Florida Form 1120

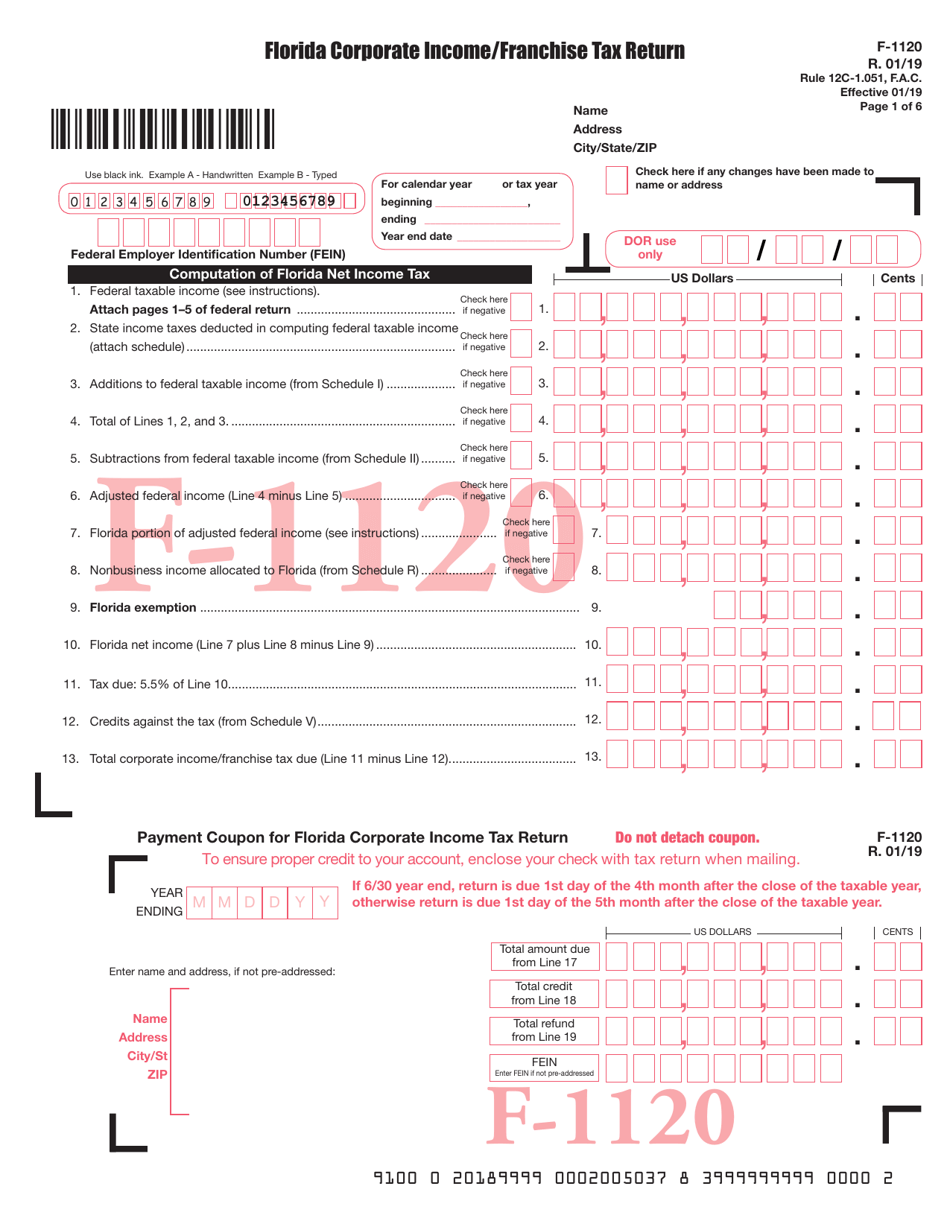

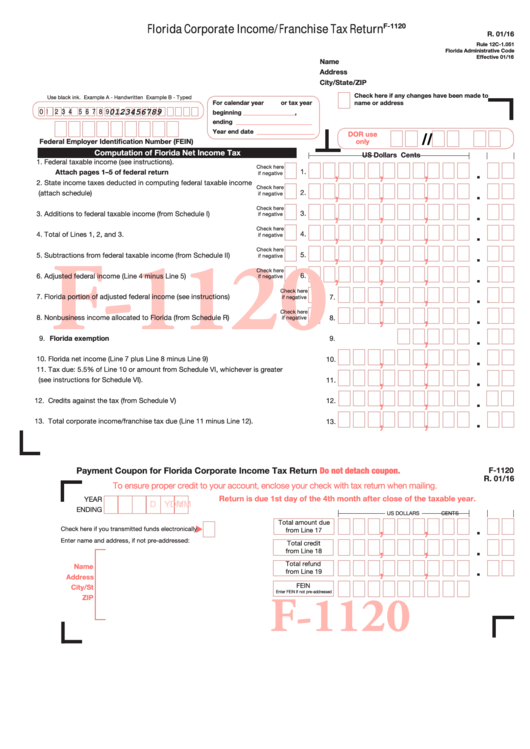

Florida Form 1120 - Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Save or instantly send your ready documents. Adjusted federal income (line 4 minus line 5). It has florida net income of $45,000 or less. Ad easy guidance & tools for c corporation tax returns. For example, for a taxpayer with a tax year that ends. (note that an s corporation is. Get ready for tax season deadlines by completing any required tax forms today. Use this form to report the. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. It has florida net income of $45,000 or less. Use this form to report the. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Easily fill out pdf blank, edit, and sign them. If negative check here 6. Florida corporate income/franchise tax return for 2022 tax year. Web where to file your taxes (for forms 1120) | internal revenue service home file individuals where to file where to file your taxes (for forms 1120) page. Get ready for tax season deadlines by completing any required tax forms today. It has florida net income of $45,000. Web corporate income. It has florida net income of $45,000. It conducts 100% of its business in. Save or instantly send your ready documents. It has florida net income of $45,000 or less. Use this form to report the. Web corporate income tax is imposed by section (s.) 220.11, florida statutes (f.s.). Corporation income tax return, including recent updates, related forms and instructions on how to file. Or (2) the 15th day following the due date, without extension, for the filing of the related. Easily fill out pdf blank, edit, and sign them. Adjusted federal income (line 4 minus. For example, for a taxpayer with a tax year that ends. Ad easy guidance & tools for c corporation tax returns. Florida corporate income/franchise tax return for 2014 tax year: Get ready for tax season deadlines by completing any required tax forms today. Web for all other tax year endings, the due date is on or before the first day. Web corporate income tax is imposed by section (s.) 220.11, florida statutes (f.s.). Get ready for tax season deadlines by completing any required tax forms today. Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Web for all other tax year endings, the due date is on or before the first day of the fifth month following. Or (2) the 15th day following the due date, without extension, for the filing of the related. Web corporate income tax is imposed by section (s.) 220.11, florida statutes (f.s.). If negative check here 6. It has florida net income of $45,000. Florida corporate income/franchise tax return for 2014 tax year: Web we would like to show you a description here but the site won’t allow us. Save or instantly send your ready documents. If negative check here 6. Get ready for tax season deadlines by completing any required tax forms today. Florida corporate income/franchise tax return for 2014 tax year: Save or instantly send your ready documents. Florida corporate income/franchise tax return for 2022 tax year. Web information about form 1120, u.s. Web we would like to show you a description here but the site won’t allow us. It has florida net income of $45,000. Or (2) the 15th day following the due date, without extension, for the filing of the related. Use this form to report the. (note that an s corporation is. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Web we would. Ad easy guidance & tools for c corporation tax returns. Web where to file your taxes (for forms 1120) | internal revenue service home file individuals where to file where to file your taxes (for forms 1120) page. Efective 01/23 name page 1 of 6 address city/state/zip use black ink. Save or instantly send your ready documents. If negative check here 6. Adjusted federal income (line 4 minus line 5). Web information about form 1120, u.s. It has florida net income of $45,000. For example, for a taxpayer with a tax year that ends. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Florida corporate income/franchise tax return for 2022 tax year. Web corporate income tax is imposed by section (s.) 220.11, florida statutes (f.s.). It has florida net income of $45,000 or less. Easily fill out pdf blank, edit, and sign them. Web we would like to show you a description here but the site won’t allow us. Get ready for tax season deadlines by completing any required tax forms today. Florida corporate income/franchise tax return for 2014 tax year: Use this form to report the. (note that an s corporation is. Subtractions from federal taxable income (from schedule ii).How to Complete Form 1120S Tax Return for an S Corp

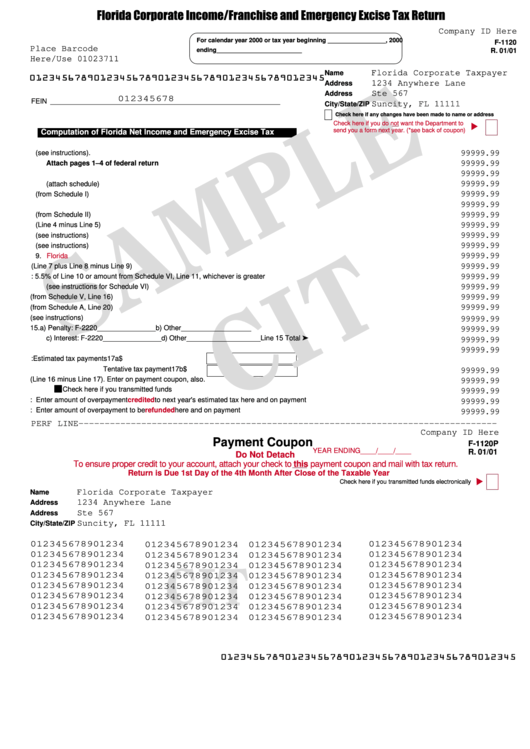

Form F1120 Florida Corporate And Emergency Excise

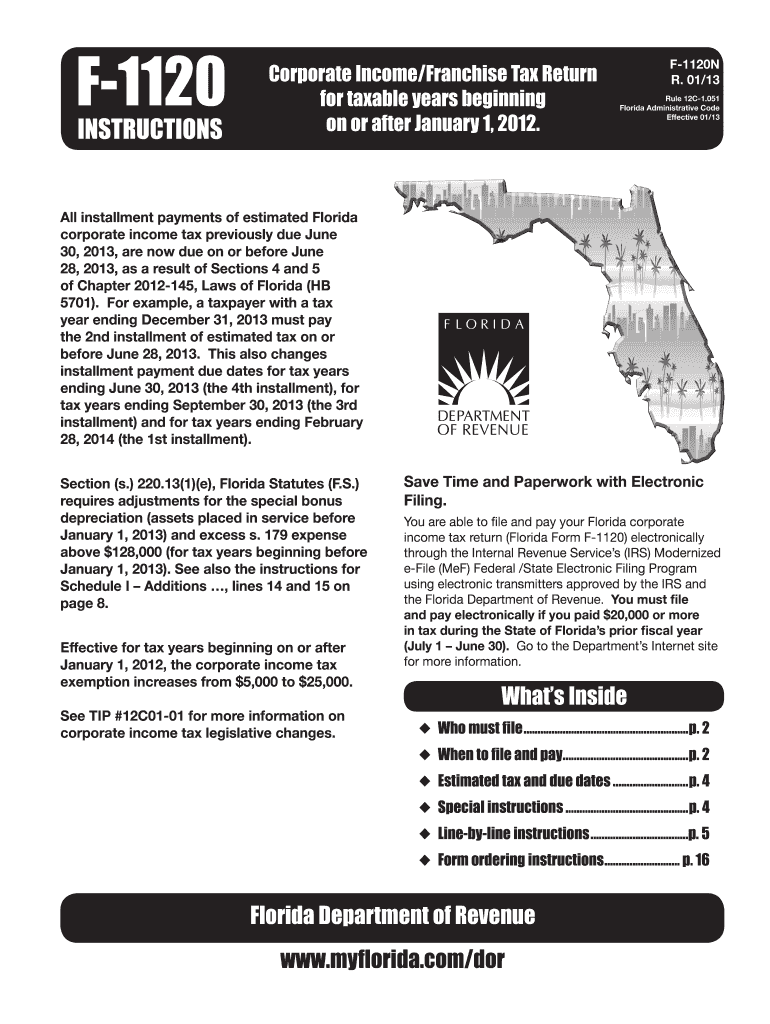

Fl F 1120 Instructions Form Fill Out and Sign Printable PDF Template

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Form F1120 Fill Out, Sign Online and Download Printable PDF, Florida

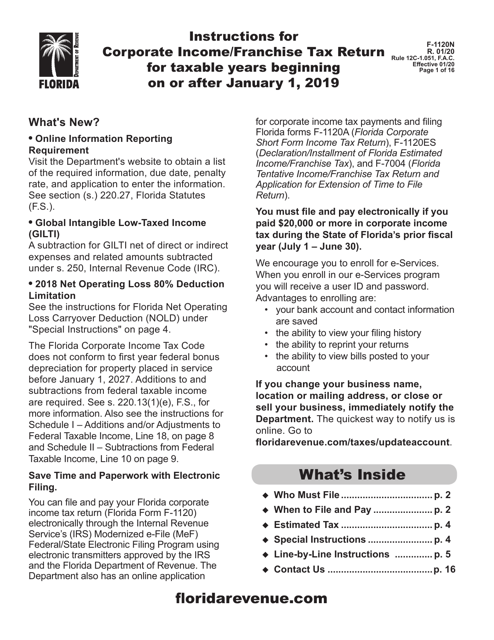

Download Instructions for Form F1120 Florida Corporate

IRS Accepted And Schedules For Forms 1120/1120F/1120S 20112022 Fill

F1120 Florida Department of Revenue

Irs Instructions Form 1120s Fillable and Editable PDF Template

Fillable Form F1120 Florida Corporate Tax Return

Related Post: