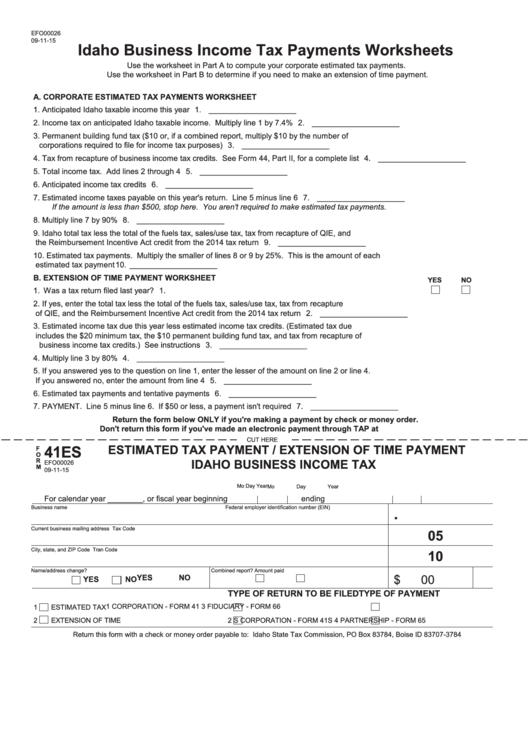

Idaho Form 41Es

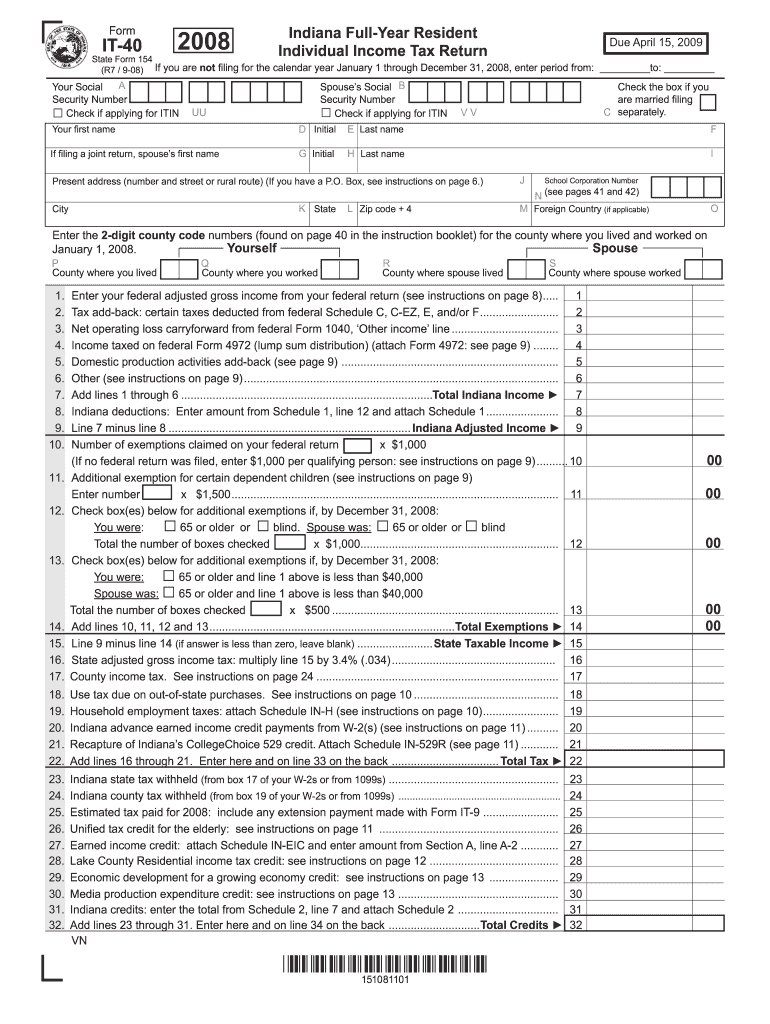

Idaho Form 41Es - Estimated tax payments each estimated tax payment must be 25% of the lesser of the corporation's income tax for the. Save or instantly send your ready documents. Estimated tax payment/extension of time payment business income tax and instructions 2022. Try it for free now! S corporation income tax return and instructions 2021. See page 1 of the instructions for reasons to amend and enter the number that applies. Estimated tax payment / extension of time payment idaho business income tax. Cut here yes no yes no for. Web a preprinted form, use the form 41es, available at tax.idaho.gov. S corporation income tax return and instructions 2022. Web if you owe state tax and you want to make an extension payment, use idaho form 41es (estimated tax payment / extension of time payment, idaho business income tax). Estimated tax payment / extension of time payment idaho business income tax. If you need to make a payment, you can mail the form at the bottom of. Web 2022. Web form 41 corporation income tax return2022 amended return? See page 1 of the instructions for reasons to amend and enter the number that applies. S corporation income tax return and instructions 2021. Web form, use the form 41es, available at tax.idaho.gov. Web a preprinted form, use the form 41es, available at tax.idaho.gov. Web form, use the form 41es, available at tax.idaho.gov. Web the form 41es worksheet allows you to compare the income tax on last year's return with the anticipated income tax for the current year. Web your corporation’s estimated idaho tax liability is $500 or more. Complete, edit or print tax forms instantly. Use form 41es to determine the estimated payment. You can make the estimated. If you need to make a payment, you can mail the form at the bottom of. Web 2022 amended return? • 100% of the corporation’s. S corporation income tax return and instructions 2021. Estimated tax payment/extension of time payment business income tax and instructions 2022. Try it for free now! Web choose the tax type. Web if you owe state tax and you want to make an extension payment, use idaho form 41es (estimated tax payment / extension of time payment, idaho business income tax). S corporation income tax return and instructions 2021. Show details we are not affiliated with any brand or entity on this form. Web form 41 corporation income tax return2022 amended return? Cut here yes no yes no for. Try it for free now! Web your corporation’s estimated idaho tax liability is $500 or more. Try it for free now! If you need to make a payment, you can mail the form at the bottom of. Use the smaller of the two amounts to. For calendar year 2022 or fiscal. S corporation income tax return and instructions 2021. Ad download or email id itd 3366 form & more fillable forms, register and subscribe now! Web form 41es — voucher estimated tax payment/extension of time payment business income tax mail to: Upload, modify or create forms. Estimated tax payment/extension of time payment business income tax and instructions 2022. Try it for free now! Web form 41 corporation income tax return2022 amended return? Upload, modify or create forms. Estimated tax payments each estimated tax payment must be 25% of the lesser of the corporation's income tax for the. S corporation income tax return and instructions 2021. Web form, use the form 41es, available at tax.idaho.gov. Use the form to determine the amount. S corporation income tax return and instructions 2022. Show details we are not affiliated with any brand or entity on this form. Web choose the tax type. Web a preprinted form, use the form 41es, available at tax.idaho.gov. Web form 41 corporation income tax return2022 amended return? Upload, modify or create forms. Web report error it appears you don't have a pdf plugin for this browser. Estimated tax payment/extension of time payment business income tax and instructions 2022. Web select other > extensions.; S corporation income tax return and instructions 2021. Web choose the tax type. For calendar year 2022 or fiscal. Easily fill out pdf blank, edit, and sign them. State must be activated for the above steps to work. If you need to make a payment, you can mail the form at the bottom of. S corporation income tax return and instructions 2022. Web form, use the form 41es, available at tax.idaho.gov. Save or instantly send your ready documents. Show details we are not affiliated with any brand or entity on this form. Web complete idaho form 41es online with us legal forms. You can make the estimated. Web your corporation’s estimated idaho tax liability is $500 or more. Cut here yes no yes no for. Try it for free now!Form 41es Estimated Tax Payment / Extension Of Time Payment Idaho

w9 depositFill Online, Printable, Fillable, Blank pdfFiller

Form 41 Idaho Corporation Tax Return YouTube

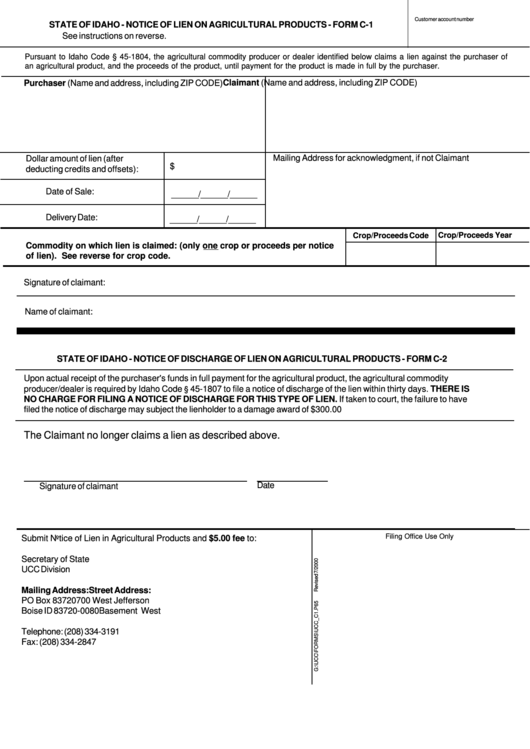

Form C1 Notice Of Lien On Agricultural Products Secretary Of State

W 9 Idaho Fill Online, Printable, Fillable, Blank pdfFiller

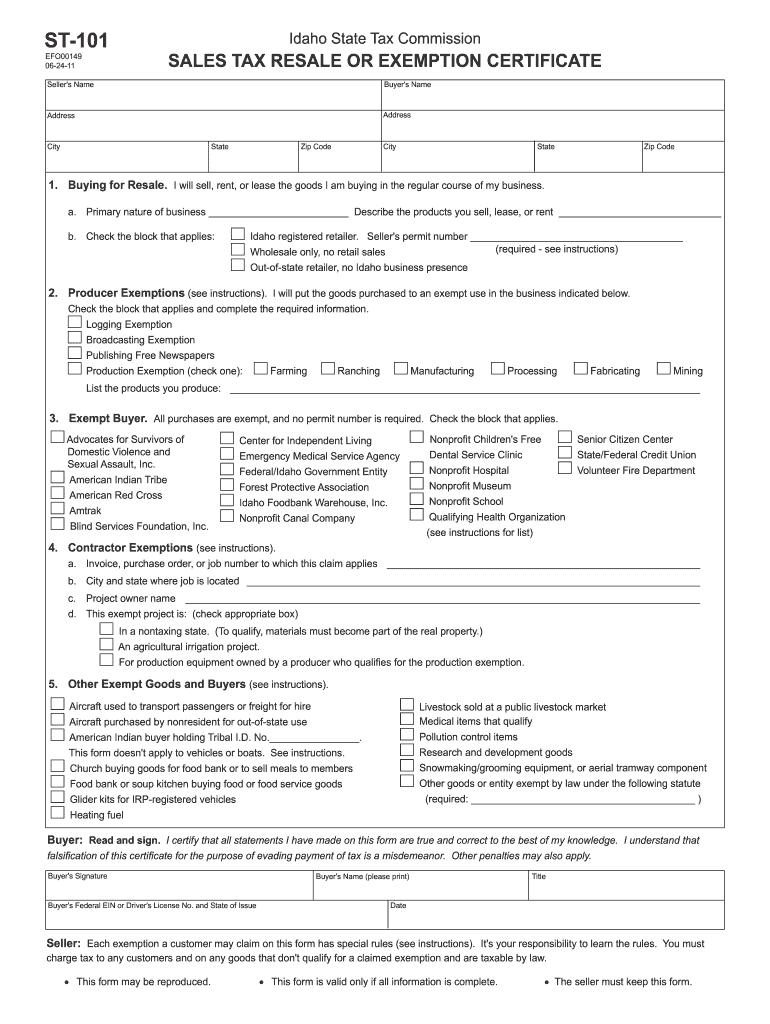

ST 101 Idaho State Tax Commission Tax Idaho Fill Out and Sign

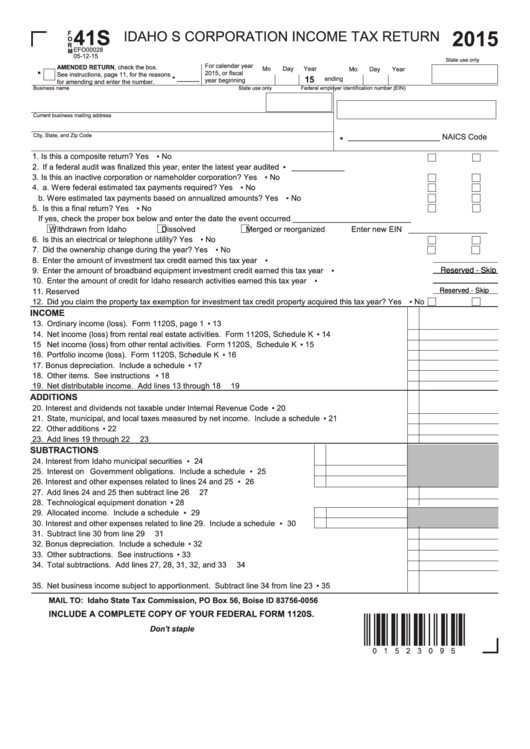

Fillable Form 41s Idaho S Corporation Tax Return 2015, Form

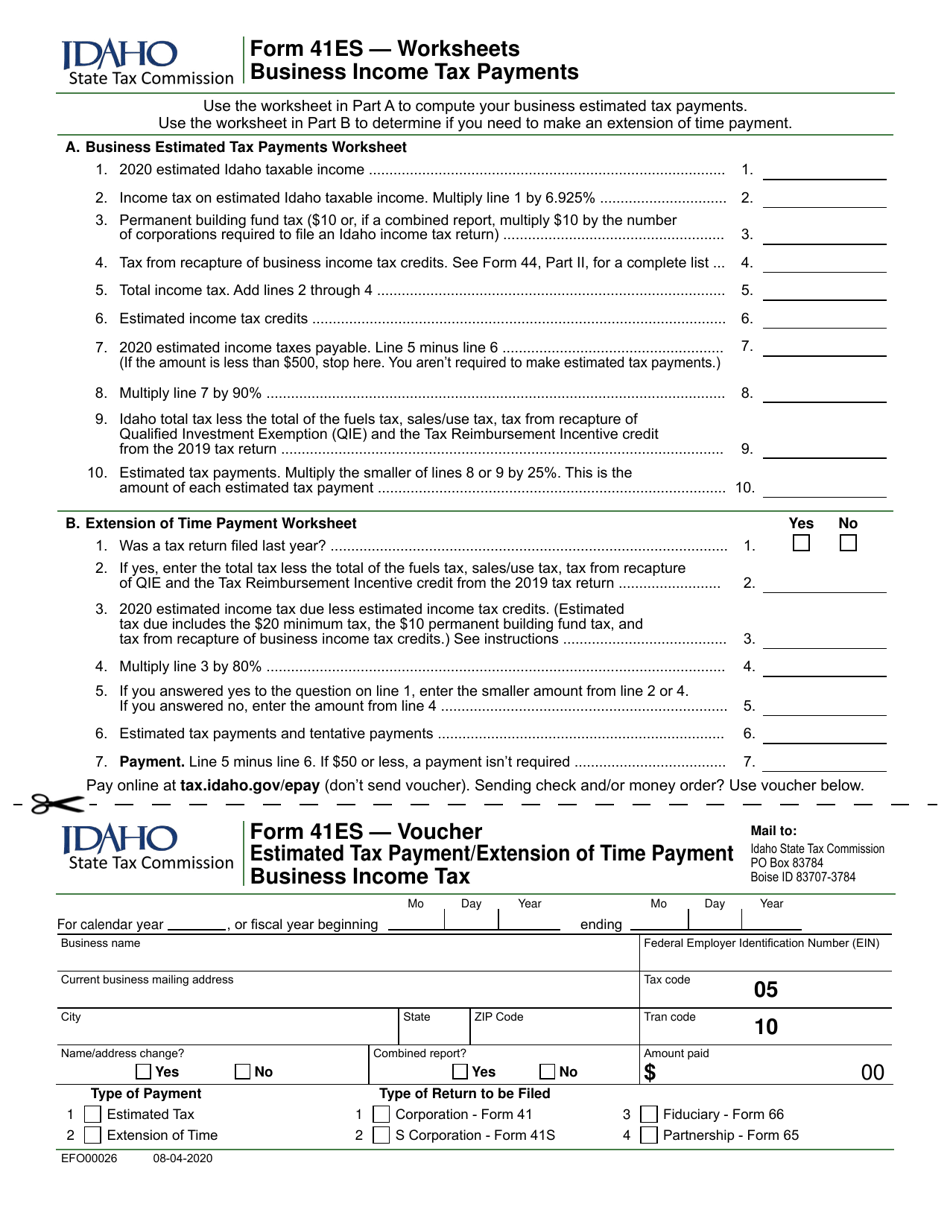

IDAHO INDIVIDUAL TAX RETURN Books Download Fill Out and Sign

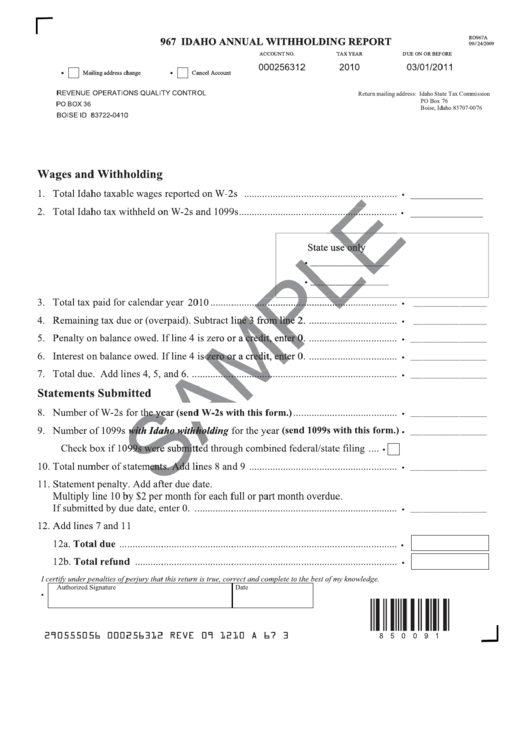

Form Ro967a Idaho Annual Withholding Report printable pdf download

Form 41ES (EFO00026) Download Fillable PDF or Fill Online Estimated Tax

Related Post: