Wi Form 4 Instructions

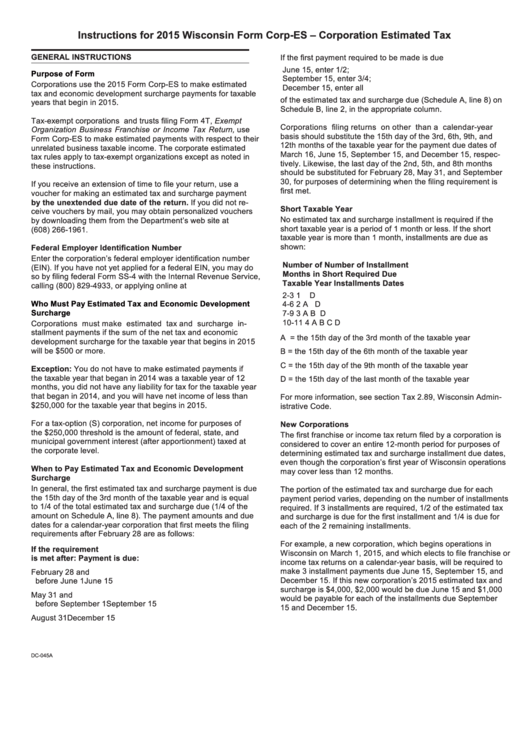

Wi Form 4 Instructions - Web form, form mv−1, filed with the department of transportation. 1‑14) wisconsin department of revenue. Franchise or income tax return. Requesting previously filed tax returns. Web wisconsin state income tax extension forms. If too little is withheld, you will generally owe tax when you file your tax return. Web frequently required to be filed with form 4: Where to file if you are filing the decedent’s income tax. 1) a rent−a−car does not qualify as a taxicab. If the document is executed in wisconsin, section 182.01(3) of the wisconsin statutes requires that it. Effective on or after january 1, 2020, every newly‑hired. Every employee is required to file a completed form wt‑4 with. If the document is executed in wisconsin, section 182.01(3) of the wisconsin statutes requires that it. Electronic filing or electronic payment. Web form corp4 (revised february 2023) page 3 of 3 drafter name. Web form, form mv−1, filed with the department of transportation. Electronic filing or electronic payment. Effective on or after january 1, 2020, every newly‑hired. Where to file if you are filing the decedent’s income tax. Requesting previously filed tax returns. Web 136 rows form 4 instructions: Web form corp4 (revised february 2023) page 3 of 3 drafter name. Web wisconsin state income tax extension forms. Electronic filing or electronic payment. Web form, form mv−1, filed with the department of transportation. Web wisconsin state income tax extension forms. If too little is withheld, you will generally owe tax when you file your tax return. D check if applicable and attach explanation: Web 136 rows form 4 instructions: Effective on or after january 1, 2020, every newly‑hired. Web you must file a copy of your federal return with form 4, even if no wisconsin activity. Web frequently required to be filed with form 4: Web general instructions purpose of form use form 804 to claim a refund on behalf of a decedent (deceased taxpayer). 2) a limousine with driver that holds 8 people is hired by a.. Franchise or income tax return. If the document is executed in wisconsin, section 182.01(3) of the wisconsin statutes requires that it. D check if applicable and attach explanation: Web frequently required to be filed with form 4: Web form corp4 (revised february 2023) page 3 of 3 drafter name. Web form, form mv−1, filed with the department of transportation. D check if applicable and attach explanation: Web you must file a copy of your federal return with form 4, even if no wisconsin activity. 1‑14) wisconsin department of revenue. This document is to be used in conjunction with the form. Every employee is required to file a completed form wt‑4 with. If the document is executed in wisconsin, section 182.01(3) of the wisconsin statutes requires that it. Web wisconsin state income tax extension forms. D check if applicable and attach explanation: Sections 178.0120 (4), 179.0124(4), 180.0129, 181.0129, 183.0122(4), and 185.825. Web form corp4 (revised february 2023) page 3 of 3 drafter name. This document is to be used in conjunction with the form. 8‑23) wisconsin department of revenue. Web frequently required to be filed with form 4: 1) a rent−a−car does not qualify as a taxicab. If too little is withheld, you will generally owe tax when you file your tax return. Web form corp4 (revised february 2023) page 3 of 3 drafter name. Sections 178.0120 (4), 179.0124(4), 180.0129, 181.0129, 183.0122(4), and 185.825. Where to file if you are filing the decedent’s income tax. Web form, form mv−1, filed with the department of transportation. Web general instructions purpose of form use form 804 to claim a refund on behalf of a decedent (deceased taxpayer). If too little is withheld, you will generally owe tax when you file your tax return. Sections 178.0120 (4), 179.0124(4), 180.0129, 181.0129, 183.0122(4), and 185.825. Where to file if you are filing the decedent’s income tax. Franchise or income tax return. Web 136 rows form 4 instructions: Effective on or after january 1, 2020, every newly‑hired. 1‑14) wisconsin department of revenue. Web form corp4 (revised february 2023) page 3 of 3 drafter name. This document is to be used in conjunction with the form. 2) a limousine with driver that holds 8 people is hired by a. 1) a rent−a−car does not qualify as a taxicab. 8‑23) wisconsin department of revenue. Every employee is required to file a completed form wt‑4 with. Electronic filing or electronic payment. Web wisconsin state income tax extension forms. Web form, form mv−1, filed with the department of transportation. Web frequently required to be filed with form 4: Requesting previously filed tax returns. Web you must file a copy of your federal return with form 4, even if no wisconsin activity.Instructions For 2015 Wisconsin Form CorpEs printable pdf download

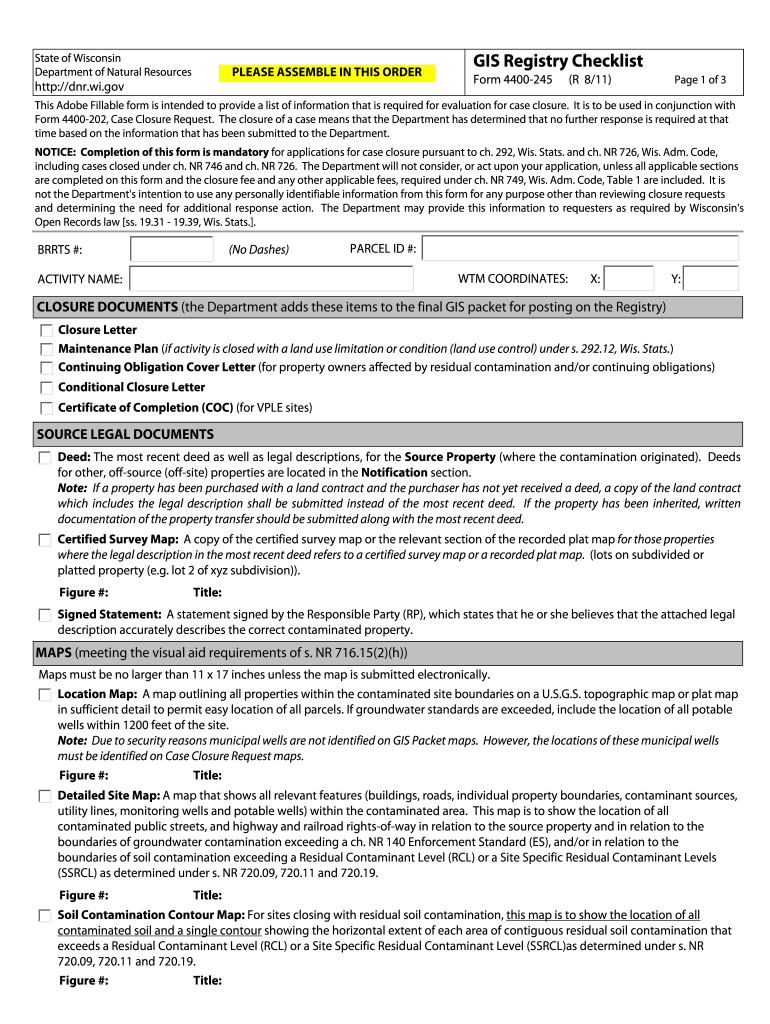

4400 Form Fill Out and Sign Printable PDF Template signNow

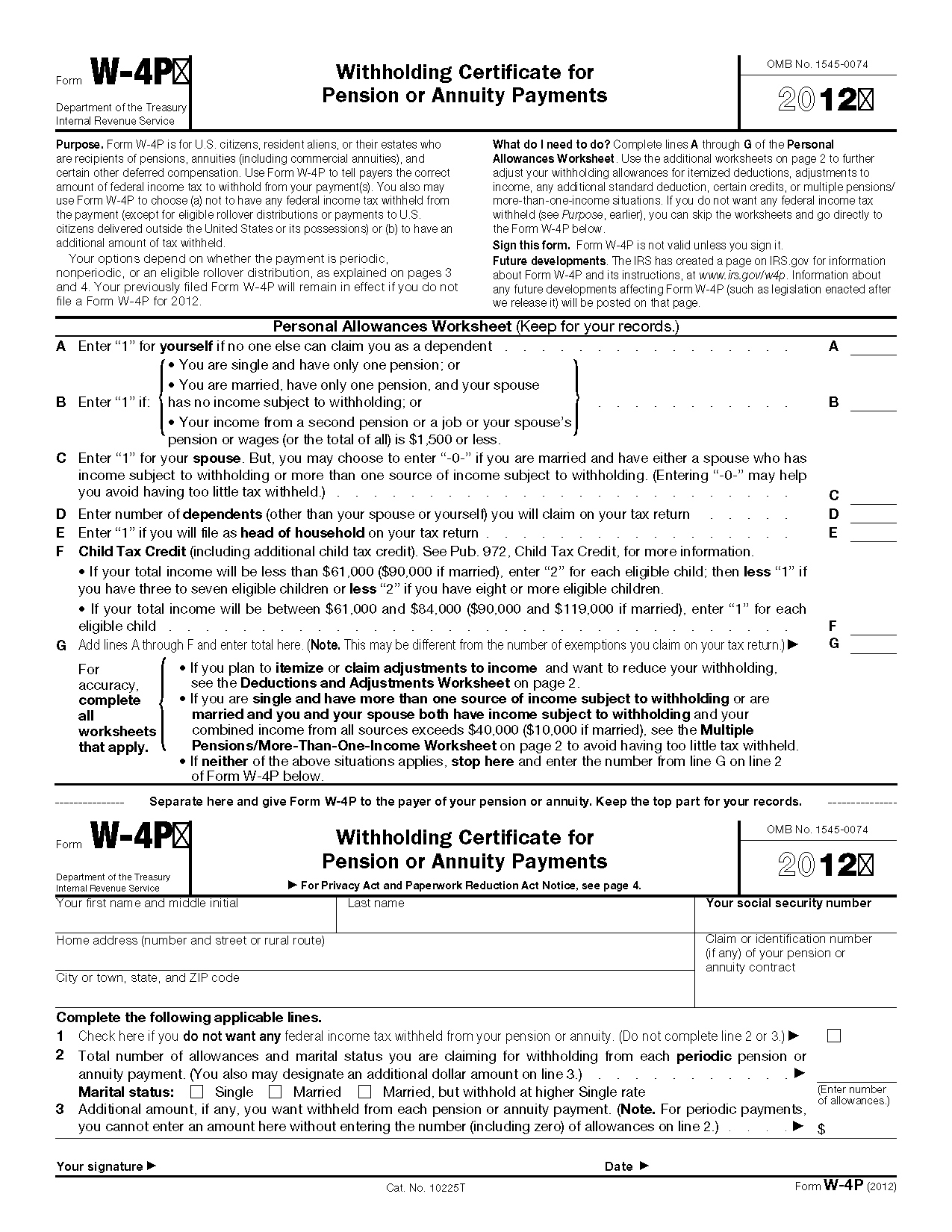

Wisconsin W4 2022 W4 Form

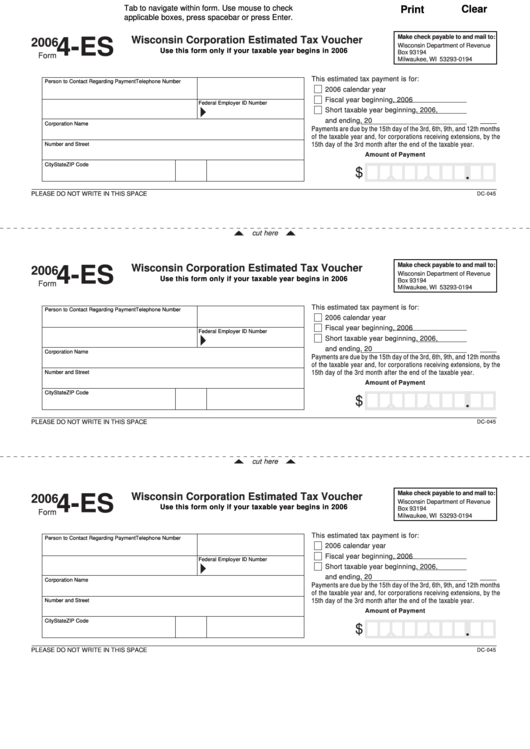

Printable Wisconsin Tax Forms Printable Forms Free Online

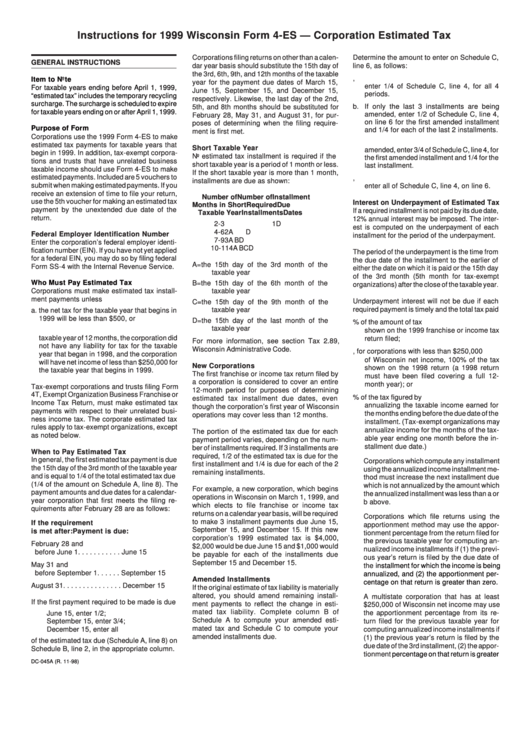

Instructions For 1999 Wisconsin Form 4Es Corporation Estimated Tax

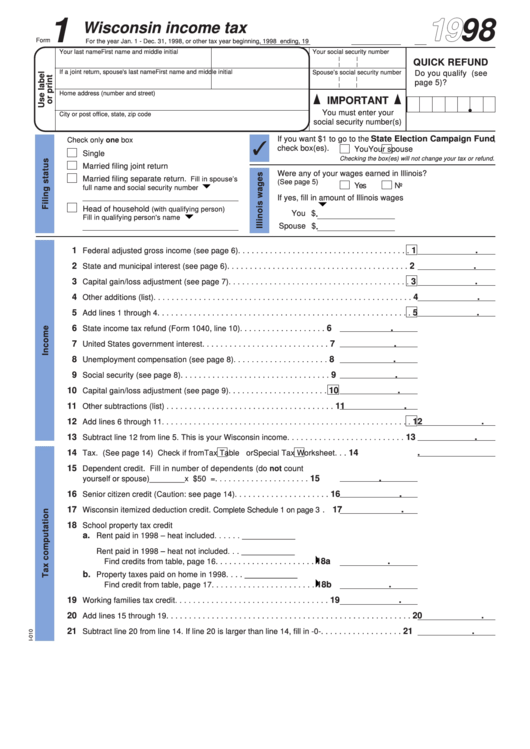

1 Wisconsin Tax Form Instruction

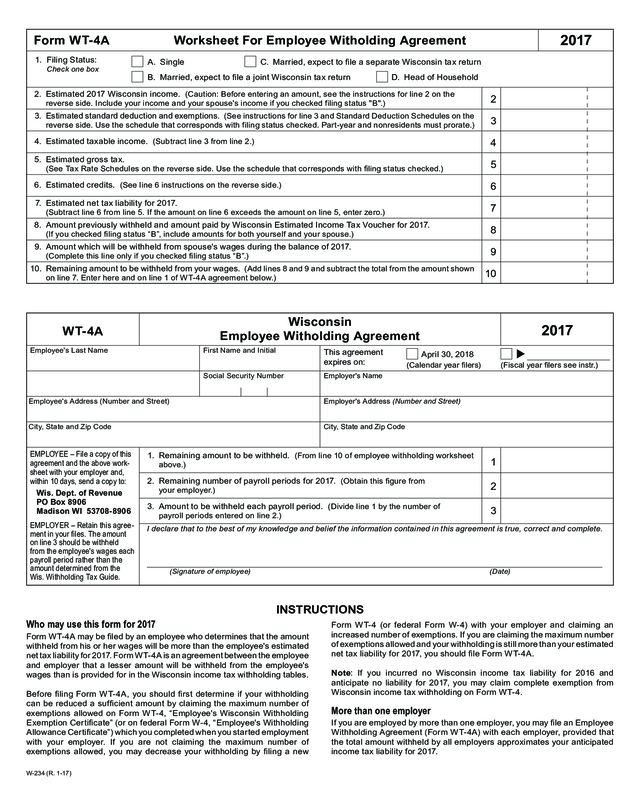

Form Wt4A Wisconsin Department Of Revenue Edit, Fill, Sign Online

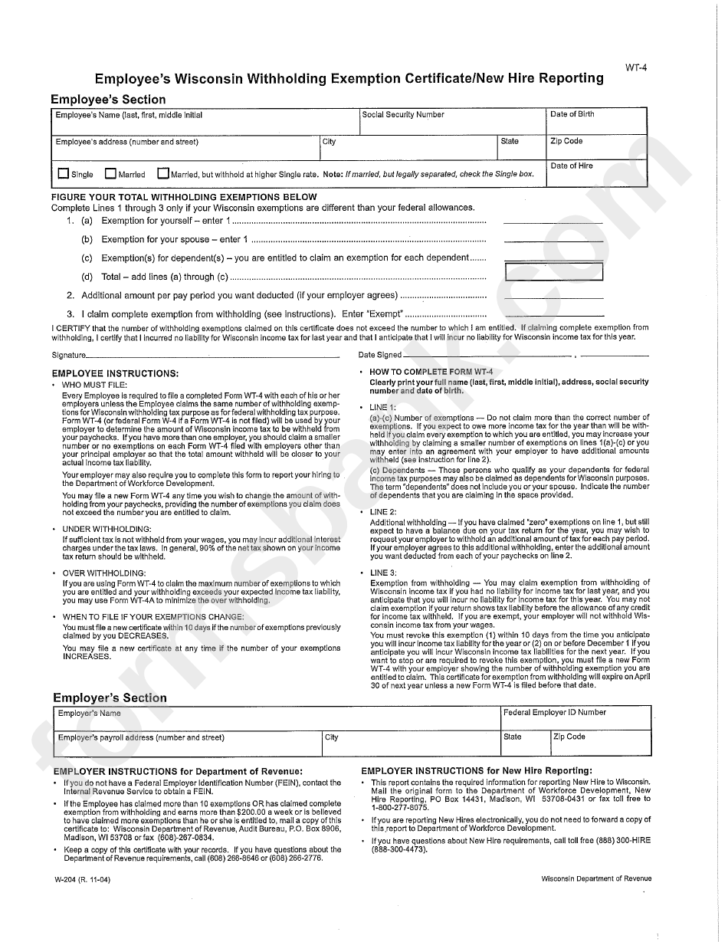

Form Wt 4 Employee S Wisconsin Withholding Exemption W4 Form 2021

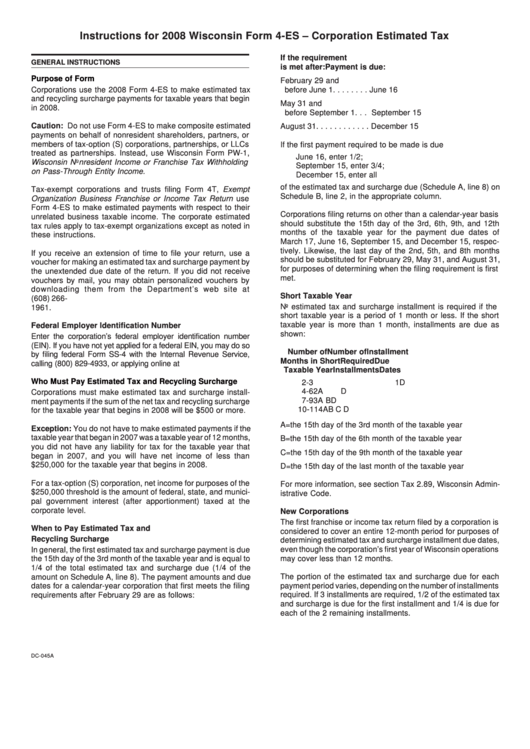

Instructions For 2008 Wisconsin Form 4Es Corporation Estimated Tax

2017 Wisconsin Instructions Fill Out and Sign Printable PDF Template

Related Post: