Ca State Witholding Form

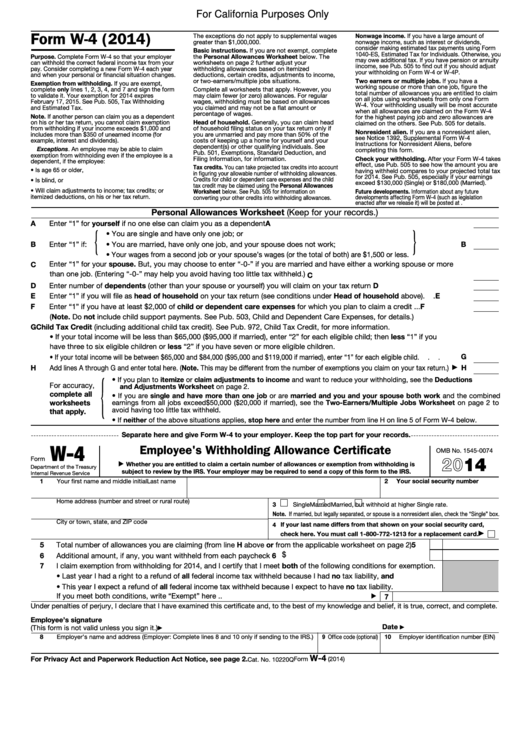

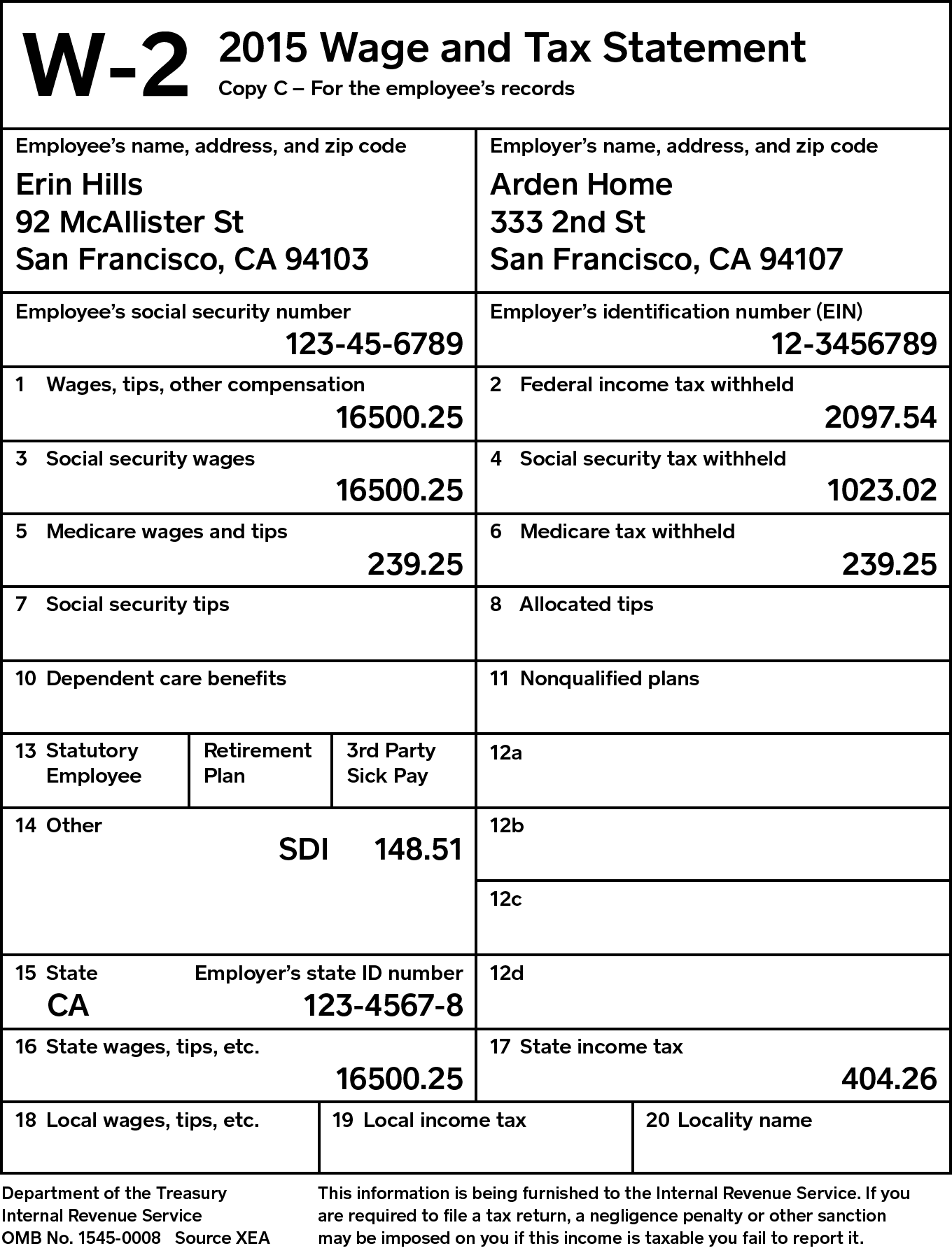

Ca State Witholding Form - Total number of allowances you’re claiming (use worksheet a. Web the income tax withholdings formula for the state of california includes the following changes: Use the calculator or worksheet to determine the number of. To determine the applicable tax rate for. The low income exemption amount for married with 0 or 1 allowance. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Pay your team and access hr and benefits with the #1 online payroll provider. Complete, edit or print tax forms instantly. We consistently offer best in class solutions to you & your client's tax problems. If there is ca withholding reported on the. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Try it for free now! Total number of allowances you’re claiming (use worksheet a. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web california provides two methods for determining the withholding amount from wages and salaries. The low income exemption amount for married with 0 or 1 allowance. California, massachusetts and new york. Total number of allowances you’re claiming (use worksheet a. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax:. Ad join us and see why tax pros. We consistently offer best in class solutions to you & your client's tax problems. Web the california state controller’s office publishes current tax rates on their website in the form of tax withholding tables. Complete, edit or print tax forms instantly. Pay your team and access hr and benefits with the #1 online payroll provider. Web the income tax withholdings. Web the de 4 is an important form for california residents who work and earn wages in the state. Upload, modify or create forms. Web the income tax withholdings formula for the state of california includes the following changes: Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Get ready for. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web simplified income, payroll, sales and use tax information for you and your business Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. The de 4 is used to compute the amount of taxes. Employee's withholding certificate form 941; Try it for free now! Pay your team and access hr and benefits with the #1 online payroll provider. California, massachusetts and new york. Upload, modify or create forms. Try it for free now! Irs further postpones tax deadlines for most california. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Ad approve payroll when you're ready, access employee services & manage it all in one place. We consistently offer best in class solutions to you &. Irs further postpones tax deadlines for most california. If there is ca withholding reported on the. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Try it for free now! Complete, edit or print tax forms instantly. Web california residents or entities exempt from the withholding requirement should complete form 590 and submit it to the withholding agent before payment is made. Web the income tax withholdings formula for the state of california includes the following changes: Irs further postpones tax deadlines for most california. Pay your team and access hr and benefits with the #1 online. Upload, modify or create forms. Employee's withholding certificate form 941; Web california extends due date for california state tax returns. Web the income tax withholdings formula for the state of california includes the following changes: We consistently offer best in class solutions to you & your client's tax problems. Pay your team and access hr and benefits with the #1 online payroll provider. The form is used to calculate your california personal income tax. You can download form de 4 from edd’s website at edd.ca.gov or go to ftb.ca.gov and search. Web compare the state income tax withheld with your estimated total annual tax. This certificate, de 4, is for california personal income tax (pit) withholdingpurposes only. We consistently offer best in class solutions to you & your client's tax problems. Get ready for tax season deadlines by completing any required tax forms today. Web california residents or entities exempt from the withholding requirement should complete form 590 and submit it to the withholding agent before payment is made. Complete, edit or print tax forms instantly. Web the california state controller’s office publishes current tax rates on their website in the form of tax withholding tables. Ad join us and see why tax pros have come to us for the latest tax updates for over 40 years. Total number of allowances you’re claiming (use worksheet a. Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. If there is ca withholding reported on the. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck.California Worksheet A Regular Withholding Allowances Tripmart

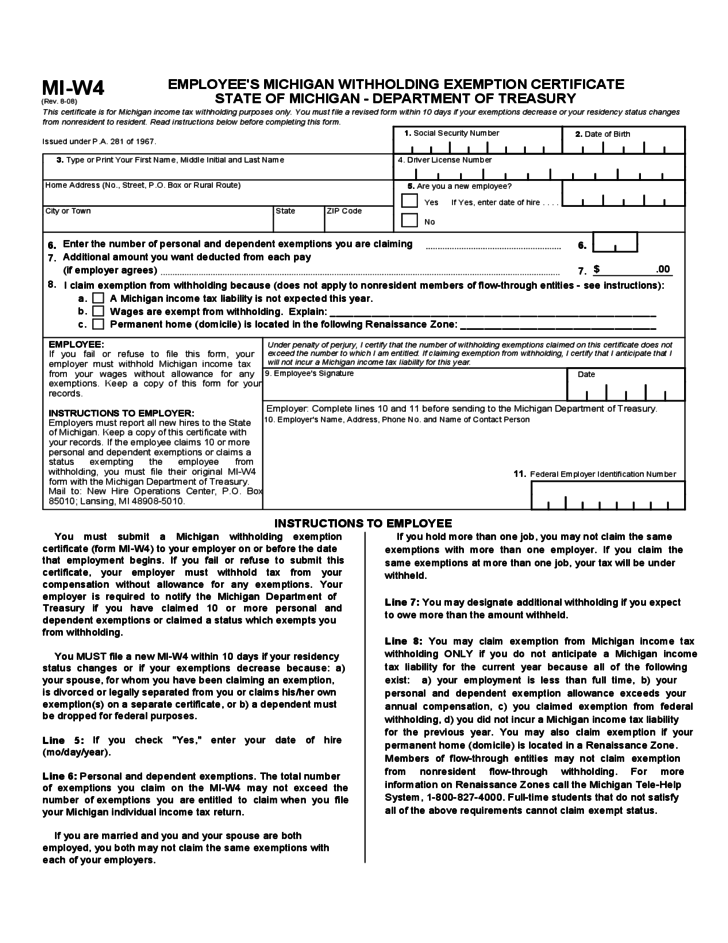

Form De4 California Employee Withholding

California withholding form Fill out & sign online DocHub

California Employee State Withholding Form 2023

Ca De 4 Printable Form California Employee's Withholding Allowance

1+ California State Tax Withholding Forms Free Download

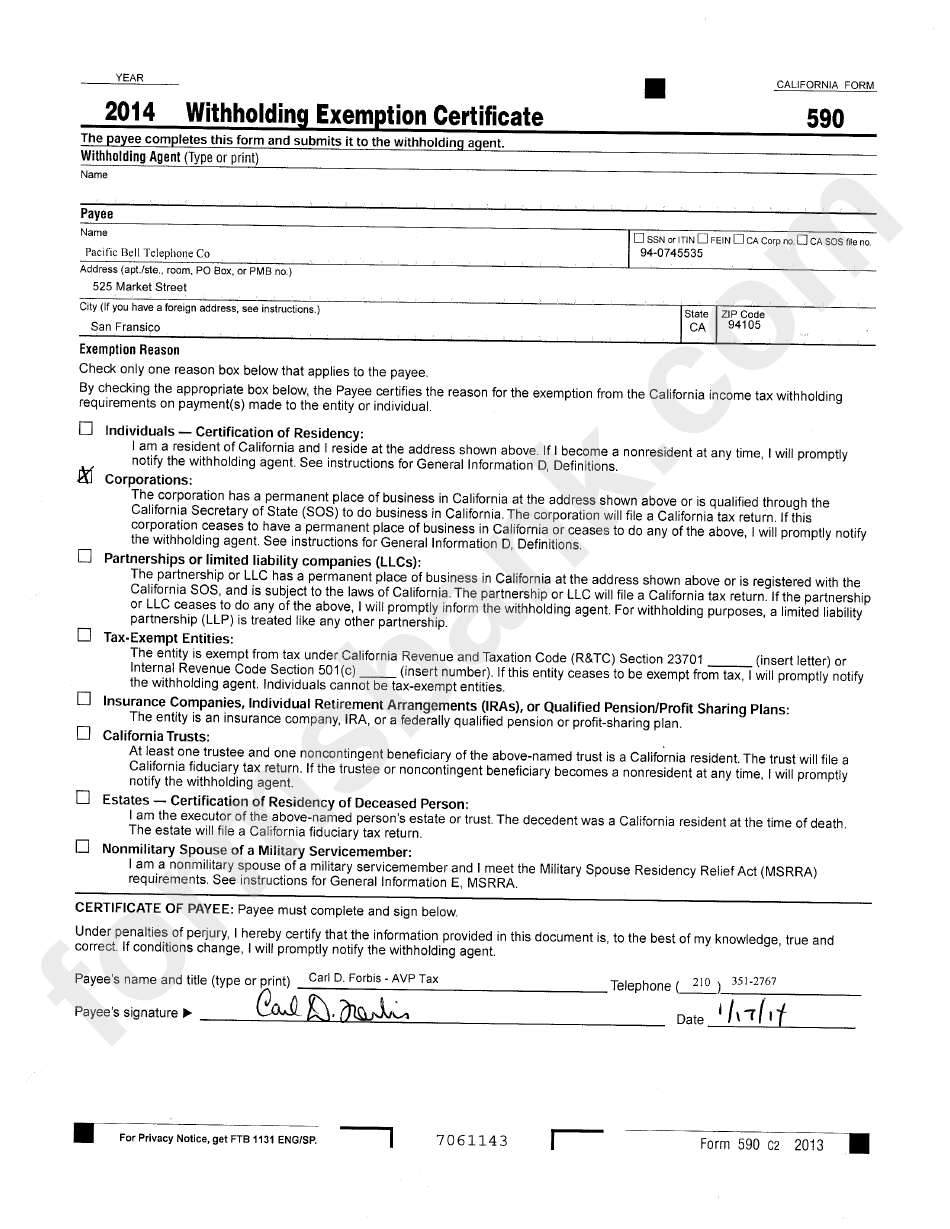

California Form 590 Withholding Exemption Certificate 2014

De 4 California State Tax Withholding Form

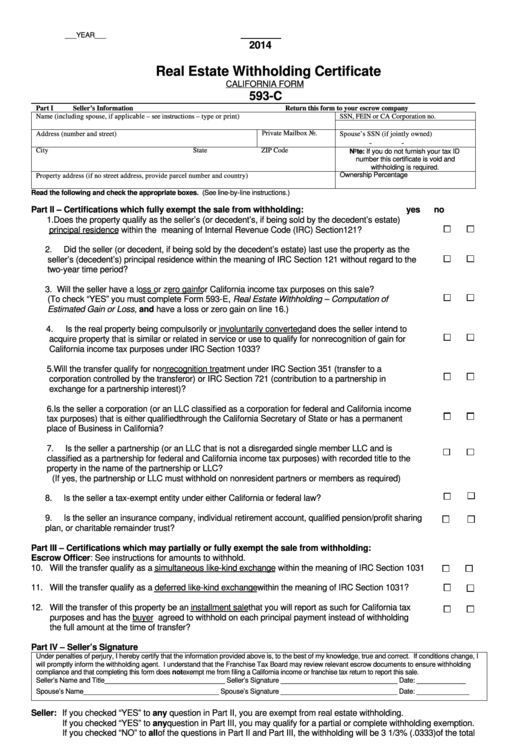

California Form 593C Real Estate Withholding Certificate 2014

California Employee Withholding Form 2022 2023

Related Post: