Form 740 Np

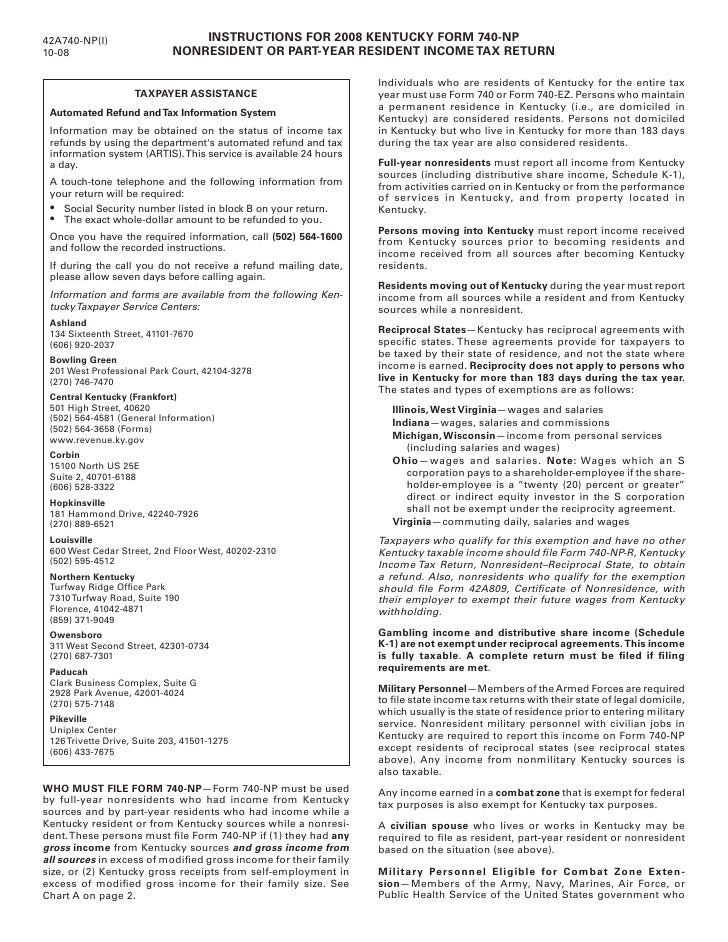

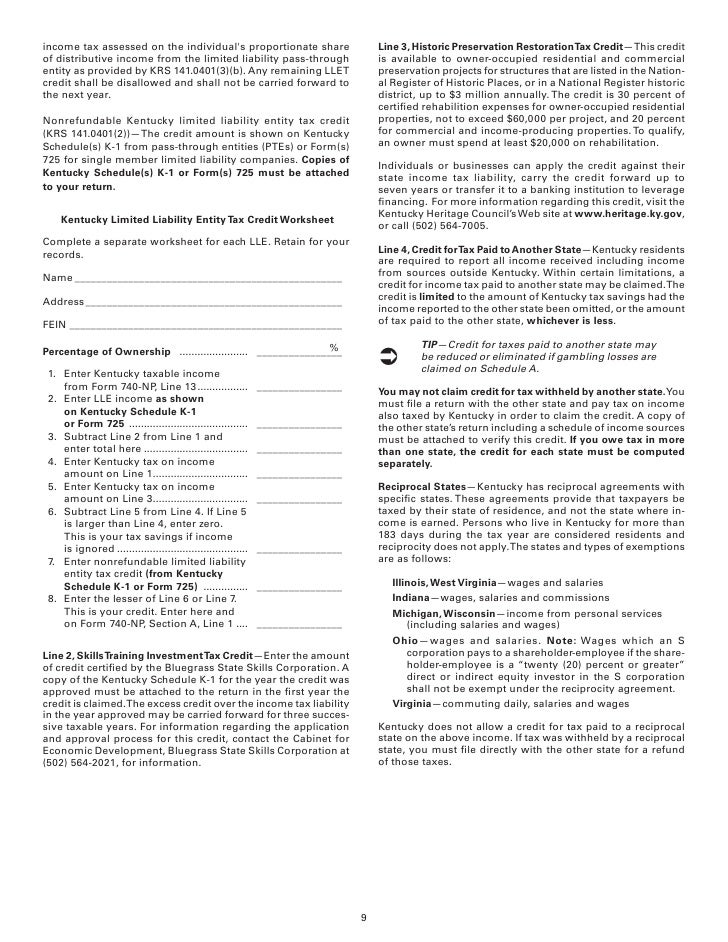

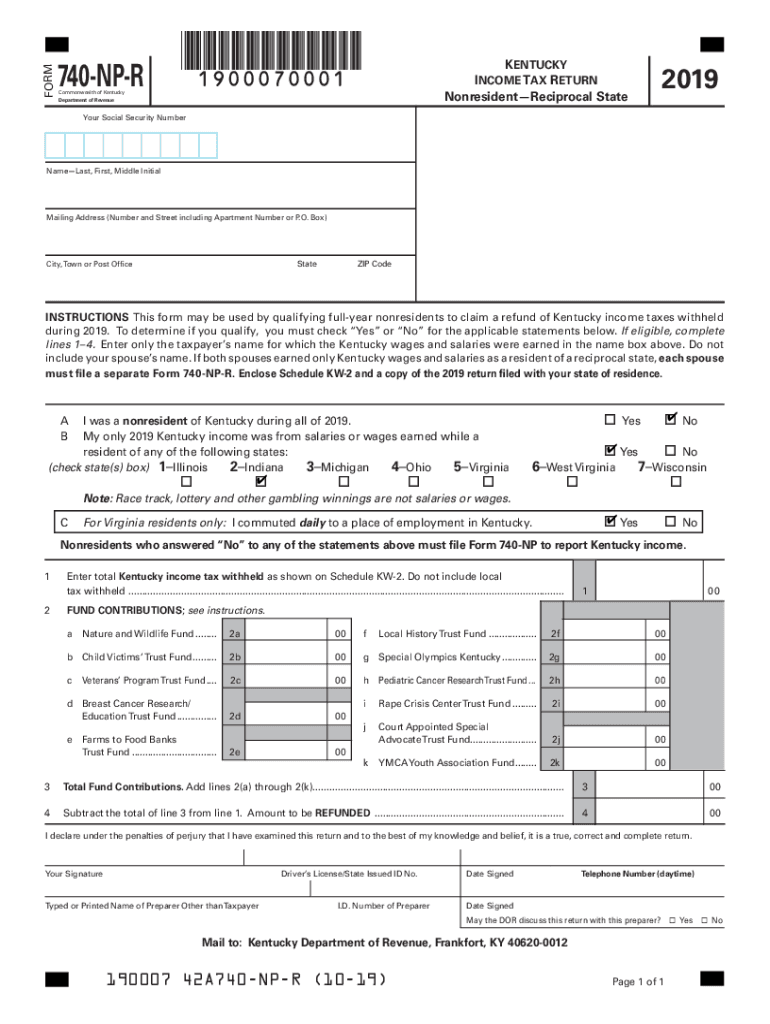

Form 740 Np - Use a 740npr 2022 template to make your document workflow more streamlined. •persons moving out of kentucky. This form is for income earned in tax year 2022, with tax returns due in. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. A $40 tax credit is allowed for each individual reported on the return who is age 65 or. Web which form should i file? Web 333 3131193 form 540nr 2019 side 1 • • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. You may itemize your deductions for kentucky even if you do not itemize for federal purposes. Web which form should i file? It was viewed 321 times while on public inspection. Web this pdf is the current document as it appeared on public inspection on 10/12/2023 at 4:15 pm. Use a 740npr 2022 template to make your document workflow more streamlined. •persons moving out of kentucky. Web which form should i file? It was viewed 321 times while on public inspection. This form is for income earned in tax year 2022, with tax returns due in. Kentucky nonresident income tax withholding on distributive share income. It was viewed 321 times while on public inspection. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will. Web 333 3131193 form 540nr 2019 side 1 • • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result. Web which form should i file? Kentucky nonresident income tax withholding on distributive share income. A $40 tax credit is allowed for each individual reported on the return who is age 65 or. •persons moving out of kentucky. Web 333 3131193 form 540nr 2019 side 1 • • • • • • filing status 6 if someone can claim you. A $40 tax credit is allowed for each individual reported on the return who is age 65 or. Web deduction from form 540nr, line 18, and go to line 6. •persons moving out of kentucky. It was viewed 321 times while on public inspection. This form is for income earned in tax year 2022, with tax returns due in. Web 333 3131193 form 540nr 2019 side 1 • • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. You may itemize your deductions for kentucky even if you do not itemize for federal purposes. Web deduction from form 540nr, line 18, and go to line 6.. It was viewed 321 times while on public inspection. Web 333 3131193 form 540nr 2019 side 1 • • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. Web this pdf is the current document as it appeared on public inspection on 10/12/2023 at 4:15 pm. This. Use a 740npr 2022 template to make your document workflow more streamlined. This form is for income earned in tax year 2022, with tax returns due in. Kentucky nonresident income tax withholding on distributive share income. Web this pdf is the current document as it appeared on public inspection on 10/12/2023 at 4:15 pm. A $40 tax credit is allowed. Web which form should i file? Reciprocal state (il, in, mi, oh, va, wv or wi) with kentucky income of wages and salaries only. You may itemize your deductions for kentucky even if you do not itemize for federal purposes. Use a 740npr 2022 template to make your document workflow more streamlined. Web this pdf is the current document as. It was viewed 321 times while on public inspection. Web deduction from form 540nr, line 18, and go to line 6. Web which form should i file? Reciprocal state (il, in, mi, oh, va, wv or wi) with kentucky income of wages and salaries only. This form is for income earned in tax year 2022, with tax returns due in. This form is for income earned in tax year 2022, with tax returns due in. Web which form should i file? Kentucky nonresident income tax withholding on distributive share income. You may itemize your deductions for kentucky even if you do not itemize for federal purposes. Reciprocal state (il, in, mi, oh, va, wv or wi) with kentucky income of wages and salaries only. It was viewed 321 times while on public inspection. Use a 740npr 2022 template to make your document workflow more streamlined. Web which form should i file? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. A $40 tax credit is allowed for each individual reported on the return who is age 65 or. Web deduction from form 540nr, line 18, and go to line 6. Web this pdf is the current document as it appeared on public inspection on 10/12/2023 at 4:15 pm. Web 333 3131193 form 540nr 2019 side 1 • • • • • • filing status 6 if someone can claim you (or your spouse/rdp) as a dependent, check the box here. •persons moving out of kentucky.740NP 2008 Instructions Form 42A740NP(I)

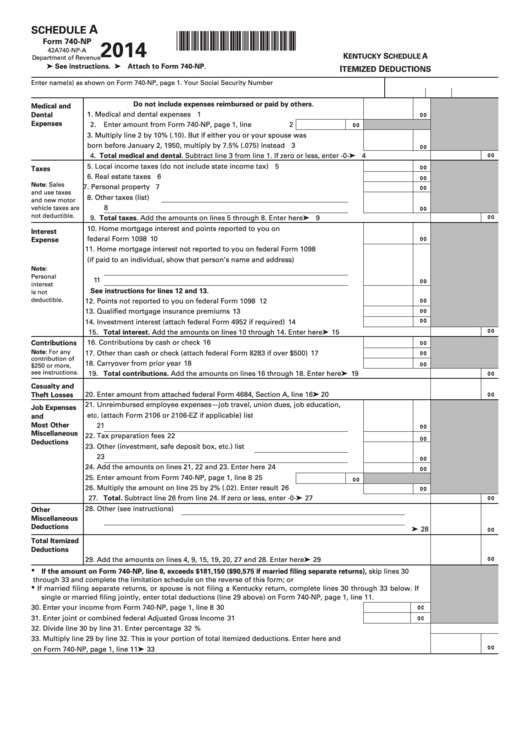

Fillable Schedule A Form 740Np Kentucky Schedule A Itemized

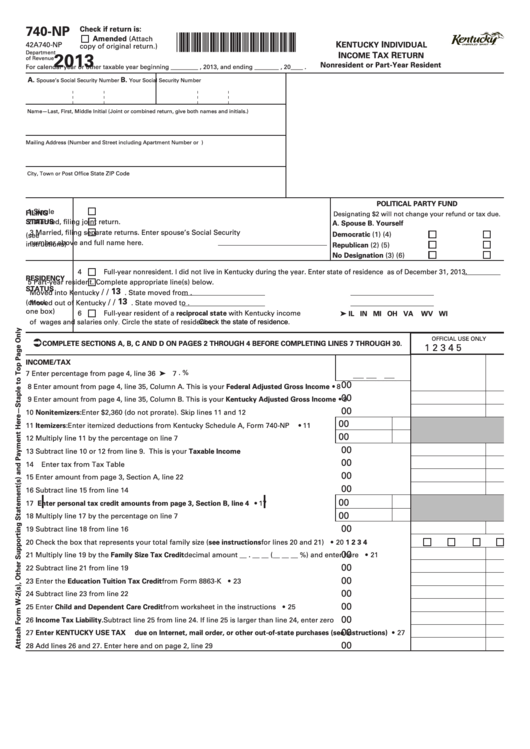

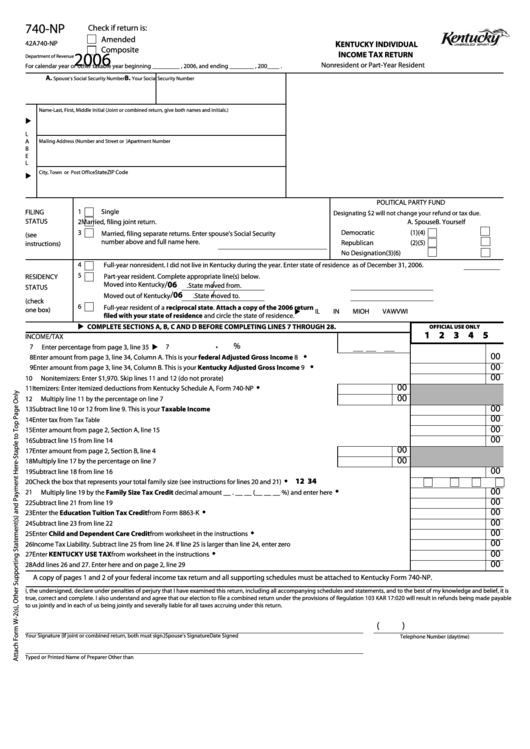

Fillable Form 740Np Kentucky Individual Return Nonresident

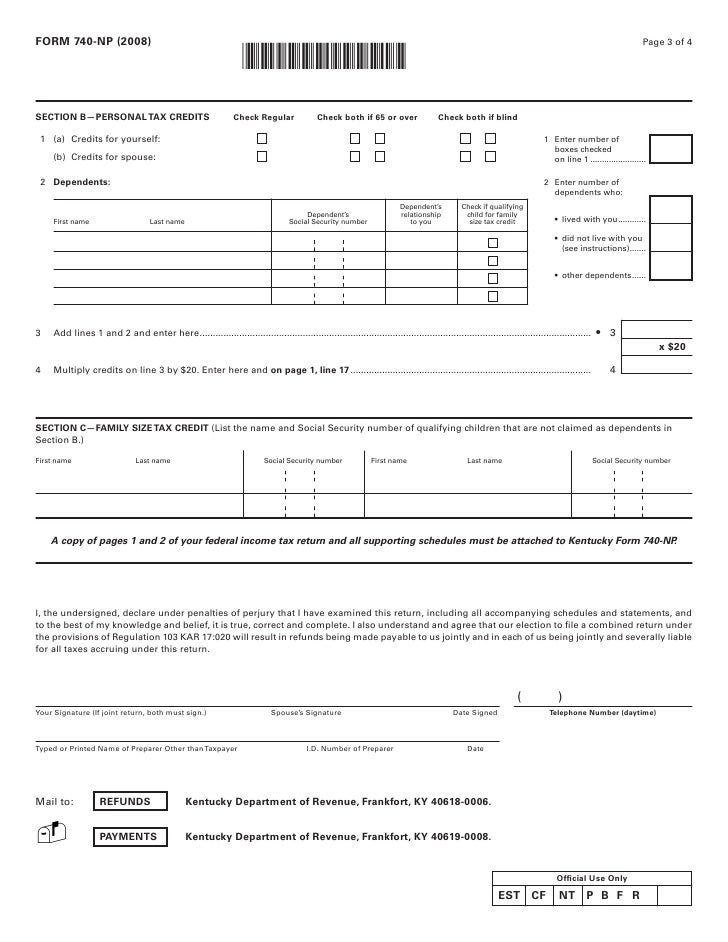

740NP 2008 Kentucky Individual Tax Return Nonresident or Pa…

740NP 2008 Instructions Form 42A740NP(I)

Kentucky Form 740 Np ≡ Fill Out Printable PDF Forms Online

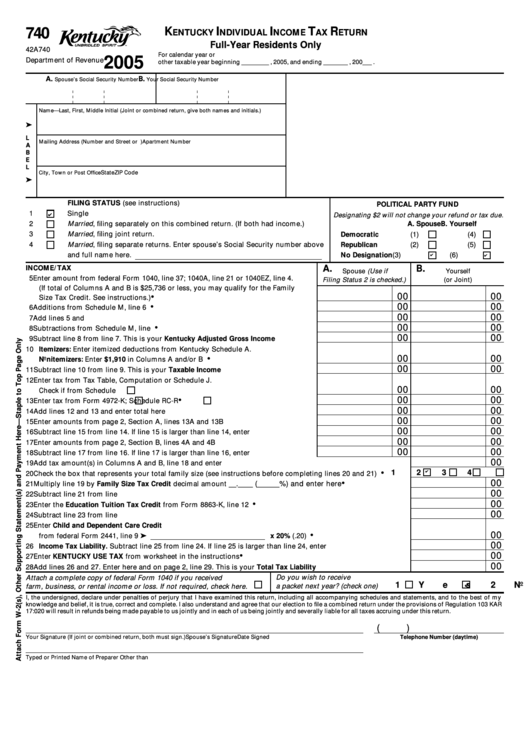

Fillable Form 740 Individual Tax Return FullYear Residents

Kentucky form 740 Fill out & sign online DocHub

Fillable Form 740Np Kentucky Individual Tax Return

740 NP R Fill Out and Sign Printable PDF Template signNow

Related Post: