How To Fill Out Alabama A4 Form

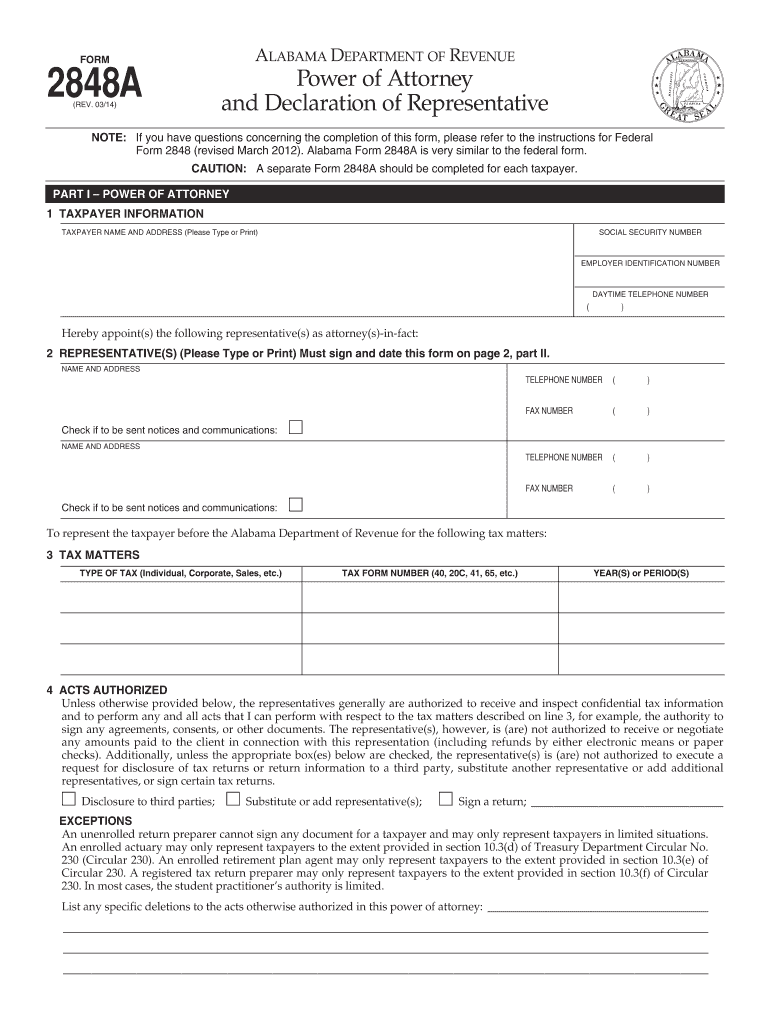

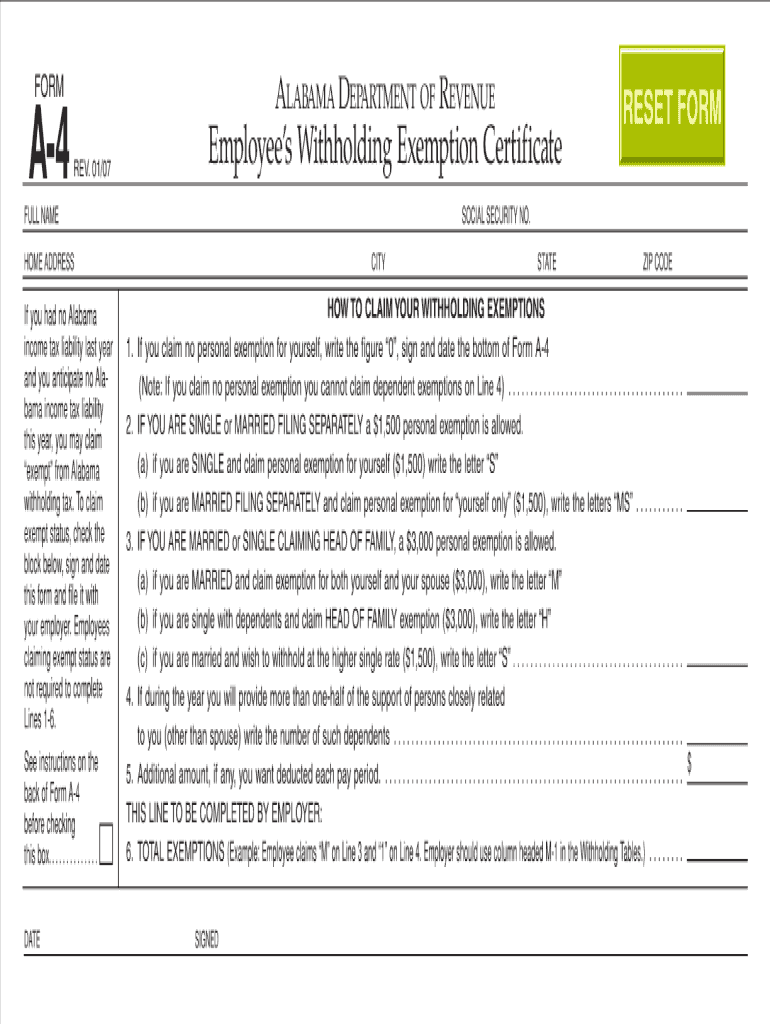

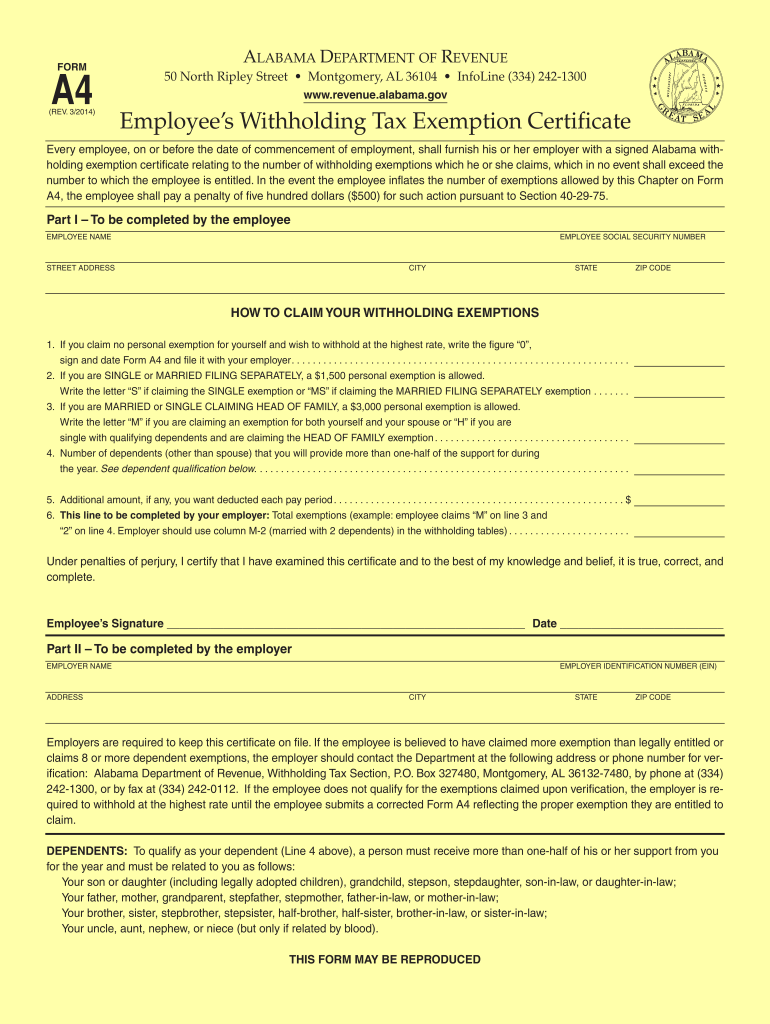

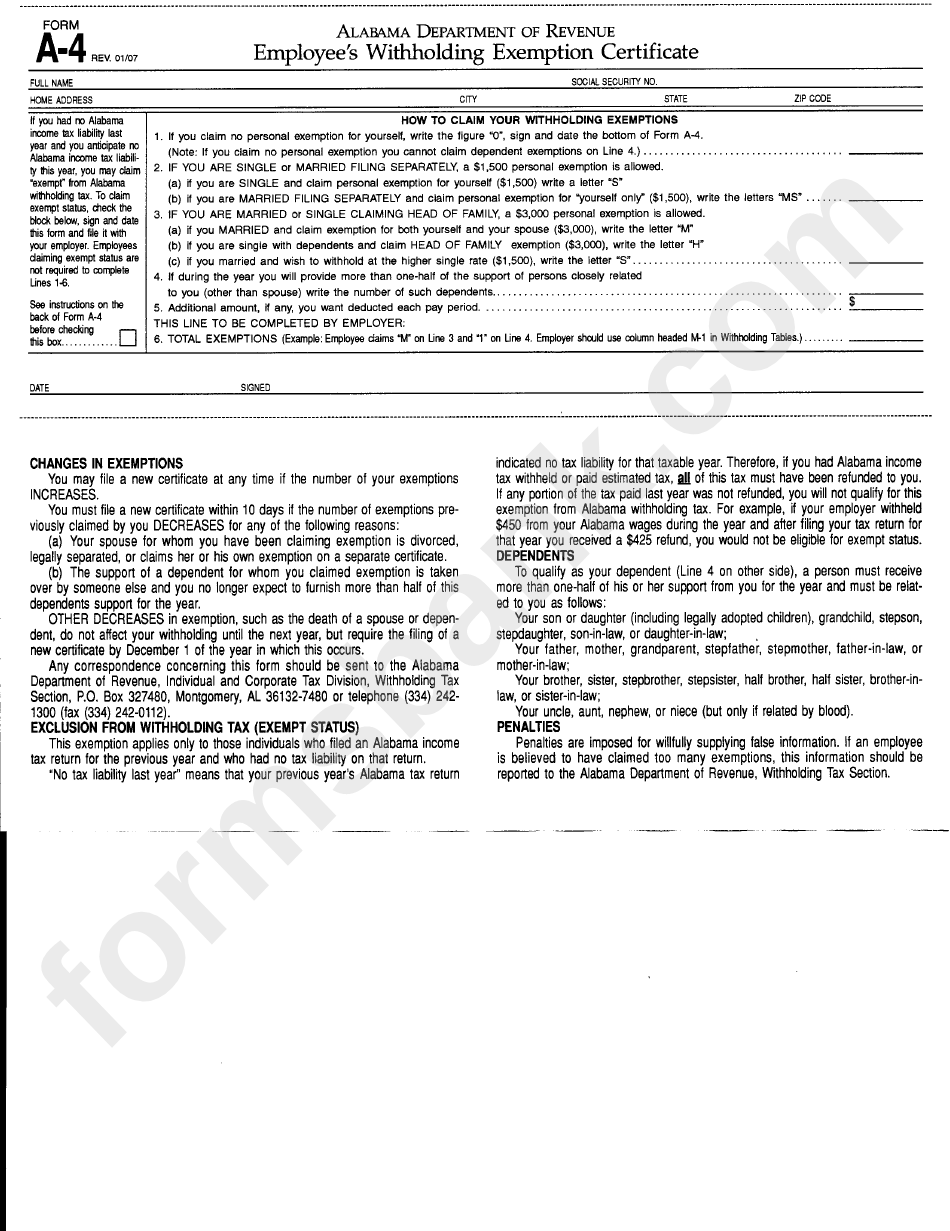

How To Fill Out Alabama A4 Form - An exem ption from withholding may be claimed if you. If you are single or married filing separately, a $1,500 personal exemption is allowed. Web sign and date form a4 and file it with your employer. Only use the print form button if. You must sign and date the form. In lieu of alabama form 99. Alabama income tax forms &. Web employees in alabama fill out form a4, employee's withholding tax exemption certificate, to be used when calculating withholdings. Easily sign the alabama a 4 with your finger. Web complete a new w4 form each calendar year. An exem ption from withholding may be claimed if you. If you are single or married filing separately, a $1,500 personal exemption is allowed. Alabama income tax forms &. Web if you are trying to locate, download, print, or fill state of alabama tax forms, you can do so on the alabama department of revenue website. Send filled & signed. Easily sign the form with your finger. Web you are responsible only for the tax due on your return and you are entitled to a $1,500 personal exemption for the filing status of “married filing a separate return.”. Only use the print form button if. Send filled & signed alabama a 4 form 2023 pdf. What is alabama state withholding. Only use the print form button if. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web sign and date form a4 and file it with your employer. Send filled & signed form or save. What is alabama state withholding. Only use the print form button if. You must sign and date the form. Web is there any way to claim exemption on the alabama a4 form from the income portion of state tax? Web you are responsible only for the tax due on your return and you are entitled to a $1,500 personal exemption for the filing status of. Alabama does not have any reciprocal. What is alabama state withholding form al a4? If you are single or married filing separately, a $1,500 personal exemption is allowed. Find an existing withholding account number: Web the employer must fill out number 6. While completing this section, the employer can point out if any of the sections above have not been completed correctly. Send filled & signed form or save. You must sign and date the form. If you are single or married filing separately, a $1,500 personal exemption is allowed. Alabama income tax forms &. Easily sign the alabama a 4 with your finger. If you are single or married filing separately, a $1,500 personal exemption is allowed. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax. Open form follow the instructions. Send filled &. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Web the employer must fill out number 6. Often referred to as alabama state withholding form al. Send filled & signed form or save. Send filled & signed alabama a 4. Web if you are trying to locate, download, print, or fill state of alabama tax forms, you can do so on the alabama department of revenue website. Web is there any way to claim exemption on the alabama a4 form from the income portion of state tax? Easily sign the alabama a 4 with your finger. Web complete a new. Easily sign the alabama a 4 with your finger. Alabama income tax forms &. If you are single or married filing separately, a $1,500 personal exemption is allowed. Web if you are trying to locate, download, print, or fill state of alabama tax forms, you can do so on the alabama department of revenue website. Web 01 fill and edit. Only use the print form button if. Web is there any way to claim exemption on the alabama a4 form from the income portion of state tax? Web you are responsible only for the tax due on your return and you are entitled to a $1,500 personal exemption for the filing status of “married filing a separate return.”. Web employees in alabama fill out form a4, employee's withholding tax exemption certificate, to be used when calculating withholdings. Web if you had no alabama income tax liability last year and you anticipate no alabama income tax liability this year, you may claim ''exempt'' from alabama withholding tax. File this form with your employer. Send filled & signed alabama a 4 form 2023 pdf. While completing this section, the employer can point out if any of the sections above have not been completed correctly. Often referred to as alabama state withholding form al. Web in addition to the federal income tax withholding form, w4, each employee needs to fill out an alabama state income tax withholding form, a4. What is alabama state withholding form al a4? Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket. Web sign and date form a4 and file it with your employer. You must sign and date the form. Web 01 fill and edit template. 03 export or print immediately. Web complete a new w4 form each calendar year. Open the a4 form alabama and follow the instructions. Send filled & signed form or save. Web if you are trying to locate, download, print, or fill state of alabama tax forms, you can do so on the alabama department of revenue website.Alabama Form 2848a Fill Out and Sign Printable PDF Template signNow

Fill Free fillable forms State of Alabama

Alabama a4 Fill out & sign online DocHub

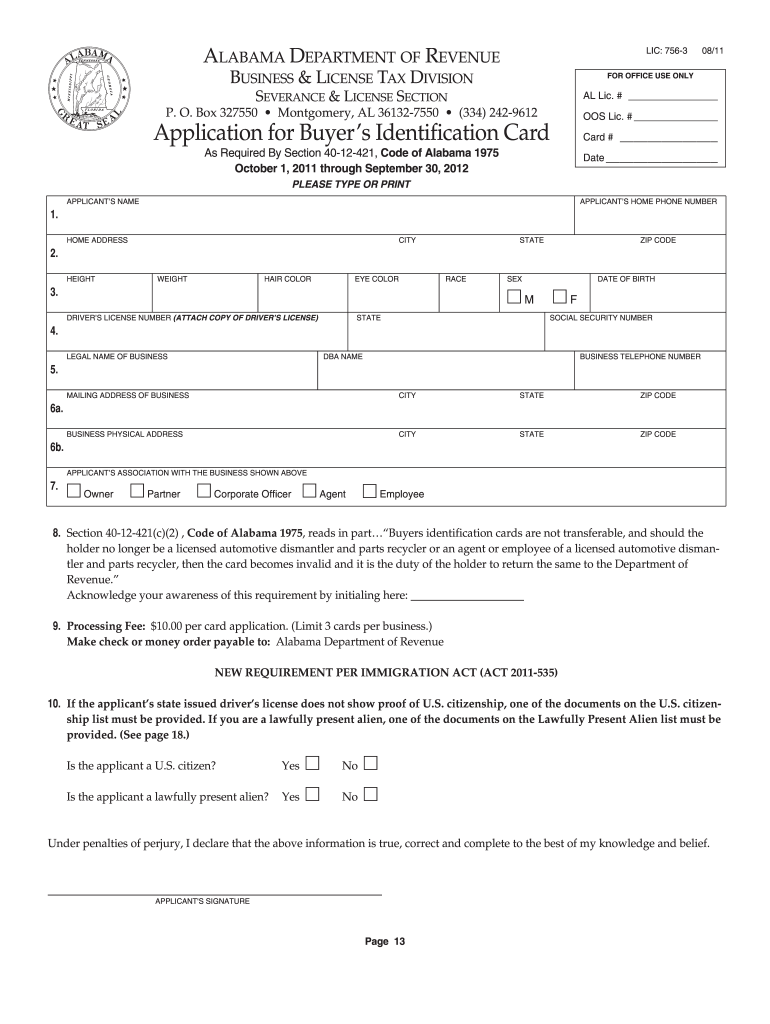

lic 756 3 pdf Fill out & sign online DocHub

Alabama a4 Fill out & sign online DocHub

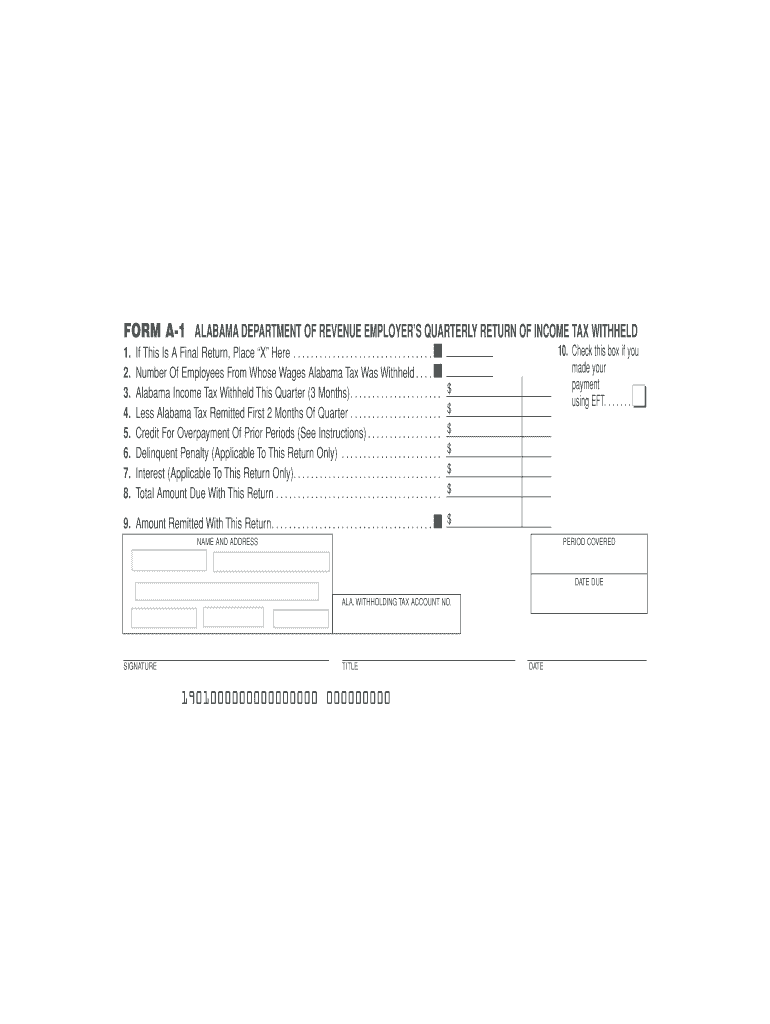

Alabama Form a 1 Fill Out and Sign Printable PDF Template signNow

Fill Free fillable forms State of Alabama

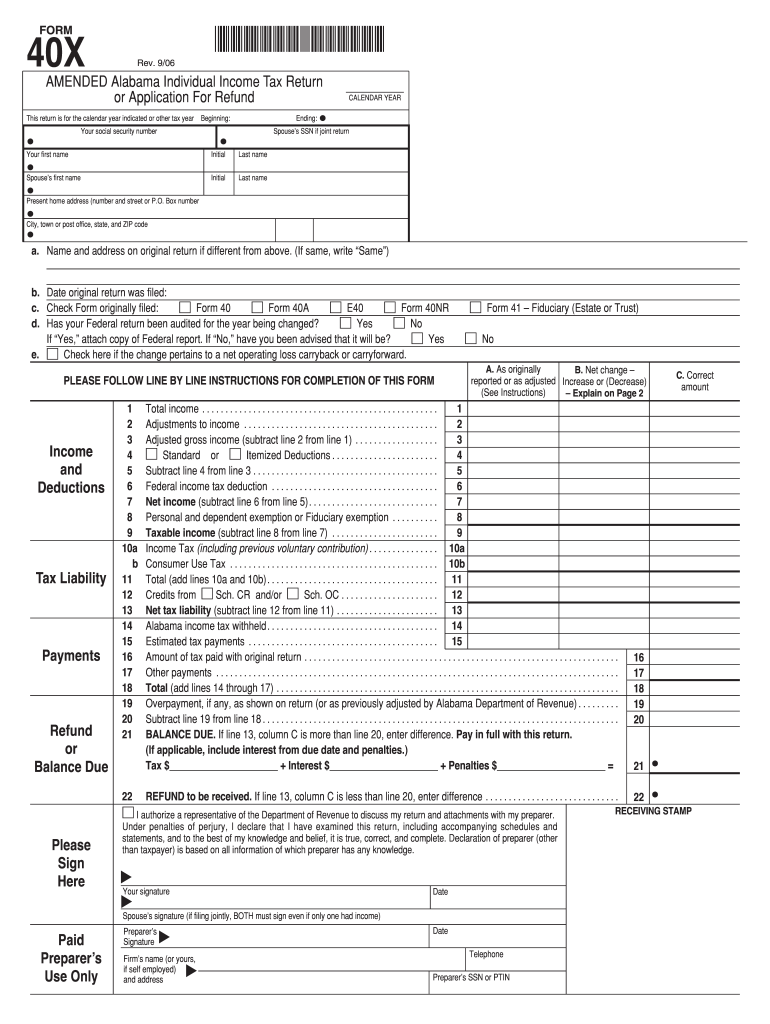

Alabama Form 40x Instructions Fill Online, Printable, Fillable, Blank

Fill Free fillable forms State of Alabama

Alabama Form A4 Employee's Withholding Tax Exemption Certificate 2023

Related Post: