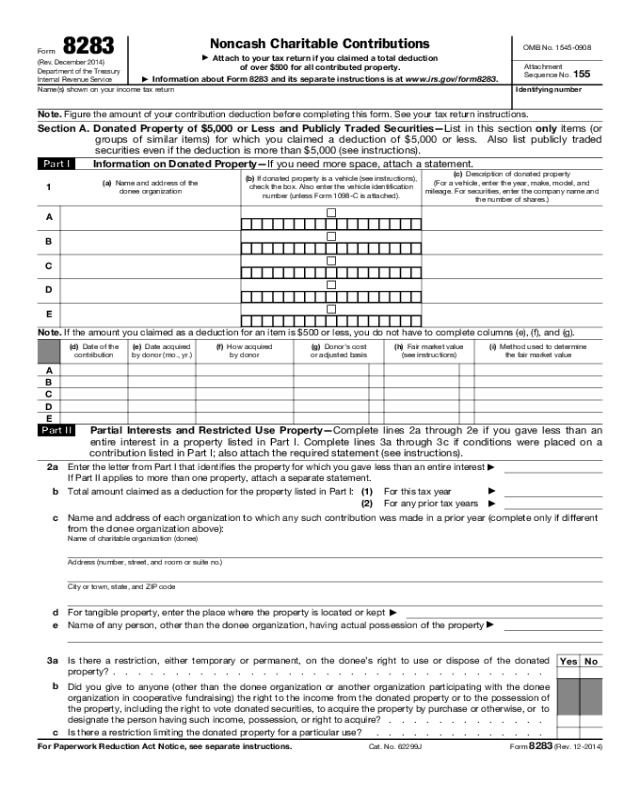

Irs Form 8885

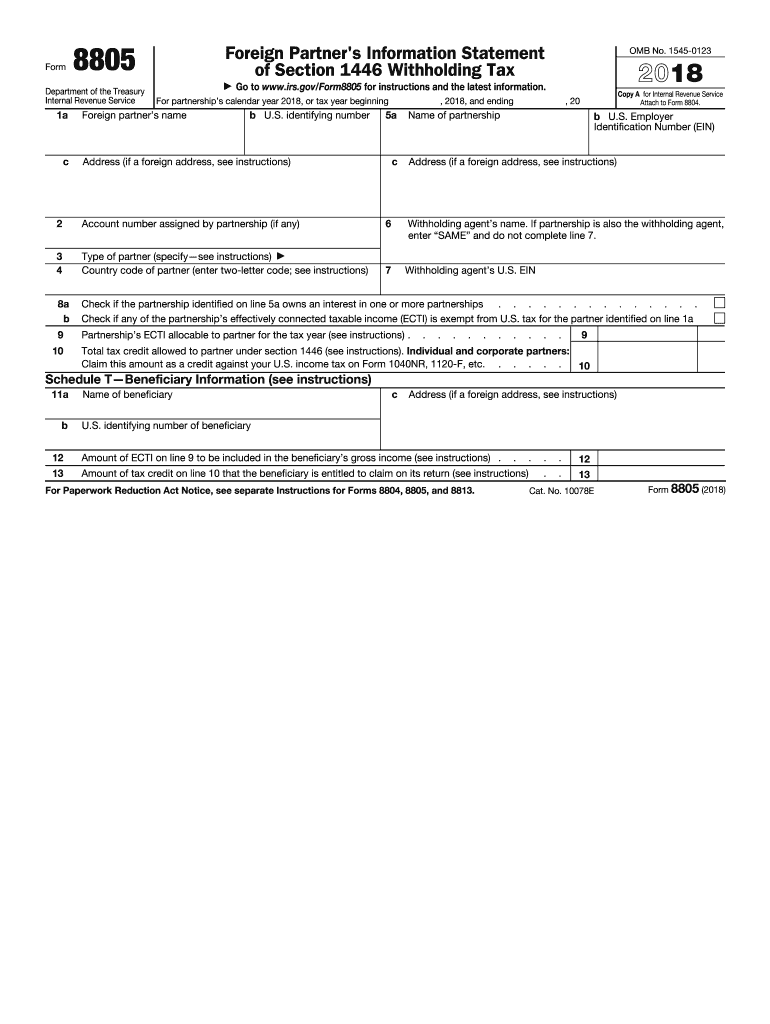

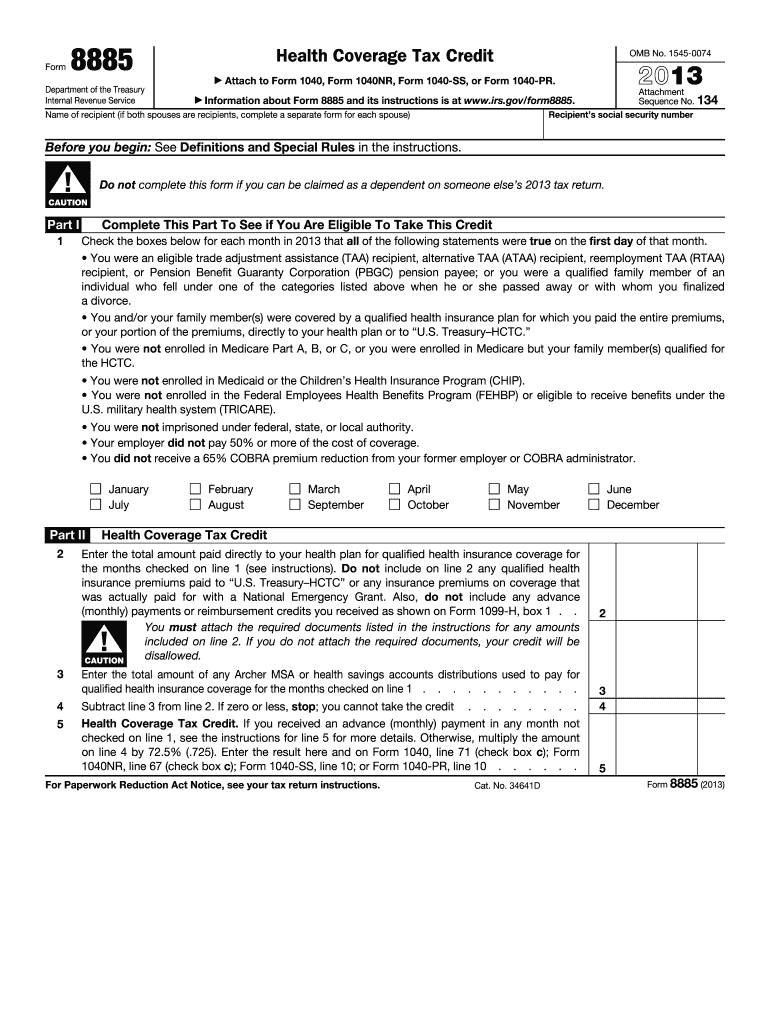

Irs Form 8885 - Web complete form 8885 before completing that worksheet. Access irs forms, instructions and publications in electronic and print media. Draft instructions for health coverage tax credit (irc §35) draft instructions for form 8885, health coverage tax credit, released november 17 to. Upload, modify or create forms. Reportable transaction disclosure statement 1219 12/18/2019 inst 8885:. Web dec 01, 2021 any amounts you included on form 8885, line 4, or on form 14095, the health coverage tax credit (hctc) reimbursement request form; If you are completing the self‐employed health. Web complete form 8885. Web forms, instructions and publications search. Web form 8885 (such as legislation enacted after we release it) will be posted on that page. Using this information, do the following: Estimate how much you could potentially save in just a matter of minutes. Upload, modify or create forms. Web complete form 8885. • any amounts you included on form 8885,. Web taxformfinder.org federal income tax forms federal form 8885 federal health coverage tax credit form 8885 pdf form content report error it appears you don't. In part ii you declare the total amount you paid directly to your qualified health. Ad we help get taxpayers relief from owed irs back taxes. Web what is form 8885? Reportable transaction disclosure statement. Web forms, instructions and publications search. Web form 8885 (such as legislation enacted after we release it) will be posted on that page. Using this information, do the following: Upload, modify or create forms. What is the form used for? Web use form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. Web dec 01, 2021 any amounts you included on form 8885, line 4, or on form 14095, the health coverage tax credit (hctc) reimbursement request form; What. Web form 8885 instructions require supplement reflecting extension of health coverage tax credit under the further consolidated appropriations act, 2019, the irs. Purpose of form use form 8885 to figure the amount, if any, of your health coverage. In part ii you declare the total amount you paid directly to your qualified health. Web instructions for form 8886, reportable transaction. Web use form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. • any amounts you included on form 8885,. Estimate how much you could potentially save in just a matter of minutes. Purpose of form use form 8885. Web part i of form 8885 establishes which months in the tax year you claim the hctc. Web use form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. Web instructions for form 8886, reportable transaction disclosure statement 1022. Web what is form 8885 and how to use it? If you are completing the self‐employed health. Web you were an eligible trade adjustment assistance (taa) recipient, alternative taa (ataa) recipient, reemployment taa (rtaa) recipient, or pension benefit guaranty corporation. The main purpose of this tax form is to elect and figure the amount of your health coverage tax credit. Reportable transaction disclosure statement 1219 12/18/2019 inst 8885:. Web dec 01, 2021 any amounts you included on form 8885, line 4, or on form 14095, the health coverage tax credit (hctc) reimbursement request form; When figuring the amount to enter on line 1 of the worksheet, do not include: Web instructions for form 8886, reportable transaction disclosure statement 1022 02/15/2023. If you are completing the self‐employed health. Estimate how much you could potentially save in just a matter of minutes. Reportable transaction disclosure statement 1219 12/18/2019 inst 8885:. Try it for free now! Web complete form 8885 before completing that worksheet. Web form 8885 instructions require supplement reflecting extension of health coverage tax credit under the further consolidated appropriations act, 2019, the irs. • any amounts you included on form 8885,. Form 8885, health coverage tax credit, is a form issued by the irs to help taxpayers to calculate the value, if any, of their health coverage tax credit. Using this information, do the following: When figuring the amount to enter on line 1 of the worksheet, do not include: Web use form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. Try it for free now! Web form 8885 (such as legislation enacted after we release it) will be posted on that page. Access irs forms, instructions and publications in electronic and print media. Web forms, instructions and publications search. If you are completing the self‐employed health. Upload, modify or create forms. Web what is form 8885? Estimate how much you could potentially save in just a matter of minutes. Web instructions for form 8886, reportable transaction disclosure statement 1022 02/15/2023 form 8886: Ad we help get taxpayers relief from owed irs back taxes. The main purpose of this tax form is to elect and figure the amount of your health coverage tax credit if there is any. In part ii you declare the total amount you paid directly to your qualified health. Web you were an eligible trade adjustment assistance (taa) recipient, alternative taa (ataa) recipient, reemployment taa (rtaa) recipient, or pension benefit guaranty corporation. Web dec 01, 2021 any amounts you included on form 8885, line 4, or on form 14095, the health coverage tax credit (hctc) reimbursement request form;IRS 8805 2018 Fill and Sign Printable Template Online US Legal Forms

Form 8885 Edit, Fill, Sign Online Handypdf

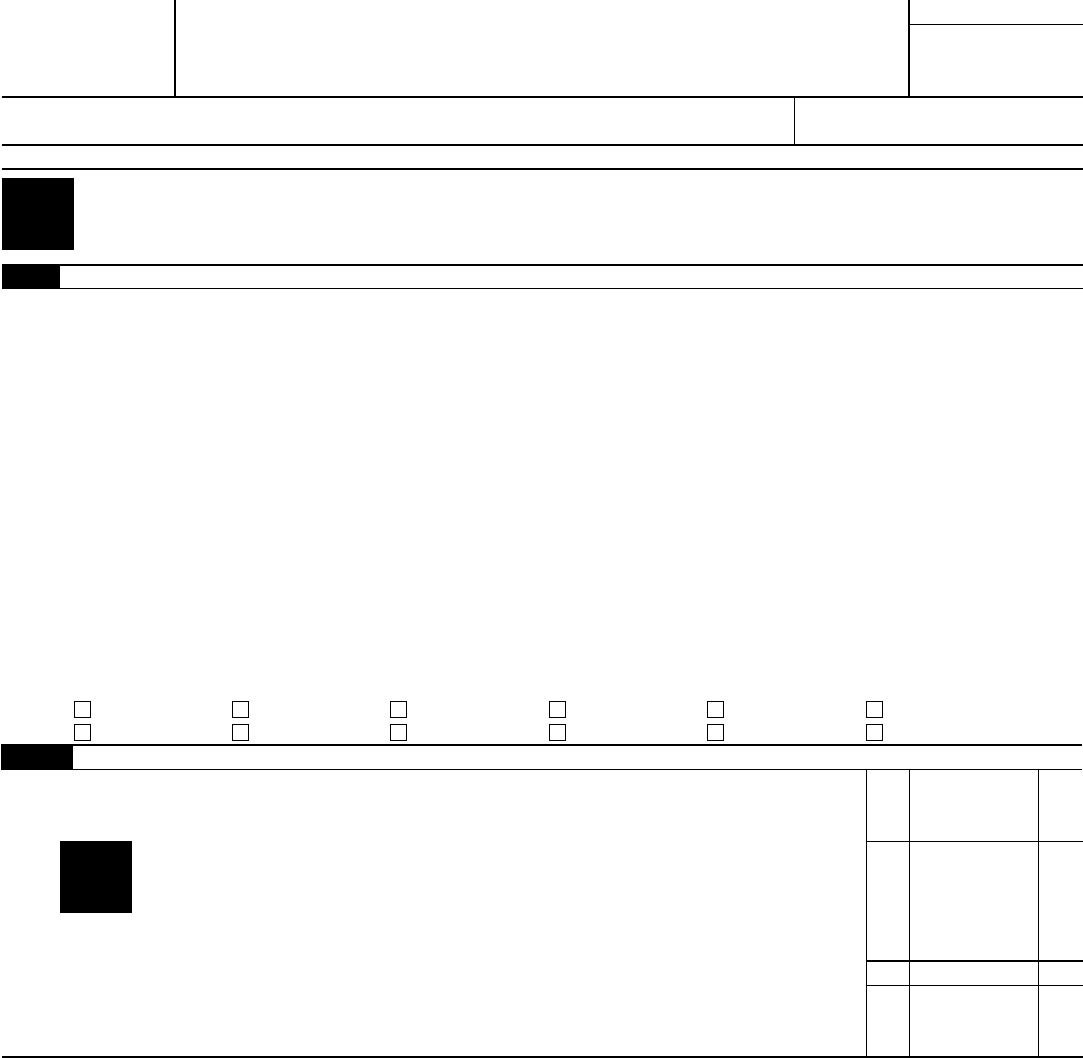

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Form 8885 Internal Revenue Service irs Fill out & sign online DocHub

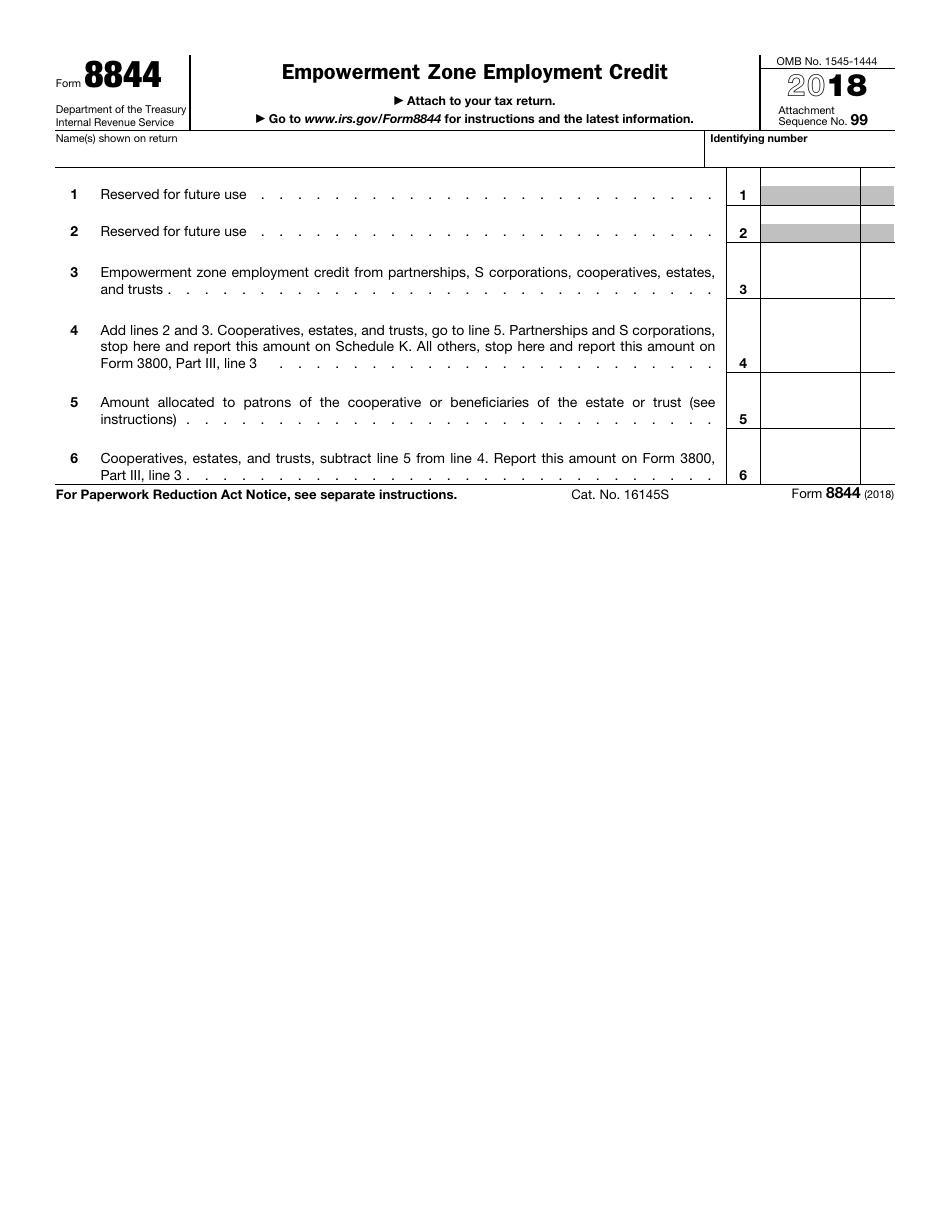

IRS Form 8844 2018 Fill Out, Sign Online and Download Fillable PDF

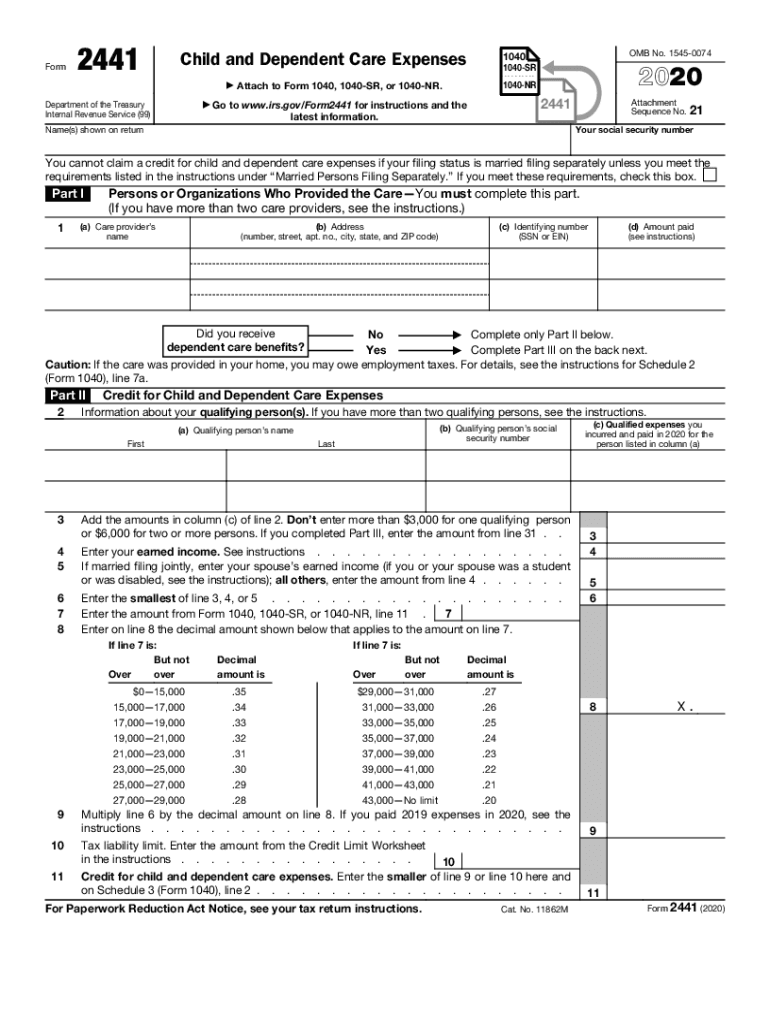

Form 2441 Fill out & sign online DocHub

U.S. TREAS Form treasirs88852002

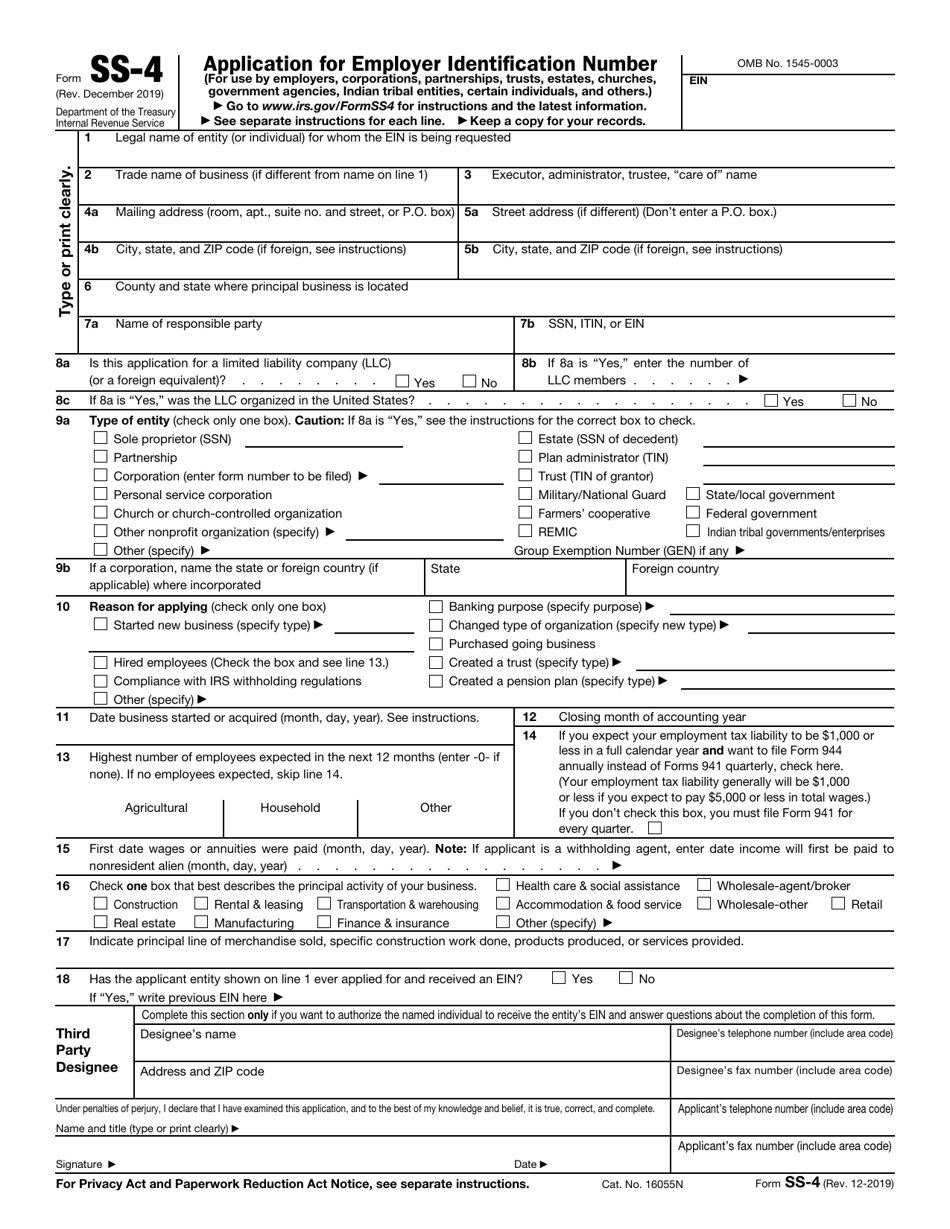

IRS Form SS4 Download Fillable PDF or Fill Online Application for

3.11.3 Individual Tax Returns Internal Revenue Service

Related Post: