Fidelity Tax Form Schedule

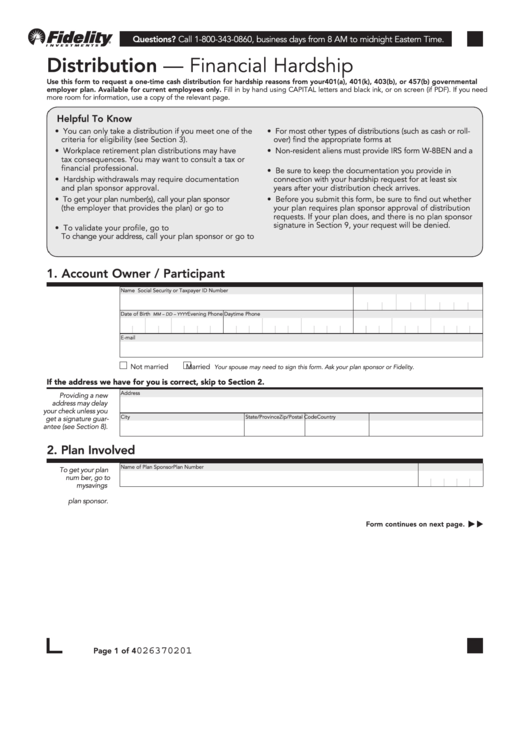

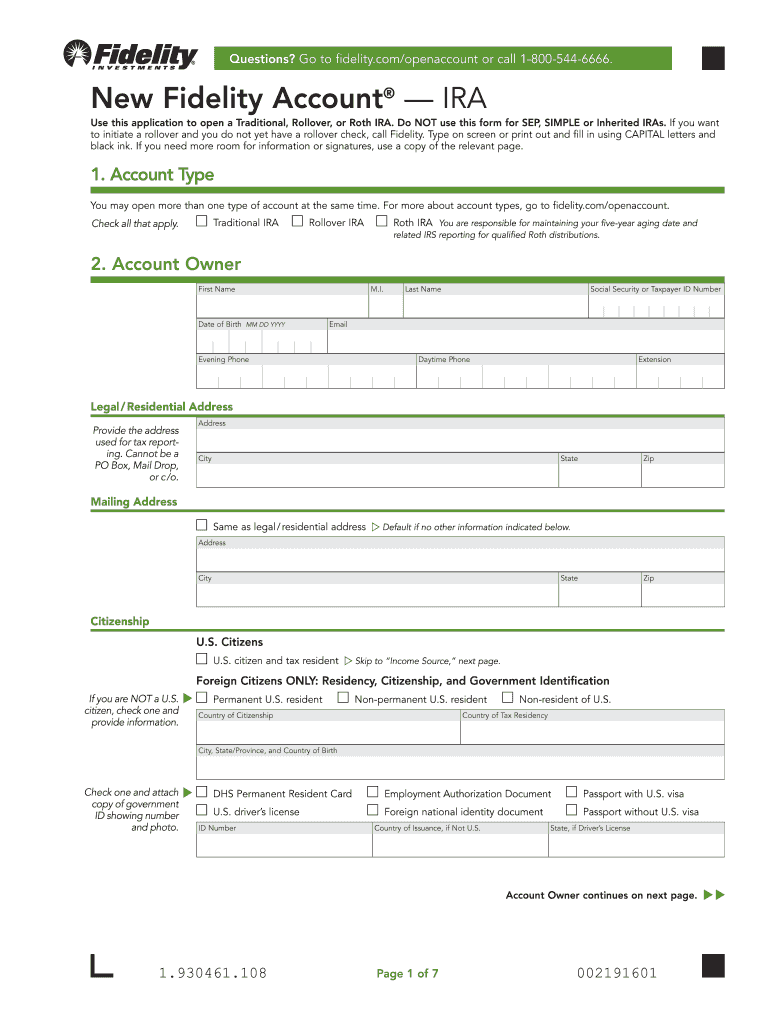

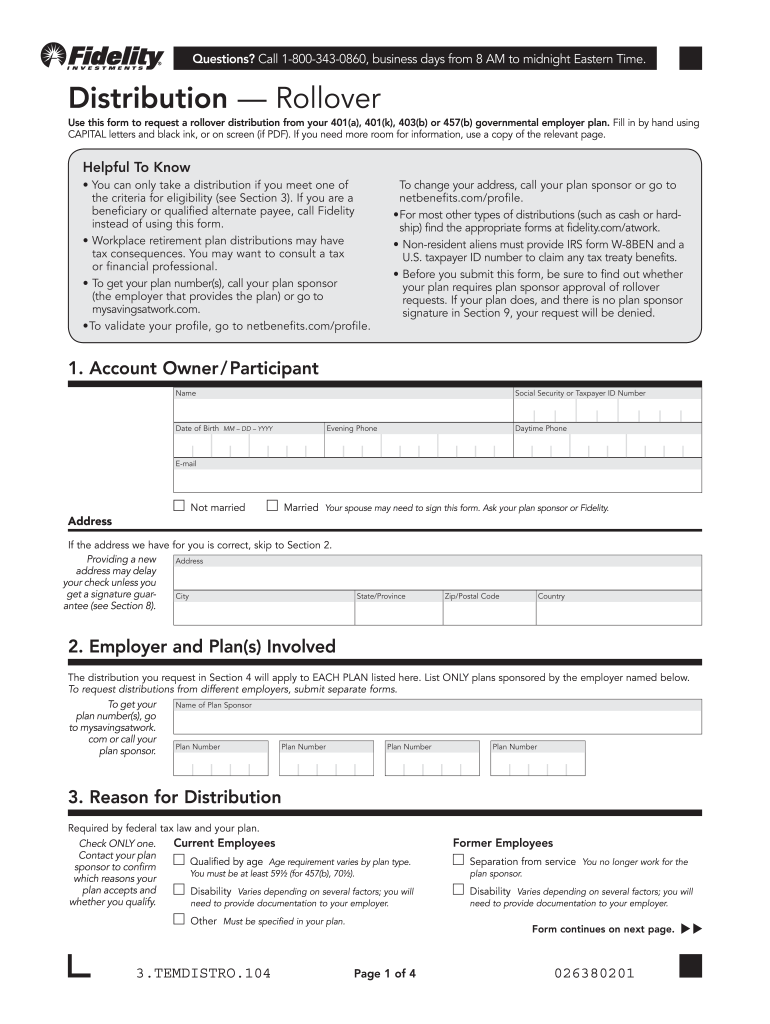

Fidelity Tax Form Schedule - Web tax form schedule* depending on the type of account of type of account you own and your account activity during the tax year, you may receive a tax form from. Web please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. Irs free file if your adjusted gross income 1 is $73,000 or less, you could file a free electronic federal return with irs free file. Web tax form schedule and definitions: Investing involves risk, including risk of loss. Learn 8 key things to look for on your consolidated 1099 tax statement. Web in the instructions for schedule 1 of form 1040, the irs has made it clear that the section “other income” on schedule 1 is where any employee stock option income that is not on. The following chart shows the mailing schedules for all the forms. Earlier this year, the u.s. *please refer to fidelity.com to see when your tax form will be available. Web tax year 2023 940 mef ats scenario 3 crocus company. Ad build your own mix of investments to invest for income or growth. 1099s have different availability dates depending on the securities. Find tax information for domestic and international fidelity mutual funds. Web schedule a time to meet. Web fidelity investments offers financial planning and advice, retirement plans, wealth management services, trading and brokerage services, and a wide range of investment. Ad build your own mix of investments to invest for income or growth. Be sure to wait until you receive all your forms and documents. The following chart shows the mailing schedules for all the forms. 1099s. Complete, edit or print tax forms instantly. Web how to file taxes if you diy 1. Web tax form schedule* depending on the type of account of type of account you own and your account activity during the tax year, you may receive a tax form from. In addition, complete and attach schedule. Web please carefully consider the plan's investment. The plan must and balance data loaded and correct be. However, if you do a rollover, you may not have to pay tax until you receive. After logging in to the site, under account type, click on the account and then click on tax. Ad get deals and low prices on turbo tax online at amazon. Web fidelity investments offers. Ad build your own mix of investments to invest for income or growth. Explore the collection of software at amazon & take your skills to the next level. Find tax information for domestic and international fidelity mutual funds. The plan must and balance data loaded and correct be. Earlier this year, the u.s. Web fidelity investments offers financial planning and advice, retirement plans, wealth management services, trading and brokerage services, and a wide range of investment. Web understanding your 1099 tax form. Web in the instructions for schedule 1 of form 1040, the irs has made it clear that the section “other income” on schedule 1 is where any employee stock option income. Ad build your own mix of investments to invest for income or growth. Get ready for tax season deadlines by completing any required tax forms today. Web under the voluntary simplified reporting option, plans with less than 25 employees must complete and attach schedules r and i. Investing involves risk, including risk of loss. Web starting early can pay off. Be sure to wait until you receive all your forms and documents. Learn 8 key things to look for on your consolidated 1099 tax statement. *please refer to fidelity.com to see when your tax form will be available. Web fidelity investments offers financial planning and advice, retirement plans, wealth management services, trading and brokerage services, and a wide range of. Ad get deals and low prices on turbo tax online at amazon. However, if you do a rollover, you may not have to pay tax until you receive. Department of labor (dol), internal revenue. Web tax form schedule* depending on the type of account of type of account you own and your account activity during the tax year, you may. • form 940 • form 940 schedule r. After logging in to the site, under account type, click on the account and then click on tax. Web also have to pay a 10% additional income tax on early distributions (unless an exception applies). Irs free file if your adjusted gross income 1 is $73,000 or less, you could file a. Web fidelity investments offers financial planning and advice, retirement plans, wealth management services, trading and brokerage services, and a wide range of investment. *please refer to fidelity.com to see when your tax form will be available. Planning for mutual fund taxes. Web understanding your 1099 tax form. Department of labor (dol), internal revenue. Helps you determine the maximum elective salary deferral. Web changes for the form 5500. Earlier this year, the u.s. View an interactive illustration of schedule d. Explore the collection of software at amazon & take your skills to the next level. 2022 fidelity tax form schedule review the dates standard tax. Web schedule automatic withdrawals from your fidelity accounts, including withdrawal plans for rmds and earnings. Web how to file taxes if you diy 1. Web under the voluntary simplified reporting option, plans with less than 25 employees must complete and attach schedules r and i. Irs free file if your adjusted gross income 1 is $73,000 or less, you could file a free electronic federal return with irs free file. 1099s have different availability dates depending on the securities. Web also have to pay a 10% additional income tax on early distributions (unless an exception applies). However, if you do a rollover, you may not have to pay tax until you receive. Web tax year 2023 940 mef ats scenario 3 crocus company. The plan must and balance data loaded and correct be.Fidelity Form Rollover Fill Out and Sign Printable PDF Template signNow

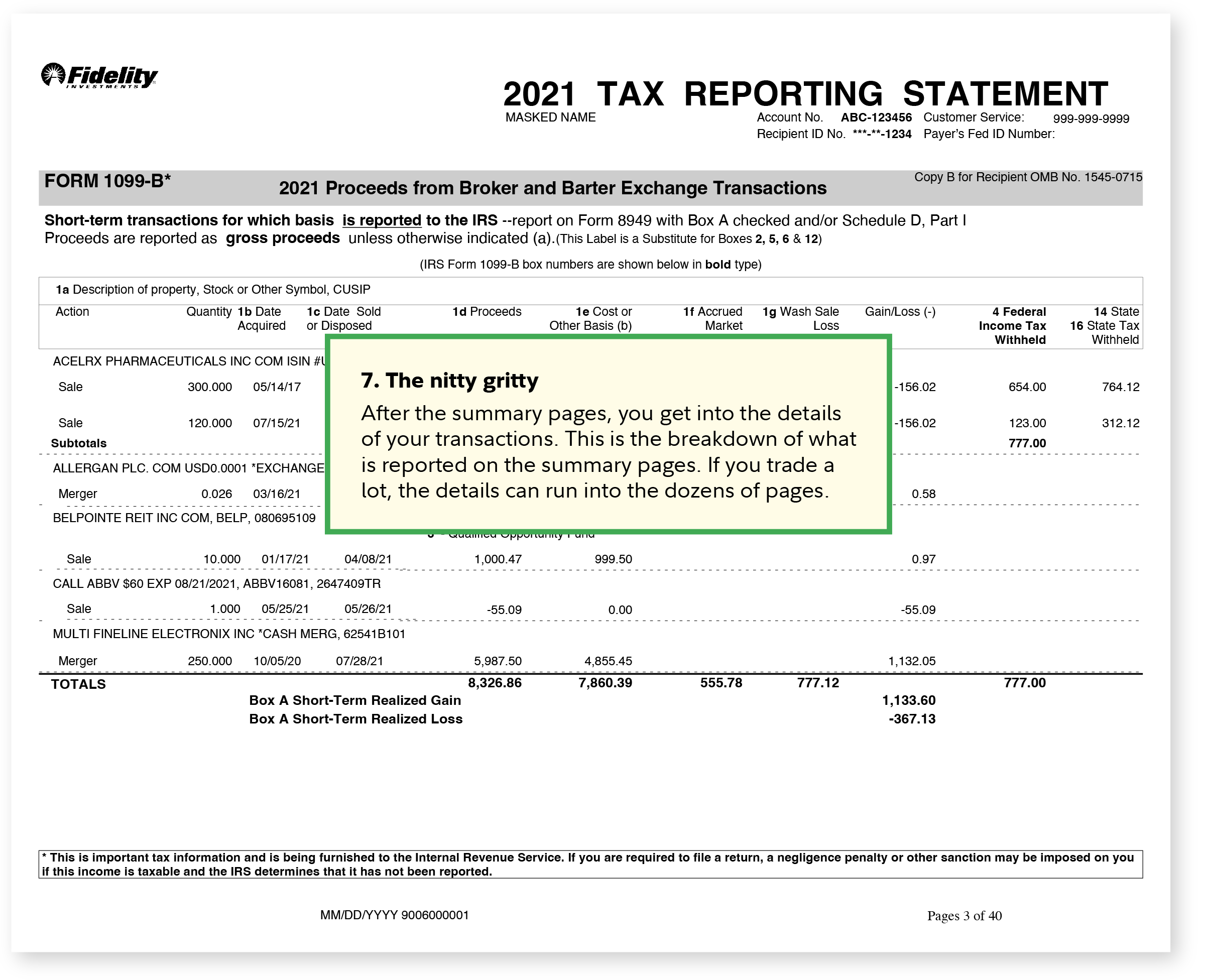

1099 tax form 1099 Fidelity

Federal Withholding Tax Tables For Pensions Review Home Decor

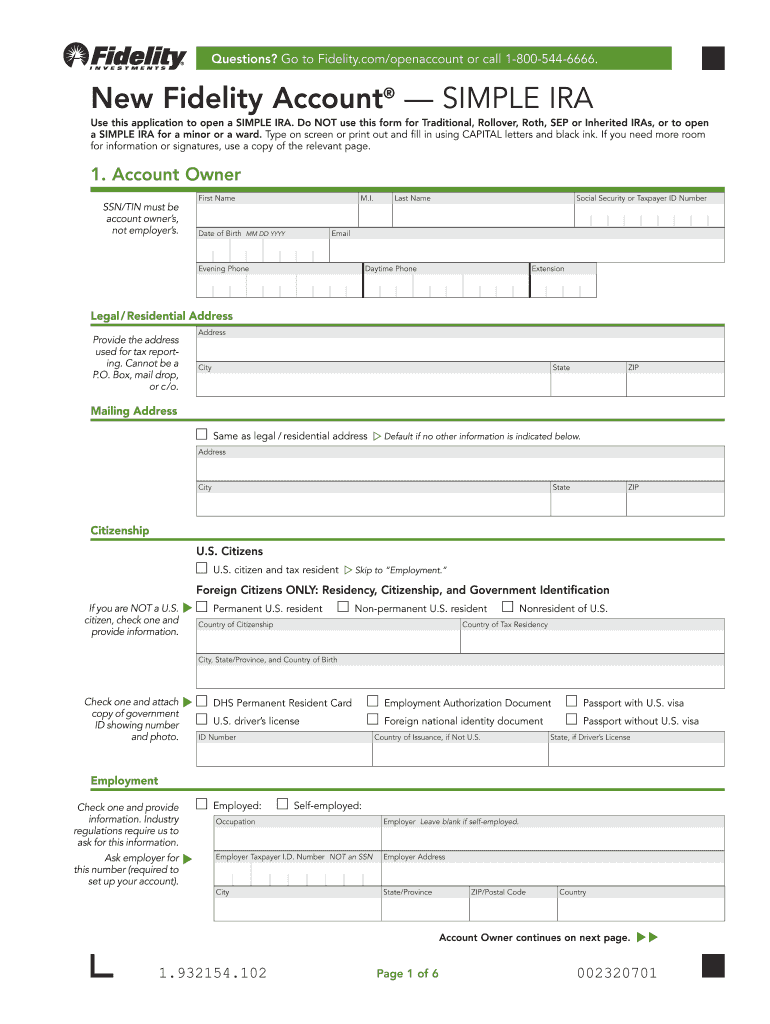

Fidelity Simple Ira Login Form Fill Out and Sign Printable PDF

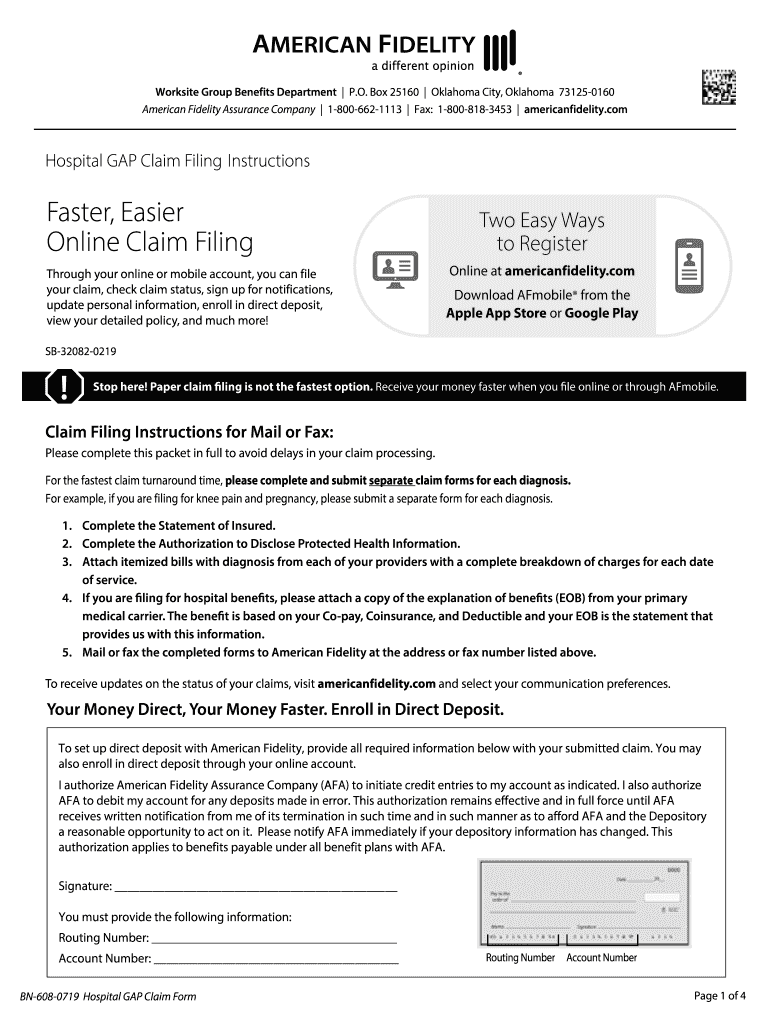

American Fidelity BN608 2019 Fill and Sign Printable Template Online

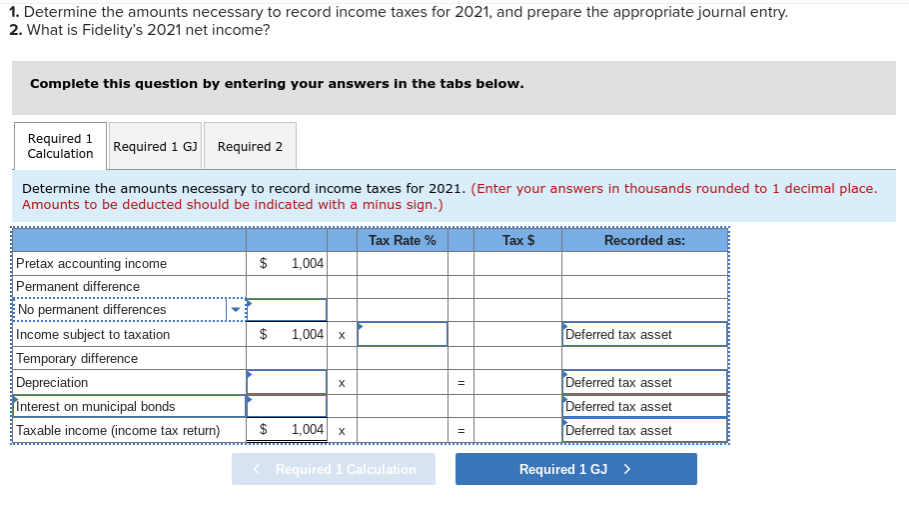

Solved For the year ended December 31, 2021, Fidelity

Fidelity Tax Forms YouTube

Top 6 Fidelity Forms And Templates free to download in PDF format

1099 tax form 1099 Fidelity

Fidelity forms Fill out & sign online DocHub

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png?resize=1040%2C688&ssl=1)