Form 1099 General Instructions

Form 1099 General Instructions - We don’t provide tax advisory services. You are not engaged in a trade or business. For more information, see section 40 and form 6478. Web about general instructions for certain information returns. • a new tax credit is allowed for cellulosic biofuel produced after 2008. The irs’s draft 2023 general instructions for information returns include information on the new iris portal. Web this guide is compiled from reliable sources and is provided for general guidance purposes only. Web you can get the general instructions from general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099g. Regardless of whether the interest is reported to you, report it as interest income on your tax return. We recommend you consult with your tax. You are engaged in a. You are not engaged in a trade or business. Web the irs encourages this. The general instructions for certain information returns contain broad information concerning forms 1097,. For more information, see section 40 and form 6478. We don’t provide tax advisory services. The portal is to open for filing and. The general instructions for certain information returns contain broad information concerning forms 1097,. Web about general instructions for certain information returns. You are not engaged in a trade or business. Web information to help you understand your tax forms. The general instructions for certain information returns contain broad information concerning forms 1097,. We recommend you consult with your tax. You are not engaged in a trade or business. • a new tax credit is allowed for cellulosic biofuel produced after 2008. Web information to help you understand your tax forms. Regardless of whether the interest is reported to you, report it as interest income on your tax return. We recommend you consult with your tax. We don’t provide tax advisory services. • a new tax credit is allowed for cellulosic biofuel produced after 2008. Web you can get the general instructions from general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099g. We don’t provide tax advisory services. For more information, see section 40 and form 6478. Web you are not required to file information return (s) if any of the following situations apply: The irs’s draft 2023 general instructions for information. For more information, see section 40 and form 6478. Web this guide is compiled from reliable sources and is provided for general guidance purposes only. You are engaged in a. The portal is to open for filing and. • a new tax credit is allowed for cellulosic biofuel produced after 2008. Web about general instructions for certain information returns. Web this guide is compiled from reliable sources and is provided for general guidance purposes only. For more information, see section 40 and form 6478. Web you can get the general instructions from general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099g. The form reports the interest income you. Web information to help you understand your tax forms. The irs’s draft 2023 general instructions for information returns include information on the new iris portal. Regardless of whether the interest is reported to you, report it as interest income on your tax return. • a new tax credit is allowed for cellulosic biofuel produced after 2008. The portal is to. We don’t provide tax advisory services. We recommend you consult with your tax. The form reports the interest income you. Regardless of whether the interest is reported to you, report it as interest income on your tax return. Web information to help you understand your tax forms. The form reports the interest income you. The irs’s draft 2023 general instructions for information returns include information on the new iris portal. The portal is to open for filing and. You are engaged in a. You are not engaged in a trade or business. Web the irs encourages this. We don’t provide tax advisory services. Web information to help you understand your tax forms. Regardless of whether the interest is reported to you, report it as interest income on your tax return. • a new tax credit is allowed for cellulosic biofuel produced after 2008. You are not engaged in a trade or business. Web this guide is compiled from reliable sources and is provided for general guidance purposes only. Web you can get the general instructions from general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099g. Web you are not required to file information return (s) if any of the following situations apply: The general instructions for certain information returns contain broad information concerning forms 1097,. The form reports the interest income you. • the current general instructions for certain information returns, and Web about general instructions for certain information returns. We recommend you consult with your tax. You are engaged in a. The portal is to open for filing and. The irs’s draft 2023 general instructions for information returns include information on the new iris portal. For more information, see section 40 and form 6478.What Is A 1099? Explaining All Form 1099 Types CPA Solutions

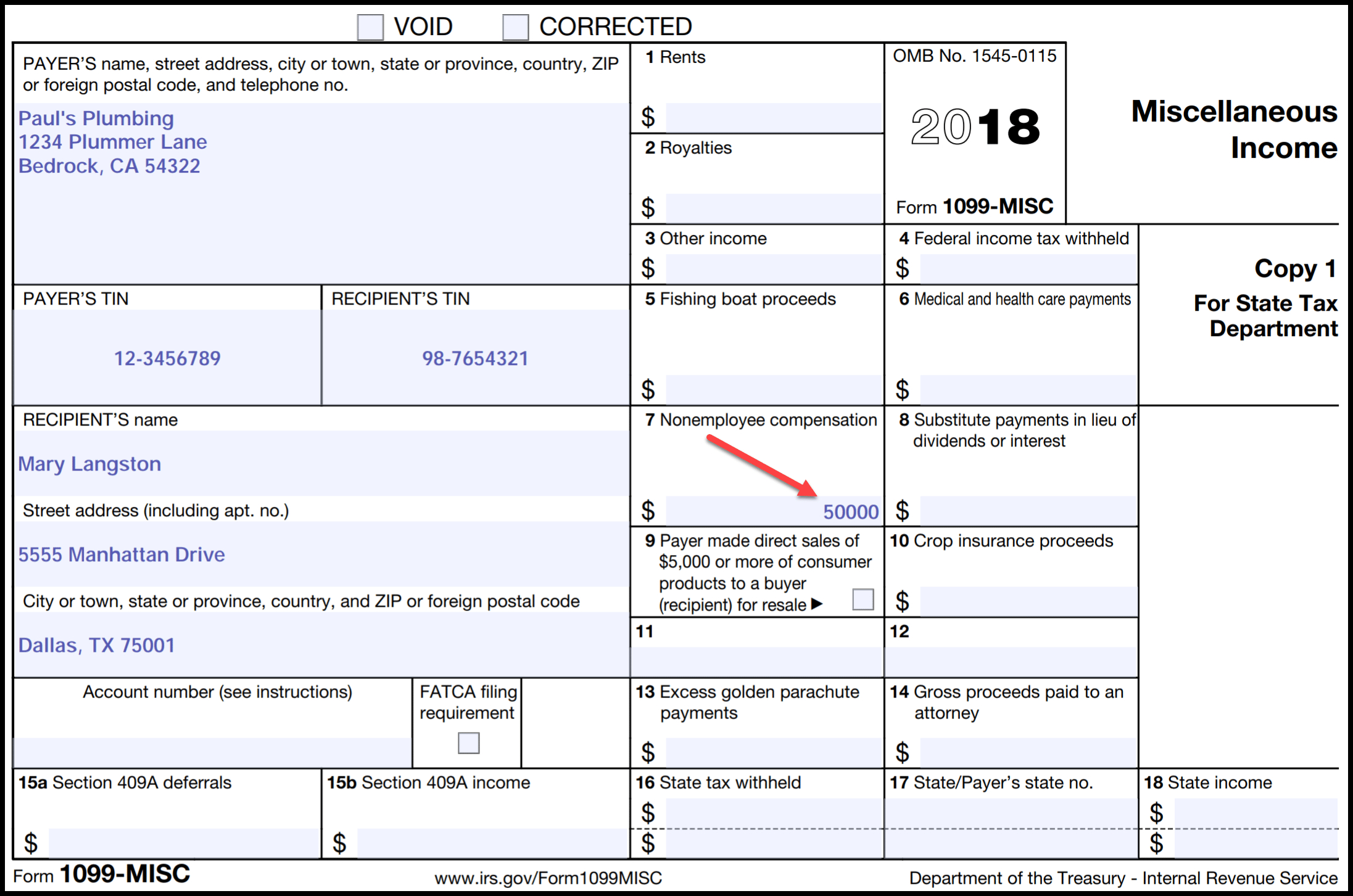

Form 1099MISC for independent consultants (6 step guide)

Free Printable 1099 Misc Forms Free Printable

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

How To Fill Out A 1099 B Tax Form Universal Network

1099 Basics & FAQs ASAP Help Center

Inst 1099 General InstructionsGeneral Instructions for Forms 1099, 1…

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Forms 1099 The Basics You Should Know Kelly CPA

What is a 1099Misc Form? Financial Strategy Center

Related Post: