Irs Mileage Tracking Form

Irs Mileage Tracking Form - Try it for free now! See an overview of previous mileage rates. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs. Follow these best practices to avoid an audit. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Remember to use the 2022 irs mileage rate if you log trips for last year. If you choose to use the. Upload, modify or create forms. So, why do you need a mileage log? Access irs forms, instructions and publications in electronic and. One, a mileage log is used to claim. Web the mileage log or logbook method of keeping track of mileage involves always recording the business trip at the time you take it within a logbook. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs. Web. Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? The easiest way to satisfy the irs mileage. An irs mileage reimbursement form should include the following: Page last reviewed or updated: Enter your personal, company and vehicle details at the top of this business mileage tracker. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? Web this data is usually recorded in a mileage tracking form, spreadsheet, logbook, or online application. Try it for free now!. One, a mileage log is used to claim. Remember to use the 2022 irs mileage rate if you log trips for last year. Web | irs compliant mileage log last updated: Upload, modify or create forms. On each occasion, you should. So, why do you need a mileage log? Access irs forms, instructions and publications in electronic and. Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? Remember to use the 2022 irs mileage rate if you log trips for last year. Web this monthly mileage report. Simple & secure service for filing form 2290 online. If you choose to use the. Web forms, instructions and publications search. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Upload, modify or create forms. The easiest way to satisfy the irs mileage. Web business mileage tracker form. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs. Web this data is usually recorded in a mileage tracking form, spreadsheet, logbook, or online application. Web tracking/recording your trips differently, for instance. Web business mileage tracker form. Web forms, instructions and publications search. Simple & secure service for filing form 2290 online. Web | irs compliant mileage log last updated: Web the mileage log or logbook method of keeping track of mileage involves always recording the business trip at the time you take it within a logbook. Web the mileage log or logbook method of keeping track of mileage involves always recording the business trip at the time you take it within a logbook. The easiest way to satisfy the irs mileage. Follow these best practices to avoid an audit. Enter your personal, company and vehicle details at the top of this business mileage tracker form along. Remember to use the 2022 irs mileage rate if you log trips for last year. Web business mileage tracker form. Web what should an irs mileage reimbursement form include? Simple & secure service for filing form 2290 online. The easiest way to satisfy the irs mileage. Simple & secure service for filing form 2290 online. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Follow these best practices to avoid an audit. Page last reviewed or updated: One, a mileage log is used to claim. Web tracking/recording your trips differently, for instance using a gps device or a mileage tracking mobile application. If you choose to use the. Web business mileage tracker form. On each occasion, you should. Web what should an irs mileage reimbursement form include? Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs. Try it for free now! Web this data is usually recorded in a mileage tracking form, spreadsheet, logbook, or online application. Template features include sections to list starting and ending. Web | irs compliant mileage log last updated: Upload, modify or create forms. Access irs forms, instructions and publications in electronic and. So, why do you need a mileage log? Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement.25 Printable IRS Mileage Tracking Templates GOFAR

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

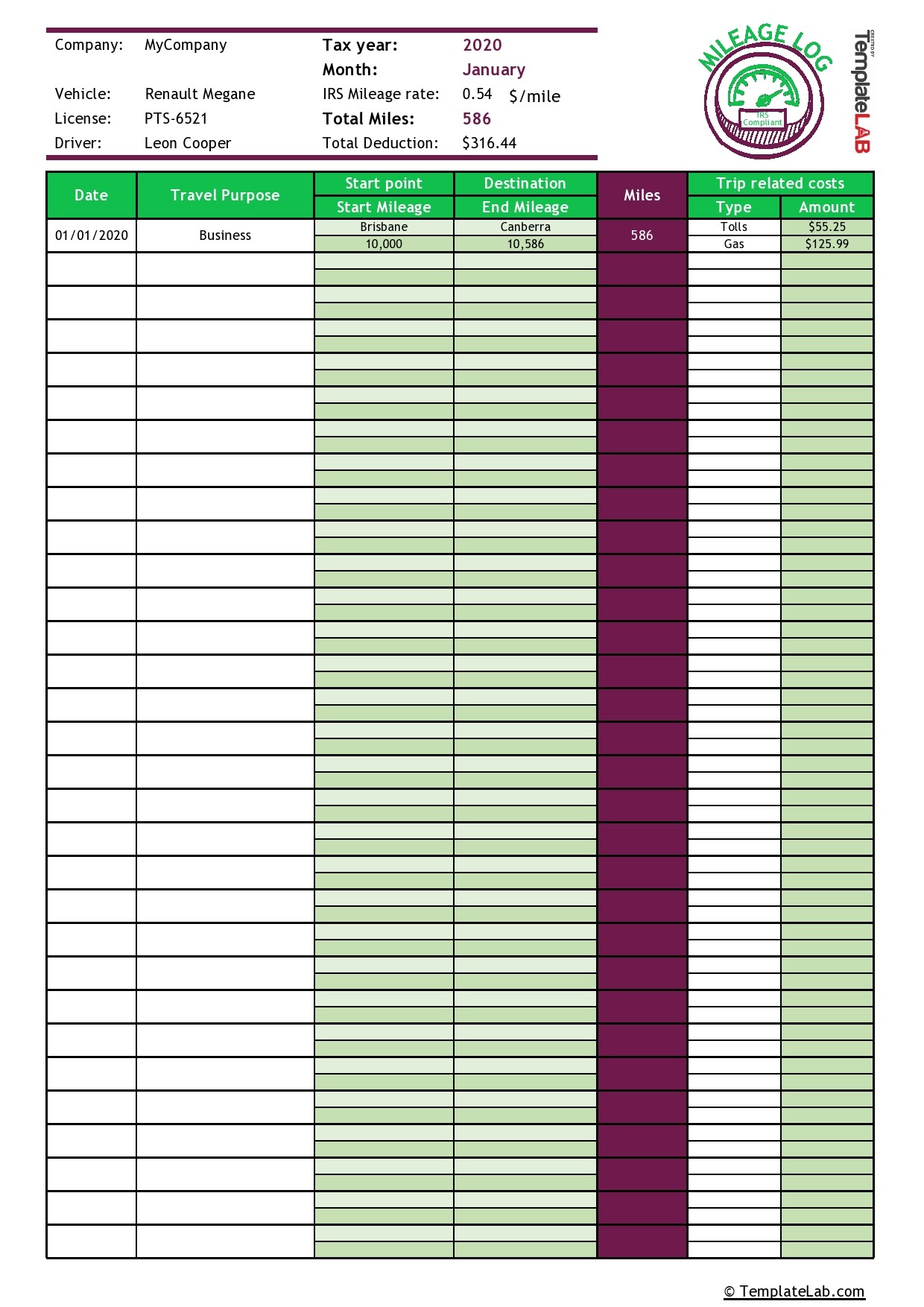

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

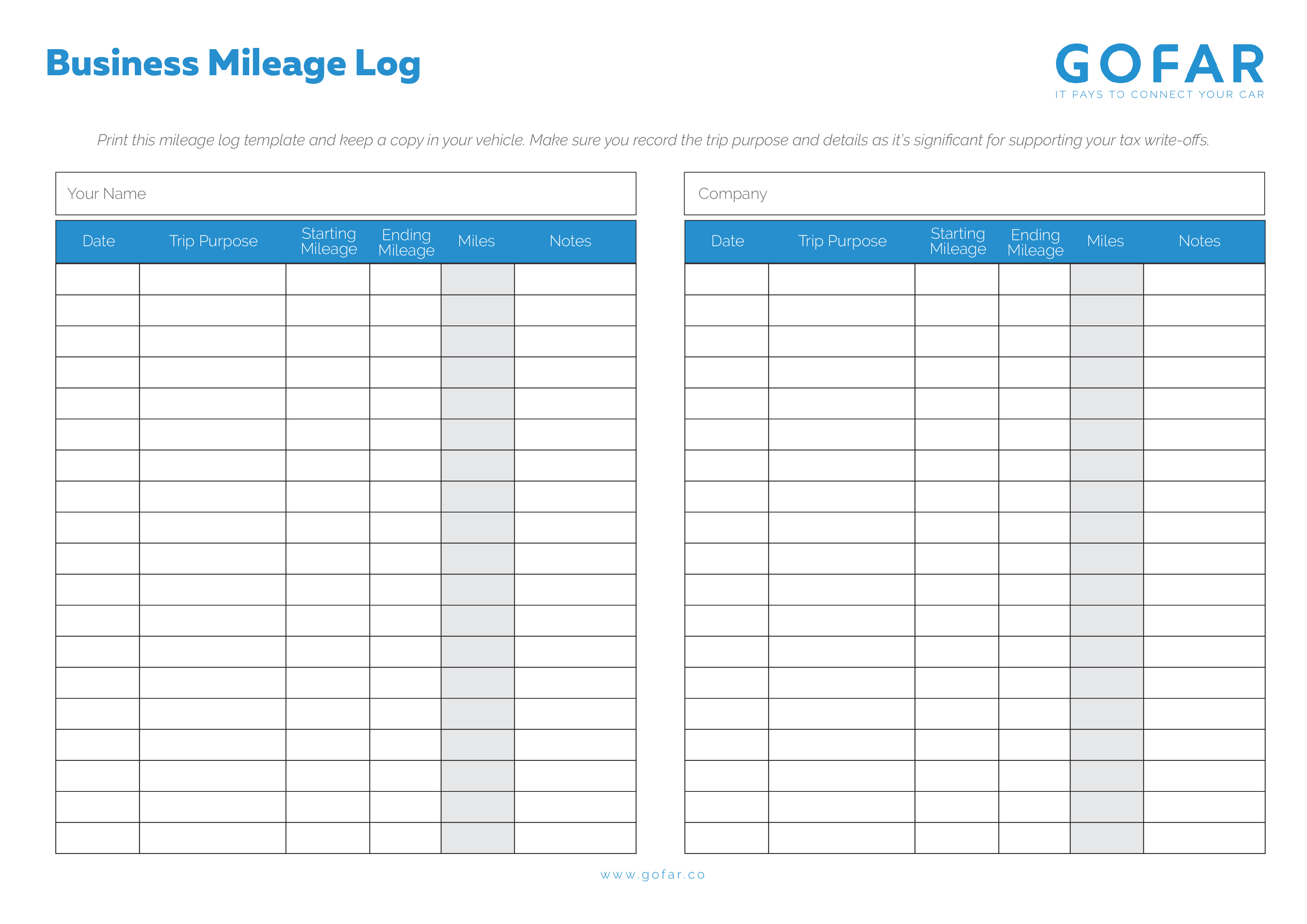

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable Irs Mileage Tracking Templates Gofar Self Employed Mileage

25 Printable IRS Mileage Tracking Templates GOFAR

Related Post: