Uber Eats 1099 Form

Uber Eats 1099 Form - Perfect for any office occasion. Web look through your 1099 form for information about your income. And satisfy those late night cravings with uber eats. Web how do i access my 1099 tax form? Uber will make your 1099s available in 2 different ways: An official irs tax document providing a summary of promotion, referral, and other miscellaneous payments for the year. Web you can access your 1099 in uber eats manager by selecting “tax information” in the menu on the left side of your screen. Whether you're on the road full time or driving on. You can either use the standard mileage method or the actual expense method to deduct your car. Web up to $5 cash back how to use your uber 1099s: If you also opted in to receive. Know what taxes you have to pay. Enjoy your favourite meals with uber eats. Delight your employees by having their favorite meals delivered anywhere they work. If you're an uber driver, then uber will send you a 1099 form to use for your tax filing. An official irs tax document that includes all gross earnings from meal orders. Web 2022 1099s will be available online to download via the uber eats manager by january 31, 2023. Web all restaurants have been opted into electronic download of their 1099. Pay your team and access hr and benefits with the #1 online payroll provider. Web you can. Web this means that if you did work for uber in 2022, you’ll receive your 1099s on or before january 31, 2023. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. And satisfy those late night cravings with uber eats. Web all restaurants have been. Delight your employees by having their favorite meals delivered anywhere they work. You earned more than $20,000 in customer payments in the last year and you provided at least. If you also opted in to receive. Web here are the essentials: You can either use the standard mileage method or the actual expense method to deduct your car. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. Web 2022 1099s will be available online to download via the uber eats manager by january 31, 2023. An official irs tax document that includes all gross earnings from meal orders. Enjoy your favourite meals with. It’s simply a form that. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. Whether you're on the road full time or driving on. Web all restaurants have been opted into electronic download of their 1099. Uber typically sends these out. Web look through your 1099 form for information about your income. Whether you're on the road full time or driving on. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. Web all restaurants have been opted into electronic download of their 1099. Web you could. The uber tax summary isn’t an official tax document. Log in to drivers.uber.com and click. Web how do i access my 1099 tax form? You can either use the standard mileage method or the actual expense method to deduct your car. Know what taxes you have to pay. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. Ad go the extra mile and order meals for your team. If you're an uber driver, then uber will send you a 1099 form to use for your tax filing. The uber tax summary isn’t an. Pay your team and access hr and benefits with the #1 online payroll provider. Web up to $5 cash back uber eats may issue an irs form 1099 indicating the approximate retail value of this reward to the irs for tax reporting purposes. Web look through your 1099 form for information about your income. Ad get food delivery now. Perfect. Not all restaurants will receive a 1099. Uber typically sends these out. Web 2022 1099s will be available online to download via the uber eats manager by january 31, 2023. Web you can access your 1099 in uber eats manager by selecting “tax information” in the menu on the left side of your screen. Ad get food delivery now. Ad go the extra mile and order meals for your team. Perfect for any office occasion. If you're an uber driver, then uber will send you a 1099 form to use for your tax filing. Web you could receive 3 types of tax documents from us: Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. You can access your 1099 in uber eats manager by selecting. Uber will make your 1099s available in 2 different ways: The uber tax summary isn’t an official tax document. Whether you're on the road full time or driving on. Go to the payments section of. Web up to $5 cash back uber eats may issue an irs form 1099 indicating the approximate retail value of this reward to the irs for tax reporting purposes. Web if you qualify to receive a 1099, the easiest way to access your document is to download it directly from your driver dashboard. Ad approve payroll when you're ready, access employee services & manage it all in one place. Log in to drivers.uber.com and click. Web this means that if you did work for uber in 2022, you’ll receive your 1099s on or before january 31, 2023.Uber eats taxes calculator KellyannOcean

Why does my Uber Eats 1099 or Annual Tax Summary say I made more than I

Ultimate Tax Guide for Uber & Lyft Drivers (Updated for 2020)

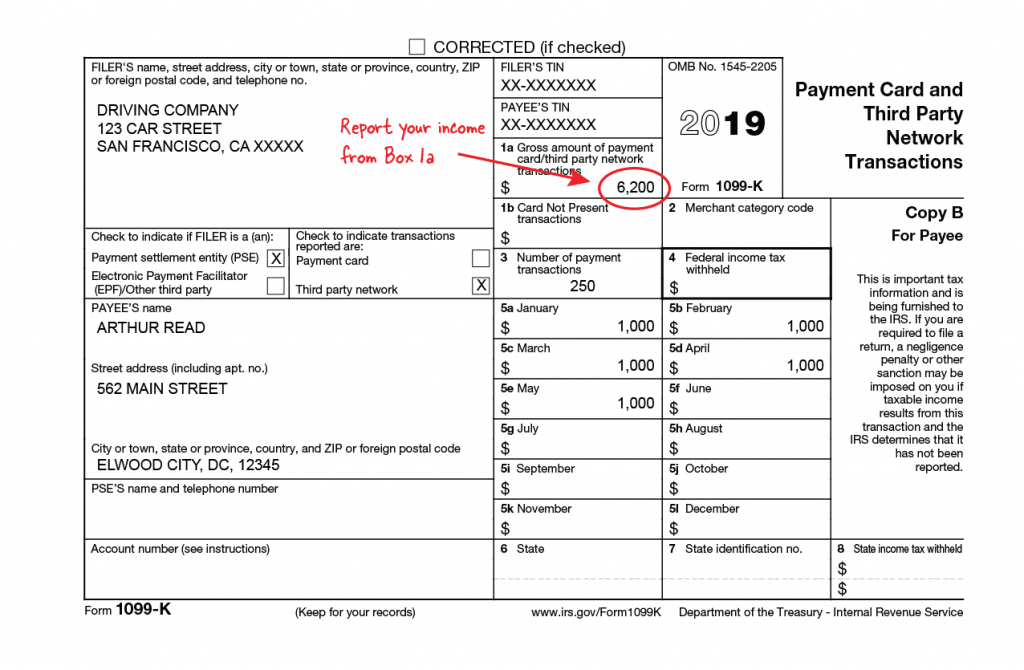

How To Use Your Uber 1099K and 1099MISC — Stride Blog

Uber Form 1099

uber eats tax calculator canada Thora Heath

Tax Help for Uber Drivers How to File Your Uber 1099

How to Get TAX FORM from DoorDash, Grubhub & Uber Eats (1099NEC) YouTube

How to Understand Uber Eats 1099s When They Lie About Your Pay

Uber Tax Forms What You Need to File Shared Economy Tax

Related Post: