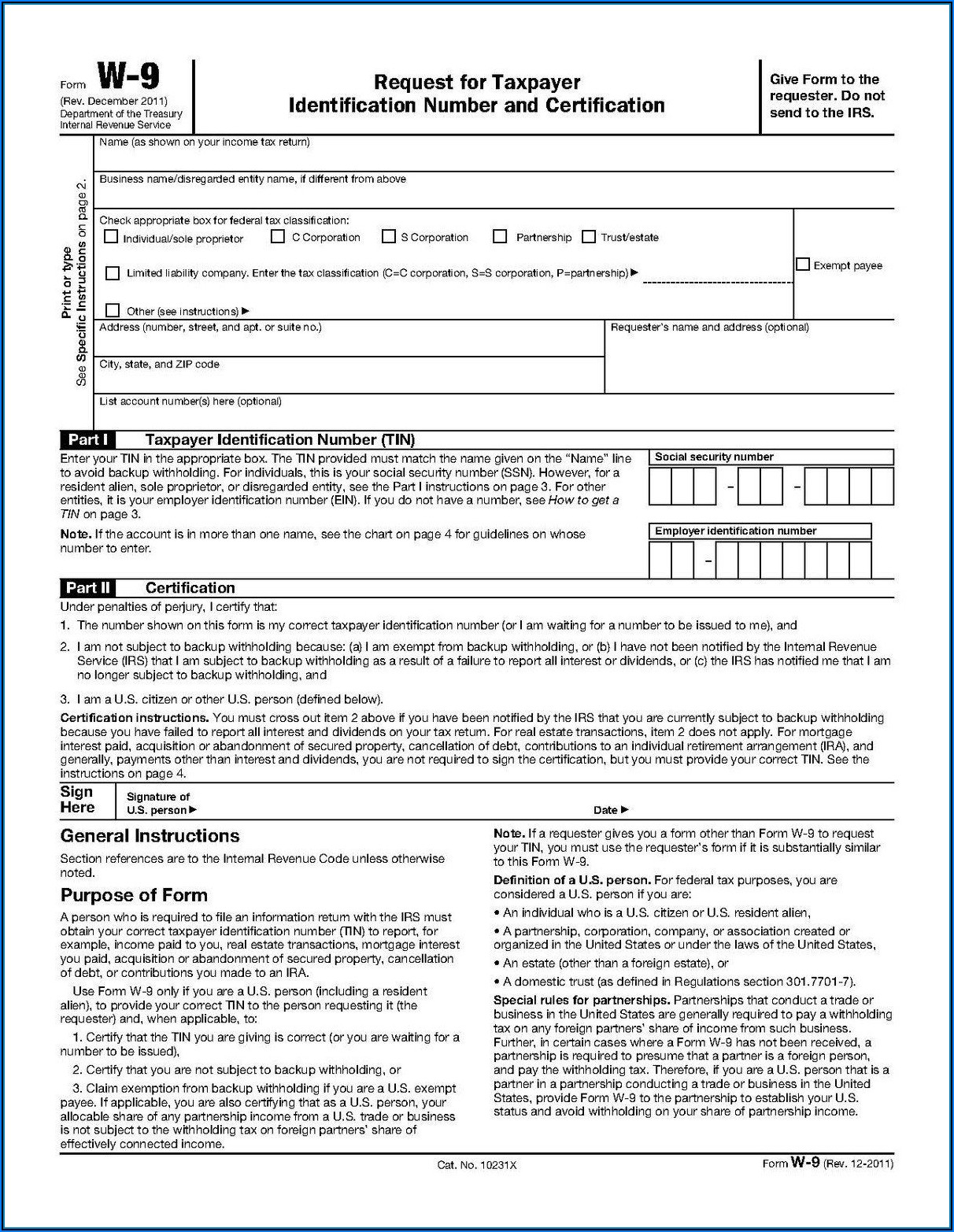

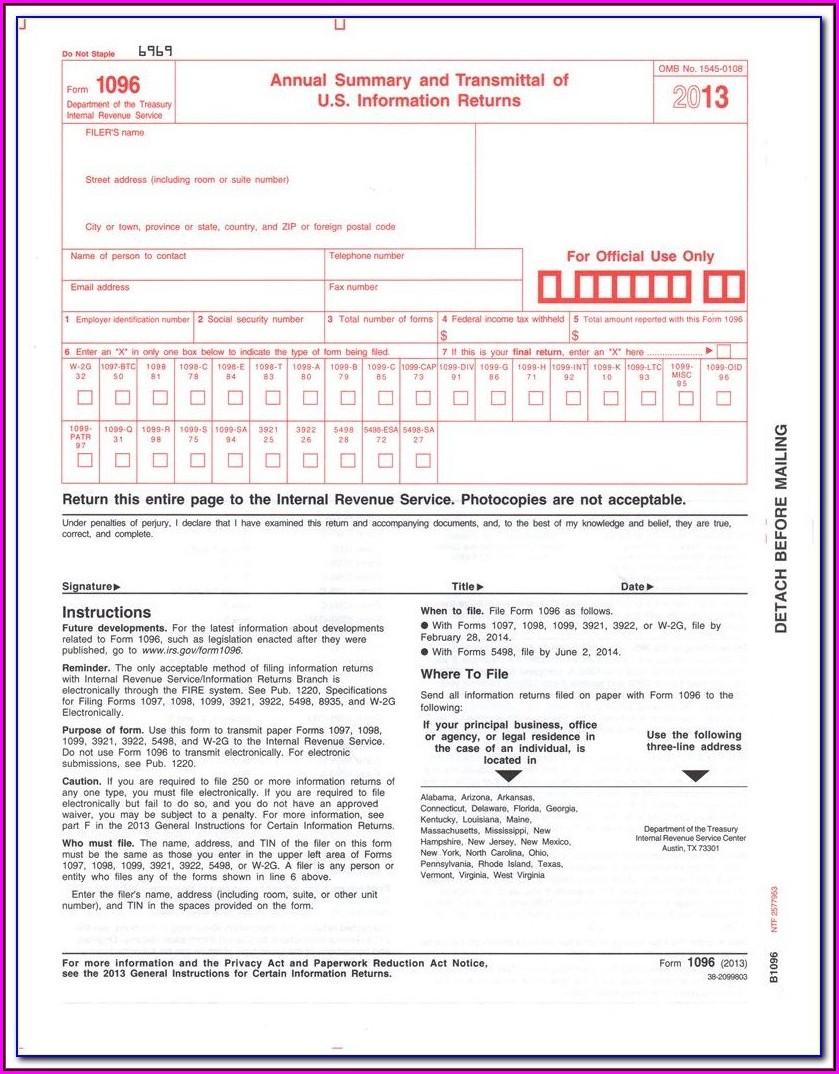

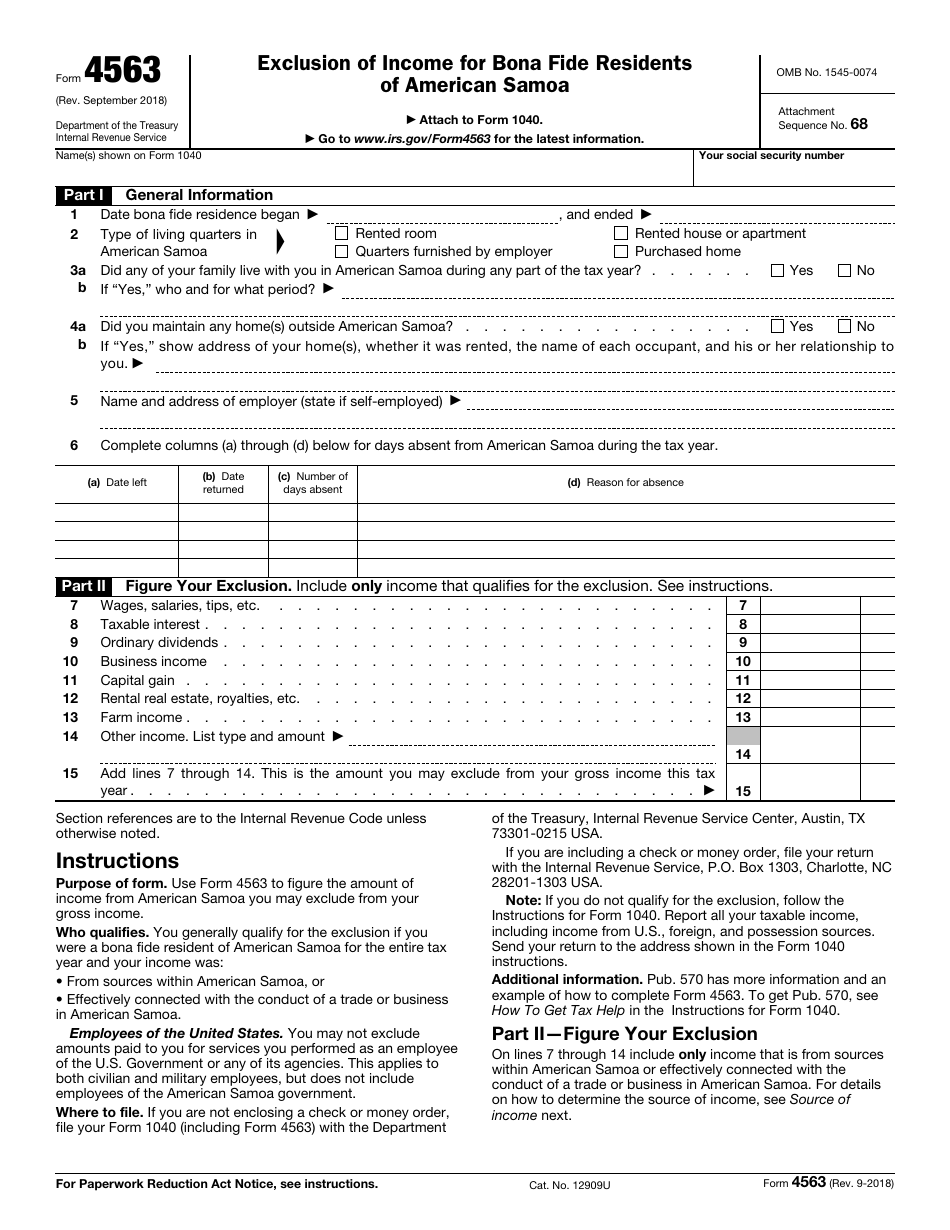

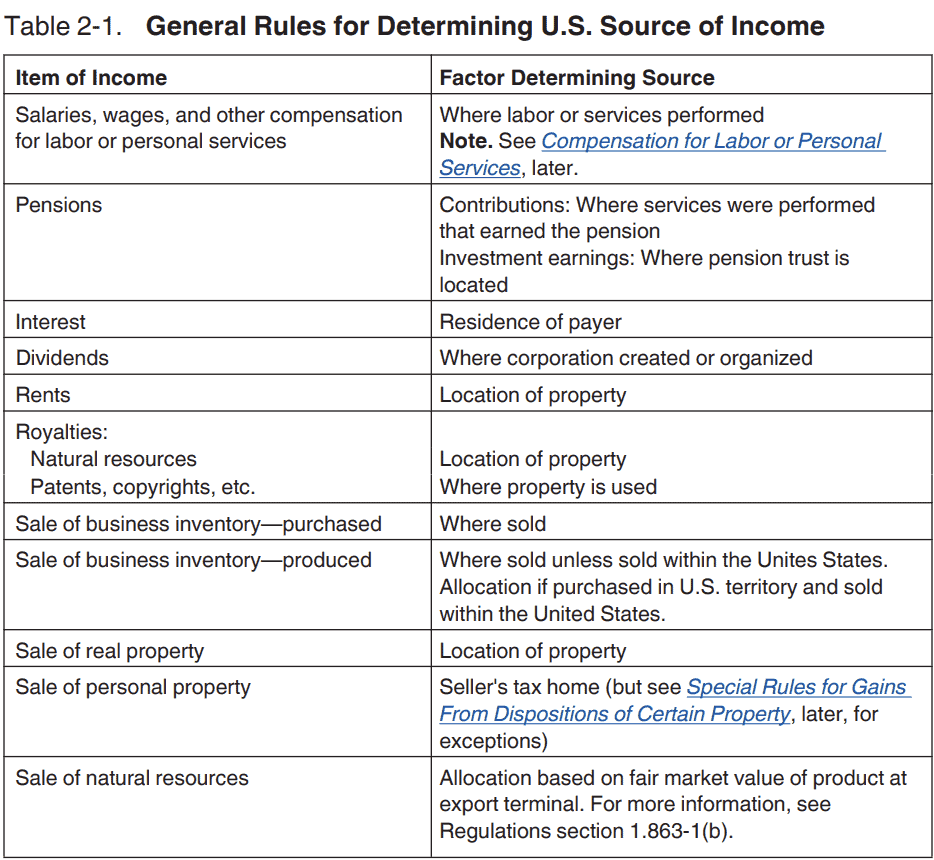

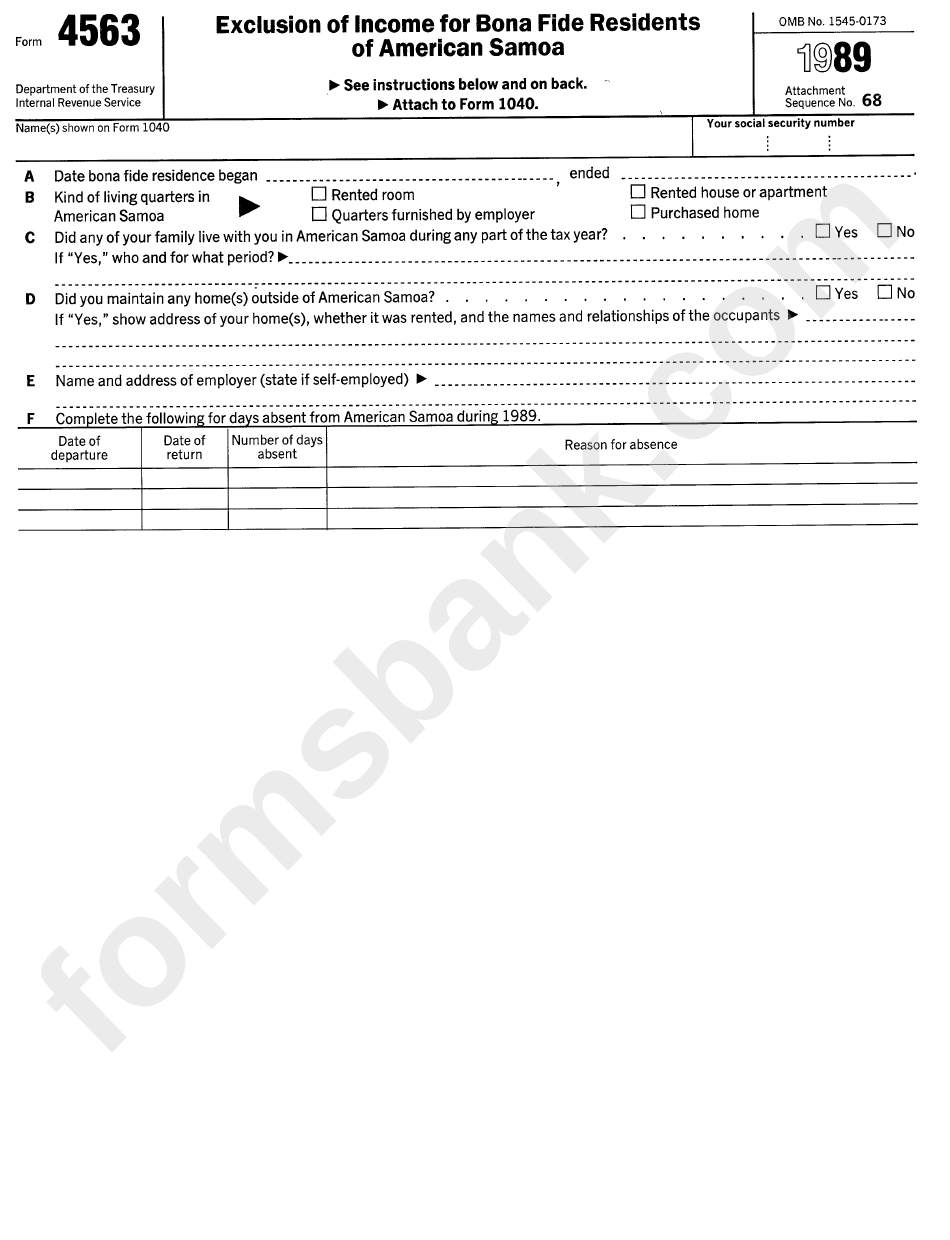

Form 4563 Irs - You generally qualify for the. In this form, one can. If you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. Request for taxpayer identification number (tin) and. Web complete form 4563 and attach it to your form 1040. Form 4563 is used by residents of american samoa to figure the amount of income they may exclude from. Web claim for empire state child credit. Web collect the right amount of tax. Web federal exclusion of income for bona fide residents of american samoa form 4563 pdf form content report error it appears you don't have a pdf plugin for this browser. Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Web claim for empire state child credit. Form 4563 or also known as exclusion of income for bona fide residents of american samoa is a tax form created and distributed by the irs that.. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Income you must report on form 1040. Who qualifies the time needed to complete. Or are excluding income from. Web claim for empire state child credit. In this form, one can. If you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service attach to form 1040 or. Use form 4563 to figure the amount of income from american samoa. Income you must report on form 1040. August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service attach to form 1040 or. Form 4562 is used to. Web tax form 4563 was released by the irs on august 1st, 2019. Use form 4563 to figure the amount of income from american. Form 4563 or also known as exclusion of income for bona fide residents of american samoa is a tax form created and distributed by the irs that. Web tax form 4563 was released by the irs on august 1st, 2019. Income you must report on form 1040. Exclusion of income for bona fide residents of american samoa keywords: Web page. Estimate how much you could potentially save in just a matter of minutes. For personal income tax purposes, nys has decoupled from federal changes made to the internal revenue code (irc). Web however, if you're filing form 2555, foreign earned income; Income you must report on form 1040. Enter the ale member’s complete address (including. Individual tax return form 1040 instructions; Essentially this tax form is the exclusion of income for bonafide residents of america samoa. You generally qualify for the. Web however, if you're filing form 2555, foreign earned income; Enter the ale member’s complete address (including. Individual tax return form 1040 instructions; Web page last reviewed or updated: Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. Form 4563 is used by residents of american samoa to figure the amount of income they may exclude from. Who qualifies the time needed to complete and file this. Web fillable form irs 4563. One is eligible to file. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Web collect the right amount of tax. You generally qualify for the. Who qualifies the time needed to complete and file this form will vary. Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. You must report on form 1040 your worldwide income for the tax year that does. Individual tax return form 1040 instructions; Essentially this tax form. Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Estimate how much you could potentially save in just a matter of minutes. Who qualifies the time needed to complete. Web fillable form irs 4563. Exclusion of income for bona fide residents of american samoa keywords: Request for taxpayer identification number (tin) and. Web federal exclusion of income for bona fide residents of american samoa form 4563 pdf form content report error it appears you don't have a pdf plugin for this browser. Essentially this tax form is the exclusion of income for bonafide residents of america samoa. Individual tax return form 1040 instructions; Or form 4563, exclusion of income for bona fide residents of american samoa; Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. One is eligible to file. Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. Web page last reviewed or updated: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web complete form 4563 and attach it to your form 1040. In this form, one can. Or are excluding income from. Income you must report on form 1040.Form 4563 (1969) Exclusion Of From Sources In United States

Form 4563 Exclusion of for Bona Fide Residents of American

Irs Downloadable Tax Forms Form Resume Examples dP9lygDYRD

Irs 1096 Forms Form Resume Examples 3q9JkxZ4YA

IRS Form 4563 Download Fillable PDF or Fill Online Exclusion of

Form 8863 Education Credits (American Opportunity and Lifetime

IRS Form 4563 Exclusion For Residents of American Samoa

IRS Form 4563 Exclusion For Residents of American Samoa

Form 4563 (1989) Exclusion Of For Bona Fide Residents Of

Form 4563 Exclusion of for Bona Fide Residents of American

Related Post:

:max_bytes(150000):strip_icc()/form-4563.asp-final-ac1376da2b4b40fdad50d2c593a18d9c.png)