Form 5498 Instructions

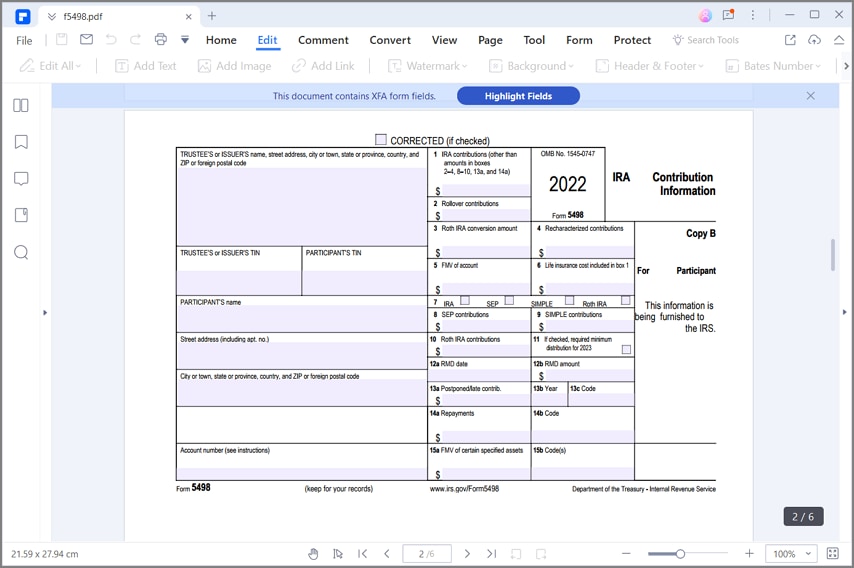

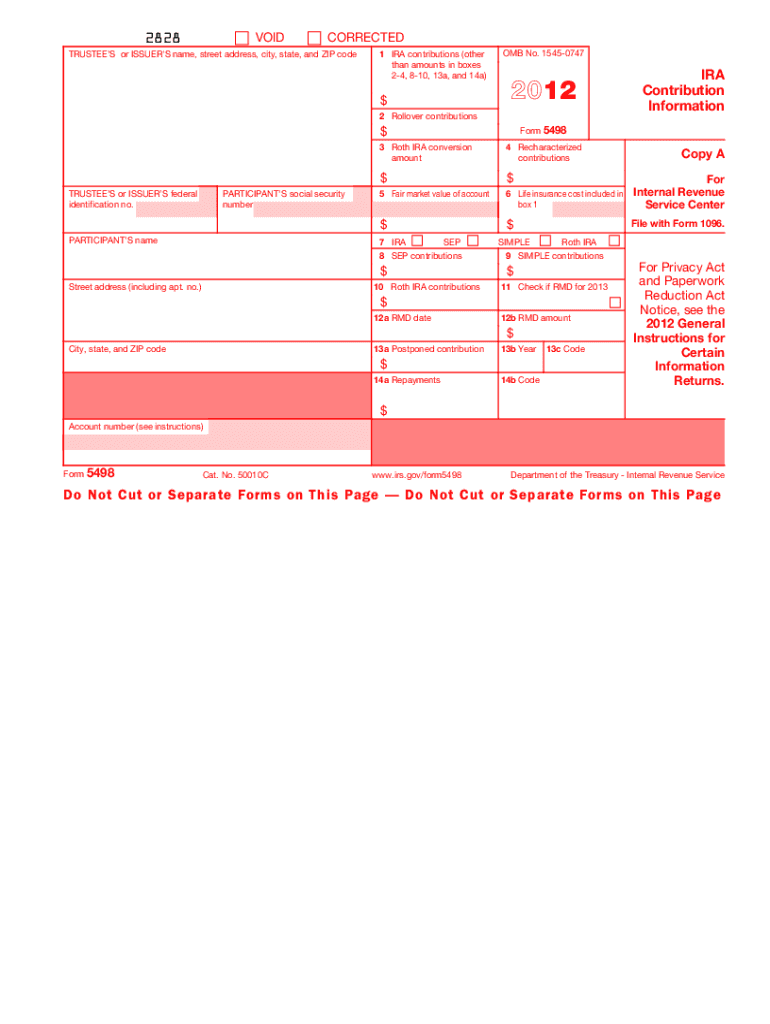

Form 5498 Instructions - You don't need to enter information from your. Complete, edit or print tax forms instantly. Guidance for certain required minimum distributions. Web filing form 5498 with the irs. Web solved•by intuit•1427•updated 1 year ago. Ad access irs tax forms. What is irs form 5498? Web form 5498 new repayment code. Web page last reviewed or updated: Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Guidance for certain required minimum distributions. Ad access irs tax forms. What do i do with form 5498? You don't need to enter information from your. We have added code “ba” for reporting a repayment of a qualified birth or adoption distribution. Complete, edit or print tax forms instantly. Form 5498 is an informational form. The irs form 5498 exists so that financial institutions can report ira information. Web keeping the differences between the iras in mind, you will be most interested in the amounts reported in boxes 1 and 10 of your form 5498. We have added code “ba” for reporting. Web specific instructions for form 5498. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. See the instructions for box 14a. Web page last reviewed or updated: Web keeping the differences between the iras in mind, you will be most interested. The irs requires the form be filed by companies that maintain an individual retirement. Web tax year 2022 form 5498 instructions for participant. What is irs form 5498? Form 5498 is an informational form. You don't need to enter information from your. The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. We have added code “ba” for reporting a repayment of a qualified birth or adoption distribution. Complete, edit or print tax forms instantly. Web irs form 5498 is used to report any money or assets transferred into an ira. Web. Ad access irs tax forms. The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report. Web tax year 2022 form 5498 instructions for participant. This includes contributions, catch up contributions, rollovers from another retirement. The information on form 5498 is submitted to the irs by the trustee. Web irs form 5498 is used to report any money or assets transferred into an ira. What do i do with form 5498? Web form 5498 reports various types of ira contributions you make and other account information in the reporting boxes of the form. See the instructions for box 14a. Form 5498 is an informational form. Web this includes irs form 5498. See the instructions for box 14a. Guidance for certain required minimum distributions. You don't need to enter information from your. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Web in form 5498, you must include basic details, such as the. Web filing form 5498 with the irs. Web irs form 5498 is used to report any money or assets transferred into an ira. What is irs form 5498? The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report. Get ready for tax season deadlines by completing any. The irs requires the form be filed by companies that maintain an individual retirement. Form 5498 is an informational form. See the instructions for box 14a. Web tax year 2022 form 5498 instructions for participant. The irs form 5498 exists so that financial institutions can report ira information. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. What do i do with form 5498? Web page last reviewed or updated: The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report. Web keeping the differences between the iras in mind, you will be most interested in the amounts reported in boxes 1 and 10 of your form 5498. This includes contributions, catch up contributions, rollovers from another retirement. Web this includes irs form 5498. File form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any. Web irs form 5498 is used to report any money or assets transferred into an ira. Web solved•by intuit•1427•updated 1 year ago. Web specific instructions for form 5498. We have added code “ba” for reporting a repayment of a qualified birth or adoption distribution. The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Solved•by turbotax•24174•updated april 05, 2023. You don't need to enter information from your.for How to Fill in IRS Form 5498

5498 Software to Create, Print & EFile IRS Form 5498

Form 5498 IRA Contribution Information Instructions and Guidelines

IRS 5498SA 2016 Fill out Tax Template Online US Legal Forms

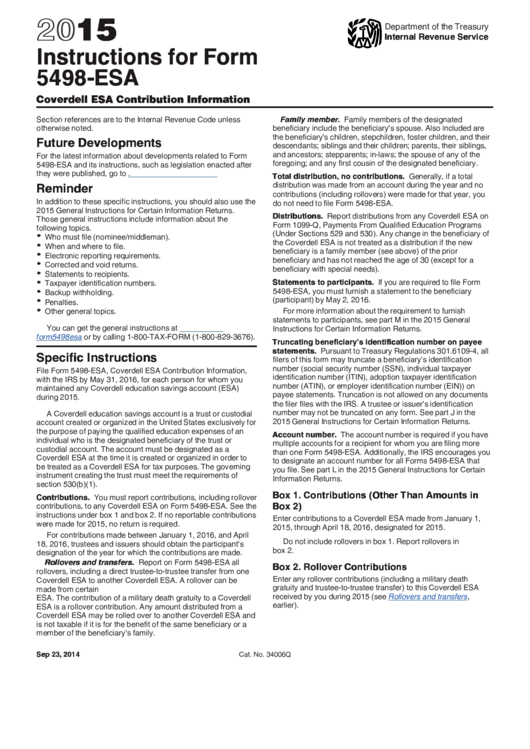

Instructions For Form 5498Esa (2015) printable pdf download

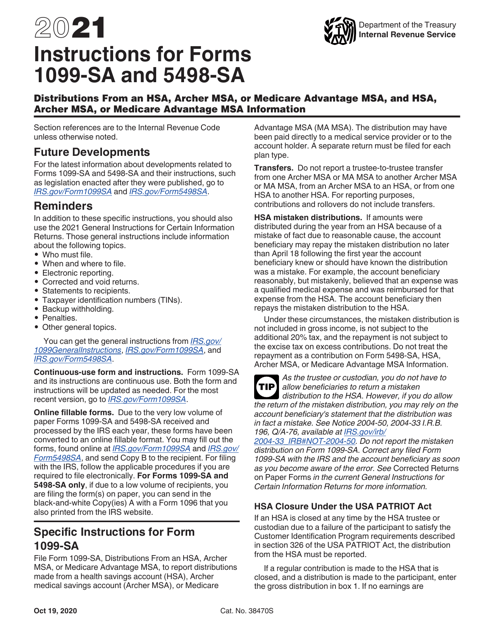

Download Instructions for IRS Form 1099SA, 5498SA PDF, 2021

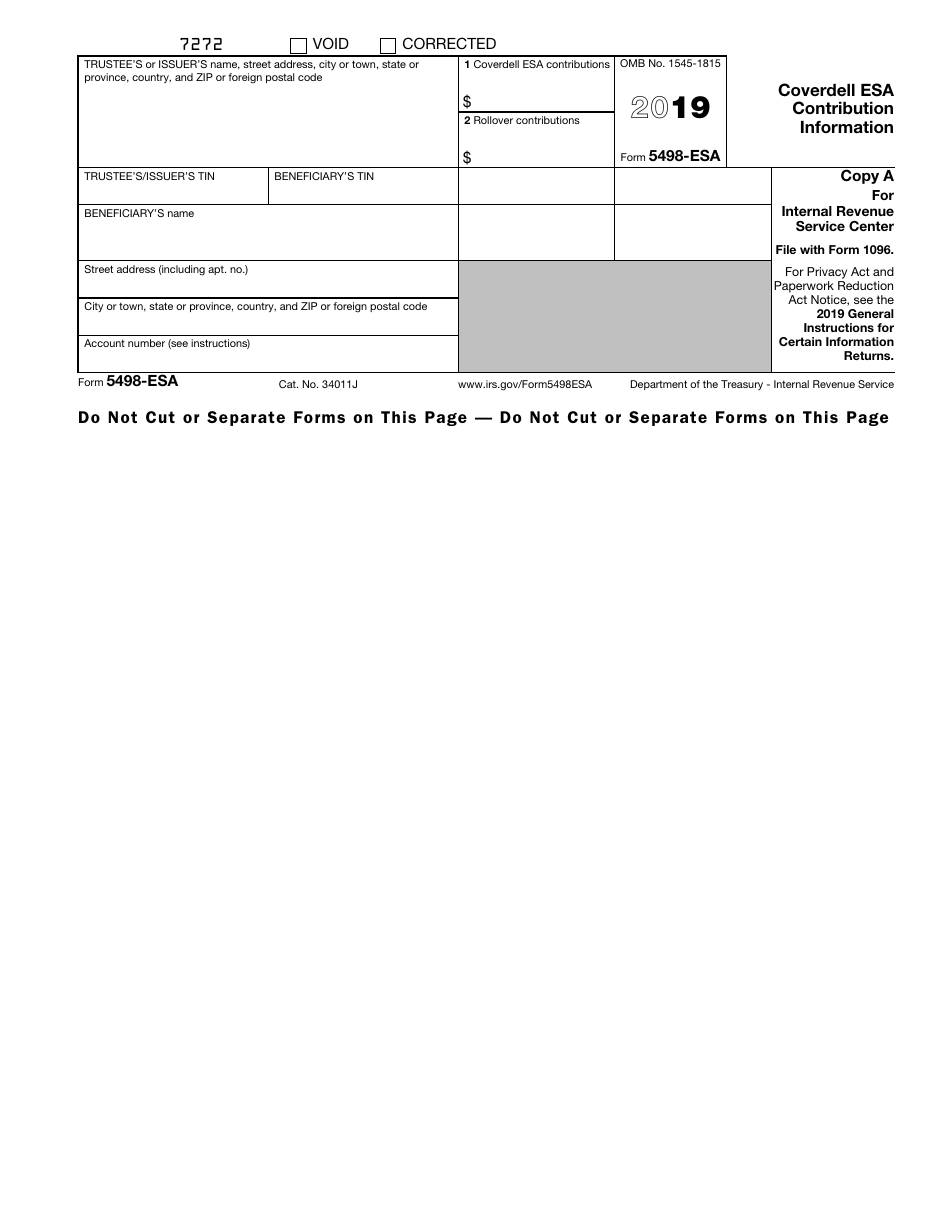

IRS Form 5498ESA 2019 Fill Out, Sign Online and Download Fillable

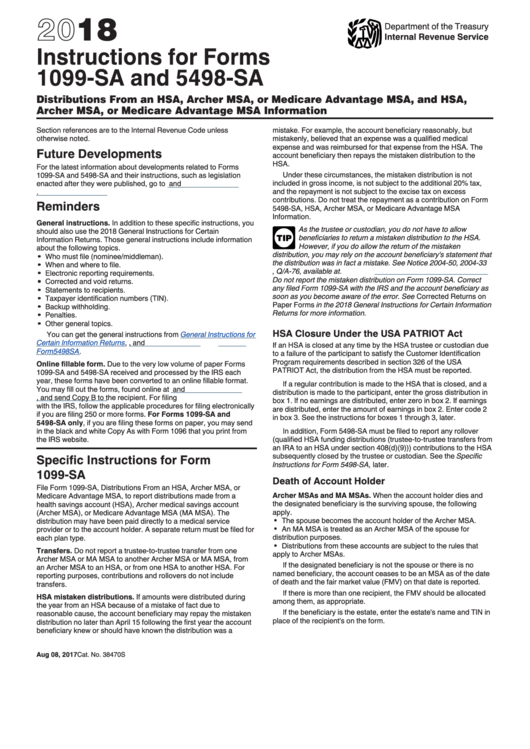

Instructions For Forms 1099Sa And 5498Sa 2018 printable pdf download

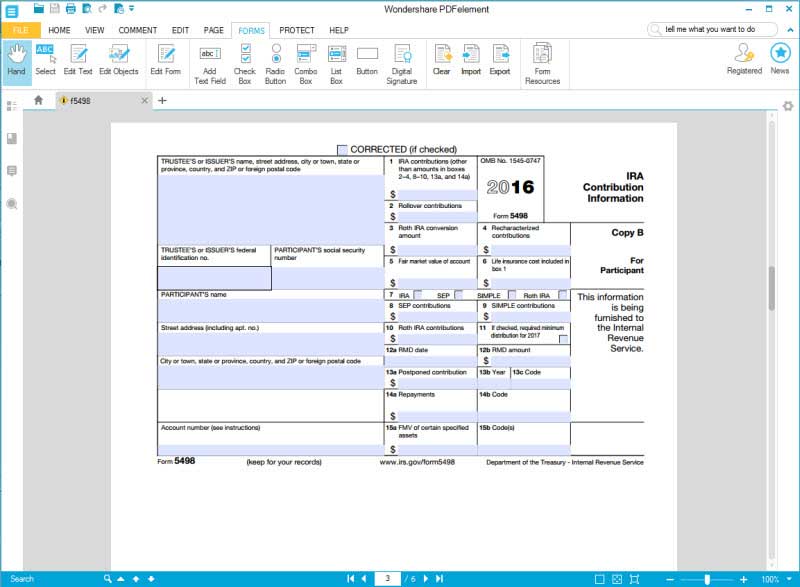

Instructions for How to Fill in IRS Form 5498

5498 IRA/ESA/SA Contribution Information (1099R)

Related Post: