Form It 205

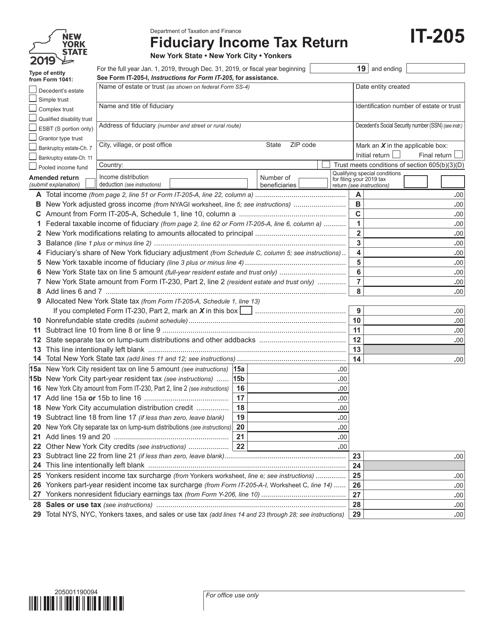

Form It 205 - When preparing a ny resident estate or trust with one nonresident beneficiary and no income from new york. New york state • new york city • yonkers. Enter the name and social security number (ssn) or employer identification number (ein) as shown on form it. The final rules provide a compliance period of twelve (12) months from the effective date. Similar to federal form 1041, page 1, schedule a calculates federal taxable fiduciary income. Please use the link below to. Web the final rules will become effective sixty (60) days after publication in the federal register. New york state • new york city •. Web new york — fiduciary income tax return. Trust or a decedent’s estate (for its final tax year) may elect under tax law section 685(c)(6)(d) or (f), as applicable, to have any part of its estimated tax. Web department of taxation and finance. Enter the name and social security number (ssn) or employer identification number (ein) as shown on form it. Web 14 rows fiduciary income tax return; It appears you don't have a pdf plugin for this browser. You can download or print. Web the final rules will become effective sixty (60) days after publication in the federal register. 1041 new york (ny) schedule a. If you are paying new york state tax for a fiduciary. Enter the name and social security number (ssn) or employer identification number (ein) as shown on form it. You can download or print. New york state • new york city • yonkers. Web department of taxation and finance. Web solved•by intuit•5•updated august 21, 2023. Similar to federal form 1041, page 1, schedule a calculates federal taxable fiduciary income. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web 14 rows fiduciary income tax return; The final rules provide a compliance period of twelve (12) months from the effective date. New york state • new york city • yonkers. If you are paying new york state tax for a fiduciary. Web new york — fiduciary income tax return. You can download or print. Web department of taxation and finance. If you are paying new york state tax for a fiduciary. Enter the name and social security number (ssn) or employer identification number (ein) as shown on form it. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. When preparing a ny resident estate or trust with one nonresident beneficiary and no income from new york. Web department of taxation and finance. You can download or print. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. The final rules provide a compliance period of twelve (12) months from. New york state • new york city •. Web department of taxation and finance. 1041 new york (ny) schedule a. The final rules provide a compliance period of twelve (12) months from the effective date. New york state • new york city • yonkers. New york state • new york city • yonkers. Web department of taxation and finance. Web solved•by intuit•5•updated august 21, 2023. Web 14 rows fiduciary income tax return; New york state • new york city •. Web 14 rows fiduciary income tax return; Enter the name and social security number (ssn) or employer identification number (ein) as shown on form it. You can download or print. It appears you don't have a pdf plugin for this browser. Web department of taxation and finance. New york state • new york city • yonkers. Web 14 rows fiduciary income tax return; Similar to federal form 1041, page 1, schedule a calculates federal taxable fiduciary income. Please use the link below to. Trust or a decedent’s estate (for its final tax year) may elect under tax law section 685(c)(6)(d) or (f), as applicable, to have any. 1041 new york (ny) schedule a. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Trust or a decedent’s estate (for its final tax year) may elect under tax law section 685(c)(6)(d) or (f), as applicable, to have any part of its estimated tax. It appears you don't have a pdf plugin for this browser. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web the final rules will become effective sixty (60) days after publication in the federal register. Enter the name and social security number (ssn) or employer identification number (ein) as shown on form it. When preparing a ny resident estate or trust with one nonresident beneficiary and no income from new york. Payment voucher for fiduciary income tax returns. You can download or print. New york state • new york city • yonkers. New york state • new york city •. If you are paying new york state tax for a fiduciary. Please use the link below to. Web department of taxation and finance. Department of taxation and finance. (12/22) how to use this form. Similar to federal form 1041, page 1, schedule a calculates federal taxable fiduciary income. New york state accumulation distribution for exempt resident trusts. Web 14 rows fiduciary income tax return;Iht205 Form Fill Out and Sign Printable PDF Template signNow

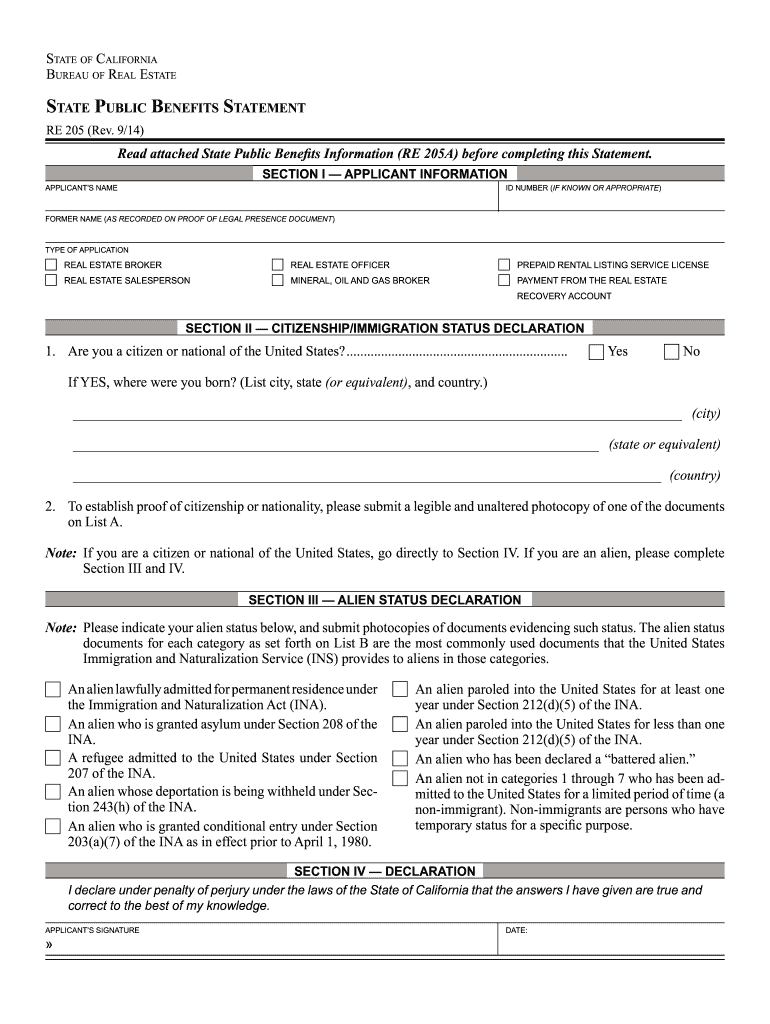

20142023 Form CA RE 205 Fill Online, Printable, Fillable, Blank

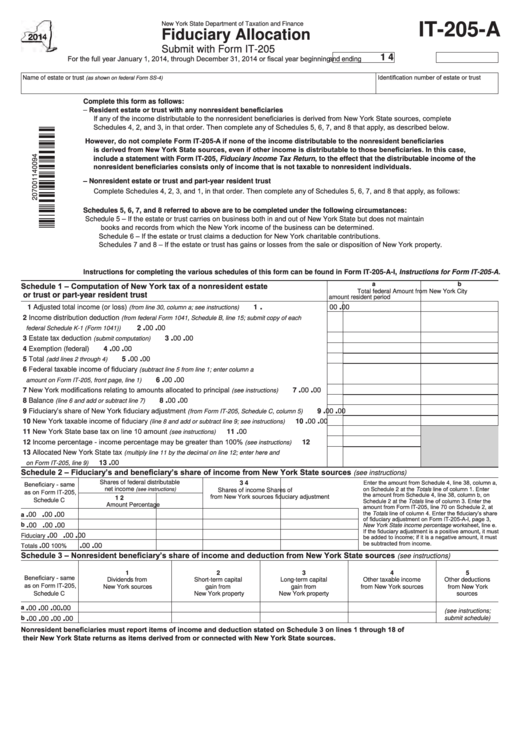

Fillable Form It205A Fiduciary Allocation 2014 printable pdf download

Form IT205 2019 Fill Out, Sign Online and Download Fillable PDF

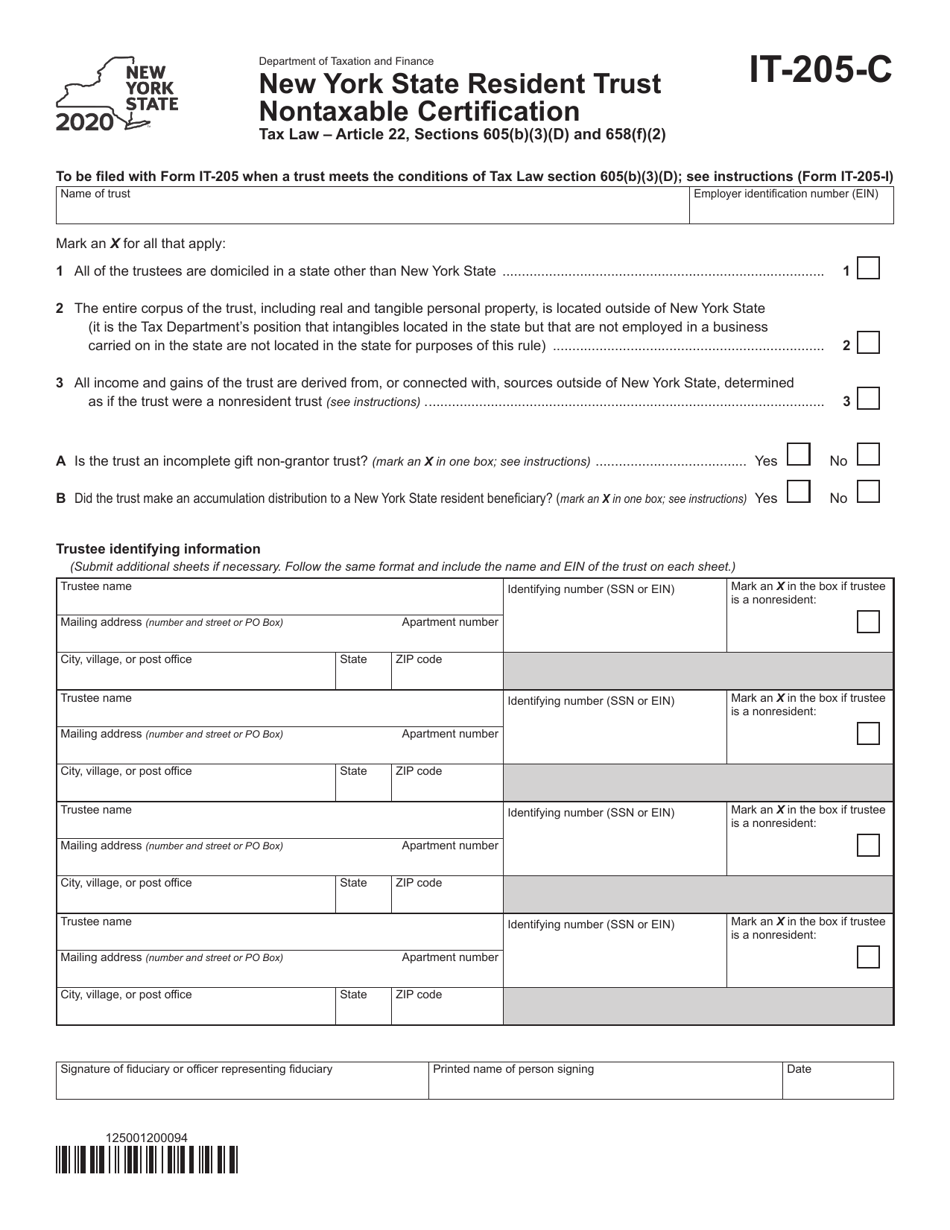

Form IT205C Download Fillable PDF or Fill Online New York State

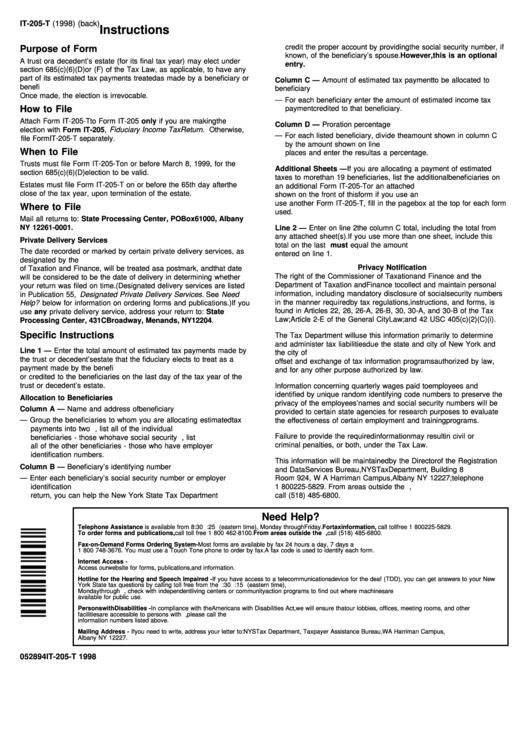

Instructions For Form It205T Allocation Of Estimated Tax Payments

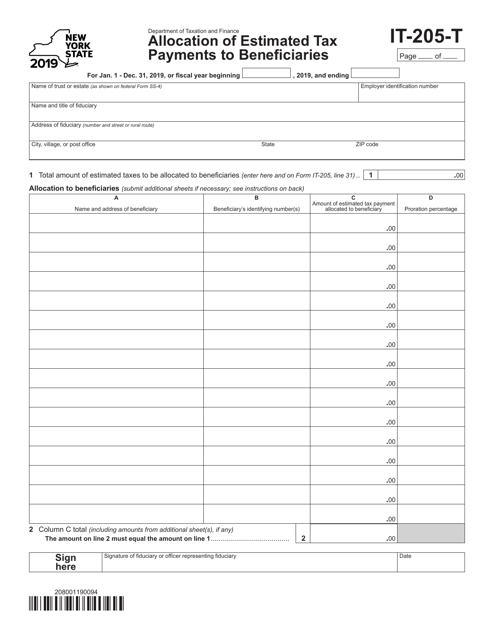

Form IT205T Download Fillable PDF or Fill Online Allocation of

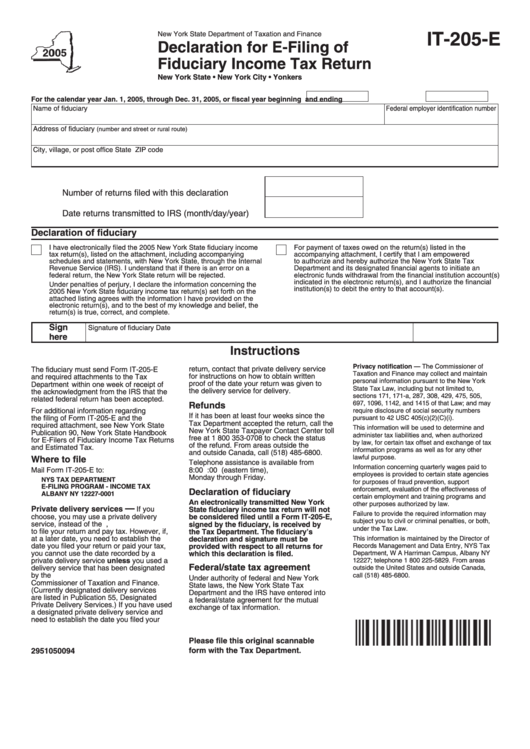

Fillable Form It205E Declaration For EFiling Of Fiduciary

Fill Free fillable Form 20 IT205A Fiduciary Allocation Submit with

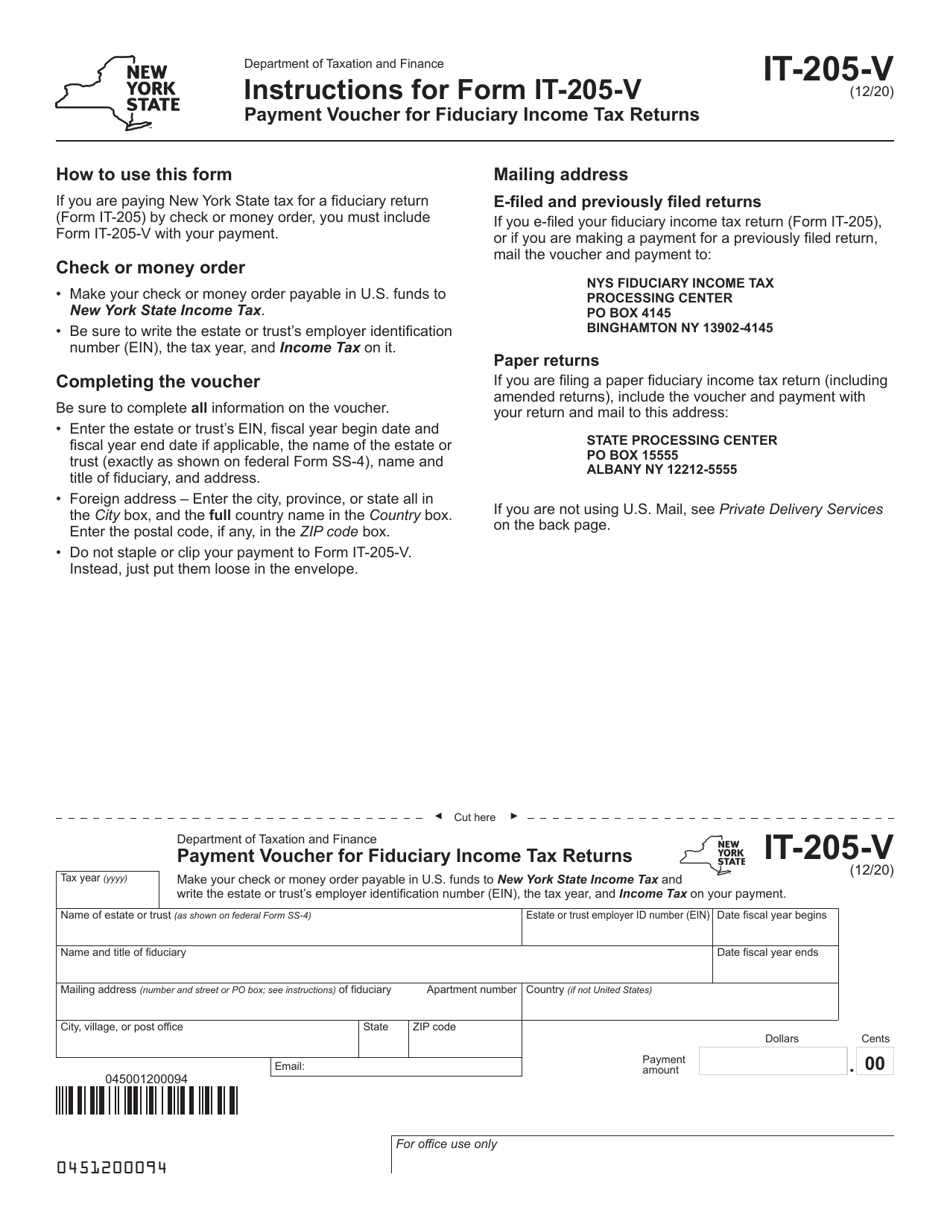

Form IT205V Download Fillable PDF or Fill Online Payment Voucher for

Related Post: