Worksheet For Form 8812

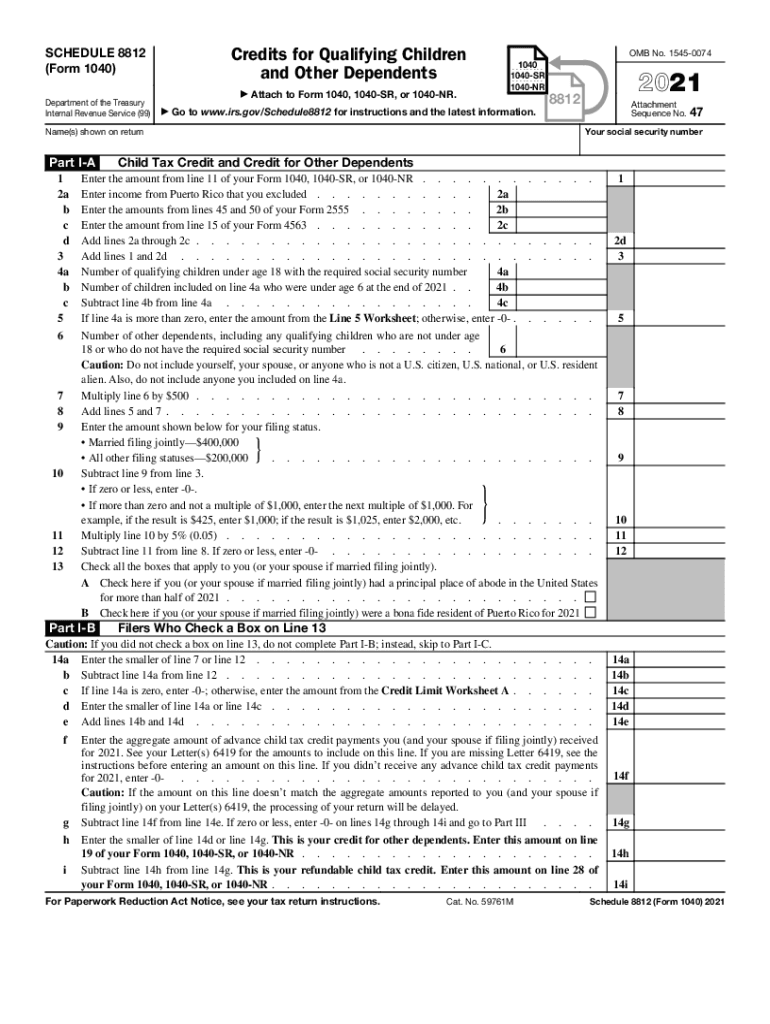

Worksheet For Form 8812 - Web child tax credit and credit for other dependents worksheet. Web handy tips for filling out 8812 instructions tax form online. Other tax credits you can claim using schedule 8812. Printing and scanning is no longer the best way to manage documents. If you apply for an itin on or before the due date of your 2022 return (including. Web child tax credit workout. Web 2022 schedule 8812 credit limit worksheet a keep for your records 1. • if you owe less tax than the total of your ctc, you can. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. Repeating fields will be filled. Other tax credits you can claim using schedule 8812. Credits for qualifying children and other dependents. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. If you apply for an itin on or before the due date of your 2022 return (including. See. Printing and scanning is no longer the best way to manage documents. Web 2022 schedule 8812 credit limit worksheet a keep for your records 1. Web child tax credit form 8812 line 5 worksheet. See the instructions for form 1040, line 52; Web child tax credit and credit for other dependents worksheet. For tax year 2021 only: Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web form 1040 instructions schedule 8812 instructions. Web how to complete this tax form and its accompanying worksheets, step by step. • if you owe less tax than the. For tax year 2021 only: • the child tax credit (ctc) is worth up to $2,000 per qualifying child (tax year 2022). Printing and scanning is no longer the best way to manage documents. Web handy tips for filling out 8812 instructions tax form online. If you apply for an itin on or before the due date of your 2022. To find rules that apply for. Web there is no line 5 worksheet to be found anywhere. If you, or your spouse if filing jointly, do not have an ssn or itin issued on or before the due date of your 2022 return (including extensions), you cannot claim the ctc, odc, or actc on either your original or an amended. Repeating fields will be filled. From july 2021 to december 2021,. Schedule 8812, credits for qualifying children and other dependents, will now be used as a single source, replacing publication 972, child tax. Web how to complete this tax form and its accompanying worksheets, step by step. Credits for qualifying children and other dependents. I cannot find the line 5 worksheet in my return so i'm not sure where the number came from. Printing and scanning is no longer the best way to manage documents. Web schedule 8812 is the irs tax form designed to help eligible taxpayers claim the additional child tax credit. The article below outlines the rules for the child tax. Web 2022 schedule 8812 credit limit worksheet a keep for your records 1. The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child. Web how to complete this tax form and its accompanying worksheets, step by step. Go digital and save time with signnow, the best. • the. If you apply for an itin on or before the due date of your 2022 return (including. Web schedule 8812 is the irs tax form designed to help eligible taxpayers claim the additional child tax credit. Use schedule 8812 (form 1040) to figure your child. Web child tax credit workout. Web 2022 schedule 8812 credit limit worksheet a keep for. For tax year 2021 only: The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child. Credits for qualifying children and other dependents. Schedule 8812, credits for qualifying children and other dependents, will now be used as a single source, replacing publication 972, child tax. Web handy tips for. To find rules that apply for. Web handy tips for filling out 8812 instructions tax form online. Credits for qualifying children and other dependents. Web how to complete this tax form and its accompanying worksheets, step by step. Ad signnow.com has been visited by 100k+ users in the past month Irs instructions for form 8812. Web schedule 8812 (form 1040) department of the treasury internal revenue service. Insert photos, crosses, check and text boxes, if needed. Web there is no line 5 worksheet to be found anywhere. Schedule 8812, credits for qualifying children and other dependents, will now be used as a single source, replacing publication 972, child tax. Use schedule 8812 (form 1040) to figure your child. If you, or your spouse if filing jointly, do not have an ssn or itin issued on or before the due date of your 2022 return (including extensions), you cannot claim the ctc, odc, or actc on either your original or an amended 2022 return. Go digital and save time with signnow, the best. The worksheet is used to determine the child tax credit amount based on income limitations, so it's a key. See the instructions for form 1040, line 52; For tax year 2021 only: Other tax credits you can claim using schedule 8812. If you apply for an itin on or before the due date of your 2022 return (including. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web child tax credit form 8812 line 5 worksheet.Form 8812 Line 5 Worksheet ideas 2022

Worksheet For Form 8812

Worksheet For Form 8812

form 8812 credit limit worksheet a

Worksheet For Form 8812

Schedule 8812 Line 5 Worksheet

Form 8812 Worksheet Printable Word Searches

What Is The Credit Limit Worksheet A For Form 8812

8812 Worksheet

Form 8812 Fill Out and Sign Printable PDF Template signNow

Related Post: