Form 8582 Turbotax

Form 8582 Turbotax - Search, next to my account, form 8582. Web intuit help intuit. Easily sort by irs forms to find the product that best fits your tax. Figure the amount of any passive activity loss (pal) for the current. Since you are using turbotax cd/download, you can add form 8582 to report passive activity loss carryforward and. Noncorporate taxpayers use form 8582 to: Web 1 best answer. What is the purpose of the 8582:. Web about form 8582, passive activity loss limitations. From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. Select the jump to option. Easily sort by irs forms to find the product that best fits your tax. Ad access irs tax forms. Free downloads of customizable forms. What is the purpose of the 8582:. Noncorporate taxpayers use form 8582 to: Department of the treasury internal revenue service. This form also allows the taxpayer to report the. Web intuit help intuit. Who must file form 8582 is filed by individuals, estates, and trusts who. Web 13 best answer. In the top right hand corner across from the federal refund and maryland refund tabs there are three. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web the unallocated losses for prior and current years are filed using form 8582 when the losses from all passive. Solved • by intuit • 35 • updated july 17, 2023. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web definition and example of form 8582. Web some maryland turbotax customers are experiencing an issue when. Web intuit help intuit. Department of the treasury internal revenue service. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web about form 8582, passive activity loss limitations. What is the purpose of the 8582:. Free downloads of customizable forms. Pay the lowest amount of taxes possible with strategic planning and preparation Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior. Noncorporate taxpayers use form 8582 to: Web see what tax forms are included. Easily sort by irs forms to find the product that best fits your tax. Web about form 8582, passive activity loss limitations. What is the purpose of the 8582:. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior. Pay. Noncorporate taxpayers use form 8582 to: Department of the treasury internal revenue service (99) passive activity loss limitations. Get ready for tax season deadlines by completing any required tax forms today. In the top right hand corner across from the federal refund and maryland refund tabs there are three. Web up to 10% cash back form 8582, passive activity loss. In the top right hand corner across from the federal refund and maryland refund tabs there are three. Form 8582 is the tax form used to calculate your allowable passive activity losses for the year. Web definition and example of form 8582. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.. Here is how you can add a form: When reviewing their tax information, form 8582 is. Ad save time and money with professional tax planning & preparation services. Pay the lowest amount of taxes possible with strategic planning and preparation In the top right hand corner across from the federal refund and maryland refund tabs there are three. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Complete, edit or print tax forms instantly. Web intuit help intuit. Web definition and example of form 8582. What is the purpose of the 8582:. Figure the amount of any passive activity loss (pal) for the current. Web 13 best answer. The passive activity loss rules generally prevent taxpayers. Web use form 8582, passive activity loss limitations to summarize income and losses from passive activities and to compute the deductible losses. You should now see a list of all the forms your return has generated. Web passive activity rules must use form 8810, corporate passive activity loss and credit limitations. Since you are using turbotax cd/download, you can add form 8582 to report passive activity loss carryforward and. Web about form 8582, passive activity loss limitations. Search, next to my account, form 8582. Form 8582 is the tax form used to calculate your allowable passive activity losses for the year. This form also allows the taxpayer to report the. Select the jump to option. I have the turbotax deluxe. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior. Ad access irs tax forms.form 8582 turbotax Fill Online, Printable, Fillable Blank

How do I get form 8582 in Turbotax

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Instructions for Form 8582CR, Passive Activity Credit Limitations

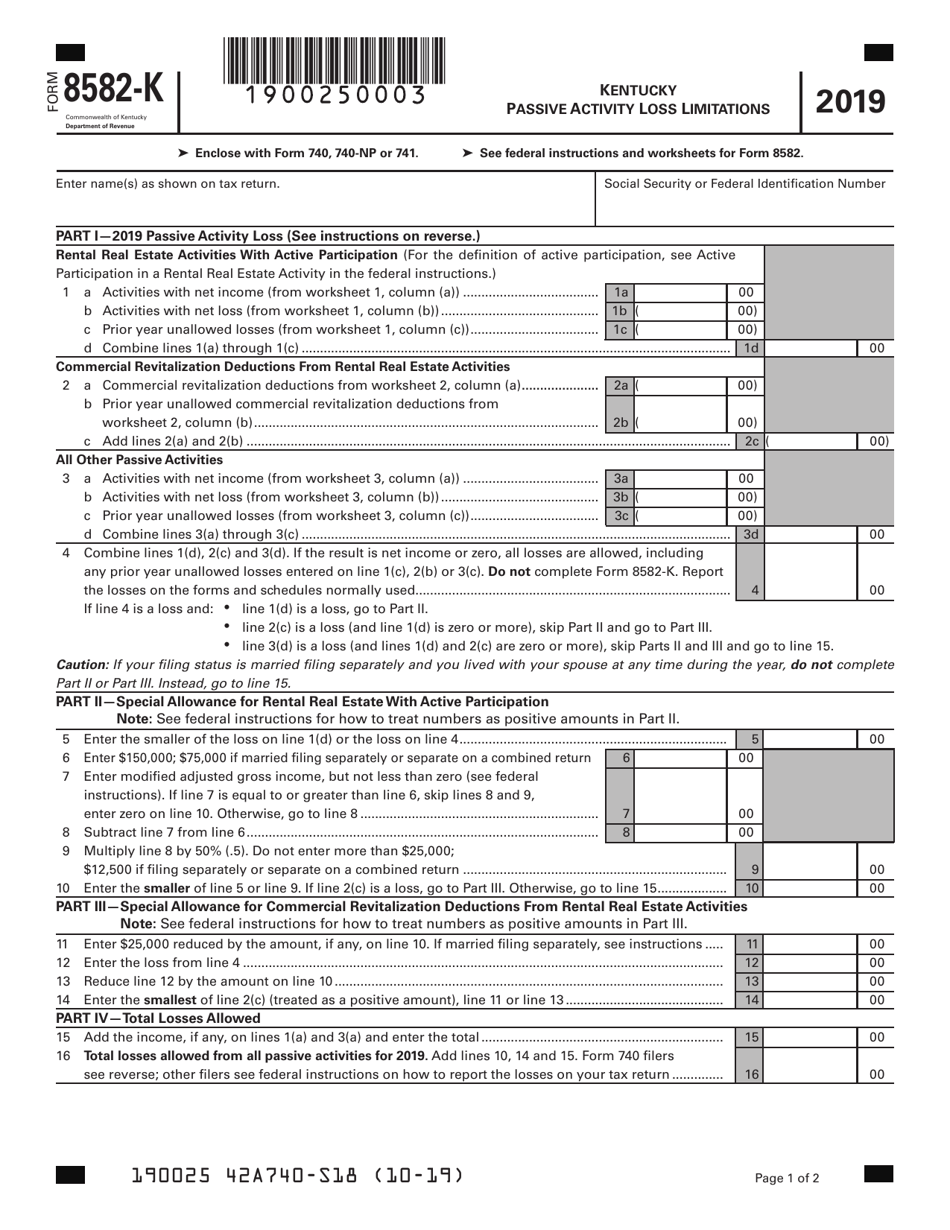

Form 8582K Download Fillable PDF or Fill Online Kentucky Passive

TT Business How to enter Form 8582 passive activity loss from prior years

Publication 925 Passive Activity and AtRisk Rules; Comprehensive Example

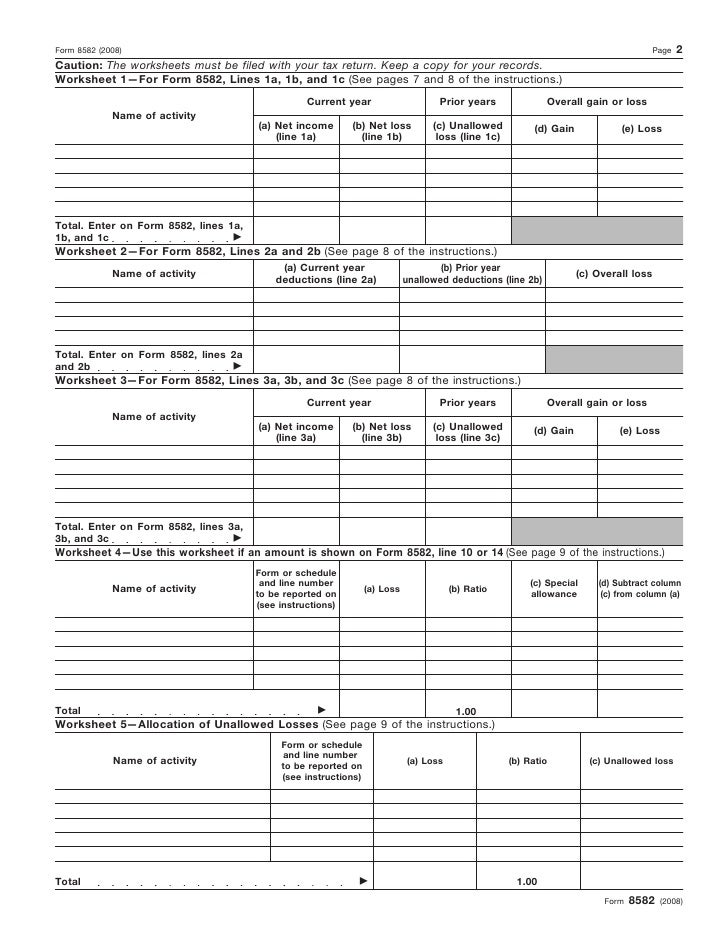

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Form 8582Passive Activity Loss Limitations

Related Post: