Your Form 941 Has Been Accepted By The Irs

Your Form 941 Has Been Accepted By The Irs - Web quickbooks desktop cheer join the conversation best answers marylandt moderator april 02, 2019 11:43 am good day, @dg11, i'm here for some clarifications. Select this when there are underreported amounts on form 941, overpayments with more than 90 days remaining before the period of. As of may 6, 2021, it had about 200,000. Fax the signed copy of your return using your computer or mobile device. Ad we help get taxpayers relief from owed irs back taxes. You must file irs form 941 if you operate a business and have employees working for you. Ad you don't have to face the irs alone. Web if you do need to send payment, mail a check made out to u.s. Web if the irs accepts your tax return, it means the information you included has been reviewed and appears to be accurate — specifically, the social security number. Get the help you need from top tax relief companies. Web quickbooks desktop cheer join the conversation best answers marylandt moderator april 02, 2019 11:43 am good day, @dg11, i'm here for some clarifications. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. If you haven’t received your ein by the due date of form 941, write “applied for”. Web the irs on thursday released details of a special process for eligible employers to withdraw erc claims that have been filed but for which the employer has. Fax the signed copy of your return using your computer or mobile device. Ask an irs question, get an answer asap. Estimate how much you could potentially save in just a matter. Select this when there are underreported amounts on form 941, overpayments with more than 90 days remaining before the period of. You must file irs form 941 if you operate a business and have employees working for you. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in. Web internal revenue service. Web if you do need to send payment, mail a check made out to u.s. Web irs form 941 is a quarterly report that cites: Ad we help get taxpayers relief from owed irs back taxes. Estimate how much you could potentially save in just a matter of minutes. Web i do know that the irs has recently sent out underpayment notices for 3rd quarter 941 payments, therefore, if you haven't received a notice, it is likely the irs did. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry space. Apply for tax forgiveness. Web i do know that the irs has recently sent out underpayment notices for 3rd quarter 941 payments, therefore, if you haven't received a notice, it is likely the irs did. Web written by a turbotax expert • reviewed by a turbotax cpa. When is form 941 due? Web the irs has made significant progress in processing forms 941, employer’s. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Select this when there are underreported amounts on form 941, overpayments with more than 90 days remaining before the period of. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on. Ad forms, deductions, tax filing and more. Web written by a turbotax expert • reviewed by a turbotax cpa. Ad we help get taxpayers relief from owed irs back taxes. You must file irs form 941 if you operate a business and have employees working for you. Web information about form 941, employer's quarterly federal tax return, including recent updates,. Ad forms, deductions, tax filing and more. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Write their name and title next to their signature. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web if. Write their name and title next to their signature. Fax the signed copy of your return using your computer or mobile device. Apply for tax forgiveness and get help through the process File form 941 with the irs one month after the last. Web here’s how taxpayers can check the status of their federal tax return. The most convenient way to check on a tax refund is by. Web quickbooks desktop cheer join the conversation best answers marylandt moderator april 02, 2019 11:43 am good day, @dg11, i'm here for some clarifications. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Ask an irs question, get an answer asap. Every year, the irs has a. Write their name and title next to their signature. Estimate how much you could potentially save in just a matter of minutes. Web irs form 941 is a quarterly report that cites: Fax the signed copy of your return using your computer or mobile device. Web the irs has made significant progress in processing forms 941, employer’s quarterly federal tax return. Ad forms, deductions, tax filing and more. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web 1 2 3 next jenop moderator january 07, 2022 06:22 pm i have details to share why the status are still submitted to intuit, ucceldon. Web here’s how taxpayers can check the status of their federal tax return. Ask a tax professional anything right now. Web first is “adjusted employment tax return”. Get the help you need from top tax relief companies. Web if the irs accepts your tax return, it means the information you included has been reviewed and appears to be accurate — specifically, the social security number. As of may 6, 2021, it had about 200,000. Ad we help get taxpayers relief from owed irs back taxes.How to fill out IRS Form 941 2019 PDF Expert

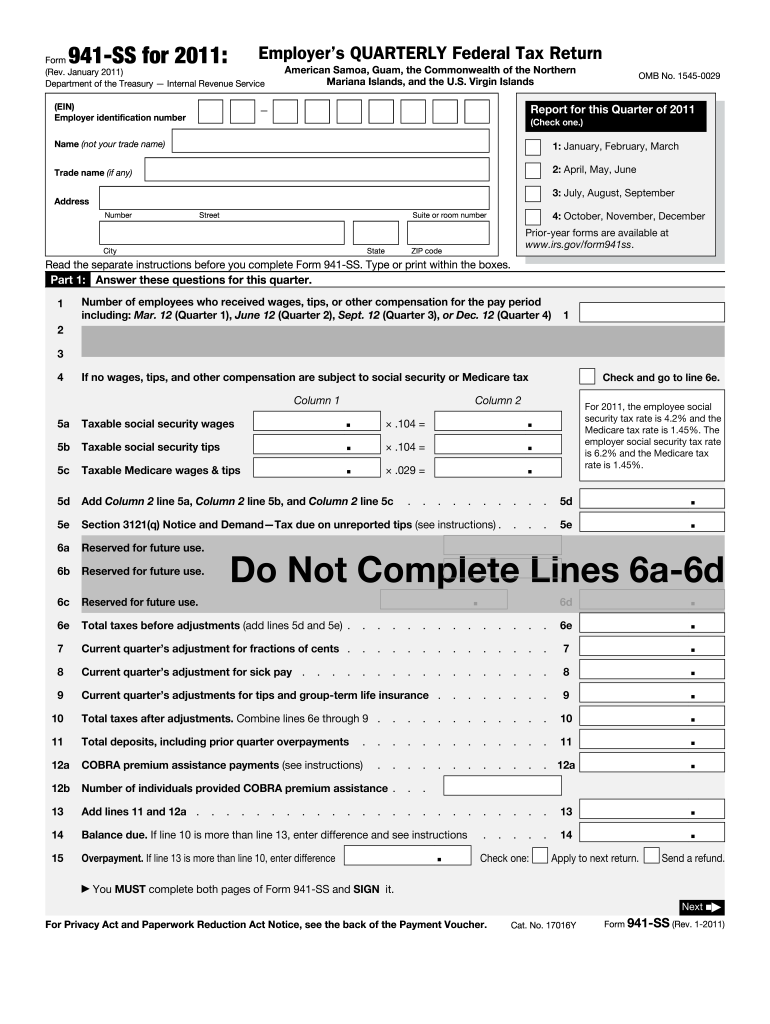

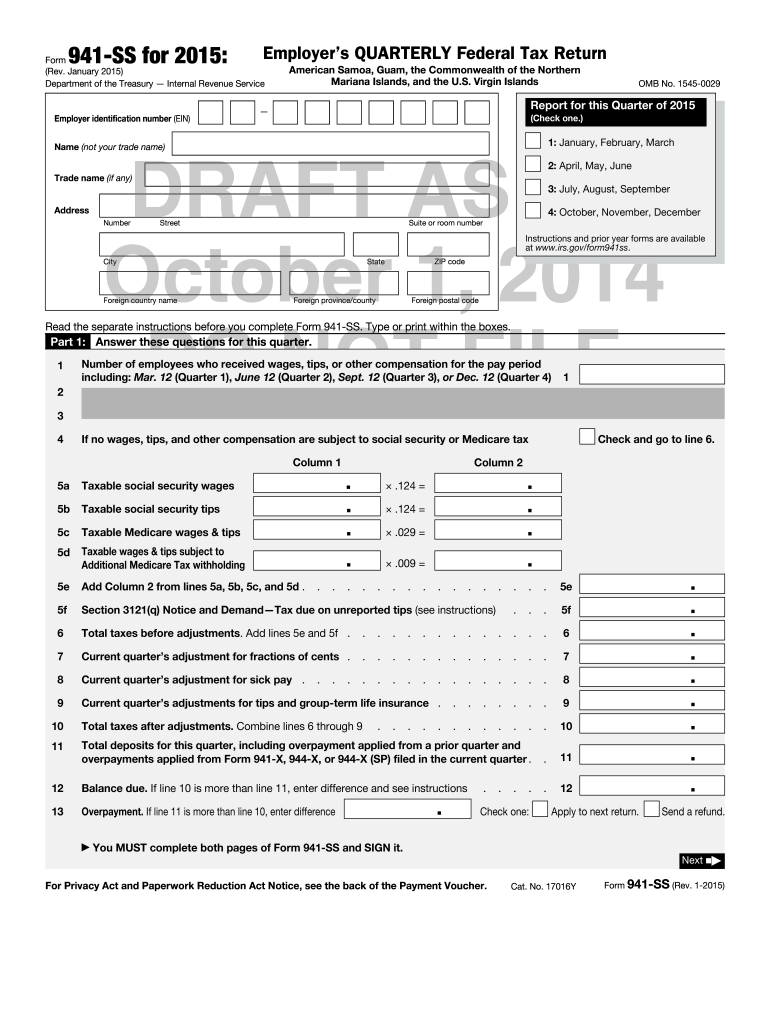

2011 Form IRS 941SSFill Online, Printable, Fillable, Blank pdfFiller

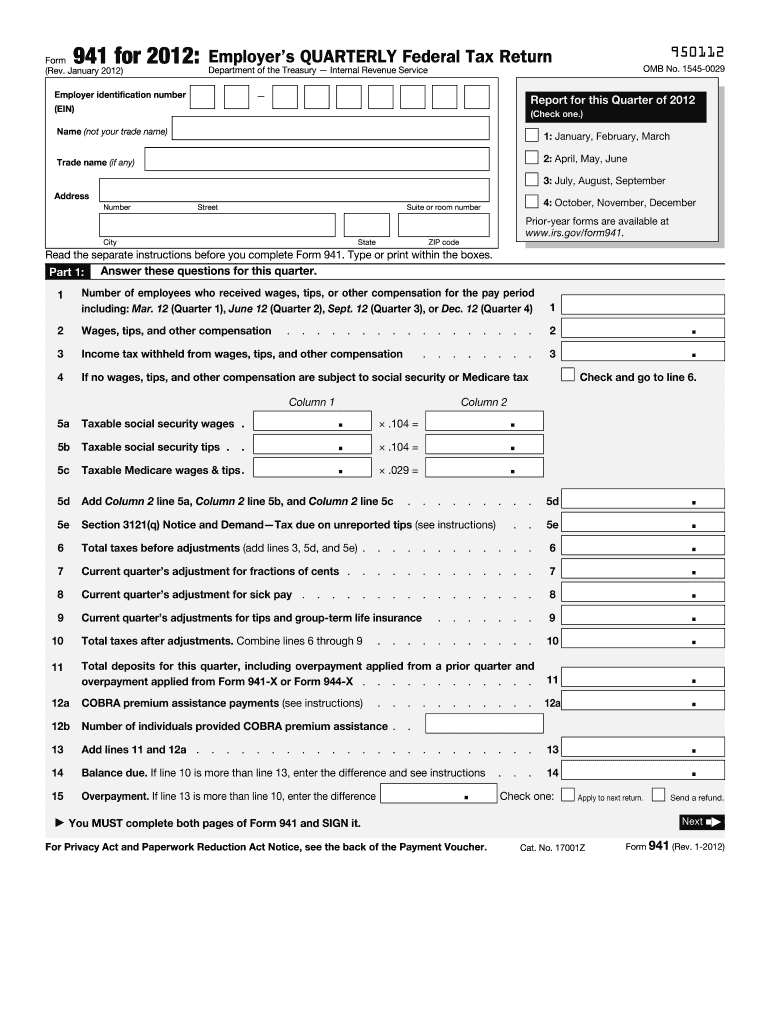

Ir's Form 941 Fill Out and Sign Printable PDF Template signNow

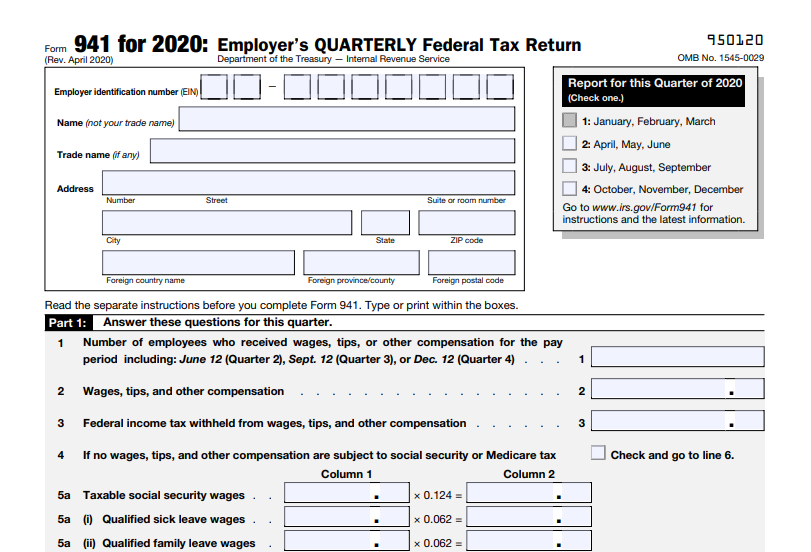

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

EFile your IRS Form 941 for the tax year 2020

Irs Releases Final Instructions For Payroll Tax Form Related To Covid

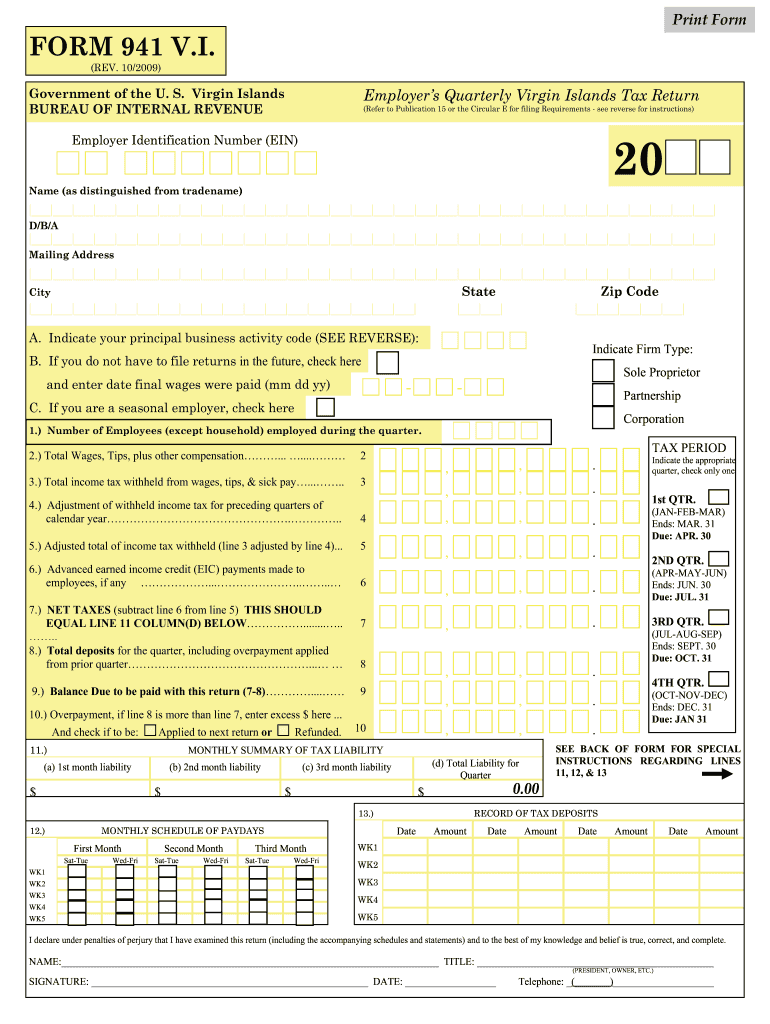

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

Fillable Online irs Form 941SS (Rev. January 2015) irs Fax Email

IRS Form 941 Fillable & Printable Samples

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Related Post: